QUOTE(GrumpyNooby @ Oct 7 2020, 09:01 AM)

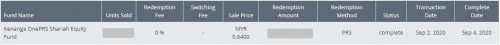

I made two switches this year at FSM platform.

No fee incurred.

Can I switch my PRS funds? Can I switch my PRS funds to a different fund house?

Yes, you can switch within same fund house and between different fund houses. You may login into your investment account and click on Funds >> Transactions >> Sell/Switch to execute the switching transaction.

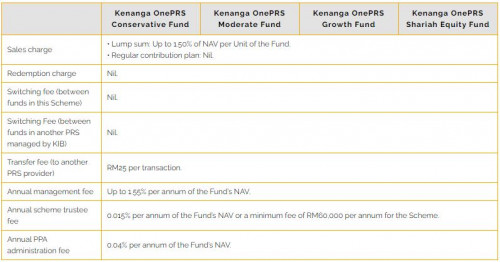

There is no switching fee and also no restriction to the number of switching transactions EXCEPT for the fund houses below:

•CIMB Principal Asset Management - 12 times* free switch per calendar year

•Manulife Asset Management Services Berhad - 12 times free switch per calendar year

*one time switching per month

However, for switching of PRS funds between different fund houses, you are subjected to the conditions below:

1. Transfers are permitted once a calendar year for each PRS Provider;

2. The transfer is only allowed after one year from the first subscription date;

3. There is sufficient units in the fund(s);

4. Each transfer request is only between two PRS Providers; and

5. All accrued benefits to be transferred from a particular fund must be transferred correspondingly to one other fund managed by the Transferee Provider.

Please be advised that you will need to pay a PPA transfer fee of MYR 25.00 per request.so, what is the highligthed sentence means???

means for different fund house???

This post has been edited by ironman16: Oct 7 2020, 09:46 AM

This post has been edited by ironman16: Oct 7 2020, 09:46 AM

Oct 7 2020, 07:31 AM

Oct 7 2020, 07:31 AM

Quote

Quote

0.0729sec

0.0729sec

0.89

0.89

7 queries

7 queries

GZIP Disabled

GZIP Disabled