QUOTE(kenzotaj @ Nov 21 2018, 04:04 PM)

Hi Guys, Need some input in strategy.. First time buying PRS, thanks in advance for all the sifus guidance

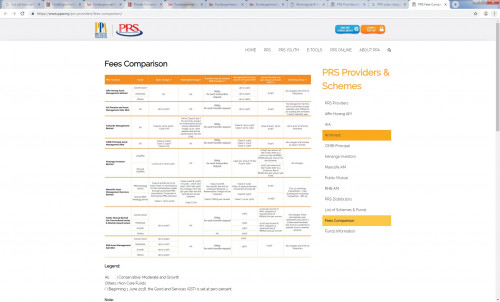

1. Should i buy via online www.PPA.my website or FSM ? Which one is cheaper in terms of less fees overall

2. In PPA website ; i see 3 types of Fees

(a) Sale charges (i understand FSM is O%; what about buying direct from PPA website?)

(b) Management Fees (about 1.0 to 1.5%) if we didnt touch the fund next year, will there be any deduction. If we top up , will they charge again management fees onto previously bought fund inside PRS too.

© Trustee Fees (about 0.04%) Also same question with (b)

3. I checked morningstar; most of the funds lost money since Jan 2018. Except Conservative Fund; In view of dismay global outlook in Asia Pacific region (charts downward trend),

Should i just buy conservation fund first - to preserve capital and when more promising outlook next year / beyond , then consider switching fund.

buying from PPA online....you get free a/c opening too

"For all online applications through PRS Online Enrolment, the PPA account opening fee of RM10.00 shall be waived till further notice.

For applicants age 30 and below who perform self-enrolment, PRS Providers’ sales charge will be at 0%"

https://prsenrolment.ppa.my/Management fees & trustee fees...cannot escape...they are charged by the fund house.....

you cannot see/feel these charges as they are pro rated charged daily and reflected into the daily NAVs.

if you buy a conservative fund now and switch later to other funds...there are switching fees and also may missed the sudden up swing of that fund.....

usually...go for the fund that can make you sleep well at night daily no matter what the market situation are. No right or wrong.

Nov 17 2018, 03:05 PM

Nov 17 2018, 03:05 PM

Quote

Quote

0.0375sec

0.0375sec

0.60

0.60

6 queries

6 queries

GZIP Disabled

GZIP Disabled