Outline ·

[ Standard ] ·

Linear+

FD rates in Malaysia, Which bank offer the highest FD rates?

|

chenster

|

Dec 14 2010, 05:41 PM Dec 14 2010, 05:41 PM

|

|

QUOTE(escargo75 @ Dec 13 2010, 09:13 AM) Hello dude, if you are not planning to do anything with the money or at least have some discipline not spend it away, you can put it in unit trust. Unit trust return is much hogher than FD for sure. Well, off course if you can take higher risk invest in stocks. i thought i heard unit trust also can be negative in returns? if i invest 10k in UT.. will i get 10k+% after a year? im not really sure how unit trust works.. |

|

|

|

|

|

leongal

|

Dec 14 2010, 05:53 PM Dec 14 2010, 05:53 PM

|

|

QUOTE(chenster @ Dec 14 2010, 05:41 PM) i thought i heard unit trust also can be negative in returns? if i invest 10k in UT.. will i get 10k+% after a year? im not really sure how unit trust works.. yes, no guarantee return with unit trusts - it depends on the market condition and what the fund is invested into 10% a year is possible, provided the market and stocks that the fund manager pick came out positive, but this rarely happens usually unit trust is for medium to long term, i.e. preferably beyond 3 years to see the returns |

|

|

|

|

|

Gen-X

|

Dec 14 2010, 06:13 PM Dec 14 2010, 06:13 PM

|

Lifetime LYN Member

|

QUOTE(leongal @ Dec 14 2010, 05:53 PM) yes, no guarantee return with unit trusts - it depends on the market condition and what the fund is invested into 10% a year is possible, provided the market and stocks that the fund manager pick came out positive, but this rarely happens usually unit trust is for medium to long term, i.e. preferably beyond 3 years to see the returns if you buy at the high and market collapse, maybe 10 years also cannot recover the capital  People will tell you that FD rate cannot beat inflation, well, if the market collapse you would wished that you have put your money in FD instead. Unit trust is like share market, timming is important and must take profit. This post has been edited by Gen-X: Dec 14 2010, 06:13 PM |

|

|

|

|

|

chenster

|

Dec 14 2010, 06:23 PM Dec 14 2010, 06:23 PM

|

|

so is it good to buy UT now?

how is the market like now?

|

|

|

|

|

|

Gen-X

|

Dec 14 2010, 06:26 PM Dec 14 2010, 06:26 PM

|

Lifetime LYN Member

|

QUOTE(chenster @ Dec 14 2010, 06:23 PM) so is it good to buy UT now? how is the market like now? This is FD thread lah, go to UT and Stock market section. You can find your answers there (people who can see the future)  anyway you may be interested in topic below, guide to invest in share market: http://forum.lowyat.net/index.php?showtopic=1638400&hl=This post has been edited by Gen-X: Dec 14 2010, 06:33 PM |

|

|

|

|

|

chenster

|

Dec 15 2010, 12:23 PM Dec 15 2010, 12:23 PM

|

|

i know la fd thread..

but there is this FD+UT offered by CIMB now..

so thinking if purely put on FD or try to invest in FD+UT..

if the market is not good.. and after a year, the return is less than FD.. then better not la..

|

|

|

|

|

|

bearbear

|

Dec 15 2010, 12:31 PM Dec 15 2010, 12:31 PM

|

|

FD is suppose to be safe and sound with no risk involve, the problem is are you willing to take the risk? why should u try something u r not familiar with just because there's a promotion?  |

|

|

|

|

|

chenster

|

Dec 15 2010, 01:54 PM Dec 15 2010, 01:54 PM

|

|

hi bear bear..

it is not a promotion...

i asked for a better return in 1 year..

they mentioned to me both products

FD and FD+UT

of course.. they talk big on ROI for FD+UT

so now im asking experts here on the market health for UT under CIMB..

|

|

|

|

|

|

heavenly91

|

Dec 17 2010, 11:14 PM Dec 17 2010, 11:14 PM

|

|

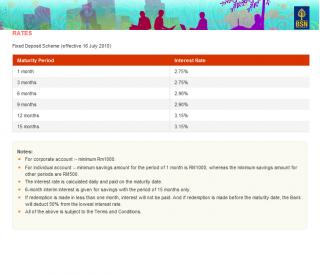

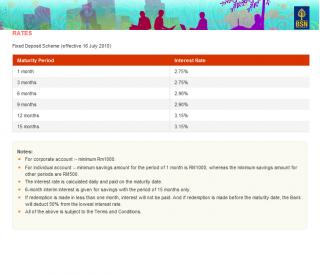

I am using BSN now. But I feel like changing to Affin cause have higher interest for 1 year plan  [attachmentid=1944806] This post has been edited by heavenly91: Dec 17 2010, 11:33 PM |

|

|

|

|

|

MilesAndMore

|

Dec 17 2010, 11:41 PM Dec 17 2010, 11:41 PM

|

Look at all my stars!!

|

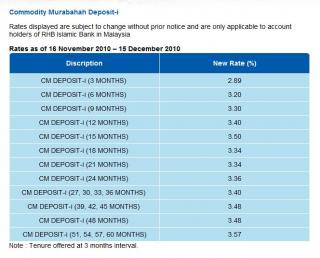

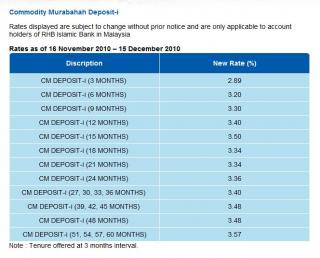

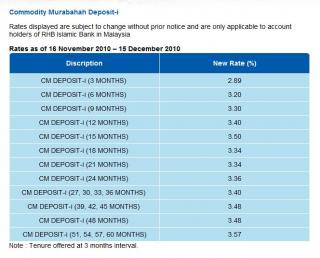

QUOTE(heavenly91 @ Dec 17 2010, 11:14 PM) The highest should be RHB Islamic Bank. The 1 year rate is 3.40% and you can request for upfront payment. Meaning you lock your deposit for 1 year and you can get the interest immediately on the day you make the placement. The other bank that offers such deposit is HSBC Amanah but the rate and T&C are not as good. This is basically like a regular fixed deposit account that is Shariah compliant.

|

|

|

|

|

|

heavenly91

|

Dec 17 2010, 11:43 PM Dec 17 2010, 11:43 PM

|

|

QUOTE(MilesAndMore @ Dec 17 2010, 11:41 PM) QUOTE(heavenly91 @ Dec 17 2010, 11:14 PM) The highest should be RHB Islamic Bank. The 1 year rate is 3.40% and you can request for upfront payment. Meaning you lock your deposit for 1 year and you can get the interest immediately on the day you make the placement. The other bank that offers such deposit is HSBC Amanah but the rate and T&C are not as good. This is basically like a regular fixed deposit account that is Shariah compliant.

Hmm one thing I worry about the islamic fd thing is later they bankrupt how? Will the govern back us up? |

|

|

|

|

|

MilesAndMore

|

Dec 17 2010, 11:46 PM Dec 17 2010, 11:46 PM

|

Look at all my stars!!

|

QUOTE(heavenly91 @ Dec 17 2010, 11:43 PM) Hmm one thing I worry about the islamic fd thing is later they bankrupt how?

Will the govern back us up? No worries. It is insured by PIDM too, just like all your money at non-Islamic banks. |

|

|

|

|

|

heavenly91

|

Dec 17 2010, 11:49 PM Dec 17 2010, 11:49 PM

|

|

QUOTE(MilesAndMore @ Dec 17 2010, 11:46 PM) No worries. It is insured by PIDM too, just like all your money at non-Islamic banks. I see. Well actually I don't really check on the Islamic deposit rates because they are confusing. I guess you already checked on every bank. Is this the best plan out of the other Islamic banks? |

|

|

|

|

|

MilesAndMore

|

Dec 17 2010, 11:57 PM Dec 17 2010, 11:57 PM

|

Look at all my stars!!

|

QUOTE(heavenly91 @ Dec 17 2010, 11:49 PM) I see.

Well actually I don't really check on the Islamic deposit rates because they are confusing.

I guess you already checked on every bank.

Is this the best plan out of the other Islamic banks? For 12-month tenure ? Yeah. I guess it is. |

|

|

|

|

|

heavenly91

|

Dec 17 2010, 11:59 PM Dec 17 2010, 11:59 PM

|

|

QUOTE(MilesAndMore @ Dec 17 2010, 11:57 PM) For 12-month tenure ? Yeah. I guess it is. Hmm what is the minimum cash I need to deposit in? And what is the terms and condition ? o.O |

|

|

|

|

|

MilesAndMore

|

Dec 18 2010, 01:06 AM Dec 18 2010, 01:06 AM

|

Look at all my stars!!

|

QUOTE(heavenly91 @ Dec 17 2010, 11:59 PM) Hmm what is the minimum cash I need to deposit in?

And what is the terms and condition ? o.O RM5,000 only. T&C ? More or less like regular FD. |

|

|

|

|

|

heavenly91

|

Dec 18 2010, 01:27 AM Dec 18 2010, 01:27 AM

|

|

QUOTE(MilesAndMore @ Dec 18 2010, 01:06 AM) RM5,000 only. T&C ? More or less like regular FD. alrite will check on it =) |

|

|

|

|

|

Robin Liew

|

Dec 18 2010, 08:11 AM Dec 18 2010, 08:11 AM

|

Getting Started

|

fd rate is freaking low

i wanted to deposit for the 12 yr plan @3.4% but the housing loan interest is 4%.... so i think better dump into housing loan

wise?

|

|

|

|

|

|

michspc

|

Dec 18 2010, 09:36 AM Dec 18 2010, 09:36 AM

|

New Member

|

QUOTE(Robin Liew @ Dec 18 2010, 08:11 AM) fd rate is freaking low i wanted to deposit for the 12 yr plan @3.4% but the housing loan interest is 4%.... so i think better dump into housing loan wise? try foreign currency FD, u can get 5.3% per year |

|

|

|

|

|

SUSDavid83

|

Dec 18 2010, 09:48 AM Dec 18 2010, 09:48 AM

|

|

QUOTE(michspc @ Dec 18 2010, 09:36 AM) try foreign currency FD, u can get 5.3% per year That is placing FCFD in AUD right? |

|

|

|

|

Dec 14 2010, 05:41 PM

Dec 14 2010, 05:41 PM

Quote

Quote

0.0244sec

0.0244sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled