(bank simpanan nasional)

Well actually I am kinda blur with investments..

Can someone explain to me how fixed deposit interest rate goes?

Do they pay monthly or yearly?

Kinda blur..

FD rates in Malaysia, Which bank offer the highest FD rates?

|

|

Jun 10 2010, 08:12 PM Jun 10 2010, 08:12 PM

Return to original view | Post

#1

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

|

|

|

|

|

|

Jun 12 2010, 11:20 AM Jun 12 2010, 11:20 AM

Return to original view | Post

#2

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

Alright..

Understand how the FD system goes adi.. Hmm any suggestion for a good bank that can offer fixed deposit for every 6 months ppl? To me right, if the fixed deposit plan is more than 2 years is crazy. I mean who knows when the inflation will occur right? Even though the % interest is higher but how if our Msian Ringgit currency reduce? |

|

|

Jun 12 2010, 09:48 PM Jun 12 2010, 09:48 PM

Return to original view | Post

#3

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

gundam76: 5%? this is so depressing.. Gotta ought for better plans then =)

|

|

|

Jun 15 2010, 01:50 PM Jun 15 2010, 01:50 PM

Return to original view | Post

#4

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

QUOTE(gundam76 @ Jun 12 2010, 11:41 PM) Then do you have any suggestion ??? invest in share market ?? which share market you propose ?? unit trust ?? so many which one ?? can help me?? not ah long..OR would you like to suggest become ah loong and lent money and set a higher interest ??? If you would like to use the word depressing, let's say you dont have any money at all, this is call depressing !!! My interest is pay out during January, during economy crisis, we all dun have bonus and increment. But for that particular year, I still can spend and some more maintain the Ang pow money for my dear parents !!!! so, what is so depressing about ?? share.. now I am waiting for my friend to explain to me more abt shares.. =) |

|

|

Jun 15 2010, 10:11 PM Jun 15 2010, 10:11 PM

Return to original view | Post

#5

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

QUOTE(gundam76 @ Jun 15 2010, 04:01 PM) Mind I share with you what I have gone thru, share is good, the return is good. but of course, the risk is there. I gain some share before, buy then after few days, I sold it and I got more than Rm300++, it is better than FD for sure. However, if the share drops, you will lost a lot depending on how many lots you purchase. I see.. Before you buy that share, you need to know the company back groud, their financial back ground and who is managing it. Who are the ppl involved. Share you need to monitor from time to time, if the price is good, and IF you are not greedy, you will get some extra money sort of like bonus or angpow when you sell it. If you have the free time and extra money, you can consider it. Ppl like me, well, I kena burnt but thank god it is not much. I learnt my lesson. So, I end up in FD. Btw I am a student LOL I heard of a phrase. A big risk will come with a big earning.. FD need to use maybe RM50k with 3% interest to get RM1500 a year. If you divide by 12 month means you only earn RM 125 a month How can we possibly live a happy live with only extra RM 125? And.. I don't have the capability to have that much off $$ to start with.. |

|

|

Dec 17 2010, 11:14 PM Dec 17 2010, 11:14 PM

Return to original view | Post

#6

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

|

|

|

|

|

|

Dec 17 2010, 11:43 PM Dec 17 2010, 11:43 PM

Return to original view | Post

#7

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

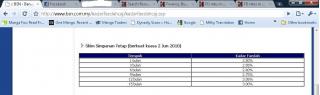

QUOTE(MilesAndMore @ Dec 17 2010, 11:41 PM) QUOTE(heavenly91 @ Dec 17 2010, 11:14 PM) The highest should be RHB Islamic Bank. The 1 year rate is 3.40% and you can request for upfront payment. Meaning you lock your deposit for 1 year and you can get the interest immediately on the day you make the placement. The other bank that offers such deposit is HSBC Amanah but the rate and T&C are not as good. This is basically like a regular fixed deposit account that is Shariah compliant. [attachmentid=1944831] Will the govern back us up? |

|

|

Dec 17 2010, 11:49 PM Dec 17 2010, 11:49 PM

Return to original view | Post

#8

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

QUOTE(MilesAndMore @ Dec 17 2010, 11:46 PM) I see.Well actually I don't really check on the Islamic deposit rates because they are confusing. I guess you already checked on every bank. Is this the best plan out of the other Islamic banks? |

|

|

Dec 17 2010, 11:59 PM Dec 17 2010, 11:59 PM

Return to original view | Post

#9

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

|

|

|

Dec 18 2010, 01:27 AM Dec 18 2010, 01:27 AM

Return to original view | Post

#10

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

|

|

|

Apr 10 2011, 12:11 AM Apr 10 2011, 12:11 AM

Return to original view | Post

#11

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

Hey there.

I have about RM10k to invest. My dad advised me to invest in shares as they can yield up to RM140 per 6 months for every share block I buy. But if I invest in FD, I will make roughly about RM300 a year? That's sad isn't? Or there is a better FD plan nowadays? Should I buy a share instead? |

|

|

Apr 10 2011, 12:40 PM Apr 10 2011, 12:40 PM

Return to original view | Post

#12

|

Senior Member

1,717 posts Joined: Apr 2010 From: Selangor |

QUOTE(cherroy @ Apr 10 2011, 10:23 AM) There are plenty of shares that can yield >4~5%, but in shares, your capital is not protected, can result in loss if market condition unfavourable. Hmm so... FD is better? o.OShould or should not, no one can answer this. As it is about willingness of taking such a risk. |

|

Topic ClosedOptions

|

| Change to: |  0.0302sec 0.0302sec

0.34 0.34

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 01:48 PM |