Outline ·

[ Standard ] ·

Linear+

Maybank m2u savers 2.1% pa, 2 gud 2 b true 4 savings acc?

|

witchjaz

|

Dec 21 2016, 10:55 AM Dec 21 2016, 10:55 AM

|

New Member

|

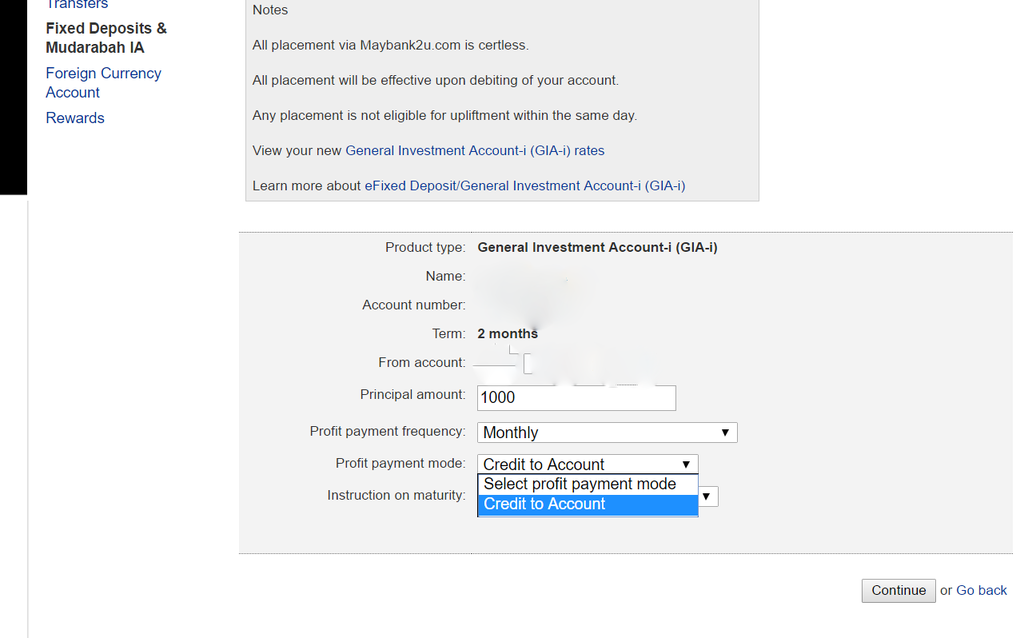

QUOTE(jayzshadower @ Dec 20 2016, 04:46 PM) Anyone notice that GIA-i don't allow credit to principal now ? Now I can only choose Credit to account, last time I did still can, why now cannot ?  » Click to show Spoiler - click again to hide... « Hi.. I did a placement rm1000 on yesterday as well and I can click to choose add to principal with no hassle. You still can change your setting later on. |

|

|

|

|

|

witchjaz

|

Dec 21 2016, 10:57 AM Dec 21 2016, 10:57 AM

|

New Member

|

Hi..

I would like to check with you whether I can perform cash deposit direct to GIA-i account and choose tenure later on?

|

|

|

|

|

|

witchjaz

|

Dec 21 2016, 11:01 AM Dec 21 2016, 11:01 AM

|

New Member

|

QUOTE(witchjaz @ Dec 21 2016, 10:55 AM) Hi.. I did a placement rm1000 on yesterday as well and I can click to choose add to principal with no hassle. You still can change your setting later on. You can click on your "FD account" and "manage my account" and click on "modify" to change the setting. |

|

|

|

|

|

celaw

|

Feb 5 2017, 06:06 PM Feb 5 2017, 06:06 PM

|

|

Anyone know what is the cut off time that m2u savers calculate interest? Example: I have 3k balance beginning of the day, I withdraw 2k at 12 noon. Deposit back 2k at 10pm night. Do I earn any interest for this day itself?

|

|

|

|

|

|

cybpsych

|

Feb 5 2017, 06:52 PM Feb 5 2017, 06:52 PM

|

|

QUOTE(celaw @ Feb 5 2017, 06:06 PM) Anyone know what is the cut off time that m2u savers calculate interest? Example: I have 3k balance beginning of the day, I withdraw 2k at 12 noon. Deposit back 2k at 10pm night. Do I earn any interest for this day itself? balance as of midnight, daily. |

|

|

|

|

|

celaw

|

Feb 5 2017, 07:13 PM Feb 5 2017, 07:13 PM

|

|

QUOTE(cybpsych @ Feb 5 2017, 07:52 PM) balance as of midnight, daily. I see. Then I just need to ensure my balance is more than 2k by night time. Tq very much. |

|

|

|

|

|

monara

|

Feb 5 2017, 08:48 PM Feb 5 2017, 08:48 PM

|

|

QUOTE(celaw @ Feb 5 2017, 07:13 PM) I see. Then I just need to ensure my balance is more than 2k by night time. Tq very much. Specifically before 10pm i believe 😊 |

|

|

|

|

|

celaw

|

Feb 5 2017, 09:58 PM Feb 5 2017, 09:58 PM

|

|

QUOTE(monara @ Feb 5 2017, 09:48 PM) Specifically before 10pm i believe 😊 If is let say 9.30pm, then we can exploit it with GIA-i account. Everyday morning withdraw the GIA-i to earn 3.5%, then put at savings account until 9.30pm to get another 2%, then put back at GIA-i @ 9.45pm. |

|

|

|

|

|

cklimm

|

Feb 5 2017, 10:15 PM Feb 5 2017, 10:15 PM

|

|

QUOTE(celaw @ Feb 5 2017, 09:58 PM) If is let say 9.30pm, then we can exploit it with GIA-i account. Everyday morning withdraw the GIA-i to earn 3.5%, then put at savings account until 9.30pm to get another 2%, then put back at GIA-i @ 9.45pm. too many abnormal transactions may lead to account closure, do at own risk |

|

|

|

|

|

monara

|

Feb 5 2017, 10:17 PM Feb 5 2017, 10:17 PM

|

|

QUOTE(celaw @ Feb 5 2017, 09:58 PM) If is let say 9.30pm, then we can exploit it with GIA-i account. Everyday morning withdraw the GIA-i to earn 3.5%, then put at savings account until 9.30pm to get another 2%, then put back at GIA-i @ 9.45pm. Not really clear, but i guess ur method is to get interest for 2 account with the same money? That 10 pm is the last transaction time for gia, while as someone mentioned earlier, the cut-off time for bank to do calculation is midnight (i.e. balance as at 12am), i suppose bank use the same exact cut off time for all the account. |

|

|

|

|

|

MGM

|

Feb 21 2017, 11:28 AM Feb 21 2017, 11:28 AM

|

|

QUOTE(fruitie @ Feb 21 2017, 11:09 AM) Well, I also closed my AmBank account last year's May after it reduced the interest rate. Hate to go OT here but I will add on that I have closed my Savers account too because it needs RM 2k to be maintained in order to get interest and need to have at least RM 250 balance. So in short, RM 0.11 is really a pretty negligence amount.  I am using Savers-i n not Savers as it still earns interest for amt <RM2000. Dont u need an account to hold your funds temporarily in & out from GIA-i? QUOTE(deity01 @ Oct 12 2016, 10:58 AM) got la...but I lazy search for you..lol infact..m2u saver-i cover more... m2u saver: 0% from 0 - <2000, 2.0% 2000 - 50000, 2.2% >50000 m2u saver-i: 0.4% from 0 - <2000, 2.0% 2000 - 50000, 2.2% >50000 |

|

|

|

|

|

Ramjade

|

Feb 21 2017, 11:35 AM Feb 21 2017, 11:35 AM

|

|

QUOTE(MGM @ Feb 21 2017, 11:28 AM) I am using Savers-i n not Savers as it still earns interest for amt <RM2000. Dont u need an account to hold your funds temporarily in & out from GIA-i? All you need is your main account. |

|

|

|

|

|

fruitie

|

Feb 21 2017, 11:36 AM Feb 21 2017, 11:36 AM

|

Rise and Shine

|

QUOTE(MGM @ Feb 21 2017, 11:28 AM) I am using Savers-i n not Savers as it still earns interest for amt <RM2000. Dont u need an account to hold your funds temporarily in & out from GIA-i? No need. I will only uplift when I need.  Maybe because I'm single so no family commitment, I only have around RM 100 in my Wadiah account.  If emergency use CC and if can wait, wait till next morning to uplift my money from GIA-i if it is after 10.00 p.m. |

|

|

|

|

|

cybpsych

|

Feb 21 2017, 11:38 AM Feb 21 2017, 11:38 AM

|

|

QUOTE(MGM @ Feb 21 2017, 11:28 AM) I am using Savers-i n not Savers as it still earns interest for amt <RM2000. Dont u need an account to hold your funds temporarily in & out from GIA-i? the only trouble is the timing (6am-10pm) to withdraw from GIA-i, and little effort to keep placing-withdrawing as and when needed. other than that, the profit 3.5%p.a. now is much much better than M2U Savers. |

|

|

|

|

|

MGM

|

Mar 2 2017, 11:51 AM Mar 2 2017, 11:51 AM

|

|

Better than Savers-i?

The RHB Smart Account and RHB Smart Account-i, which can be opened online, reward customers attractive returns of 3% per annum and 1% bonus payouts based on the banking transaction performed.

|

|

|

|

|

|

Ramjade

|

Mar 2 2017, 11:58 AM Mar 2 2017, 11:58 AM

|

|

QUOTE(MGM @ Mar 2 2017, 11:51 AM) Better than Savers-i? The RHB Smart Account and RHB Smart Account-i, which can be opened online, reward customers attractive returns of 3% per annum and 1% bonus payouts based on the banking transaction performed. It's like OCBC 360 |

|

|

|

|

|

vincabby

|

Mar 3 2017, 10:05 AM Mar 3 2017, 10:05 AM

|

|

QUOTE(MGM @ Mar 2 2017, 11:51 AM) Better than Savers-i? The RHB Smart Account and RHB Smart Account-i, which can be opened online, reward customers attractive returns of 3% per annum and 1% bonus payouts based on the banking transaction performed. provided you have 2k which gives you extra 1.5%, use their debit up to 1k, give you another 0.5%, with all this things in there, maybank2u savers is more straightforward. put in money, take interest, settled. |

|

|

|

|

|

MGM

|

Mar 3 2017, 10:09 AM Mar 3 2017, 10:09 AM

|

|

QUOTE(vincabby @ Mar 3 2017, 10:05 AM) provided you have 2k which gives you extra 1.5%, use their debit up to 1k, give you another 0.5%, with all this things in there, maybank2u savers is more straightforward. put in money, take interest, settled. So leceh, will stick with MBB eGIA. TQ. |

|

|

|

|

|

sendohz

|

Mar 3 2017, 10:11 AM Mar 3 2017, 10:11 AM

|

|

QUOTE(MGM @ Mar 3 2017, 10:09 AM) So leceh, will stick with MBB eGIA. TQ. Yeah, straight closed m2u savers. But in m2u system still listed as inactive. |

|

|

|

|

|

deity01

|

Mar 3 2017, 11:02 AM Mar 3 2017, 11:02 AM

|

|

QUOTE(MGM @ Mar 2 2017, 11:51 AM) Better than Savers-i? The RHB Smart Account and RHB Smart Account-i, which can be opened online, reward customers attractive returns of 3% per annum and 1% bonus payouts based on the banking transaction performed. is really like OCBC 360, if you are able to fulfil the RHB Smart Acc criteria, no harm using it, otherwise just stick with M2uSaver/ M2uSaver-i or better, the MBB eGIA-i This post has been edited by deity01: Mar 3 2017, 11:03 AM |

|

|

|

|

Dec 21 2016, 10:55 AM

Dec 21 2016, 10:55 AM

Quote

Quote 0.0194sec

0.0194sec

0.47

0.47

6 queries

6 queries

GZIP Disabled

GZIP Disabled