Click here to HSBC Malaysia Official Credit Card Website

ELIGIBILITY CRITERIA

Who can apply?

Age eligibility:

Primary Primary credit cardholder 21 years and above

Supplementary credit cardholder 18 years and above

Minimum income requirements:

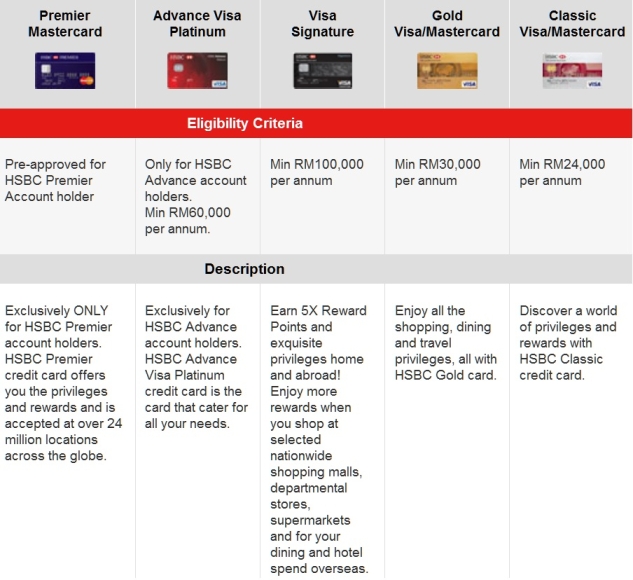

Visa Signature RM 100,000 per annum

Gold Card RM 40,000 per annum

Classic Card RM 24,000 per annum

What documents are required?

1. If you are an existing Primary cardholder for credit card issued by other banks in Malaysia for at least 12 months

Photocopy of MyKad only (both sides)

2. If you do are not an existing Primary cardholder for credit card issued by other banks in Malaysia

Salaried Employee

Photocopy of MyKad (both sides)

Recent utility bill if the address on MyKad is different from your residential address

Latest month salary slip or letter of confirmation from employer if employed less than 3 months

Latest income tax return (Form BE with tax receipt) or Form EA or EPF statement

Self-Employed

Photocopy of MyKad (both sides)

Recent utility bill if the address on MyKad is different from your residential address

Photocopy of Business Registration Form (established minimum 2 years)

Latest income tax return (Form B with tax receipt) or EPF statement

3. If you have applied for any supplementary card/s, please include:

Supplementary cardholder's MyKad

The documents above be dated within the last three months.

LATEST August 2012 - Before you sign up for a HSBC Credit Card, reconfirm if the annual fee is automatically waived with 12 swipes. Below is what cyang81 reported:

QUOTE(cyang81 @ Aug 29 2012, 10:06 PM)

My HSBC Signature have been charge RM600 annual fees on 27/Aug/12 without auto waive.

I have swiped more then 50x @ RM 10K+++

Have to call HSBC CS just now to ask about the annual fees auto waive 12x.

The CS told me now no more auto waive for all HSBC CC except HSBC Advance & Premier.

When I told him to cancel my card, then only he try to offer to waive the annual fees.

But I have to pay RM 600 first for this current statement and HSBC will credit back the annual fees in next statement billing.

Main Benefits of HSBC Credit Cards in generalI have swiped more then 50x @ RM 10K+++

Have to call HSBC CS just now to ask about the annual fees auto waive 12x.

The CS told me now no more auto waive for all HSBC CC except HSBC Advance & Premier.

When I told him to cancel my card, then only he try to offer to waive the annual fees.

But I have to pay RM 600 first for this current statement and HSBC will credit back the annual fees in next statement billing.

1. FREE Annual Fee (for Visa Signature, Gold and Classic cards need to swipe 12 times a year).

2. Discount at selected merchants (go to HSBC website to learn more)

3. Freebies when you make purchases at selected outlets with your HSBC Credit Cards at Midvalley during Sales and Festive Seasons.

4. Contest (not sure if this should be a benefit but many members here do win something from time to time).

5. Travel Insurance for Gold Card.

6. Free Purchase Protection Insurance Coverage for Gold Card.

7. 0% installment plan at selected outlets. Click here to view list of participating outlets.

8. Hotel offers worldwide. Go to HSBC website for more details.

Disadvantage of HSBC Credit Cards versus other cards

1. Reward points 1X only (except for Visa Signature where you get 5X with T&C).

2. Reward points are not evergreen, good for 3 years only.

3. You get nothing when using it to pump petrol unless there is a promotion by HSBC. Click here to Petrol Thread.

HSBC limited time Balance Transfer Offer

Please note that HSBC do not issue separate account for their Balance Transfer Plan and payment is based on hierarchy. You are advised to understand the terms and conditions before you proceed to apply for their Balance Transfer Plan. Click here to read my article on Balance Transfer Plans - Facts You Need To Know.

Ways to apply for the HSBC Credit Cards

1. Go to branch and fill in application form and submit it there.

2. Online by clicking on the official website and click Apply Now, the 1st link of this Thread/Post.

3. If you are in Klang Valley, best place is at Mid Valley on weekends where there are tons of HSBC representatives more than willing to assist you in getting a HSBC Credit Card.

HSBC Customer Service Contact Numbers

1. HSBC Malaysia Customer Service General Line 1-300-88-0181 or 03-83215202

2. HSBC Malaysia Premier Credit Card Customer Service 1-300-88-9393 or 03-83215208 or Call Collect 03-83215222

3. HSBC Malaysia Visa Signature Credit Card Customer Service 03-83215201 or Toll Free 1-800-88-7088

For other HSBC contact numbers click here.

Useful Information

When calling HSBC Customer Service, select BM instead of English to speak to a Malaysian representative. Thanks to aeiou228 where he posted at FD thread at Main Finance Section.

HSBC Premier World MasterCard and Visa Signature

Main Benefits of HSBC Premier World MasterCard and Visa Signature

1. 5X Reward Points at Mid Valley Megamall, The Garden Mall, Gurney Plaza (Penang), KSL City Mall (Johor), Parkson, Isetan, Tangs, Mercato, Village Grocer and Cold Storage subjected to maximum combined spending of RM1,500 per month i.e. after you RM1500, you get only 1 reward point for every RM1.

2. 10X Reward Points for Hotel and Dining transactions overseas subjected to RM2,000 per month.

3. Free golf green fees at selected golf clubs.

Click here to read my article on HSBC Premier World MAsterCard and Visa Signature. In this article, I did a brief comparison between Maybankard 2 Platinum Cards/Maybankard Visa Infinite/HLB Visa Signature versus HSBC Visa Signature. Also in this article I touched on HSBC's claim of having the best airmiles conversion.

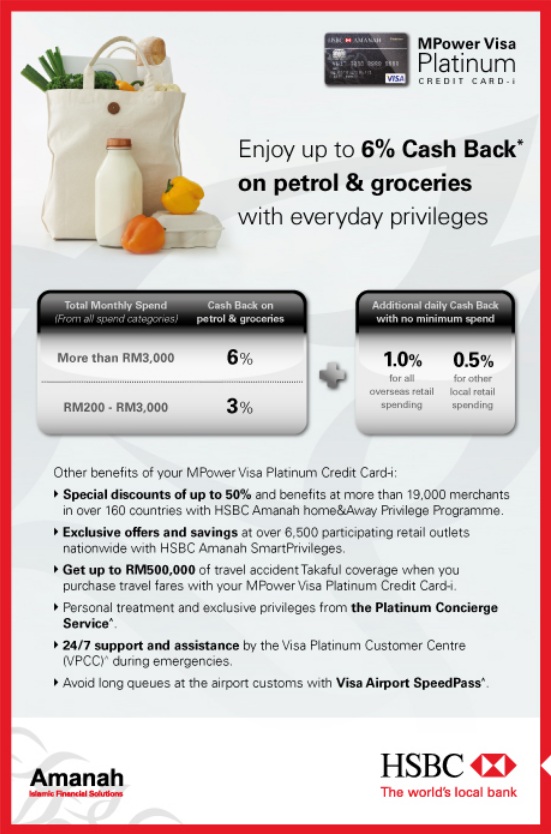

HSBC Amanah MPower Visa Platinum Cash Back Credit Card -i

Until end of 2012, the HSBC MPower Platinum Credit Card i earns you 8% cash back for petrol, dining and groceries. But like always, you need to read the terms and conditions.

Click here to read my article titled HSBC Amanah MPower Visa Platinum 8% Cash Back - Is It Really 8%?

Notice to HSBC Agents, please click spoiler below:

» Click to show Spoiler - click again to hide... «

NOTE

If you sign up for an online account to check your credit card transactions, you will no longer be issued any paper statements in the mail. So, if you want to have paper statement sent to you monthly, DO NOT sign up for online account.

Effective 15th March 2012, HSBC Tiered Interest Rates on Outstanding Balance will be increased. Click below link to see it

HSBC Credit Card Outstanding Interest Rates 2012

Updated July 2014 - when we call HSBC to beg for annual fee waiver, nowadays HSBC will tell us to pay the annual fee upfront and then they will credit us back the payment. Well, I won't tolerate that kind of ridiculous insincere offer but will demand that my annual fee be waived on the spot. Click here to read my article titled "My HSBC Visa Signature Pisses Me Off Big Time" where I shared my experience on annual fee waiver for my HSBC Visa Signature and hopefully you can learn a thing or two from it.

This post has been edited by Gen-X: Jul 16 2014, 02:18 PM

Apr 12 2011, 08:48 PM, updated 11y ago

Apr 12 2011, 08:48 PM, updated 11y ago

Quote

Quote

0.0506sec

0.0506sec

0.29

0.29

7 queries

7 queries

GZIP Disabled

GZIP Disabled