-

This post has been edited by Pink Spider: Feb 4 2012, 01:14 AM

Personal financial management, V2

Personal financial management, V2

|

|

Feb 4 2012, 12:08 AM Feb 4 2012, 12:08 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

-

This post has been edited by Pink Spider: Feb 4 2012, 01:14 AM |

|

|

|

|

|

Feb 4 2012, 01:18 AM Feb 4 2012, 01:18 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

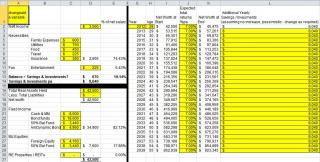

QUOTE(Pink Spider @ Feb 4 2012, 12:08 AM) No seafood here bro - just a worker ant sharing view and bouncing off some ideas/views.What to do - my little girl's in SG I took the liberty to add $50 or $500 to your xxx+ or xx,xxx+ and assumed: a. Yr balanced fund = 50% 50% split fixed income & equitiy b. Yr travelling/petrol and entertainment = 50% 50% of $450

I'm assuming U & yr parents are staying around Klang Valley, where cost of living is high. Thus, U may want to concentrate more on "income" for now, as it's the most easiest to boost at your age (new-ish to the workforce or biz). Always concentrate on giving value - your income will eventually follow (ie. U will be like a value stock, which market price will eventually catch up Hm.. are these mutual funds EXCLUDING EPF investments? If so, you should have a total of about $2M to $3M easily, which is enough for an OK-lifestyle, assuming your personal inflation (dependent on LIFEstyle or lifeSTYLE) doesnt hit more than 3-4%pa on average. If these mutual funds are INCLUDING EPF investments, fret not. Keep in mind that we've not added in yr income growth AND EPF per annum addition. I'd need more details to simulate OR U can hunt down one of my old postings in Personal Financial Management OR Fund Investment Corner, where i uploaded a ZIPPED Excel file with EPF simulation with withdrawals for mutual funds. Drop me a PM if U cant find it, i'll send it over. Asset Allocation-wise, U seem overweight in Fixed Income and totally no REIT stocks / Property investments. Personally, i've been overweight too in Fixed Income early last year to mid last year+, but even then it was about 60%+/-, not at 80%+. If this is a planned short-term overweight, it's good. If it's unplanned - be aware that Fixed Income assets, IMHO, should be used as "ammunition accumulation/holding", not as a growth tool. eg. Assume i hold & plan Fixed Income 40%, Biz Equities (Biz, normal stocks, Equity Funds) 30% Real Estate Equities (REITs + Properties) 30% Now market collapses - Biz Equities fall by 50%, thus my holding will fall to 15% (30% *50%) yar? But i still have my Fixed Income generating $ and as a spare ammo to buy into a fallen market - think LELONG / CHEAP SALE Note - U may or may not want to do "hard core" Asset Allocation rebalancing or a mixture. Personally, i only do "hard-core" forced rebalancing IF my Equity classes runs 25%+/- from my planned. Other than that, i continue stupidly on using value averaging + lelong/opportunity buying Phew - a bucket load of kaka eh. Just some point of views yar, not gospel truths. Below is the Excel in ZIP format for your "what if" play  PinkSpider.zip ( 6.76k )

Number of downloads: 42

PinkSpider.zip ( 6.76k )

Number of downloads: 42This post has been edited by wongmunkeong: Feb 4 2012, 01:24 AM |

|

|

Feb 4 2012, 01:44 AM Feb 4 2012, 01:44 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(wongmunkeong @ Feb 4 2012, 01:18 AM) Wow u still replied at this hour 1. My 18K bond funds are my "reserve", partly as "emergency fund" (I dare to take A BIT risk by putting it in MYR bonds as currently my parents still got a bit $$$ which can pay for their food and medical costs for 3-4 years. After that $$$ goes dry I'd have to cover 100% of household expenses) and partly as "reserve ammo". 2. Asset allocation - yes I'm slowly increasing my equity allocation, esp. on Emerging Markets as I'm having virtually zero exposure here. Taking it slowly cos during 2010 I got burnt badly in EM and Asia Ex-Japan funds. Targeting 25%-50% of my "Investment Funds" in equity, currently it stands at about 36% I think. 3. My balanced fund is not really balanced, it's a conservative mixed assets fund, 70% in fixed income + 30% in equities (high yield shares + REITs). So far it's yielding me 6-7% p.a. consistently. 4. Yeah, my investments are all by cash. As I believe that EPF alone is NOT sufficient to guarantee a comfortable retirement, I dun plan to withdraw my EPF, even to purchase properties/invest, I'm treating it as a safety buffer as it's legally bound to pay 4%++ annually. (am I right?) I'd do some SLIGHTLY HIGHER RISK investments by myself to supplement my EPF savings. Thanks for the encouragement. This post has been edited by Pink Spider: Feb 4 2012, 01:51 AM |

|

|

Feb 4 2012, 01:51 AM Feb 4 2012, 01:51 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Pink Spider @ Feb 4 2012, 01:44 AM) Wow u still replied at this hour Heheh - like i said, no girls (little or big) to keep me occupied, thus i'm running a muck. 1. My 18K bond funds are my "reserve", partly as "emergency fund" (I dare to take A BIT risk by putting it in MYR bonds as currently my parents still got a bit $$$ which can last for 3-4 years. After that $$$ goes dry I'd have to cover 100% of household expenses) and partly as "reserve ammo". 2. Asset allocation - yes I'm slowly increasing my equity allocation, esp. on Emerging Markets as I'm having virtually zero exposure here. Taking it slowly cos during 2010 I got burnt badly in EM and Asia Ex-Japan funds. Targeting 25%-50% of my "Investment Funds" in equity, currently it stands at about 36% I think. 3. My balanced fund is not really balanced, it's a conservative mixed assets fund, 70% in fixed income + 30% in equities (high yield shares + REITs). So far it's yielding me 6-7% p.a. consistently. 4. Yeah, my investments are all by cash. As I believe that EPF alone is NOT sufficient to guarantee a comfortable retirement, I dun plan to withdraw my EPF, even to purchase properties/invest, I'm treating it as a safety buffer as it's legally bound to pay 4%++ annually. (am I right?) I'd do some SLIGHTLY HIGHER RISK investments by myself to supplement my EPF savings. Thanks for the encouragement. Er.. EPF doesnt guarantee 4%++ leh. It's 2.5%pa minimum - eek! http://www.kwsp.gov.my/index.php?ch=p2faqi...ac=620&expand=1 |

|

|

Feb 4 2012, 01:55 AM Feb 4 2012, 01:55 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(wongmunkeong @ Feb 4 2012, 01:51 AM) Heheh - like i said, no girls (little or big) to keep me occupied, thus i'm running a muck. Er.. EPF doesnt guarantee 4%++ leh. It's 2.5%pa minimum - eek! http://www.kwsp.gov.my/index.php?ch=p2faqi...ac=620&expand=1 Anyway, it's still got the stability factor there. Probably will withdraw some to buy into high-yield blue chips in future. U could always fork out a bit money for girls. Tata and goodnite Wong Seafood, thanx for the late night chat. |

|

|

Feb 4 2012, 09:53 AM Feb 4 2012, 09:53 AM

|

Newbie

4 posts Joined: Feb 2012 |

Hi Wong,

Thank you for your time and patient to explain to me I understand your point of that 8% only for the 1st year and should be okay for long term. However, I'm still noobie in investing, I wouldn't risk the confirmed 4%-5% by EPF with something that's I'm not sure will even make it 8% to break even with the EPF interest. Anyway, I still have a healthy amount of saving which I can pump into investment every month (equity and gold) without the need to go into my EPF fund. REITs does sound suitable to me as I'm too lazy to go around search for good properties or doing the whole land-lord thing. Definitely interested in REITs, however will do some more fact-finding before diving into it. Any good recommended REITs that I can keep an eye for Thanks again QUOTE(wongmunkeong @ Feb 3 2012, 11:32 PM) Eh, no Mr Mr here to me pls. Surname = Wong, not Mr. This post has been edited by neo-spider: Feb 4 2012, 09:54 AMAh - these savings / fun spending are inclusive of your bonus? Still good leh - it's near my own personal level of cash savings inclusive of bonus and you've got age/time & growth on your side. I'm a geezer comparatively Well, your logic of EPF --> Mutual Funds needing 8%pa to break even isnt too right. Note that that's just for the 1st year, U should take long term into consideration. Please note i'm NOT advocating U should move yr EPF into mutual funds k, just going to share some return i myself managed to eek out. Below are snapshots of Equity funds i hold in Prudential SmallCaps + Public Sector Select Fund (PSSF) & Bond fund Public Select Bond Fund. Please note i'm my own agent for Public Mutual, thus take the PSSF returns with a pinch of salt due to lowered cost of entry. For PSBF, agents dont get any of the 0.25% commissions (if i'm not mistaken). Take a look see - worthwhile? It's not ALL profits yar as U can see from the "untouched-up", other than amount and units lar, snapshots. Take special note of Prudential's SmallCap which i paid FULL service charges. In those days, i think it was about 6%++. Worthwhile? It depends on your own selection and methodology i guess. Heck, if U can handle gold's wild runs, this is sup sup water for U i think [attachmentid=2667236] [attachmentid=2667238] [attachmentid=2667239] U've just got introduced to Asset Allocation indirectly by your bond funds saving the day due to their exceptional returns these 1+ year Properties? It's always a good time OR bad time to buy - it depends on your expertise in the area + target market. This is where specialization can eek out some great deals even in a high market. Personally, i'm not an expert in properties though i do have investment real estate. Just bought based on cost VS rental yield returns + location for easier land-lording. I'd suggest U look into REITs as a start for diversifying into Real Estate asset class since REITs throws out dividends regularly and has upside potential due to its underlying properties going up in value and/or people chasing the REIT's stocks up. No issues of landlording nor lump sum locked-in BUT not much leverage (which can be a good or bad thing). Foreign FD? not my cuppa unless my daughter identifies which country's Uni she's targeting - she's a wee bit too young to do that yet though hheheh. Reason = i'd rather own the assets generating the $, than just the $. Phew - just a (many?) thought. |

|

|

|

|

|

Feb 4 2012, 10:05 AM Feb 4 2012, 10:05 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(neo-spider @ Feb 4 2012, 09:53 AM) Hi Wong, You're welcome Neo-Spider - hope it helps.Thank you for your time and patient to explain to me I understand your point of that 8% only for the 1st year and should be okay for long term. However, I'm still noobie in investing, I wouldn't risk the confirmed 4%-5% by EPF with something that's I'm not sure will even make it 8% to break even with the EPF interest. Anyway, I still have a healthy amount of saving which I can pump into investment every month (equity and gold) without the need to go into my EPF fund. REITs does sound suitable to me as I'm too lazy to go around search for good properties or doing the whole land-lord thing. Definitely interested in REITs, however will do some more fact-finding before diving into it. Any good recommended REITs that I can keep an eye for Thanks again Er.. i wouldnt say "confirm 4%-5%" for EPF. Guaranteed is only 2.5% If you're the risk mgt type, U might want to consider whether U can take out from your all your EPF when 55 given that Gov usually taps EPF's funds (ie. our money) for all sorts of stuff, even tak logical ones, without our say. Thus, there may be some hazzards to EPF's "real $ available for withdrawal" and the Gov may just push that age further OR change the withdrawal to some annuity thinggy rather than lump sum when U reach retirement. Personally, 1/3 of my net worth is tied to EPF, thus i'm taking out as much and as fast as possible to sorok into Properties (a/c2) and Mutual Funds (a/c1). The $ sorok-ed into Mutual Funds is not 100% safe from EPF's hands in my opinion, as it may just REVOKE all investments into mutual funds from tapping EPF and force a "recall". REITs? Try here: http://forum.lowyat.net/topic/1993103/+102 http://mreit.reitdata.com/ BTW, pls repeat after me - Stock INVESTING, not TRADING Just a thought This post has been edited by wongmunkeong: Feb 4 2012, 10:07 AM |

|

|

Feb 4 2012, 06:26 PM Feb 4 2012, 06:26 PM

|

Newbie

4 posts Joined: Feb 2012 |

Hi Wong,

stock investing, not stock trading Stock Investing, Not Stock Trading STOCK INVESTING, NOT STOCK TRADING STOCK INVESTING, NOT STOCK TRADING Thanks Man Well, got a lot of reading to do, the more I google, the more things I realize I don't know about Gotta start somewhere right, good thing its a long weekend Thanks for the help again QUOTE(wongmunkeong @ Feb 4 2012, 10:05 AM) You're welcome Neo-Spider - hope it helps. Er.. i wouldnt say "confirm 4%-5%" for EPF. Guaranteed is only 2.5% If you're the risk mgt type, U might want to consider whether U can take out from your all your EPF when 55 given that Gov usually taps EPF's funds (ie. our money) for all sorts of stuff, even tak logical ones, without our say. Thus, there may be some hazzards to EPF's "real $ available for withdrawal" and the Gov may just push that age further OR change the withdrawal to some annuity thinggy rather than lump sum when U reach retirement. Personally, 1/3 of my net worth is tied to EPF, thus i'm taking out as much and as fast as possible to sorok into Properties (a/c2) and Mutual Funds (a/c1). The $ sorok-ed into Mutual Funds is not 100% safe from EPF's hands in my opinion, as it may just REVOKE all investments into mutual funds from tapping EPF and force a "recall". REITs? Try here: http://forum.lowyat.net/topic/1993103/+102 http://mreit.reitdata.com/ BTW, pls repeat after me - Stock INVESTING, not TRADING Just a thought |

|

|

Feb 5 2012, 09:23 AM Feb 5 2012, 09:23 AM

|

Senior Member

661 posts Joined: Feb 2007 |

I support it... Stock INVESTING, not TRADING

QUOTE(wongmunkeong @ Feb 4 2012, 10:05 AM) You're welcome Neo-Spider - hope it helps. Er.. i wouldnt say "confirm 4%-5%" for EPF. Guaranteed is only 2.5% If you're the risk mgt type, U might want to consider whether U can take out from your all your EPF when 55 given that Gov usually taps EPF's funds (ie. our money) for all sorts of stuff, even tak logical ones, without our say. Thus, there may be some hazzards to EPF's "real $ available for withdrawal" and the Gov may just push that age further OR change the withdrawal to some annuity thinggy rather than lump sum when U reach retirement. Personally, 1/3 of my net worth is tied to EPF, thus i'm taking out as much and as fast as possible to sorok into Properties (a/c2) and Mutual Funds (a/c1). The $ sorok-ed into Mutual Funds is not 100% safe from EPF's hands in my opinion, as it may just REVOKE all investments into mutual funds from tapping EPF and force a "recall". REITs? Try here: http://forum.lowyat.net/topic/1993103/+102 http://mreit.reitdata.com/ BTW, pls repeat after me - Stock INVESTING, not TRADING Just a thought Added on February 5, 2012, 9:28 amI just start saving RM200 monthly into bond fund... as i am worried the risk on the equity fund and it also expensive. Any advice on the equity? Probably I can load another RM100 monthly if feasible to invest in equity. Interest with Kenanga Growth Fund... This post has been edited by techie.opinion: Feb 5 2012, 09:28 AM |

|

|

Feb 5 2012, 11:32 AM Feb 5 2012, 11:32 AM

|

Senior Member

952 posts Joined: Feb 2011 |

QUOTE(techie.opinion @ Feb 5 2012, 09:23 AM) I support it... Stock INVESTING, not TRADING the important is, how u understand abt the fund objective. not all the equity fund has same invetment objective/strategy.Added on February 5, 2012, 9:28 amI just start saving RM200 monthly into bond fund... as i am worried the risk on the equity fund and it also expensive. Any advice on the equity? Probably I can load another RM100 monthly if feasible to invest in equity. Interest with Kenanga Growth Fund... some fund focus on capital growth and dividends second. some focus on dividend and capital growth comes second. u must chosse which fund is match with ur own objective. also ur risk tolerance. |

|

|

Feb 5 2012, 11:40 AM Feb 5 2012, 11:40 AM

|

Senior Member

16,872 posts Joined: Jun 2011 |

QUOTE(techie.opinion @ Feb 5 2012, 09:23 AM) I support it... Stock INVESTING, not TRADING Kenanga Growth Fund's returns are crazy...wonder how they achieved it Added on February 5, 2012, 9:28 amI just start saving RM200 monthly into bond fund... as i am worried the risk on the equity fund and it also expensive. Any advice on the equity? Probably I can load another RM100 monthly if feasible to invest in equity. Interest with Kenanga Growth Fund... I'm also not dare take on too much risk, but equity exposure is necessary to offset inflation in the long run...for the risk-averse, 1/4 of ur total investment in equity should be good enuff |

|

|

Feb 5 2012, 06:38 PM Feb 5 2012, 06:38 PM

|

Senior Member

661 posts Joined: Feb 2007 |

|

|

|

Feb 6 2012, 01:49 AM Feb 6 2012, 01:49 AM

|

Junior Member

32 posts Joined: Jun 2008 |

hi all,

just need some POV on my financial situation. i know i might be criticized of my ignorance on savings and high CC debt but i'm willing to hear your advises to learn from it. Here is my situation: Salary: RM5,500 (Net) Commitment: Money for Dad : RM600 Insurance: RM300 Phone bill : RM 120 Petrol for Car : RM 400 Credit Card : RM 2300 (RM 1650 balance transfer-3 credit card which all ends in Sep 2013 and balance is minimum payment for another credit card) Gym : RM165 Car maintenance : RM 200-300 (in every 3 months use credit card most of the time) Eat/Entertainment/Misc :RM 1200 as i eat lunch and dinner outside (nobody cooks at home) Currently I'm saving RM500 per month but I need to travel for holiday in March and April. I will be able to start saving for emergency and investment from May onward. I'm planning to start investing in order to get RM 50K in 3 years (for wedding and house down payment). Any suggestion how to achieve it? I'm starting to learn on mutual funds and etc. hope i am able to come out of the debt and start learning how to earn from investment. I would want to be debt free by end of 2013. Hope this info is sufficient. Hope to hear your feedback on this. Thanks in advance. |

|

|

|

|

|

Feb 6 2012, 02:13 AM Feb 6 2012, 02:13 AM

|

Newbie

4 posts Joined: Feb 2012 |

how bout starting a business in night market...i heard they r profitable

|

|

|

Feb 6 2012, 11:58 AM Feb 6 2012, 11:58 AM

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(zero_cool81 @ Feb 6 2012, 01:49 AM) hi all, Credit Card : RM 2300just need some POV on my financial situation. i know i might be criticized of my ignorance on savings and high CC debt but i'm willing to hear your advises to learn from it. Here is my situation: Salary: RM5,500 (Net) Commitment: Money for Dad : RM600 Insurance: RM300 Phone bill : RM 120 Petrol for Car : RM 400 Credit Card : RM 2300 (RM 1650 balance transfer-3 credit card which all ends in Sep 2013 and balance is minimum payment for another credit card) Gym : RM165 Car maintenance : RM 200-300 (in every 3 months use credit card most of the time) Eat/Entertainment/Misc :RM 1200 as i eat lunch and dinner outside (nobody cooks at home) Currently I'm saving RM500 per month but I need to travel for holiday in March and April. I will be able to start saving for emergency and investment from May onward. I'm planning to start investing in order to get RM 50K in 3 years (for wedding and house down payment). Any suggestion how to achieve it? I'm starting to learn on mutual funds and etc. hope i am able to come out of the debt and start learning how to earn from investment. I would want to be debt free by end of 2013. Hope this info is sufficient. Hope to hear your feedback on this. Thanks in advance. is it total debt or every month payment amount? so long u work u don't have saving? |

|

|

Feb 6 2012, 02:50 PM Feb 6 2012, 02:50 PM

|

Junior Member

145 posts Joined: Feb 2012 |

QUOTE(lucifah @ Sep 27 2010, 11:13 PM) for 3 minutes, just ignore the blue tag Don't know what to do?i'm currently nearing my thirties. what i do and how much i earn shouldn't be important, rigth? currently, 1. i maxed out my ASB investment 2. HP repayment about RM 800, another 2 yrs left <-- my only liability, currently 3. property loan repayment = RM 2k per month, 9.5 yrs left i've been saving almost 60% of my salary. my ASB goes from zero to max within 5 years. i don;t desire many things but i still do spend normally - a new phone every year, this and that, fine watches, bicycles, gadgets, etc etc now my big problem: i just don't have any idea what else to do with the money. pls help. atm, i just dump my extra money into ASM or ASW which earns me about 6% return annually. and to quote from a popular pop song "i wanna be a billionaire, so freaking bad... bla bla bal bala bal" and oh yeah. i'm single. w/o insurance (never believe in insurance) Invest in yourself (education in financial). Added on February 6, 2012, 2:52 pm QUOTE(zero_cool81 @ Feb 6 2012, 01:49 AM) hi all, Your earnings is not bad, I believe is more than 80% of all working adults in Malaysia (if not 80% should be at least 70%).just need some POV on my financial situation. i know i might be criticized of my ignorance on savings and high CC debt but i'm willing to hear your advises to learn from it. Here is my situation: Salary: RM5,500 (Net) Commitment: Money for Dad : RM600 Insurance: RM300 Phone bill : RM 120 Petrol for Car : RM 400 Credit Card : RM 2300 (RM 1650 balance transfer-3 credit card which all ends in Sep 2013 and balance is minimum payment for another credit card) Gym : RM165 Car maintenance : RM 200-300 (in every 3 months use credit card most of the time) Eat/Entertainment/Misc :RM 1200 as i eat lunch and dinner outside (nobody cooks at home) Currently I'm saving RM500 per month but I need to travel for holiday in March and April. I will be able to start saving for emergency and investment from May onward. I'm planning to start investing in order to get RM 50K in 3 years (for wedding and house down payment). Any suggestion how to achieve it? I'm starting to learn on mutual funds and etc. hope i am able to come out of the debt and start learning how to earn from investment. I would want to be debt free by end of 2013. Hope this info is sufficient. Hope to hear your feedback on this. Thanks in advance. Your problem is not uncommon. Just need to get financial-health-check and a program to recover. This post has been edited by AskChong: Feb 6 2012, 02:52 PM |

|

|

Feb 6 2012, 02:55 PM Feb 6 2012, 02:55 PM

|

Junior Member

32 posts Joined: Jun 2008 |

QUOTE(MNet @ Feb 6 2012, 11:58 AM) Credit Card : RM 2300 Rm 2300 is the balance transfer amount i'm paying every month plus another Rm 650 minimum card payment. Yup i have not been saving all this while as my expenses always exceeds my income hence my credit card usage. now my outstanding debt is about rm 52k (RM 10k owe my dad and rm 42k my credit card ). I'm trying my level best to put some money aside for saving at the same time pay off my debt. worried this is going to effect my mortgage loan application for my future house. all my debt will be settled by end 2013 if i stay strict with my expenses which is going to be very though. Just would like some opinions on how to manage this plus make some savings for future.is it total debt or every month payment amount? so long u work u don't have saving? |

|

|

Feb 6 2012, 02:55 PM Feb 6 2012, 02:55 PM

|

Junior Member

145 posts Joined: Feb 2012 |

|

|

|

Feb 6 2012, 02:58 PM Feb 6 2012, 02:58 PM

|

Junior Member

32 posts Joined: Jun 2008 |

QUOTE(AskChong @ Feb 6 2012, 02:50 PM) Don't know what to do? Yup. I totally agree. I just need to manage it well. Just struck me how ignorant i am to financial planning. hope my problem helps enlighten others too. Invest in yourself (education in financial). Added on February 6, 2012, 2:52 pm Your earnings is not bad, I believe is more than 80% of all working adults in Malaysia (if not 80% should be at least 70%). Your problem is not uncommon. Just need to get financial-health-check and a program to recover. |

|

|

Feb 6 2012, 02:59 PM Feb 6 2012, 02:59 PM

|

Junior Member

145 posts Joined: Feb 2012 |

You are good. Can save 40% of your income.

I advise you start investing in YOURSELF first, in Money Skill. QUOTE(dello @ Jan 7 2012, 01:42 PM) Pay - 3800 Pay (after deduction) - RM 3400 FIXED Study Loan - 450 Parents - 250 Bill - 100 Credit Card - 100 Food and misc - 800 BALANCE - RM 1800 Should have gotten better grades.. lose so much on student loan darnz With this balance can buy house and car ar? Added on February 6, 2012, 3:02 pm QUOTE(youngman28 @ Jan 12 2012, 12:45 PM) hi, Look like better to Payout AIA loan (3 years left and high fixed rate). Then, may be you can consider to refinance for BLR-2.x% and invest it (if you know enough on investment, to gain 7% return is easy).I am in the early 40, reccently face some dilema on which loan need to setter first on my home loan? Loan A- Balance around 190k, mthly instalment RM1600, left 12 years +, currently tenant out for kindergarden purpose, so every month generate rental income of RM1200 to cover the instalment, balance need to top up around RM400. Loan B- Existing house stay by me, balance around 30k, monthly instalment RM768, left 3 years+ My question is, in coming Feb/March, i will have some cash to come in result from sold off an old house, but i doesn 't quite clear which one need to setter off first. Let say i have 70k to clear off the instalment. In my plan 1, i willl pay-off the Loan B(30k), and pay off 40 k for loan A because after all i need not to pay the instalment any more, but the cons is that the bal interest charge was not that much , is around 2-3k, On alternatively, i come out with plan 2, pay back 70k for loan A, and it will reduce the interest drastically, and reduce the tenure as well, but the cons is that i need continue to serve the instalment for loan B. Plan 1- clear-off loan B, have more COH Plan 2 -reduce the amount of loan A, less COH, but reduce interest charge in long term. Need some advise on Personal finance on above matter, which plan i need to use in order to get better return on personal management /investment, especially under current uncertainty economy? This post has been edited by AskChong: Feb 6 2012, 03:02 PM |

|

Topic ClosedOptions

|

| Change to: |  0.0271sec 0.0271sec

0.69 0.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 09:12 PM |