QUOTE(Ramjade @ Dec 19 2024, 07:17 AM)

It is RM300,000 to qualify for HSBC Premier Banking in Malaysia now. For HSBC Premier Elite, the minimum TRB is RM3 million.Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Jan 10 2025, 09:07 PM Jan 10 2025, 09:07 PM

Show posts by this member only | IPv6 | Post

#6041

|

|

Moderator

9,301 posts Joined: Mar 2008 |

|

|

|

|

|

|

Jan 11 2025, 08:49 AM Jan 11 2025, 08:49 AM

Show posts by this member only | IPv6 | Post

#6042

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(MilesAndMore @ Jan 10 2025, 09:07 PM) It is RM300,000 to qualify for HSBC Premier Banking in Malaysia now. For HSBC Premier Elite, the minimum TRB is RM3 million. I won't bother with priority banking.The only priority banking I want is with DBS. But if no priority it's ok. Won't die. This post has been edited by Ramjade: Jan 11 2025, 08:50 AM |

|

|

Jan 14 2025, 03:31 PM Jan 14 2025, 03:31 PM

|

Senior Member

9,348 posts Joined: Aug 2010 |

|

|

|

Jan 14 2025, 03:37 PM Jan 14 2025, 03:37 PM

|

All Stars

24,335 posts Joined: Feb 2011 |

|

|

|

Jan 14 2025, 03:38 PM Jan 14 2025, 03:38 PM

|

Senior Member

9,348 posts Joined: Aug 2010 |

|

|

|

Jan 14 2025, 04:12 PM Jan 14 2025, 04:12 PM

|

All Stars

24,335 posts Joined: Feb 2011 |

nexona88 liked this post

|

|

|

|

|

|

Jan 19 2025, 01:45 PM Jan 19 2025, 01:45 PM

|

Senior Member

1,630 posts Joined: Jun 2006 |

Has anyone considered CIMB fastsaver ? at least they offer 3.2% for those existing customers (new customer is 5%) .

but the terms and conditions is so complicated. I wonder if anyone tried ? https://www.cimb.com.sg/content/dam/cimbsg/...ug-dec-2024.pdf |

|

|

Jan 19 2025, 02:14 PM Jan 19 2025, 02:14 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

QUOTE(ccschua @ Jan 19 2025, 01:45 PM) Has anyone considered CIMB fastsaver ? at least they offer 3.2% for those existing customers (new customer is 5%) . you dont need to read the whole thing. I just read first half page and its enough for me to deduce the feasibility. but the terms and conditions is so complicated. I wonder if anyone tried ? https://www.cimb.com.sg/content/dam/cimbsg/...ug-dec-2024.pdf QUOTE To qualify for this Promotion, Customer has to: a) hold both a CIMB Visa Signature Principal Credit Card (as principal cardmember, the “Principal Cardmember”) and a FastSaver/FastSaver-i Account (“Qualifying Account”) during the Promotion Period; and b) meet a minimum spend of S$300 posted within the same statement month on their CIMB Visa Signature Credit Card. Exclusions apply to minimum spend under Clause 35, 36 and 37 Is it even possible for Non SG resident to have a credit card in the first place? I think its a valid topic for discussion, since we already have SG bank account and SG bank debit card. Now, the next frontier is SG bank Credit Card This post has been edited by john123x: Jan 19 2025, 02:16 PM |

|

|

Jan 19 2025, 02:23 PM Jan 19 2025, 02:23 PM

|

Senior Member

3,488 posts Joined: Jan 2003 |

|

|

|

Jan 19 2025, 02:38 PM Jan 19 2025, 02:38 PM

|

All Stars

24,335 posts Joined: Feb 2011 |

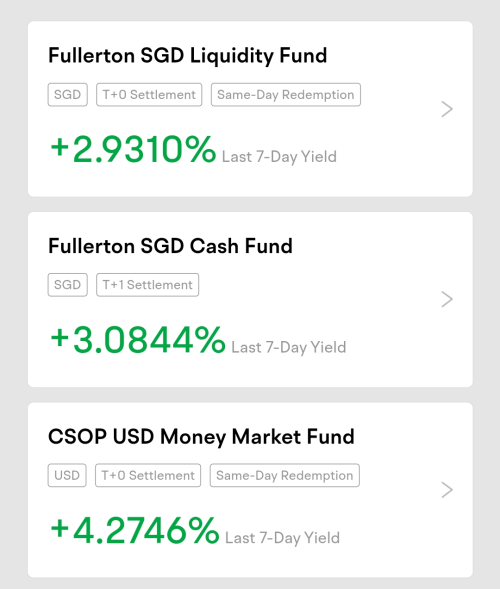

QUOTE(ccschua @ Jan 19 2025, 01:45 PM) Has anyone considered CIMB fastsaver ? at least they offer 3.2% for those existing customers (new customer is 5%) . Just open tiger sg or moomoo sg. Moomoo sg harder open. Once open just buy Fullerton SGD cash fund. No need complicated terms and conditions or jumping though hoops.but the terms and conditions is so complicated. I wonder if anyone tried ? https://www.cimb.com.sg/content/dam/cimbsg/...ug-dec-2024.pdf |

|

|

Jan 19 2025, 02:43 PM Jan 19 2025, 02:43 PM

|

Senior Member

3,488 posts Joined: Jan 2003 |

|

|

|

Jan 19 2025, 03:10 PM Jan 19 2025, 03:10 PM

|

Senior Member

1,630 posts Joined: Jun 2006 |

hav u tried the USD MMF giving 4.2% ? assuming that conversion rate is constent, do I get 4.2% or need to factor in conversion charges ?

I do notice Moomoo my offering 4.2% as well, but I have not tried. I wonder if anyone who had tried can share what is the experience ? This post has been edited by ccschua: Jan 19 2025, 03:10 PM |

|

|

Jan 19 2025, 03:15 PM Jan 19 2025, 03:15 PM

Show posts by this member only | IPv6 | Post

#6053

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(Medufsaid @ Jan 19 2025, 02:43 PM) nowadays fullerton sgd cash fund returns are a bit lower, tat's why i switched back to stashaway simple sgd Of course what. US interest rate drop so and SG interest is directly tied to US. So Fullerton interest also drop. QUOTE(ccschua @ Jan 19 2025, 03:10 PM) hav u tried the USD MMF giving 4.2% ? assuming that conversion rate is constent, do I get 4.2% or need to factor in conversion charges ? I won't bother as I am not sure how good or bad is the exchange rate by moomoo. All these mmf is just for you to park your money. I am able to put my money to work but earning min 3%p.a and growing automatically around 15%p.a without the need for new cash injection. Short term I gain lesser than MMF. Long term, I earn more than MMF.I do notice Moomoo my offering 4.2% as well, but I have not tried. I wonder if anyone who had tried can share what is the experience ? Of course need to factor in conversion charges. Never chase all these foreign FD rates. Only do it if you are using that country currency to invest. Don't suja2 change from ringgit to USD just because of the interest rate. This post has been edited by Ramjade: Jan 19 2025, 03:59 PM |

|

|

|

|

|

Jan 19 2025, 11:13 PM Jan 19 2025, 11:13 PM

|

Junior Member

91 posts Joined: Oct 2018 |

QUOTE(Medufsaid @ Jan 7 2025, 09:42 AM) 604weekendwarrior try to get DBS multicurrency account (after opening DBS vickers), as this is the most useful one. can deposit/withdraw USD from Moomoo SG or Tiger for free. need to go SG, and no guarantee In case anyone wanted a USD account in Singapore.I was actually able to open a Foreign Currency - USD account with CIMB SG. Since I already had an account with them, the cs agent when I called said I just have to just desktop (opening USD account wasn't available on the app) under services and apply for the account. Put in all my details, thought it would take a few weeks. Logged in the next day and my USA account was there. Did a test transfer from Instarem into the USD account and got the deposit late in the day. Minimum balance is USD $1000 |

|

|

Jan 20 2025, 07:11 AM Jan 20 2025, 07:11 AM

Show posts by this member only | IPv6 | Post

#6055

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(604weekendwarrior @ Jan 19 2025, 11:13 PM) In case anyone wanted a USD account in Singapore. I would not go with Cimb or any other sg bank foreign currency account. Reason is the min fall below amount which means extra fees for the bank should the amount drop below the required threshold and the money needs to be lock up and cannot be put to use. 2nd would be the exchange rate. I have always hated Singapore banks to lockup min amount.I was actually able to open a Foreign Currency - USD account with CIMB SG. Since I already had an account with them, the cs agent when I called said I just have to just desktop (opening USD account wasn't available on the app) under services and apply for the account. Put in all my details, thought it would take a few weeks. Logged in the next day and my USA account was there. Did a test transfer from Instarem into the USD account and got the deposit late in the day. Minimum balance is USD $1000 If really want a foreign currency account, rhb multi currency in Malaysia would be a better choice. If course if you are willing to travel to Singapore together a DBS account, by all means go for it as there is no minimum amount with DBS. I keep only SGD0.10 inside my DBS account. This post has been edited by Ramjade: Jan 20 2025, 07:14 AM |

|

|

Jan 20 2025, 04:42 PM Jan 20 2025, 04:42 PM

|

Senior Member

1,598 posts Joined: Aug 2014 |

Let's say that my only intention is to keep my money in Fullerton SGD Cash Fund, and I do not intend to perform any stock trading.

For that, will Tiger Brokers and Moomoo Singapore impose any fee, such as platform fee? Thank you for your clarification. This post has been edited by kart: Jan 20 2025, 04:43 PM |

|

|

Jan 20 2025, 04:51 PM Jan 20 2025, 04:51 PM

Show posts by this member only | IPv6 | Post

#6057

|

All Stars

24,335 posts Joined: Feb 2011 |

QUOTE(kart @ Jan 20 2025, 04:42 PM) Let's say that my only intention is to keep my money in Fullerton SGD Cash Fund, and I do not intend to perform any stock trading. Supposedly no fees from either of them. They are not fsm. I have used moomoo sg only. So far no fees for parking my money with Fullerton under moomoo. Never used Tiger before.For that, will Tiger Brokers and Moomoo Singapore impose any fee, such as platform fee? Thank you for your clarification. This post has been edited by Ramjade: Jan 20 2025, 04:57 PM kart liked this post

|

|

|

Jan 20 2025, 06:36 PM Jan 20 2025, 06:36 PM

|

Senior Member

5,156 posts Joined: Jan 2003 |

|

|

|

Jan 20 2025, 11:23 PM Jan 20 2025, 11:23 PM

|

Senior Member

1,630 posts Joined: Jun 2006 |

fullerton sgd cash for the past few days has not been impressive. it is around 3.1%. is this about right ?

|

|

|

Jan 20 2025, 11:55 PM Jan 20 2025, 11:55 PM

Show posts by this member only | IPv6 | Post

#6060

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(Ramjade @ Jan 11 2025, 08:49 AM) QUOTE(MilesAndMore @ Jan 10 2025, 09:07 PM) QUOTE(Ramjade @ Dec 19 2024, 07:17 AM) It is RM300,000 to qualify for HSBC Premier Banking in Malaysia now. For HSBC Premier Elite, the minimum TRB is RM3 million.The only priority banking I want is with DBS. But if no priority it's ok. Won't die. Ramjade liked this post

|

| Change to: |  0.0175sec 0.0175sec

1.06 1.06

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:59 AM |