Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

!@#$%^

|

Sep 11 2023, 07:56 PM Sep 11 2023, 07:56 PM

|

|

QUOTE(yjy @ Sep 11 2023, 07:01 PM) Updated on opening the OCBC account. I happened to have a trip to go to SG so I dropped into the branch asking if I could get some assistance with getting the broken app to work. I swear I'd probbaly tried at least 20 times. Magically the IC scan worked on the 1st go in front of the staff member. Branch magic... i think there was a bug, unable to read the IC. up until around last Friday then it was okay at one go. |

|

|

|

|

|

!@#$%^

|

Sep 11 2023, 07:58 PM Sep 11 2023, 07:58 PM

|

|

QUOTE(Medufsaid @ Sep 11 2023, 07:23 PM) ziet is aware. whether he'll release an updated video is another matter  https://www.youtube.com/watch?v=mXjaob63K2w https://www.youtube.com/watch?v=mXjaob63K2wso cannot apply cimb sg already? |

|

|

|

|

|

john123x

|

Sep 11 2023, 08:05 PM Sep 11 2023, 08:05 PM

|

|

QUOTE(fishermanG @ Sep 11 2023, 07:12 PM) Just opened Maybank iSAVvy Savings account via Maybank2U MY. Got the SMS to setup online banking (maybank2u sg) etc. Deposited $200 via Wise to try out first. No issues. All seems smooth so far. Questions: 1) Why does the mobile app prompt SMS OTP every single time I tried to login? Secure2U is enabled though. 2) I was testing to send the SGD to my own Maybank MY account (to enjoy zero fees/commission) but it gave me this error "Transaction Signing error... please contact Maybank etc..." Do I need to wait a couple of days to enjoy the full online banking experience? Edit: formatting 1. I think Secure2U needs time to fully activate (i think 24 hours) when its active, you no need SMS OTP to login. an activated secure2u can log into maybank website very fast: 1.maybank website, click the QR picture 2.maybank app, Scan Icon, select "Scan QR and login", scan QR 3. approve secure2u notification at app |

|

|

|

|

|

Medufsaid

|

Sep 11 2023, 08:07 PM Sep 11 2023, 08:07 PM

|

|

--deleted--

This post has been edited by Medufsaid: Jul 12 2024, 09:01 AM

|

|

|

|

|

|

SUSTOS

|

Sep 11 2023, 08:44 PM Sep 11 2023, 08:44 PM

|

|

OCBC Frank account application update: QUOTE Dear Valued Customer

We are pleased to inform you that your FRANK Visa Debit Card application has been approved.

Here are some points you should take note of.

Using the digital card

To retrieve your digital card number, expiry date and CVV (the three digits beside the signature box at the back of the card), go to:

OCBC website > Banking for Individuals > Personal Banking > Cards > See all cards > Debit Cards > select 'Learn More' under FRANK Visa Debit Card > select 'Apply or Retrieve Details' and enter your unique reference code, XXXXXXXXXX.

You can also apply for OCBC Online Banking access on the same page. For security reasons, after seven days from the date of this email, the page will no longer be accessible.

Before you can use this card, you must:

1. Deposit money in the savings account that we opened for you under this application; and

2. Add the card to your mobile wallet - no activation is required. If you wish to make purchases via any website or app, you can only do so at those that request your CVV.

If you have OCBC Online Banking access, you may - at any time - log in to view details of and deposit money in the savings account. Here is what you should do:

1. Go to the 'Customer service' tab on the navigation panel > Click on 'Online Banking - Link/delink accounts' > Enter the One-Time Password sent to your mobile phone

2. Select your newly created savings account to have its details displayed on Online Banking. You can deposit money in this account

3. Go to the 'Your accounts' tab and click on 'Overview' to view details of the debit card tagged to this account

If you do not have OCBC Online Banking access, you can apply for it at the digital card page or wait for us to mail you an Access Code and PIN.

Using the physical card

You will receive your physical card and PIN in five working days*. You do not need to activate this physical card if you are happy using the digital card stored in your mobile wallet - no action is required of you.

Should you activate this physical card, you must replace the CVV already saved on any website or app (besides your mobile wallet) because it is different. If not, you will be unable to make transactions on these platforms.

If you have any questions, please call us at 1800 363 3333.

Thank you for banking with us. We look forward to serving you again.

Yours sincerely

Leonard Tok

Executive Director

Cards Business

Group Lifestyle Financing

OCBC

* If you applied for a FRANK debit card, you may have to wait a little longer - up to seven working days - while we customise your card with your chosen design. One more thing: The default design you will see at the link above is merely illustrative. Your physical card will carry the design you picked!

Do allow us to warn you against phishing attempts involving emails that claim to be from OCBC. We will not send you any emails with links. Enter your login credentials (Access Code, PIN or One-Time Password) only into the OCBC Digital app or OCBC Pay Anyone app, or after accessing the OCBC website (always type out the URL to do this). |

|

|

|

|

|

SUSTOS

|

Sep 11 2023, 09:09 PM Sep 11 2023, 09:09 PM

|

|

QUOTE(TOS @ Sep 11 2023, 08:44 PM) OCBC Frank account application update: Warning: Those who open an account with Frank may not be able to open any other account apart from 360. A message from the website will show that you don't have a valid reference account for the purpose of opening say, Monthly Saving account. Lesson is DON'T open OCBC account on any SG uni campus or any FRANK store! Head straight to the nearest OCBC branch and queue like other Sporeans... This post has been edited by TOS: Sep 11 2023, 09:10 PM |

|

|

|

|

|

lilsunflower

|

Sep 11 2023, 11:47 PM Sep 11 2023, 11:47 PM

|

|

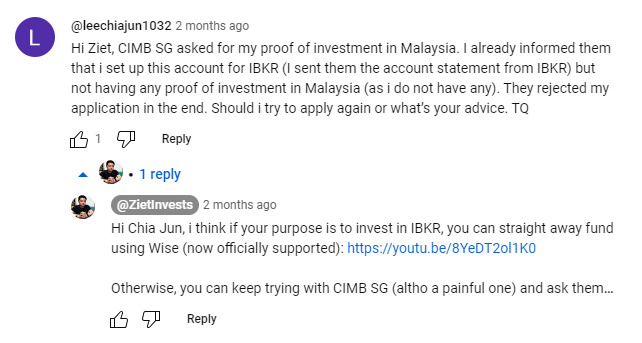

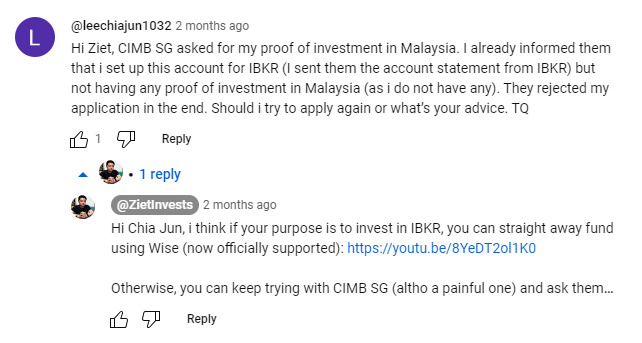

QUOTE(!@#$%^ @ Sep 11 2023, 03:50 PM) After writing an e-mail asking them to refund my money, I received a call from CIMB SG apologies for the long waiting time. They said that if I sent them proof of having some form of investment in Malaysia (e.g. share trading account statement), this would fulfil their requirements and they could open the account. Otherwise it would take up to 5 business days to refund the money. I sent my Malaysian share trading account statement and account was opened the same day. It was not an easy or logical process for me, and I hope everyone else has a better experience. |

|

|

|

|

|

!@#$%^

|

Sep 11 2023, 11:54 PM Sep 11 2023, 11:54 PM

|

|

QUOTE(lilsunflower @ Sep 11 2023, 11:47 PM) After writing an e-mail asking them to refund my money, I received a call from CIMB SG apologies for the long waiting time. They said that if I sent them proof of having some form of investment in Malaysia (e.g. share trading account statement), this would fulfil their requirements and they could open the account. Otherwise it would take up to 5 business days to refund the money. I sent my Malaysian share trading account statement and account was opened the same day. It was not an easy or logical process for me, and I hope everyone else has a better experience. strange but why need proof of investment in malaysia? lol |

|

|

|

|

|

Medufsaid

|

Sep 12 2023, 08:59 AM Sep 12 2023, 08:59 AM

|

|

!@#$%^ same goes them needing proof of income and cukai number. This isn't a credit card service where you're afraid they can't pay debt

|

|

|

|

|

|

!@#$%^

|

Sep 12 2023, 10:19 AM Sep 12 2023, 10:19 AM

|

|

QUOTE(Medufsaid @ Sep 12 2023, 08:59 AM) !@#$%^ same goes them needing proof of income and cukai number. This isn't a credit card service where you're afraid they can't pay debt tax number understandable because i think malaysian gov wants to know how much u have there |

|

|

|

|

|

SUSTOS

|

Sep 12 2023, 01:48 PM Sep 12 2023, 01:48 PM

|

|

QUOTE(TOS @ Sep 11 2023, 09:09 PM) Warning: Those who open an account with Frank may not be able to open any other account apart from 360. A message from the website will show that you don't have a valid reference account for the purpose of opening say, Monthly Saving account. Lesson is DON'T open OCBC account on any SG uni campus or any FRANK store! Head straight to the nearest OCBC branch and queue like other Sporeans... I made a mistake. Was too excited yesterday lol My Frank account was finally set up today. And yes, you can open monthly savings account from the online banking portal. » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

john123x

|

Sep 12 2023, 02:05 PM Sep 12 2023, 02:05 PM

|

|

QUOTE(TOS @ Sep 12 2023, 01:48 PM) I made a mistake. Was too excited yesterday lol My Frank account was finally set up today. And yes, you can open monthly savings account from the online banking portal. » Click to show Spoiler - click again to hide... « are you a SG resident or working in Singapore? I dont think its possible for Non resident to apply for Frank This post has been edited by john123x: Sep 12 2023, 02:07 PM |

|

|

|

|

|

SUSTOS

|

Sep 12 2023, 02:08 PM Sep 12 2023, 02:08 PM

|

|

QUOTE(john123x @ Sep 12 2023, 02:05 PM) are you a SG resident or working in Singapore? I dont think its possible for Non resident to apply for Franbk Student in SG. Frank is targeted to students... But you don't need Frank. Monthly saving account is good enough. Why tie 1000 SGD with the bank when you just need to set aside 500 SGD? This post has been edited by TOS: Sep 12 2023, 02:12 PM |

|

|

|

|

|

Ramjade

|

Sep 12 2023, 02:17 PM Sep 12 2023, 02:17 PM

|

|

QUOTE(john123x @ Sep 12 2023, 02:05 PM) are you a SG resident or working in Singapore? I dont think its possible for Non resident to apply for Frank TOS steps is not applicable to us Malaysian who is not a student or working there. Just stick with what works for us. |

|

|

|

|

|

SUSTOS

|

Sep 12 2023, 02:19 PM Sep 12 2023, 02:19 PM

|

|

QUOTE(Ramjade @ Sep 12 2023, 02:17 PM) TOS steps is not applicable to us Malaysian who is not a student or working there. Just stick with what works for us. Hehe. For those applying without job/study in SG, make sure your phone has NFC capabilities before you open your OCBC SG account... |

|

|

|

|

|

!@#$%^

|

Sep 12 2023, 03:06 PM Sep 12 2023, 03:06 PM

|

|

no issue for those working or studying in sg

|

|

|

|

|

|

Ramjade

|

Sep 12 2023, 03:13 PM Sep 12 2023, 03:13 PM

|

|

QUOTE(!@#$%^ @ Sep 12 2023, 03:06 PM) no issue for those working or studying in sg Yeah. You can open any account you want. That's why no need guide for people working or studying there. Guided needed for people like me. |

|

|

|

|

|

evangelion

|

Sep 14 2023, 09:27 AM Sep 14 2023, 09:27 AM

|

|

QUOTE(TOS @ Sep 12 2023, 02:19 PM) Hehe. For those applying without job/study in SG, make sure your phone has NFC capabilities before you open your OCBC SG account... Bro, can elaborate?  |

|

|

|

|

|

SUSTOS

|

Sep 14 2023, 09:43 AM Sep 14 2023, 09:43 AM

|

|

QUOTE(evangelion @ Sep 14 2023, 09:27 AM) Bro, can elaborate?  You can just try to follow Mr. Gray's method: https://forum.lowyat.net/index.php?showtopi...ost&p=107765266Download OCBC Sg app and open Statements Saving Account from there. If your phone don't have NFC capabilities, then the app will inform you and you will not be able to open an OCBC SG account using that phone (so need to use someone else's phone). |

|

|

|

|

|

wkchia

|

Sep 14 2023, 10:06 AM Sep 14 2023, 10:06 AM

|

|

Anyone tried funding Think or swim SG account using wise?

|

|

|

|

|

Sep 11 2023, 07:56 PM

Sep 11 2023, 07:56 PM

Quote

Quote

0.0211sec

0.0211sec

1.52

1.52

6 queries

6 queries

GZIP Disabled

GZIP Disabled