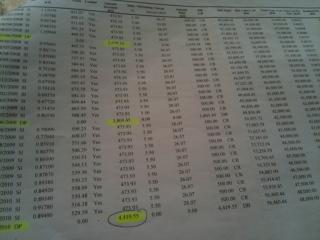

Hi unitholders, currently im helping my mother to plan our family funds. First of all, she invest in PM around 1996 and invest rm500 monthly until today for my sister. Which bring a total of 172k. She just blindly invest only. However, few weeks ago my mom opened another 1 account for me. Total 108k. I dont understand how the 5.5% charge works. Now my mum got around 120k in amanah saham wawasan 2020. So after ASW2020 pay out the interests, she plans to transfer all the money into PM. So here are the questions:

1. Should we put 120k into my sister's one? Based on my calculation, the returns for this year based on my sister account is 12%. Total amount invested rm61k+, and the return is 7k+(this is for 1 fund. got another fund i dont know the amount)

Sorry im secondary school leaver so i dont know much about unit trust or mutual fund. Learning it now by the way. Because im solely looking at the return % only. Assuming invest 500k with minimum 8.5% return, can get RM42500 annually which is more than enough to bear my education fees + living expenses in college.

2. If put 120k into my account, will the return as high as in putting 120k into my sister account?

3. Is that worth to transfer all FD from other banks into PM?

4. I heard some people say PM is riskier than amanah saham. But from my POV, lately many rumors that government will bankrupt and bla bla due to corruptions. This make me trust PM more than ASW2020 but we still need to prepare for the worst case scenario. So if PM really going down, what to do? withdraw all the money?

This post has been edited by mois: Jun 27 2010, 02:32 PM

Public Mutual v2, PB/Public series

Jun 27 2010, 02:24 PM

Jun 27 2010, 02:24 PM

Quote

Quote

0.0440sec

0.0440sec

0.97

0.97

6 queries

6 queries

GZIP Disabled

GZIP Disabled