Small update. Not sure the significance of it since no actual numbers were released.

YTLPOWER in Jordan

YTL POWER INTERNATIONAL, VERSION 2

YTL POWER INTERNATIONAL, VERSION 2

|

|

Dec 14 2010, 05:28 PM Dec 14 2010, 05:28 PM

|

Senior Member

3,037 posts Joined: Jun 2007 |

Small update. Not sure the significance of it since no actual numbers were released.

YTLPOWER in Jordan |

|

|

|

|

|

Dec 14 2010, 09:00 PM Dec 14 2010, 09:00 PM

|

Junior Member

331 posts Joined: Aug 2010 From: Kuala Lumpur |

NOT SURE WHETHER CONSIDERED A GOOD NEWS OR NOT

Flash YTL Power ventures into Jordanian oil shale projects Written by Joseph Chin of theedgemalaysia.com Tuesday, 14 December 2010 15:13 KUALA LUMPUR: YTL POWER INTERNATIONAL BHD [] is venturing into Jordanian oil shale projects which will see it building an oil plant with an output with 38,000 barrels per day. YTLPI said on Tuesday, Dec 14 it had acquired a 30% stake in Eesti Energia, Near East Investment’s (NEI) Jordanian oil shale projects. As the new strategic partner, YTLPI will contribute its experience in developing and operating large energy production and trading assets in emerging markets. According to the new shareholding structure Eesti Energia owns 65%, YTLPI 30% and NEI 5% of the oil shale projects in Jordan. http://www.theedgemalaysia.com/business-ne...e-projects.html |

|

|

Dec 15 2010, 12:23 AM Dec 15 2010, 12:23 AM

|

Senior Member

3,037 posts Joined: Jun 2007 |

I search on Google regarding Jordanian oil shales project and found this in Wikipedia.

"For dealing with increasing power consumption, Jordan plans to utilize oil shale combustion for the power generation. On 30 April 2008, the Ministry of Energy and Mineral Resources of Jordan, the National Electricity Power Company of Jordan, and Eesti Energia signed an agreement, according to which, Eesti Energia will have the exclusive right to develop the construction of an oil shale-fired power station with capacity of 600-900 MW.[19][20][21] The power station is expected to be operational by 2015. When constructed, it will be among the largest power stations in Jordan (the largest being Aqaba Thermal Power Station), and the largest oil shale-fired power station in the world after Narva Power Plants in Estonia.[21][22]" "On 29 April 2008, Eesti Energia present a feasibility study to the Government of Jordan. According to the feasibility study, the company will establish a shale oil plant with capacity of 36,000 barrels per day (5,700 m3/d).[4] The shale oil plant will use a Galoter processing technology; the construction is slated to begin by 2015.[11] The concession agreement was signed on 11 May 2010 in the presence of Jordanian and Estonian prime ministers Samir Zaid al-Rifai and Andrus Ansip.[14]" Wiki Oil Shale Jordan This post has been edited by skiddtrader: Dec 15 2010, 12:25 AM |

|

|

Dec 29 2010, 11:48 PM Dec 29 2010, 11:48 PM

|

Senior Member

2,211 posts Joined: Sep 2009 From: Kuala Lumpur |

All the 5 YTL's (YTL.YTLE,YTLCMT,YTLLAND and YTLPOWR) make a positive move today.

Above all I like YTLPOWR more, My technical indicator point to it challenging the year high of 2.76 soon. Last year it pays 15 sen dividend or 3.75 sen per Q TP: 2.75 for a 10% move Time Frame : 30 TD Any comments |

|

|

Dec 31 2010, 12:43 AM Dec 31 2010, 12:43 AM

|

Junior Member

124 posts Joined: Dec 2008 |

Year end again. I issued out an open challenge to Skid, Darkknight & June a year ago that YTL Power is a lousy stock and I'll prove it with results at the end of the year that my stock pick will outperformed YTLP. Time to take stock of portfolio

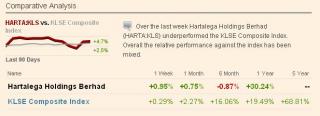

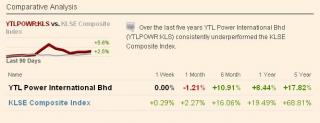

In 2010, KLSE rose 19.5% vs 2009 closing index. Genting beats KLSE, up 52.5% year on year. Second best performing stock in my portfolio after Txxxxxx. Party just started. New York racino starts operation in 2011 + Sentosa casino expansion kicks in + Hoi An casino = Super Profit in 2011. Hartalega beats KLSE, up 30.2% year on year. Could have been better if not due to the high latex price and the negative sentiment affecting the glove sector. 2011 will be an interesting year for Hartalega to gobble up the weaker glove manufacturers like Adventa and Latexx. The other guys will be finished by next year when commodity superbull run sets in momentum and wiped off the profit margin. Hartalega is the only manufacturer insulated well against this effect as butadiene is not linked to oil/latex price. In fact, the higher the price of latex goes, the higher the price of latex gloves will be, making them totally unable to compete with nitrile gloves. 2011 and beyond will see this stock at the top of my portfolio. This is for Skid, Darkknight and June. Talk is cheap and I've told you against talking like an expert trying to confuse other readers of your amateurish analysis. There are many people following this thread and you're not doing them a favour. Prove with concrete facts and numbers. See the attached charts and get sober up. YTL Power is a laggard, underperforming KLSE and merely up a lethargic 8.4% year on year vs KLSE 19.5%. Btw, Francis Yeoh is totally out of this mind and loss focus. First it was Wimax, then oil trading and now oil shale. Run for your life while you still can. YTLP is a sinking boat This post has been edited by kchong: Dec 31 2010, 02:30 AM Attached thumbnail(s)

|

|

|

Jan 1 2011, 02:55 AM Jan 1 2011, 02:55 AM

|

Junior Member

391 posts Joined: Sep 2008 |

What do you think of property counters. Know something about TAGB? Up to my neck on this one.

Francis and VT have something in common. Want to send the army in all directions wanting to conquer everywhere. Reminds me of the German's in World war 2. Though I don't expect Francis to end up like Hitler but it does look like a downward slide from the mountain top. YTL related counters, current holdings: 0 % VT related counter, BTOTO : 15% Bought @ 4.29 in Nov 2009. Only last two weeks there is some excitement. Just hoping the privatization goes through for some decent returns. This post has been edited by calmwater: Jan 1 2011, 03:09 AM |

|

|

|

|

|

Jan 1 2011, 03:34 AM Jan 1 2011, 03:34 AM

|

Junior Member

124 posts Joined: Dec 2008 |

Property stocks will still have steam ahead. There's one counter that attracted the Templeton Fund. That's the only property stock in my portfolio now. TAGB is not in my radar as the management team don't earn my trust. Tony Tiah's history is not very clean. Likewise witk VT. I treat stock investment as part ownership of a company. If I don't feel comfortable going into business with someone, I will not invest even a single share in the company.

But in all fairness to Francis, don't think we can compare him to VT. Both men have very different business ethics. Banking, plantation, oil and gas will do quite well. Hartalega will also do better in 2011. Flu epidemic just broke out in the states and Europe. Demand likely will shoot up. Avoid airlines at all cost. 2011 will be challenging year ahead |

|

|

Jan 1 2011, 04:38 AM Jan 1 2011, 04:38 AM

|

Junior Member

391 posts Joined: Sep 2008 |

Thanks buddy.

As for Tony, he seems to have turned over a new leaf. TAGB and especially TAGB-PA are deeply undervalued. My guess is lot's of investors are having wait and see stance. This horsee is about to take off. I give it not more than one year. This post has been edited by calmwater: Jan 1 2011, 04:44 AM |

|

|

Jan 1 2011, 04:06 PM Jan 1 2011, 04:06 PM

|

Senior Member

2,211 posts Joined: Sep 2009 From: Kuala Lumpur |

QUOTE(kchong @ Dec 31 2010, 12:43 AM) . When YTLPOWR only perform 8.4% on YOY as you said..YTL Power is a laggard, underperforming KLSE and merely up a lethargic 8.4% year on year vs KLSE 19.5%. Btw, Francis Yeoh is totally out of this mind and loss focus. First it was Wimax, then oil trading and now oil shale. Run for your life while you still can. YTLP is a sinking boat Have you added in the 0.15 sen dividend they paid during the year?? as that account for another 7.1% or so making it 15.3%.... Is this a sinking boat? may be not yet...anyway you couldn't run on a sinking boat without getting yourself very wet. KLCI is always a good indicator for a short term but looking at it on yearly term we should look at the content a bit.. they had change the contents over the year. |

|

|

Jan 2 2011, 02:11 AM Jan 2 2011, 02:11 AM

|

Junior Member

124 posts Joined: Dec 2008 |

Answer to you questions below:

Dividend not factored in. If you want to count beans, one could have gone even further to calculate CAGR with interest reinvested based on actual date the dividends were paid out. Francis is very fond of using this method in his address to shareholder. Even if you do that for YTLP, it still can't beat KLCI (and certainly not Genting and Hartalega even if I forego dividend from both stocks to give you a head start) QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM) When YTLPOWR only perform 8.4% on YOY as you said.. Rhethoric questions. No comment. Fact is YTLP did not perform on par against the broader market indexHave you added in the 0.15 sen dividend they paid during the year?? as that account for another 7.1% or so making it 15.3%.... QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM) Is this a sinking boat? may be not yet...anyway you couldn't run on a sinking boat without getting yourself very wet. The KLCI is a representation of a basket of companies best representing Malaysian economy. Perhaps you can come up with a better benchmark? The comparison span over 5 years' period. Yet, YTLP never did perform better than KLCI in that 5 years' period. One could have invested in an index-linked fund with much lower cost and risk and yet reaped higher return compared to YTLP. Beats me why there are still people willing to get exposed to YTLP when it started dabbling in wimax and oil shale. ROI is below par and you're exposed to high business risk. QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM) KLCI is always a good indicator for a short term but looking at it on yearly term we should look at the content a bit.. they had change the contents over the year. Added on January 2, 2011, 2:48 amCalm, TAGB does have some very good land banks especially the one at Imbi, Sri Damansara and Australia. Beside equity, I also like to have direct ownership of properties rather than owning property stocks/reits. But that's my personal investment preference. Most of my properties appreciated more than 20% in the last one year alone and it's causing some concern as I don't think this is sustainable Just be mindful that post 2012 might see some asset bubbles popping like the one that triggered the sub-prime crisis. Cost of raw material is also rising rapidly and might eat up into developer margin if they are not careful. Cheers QUOTE(calmwater @ Jan 1 2011, 04:38 AM) Thanks buddy. This post has been edited by kchong: Jan 2 2011, 02:48 AMAs for Tony, he seems to have turned over a new leaf. TAGB and especially TAGB-PA are deeply undervalued. My guess is lot's of investors are having wait and see stance. This horsee is about to take off. I give it not more than one year. |

|

|

Jan 2 2011, 02:22 PM Jan 2 2011, 02:22 PM

|

Senior Member

2,211 posts Joined: Sep 2009 From: Kuala Lumpur |

QUOTE(kchong @ Jan 2 2011, 02:11 AM) Sorry for the comments.. I realize when you say 7% are beans I am in a different league than you...To me 7%s very significant.. I got only 8.75% from ASB which I think is already very good. For my own reason I don't buy GENTING even if they give a 1000% return. |

|

|

Jan 3 2011, 12:29 AM Jan 3 2011, 12:29 AM

|

Junior Member

124 posts Joined: Dec 2008 |

Delete

This post has been edited by kchong: Apr 30 2011, 10:30 PM |

|

|

Jan 3 2011, 12:33 PM Jan 3 2011, 12:33 PM

|

Senior Member

3,944 posts Joined: Jul 2008 |

QUOTE(kchong @ Jan 3 2011, 01:29 AM) Bro, no right or wrong here and certainly don't need to say sorry just because our investment styles are different. 7% is indeed significant but when we take into consideration dividend paid by other counters they almost come to the same eventually with perhaps maybe a small percentage difference. As I analyze and contrast hundreds of stocks in Bursa, it's too time consuming counting to the last decimal points. Finally you understand "investment style are differents". We have chosen not to reply your previous post not becos you are right. Just that i think it is wasting my effort. I believe same goes for Skid taikor as well. Finally you have grown up. Syariah compliant stocks only for you I guess? I have choosen YTLP just becos it suited me and i have sold off all my YTLP at around RM 2.6+. I started to accumulate YTLP since RM 1.80. This post has been edited by darkknight81: Jan 3 2011, 12:40 PM |

|

|

|

|

|

Jan 3 2011, 06:54 PM Jan 3 2011, 06:54 PM

|

Junior Member

124 posts Joined: Dec 2008 |

What a dumb statement to cover up your ass. There's no logical justification for investing in a high risk business for low return. Period! Such a lame excuse only show you are running out of idea. Pls don't portray yourself as having high investment EQ.

I noted even right before you "claimed" to have sold off YTLP, you were still making very bullish statements about the prospect of the company and making "buy" recommendations in this forum. That's very dirty and very unethical. There are many young investors here trying to learn and you're creating this trap to hoodwink them into parting with their hard earn money to support the price so that you can off load your shares. Now the readers here will know how full of shit you are QUOTE(darkknight81 @ Jan 3 2011, 12:33 PM) Finally you understand "investment style are differents". We have chosen not to reply your previous post not becos you are right. Just that i think it is wasting my effort. I believe same goes for Skid taikor as well. Finally you have grown up. I have choosen YTLP just becos it suited me and i have sold off all my YTLP at around RM 2.6+. I started to accumulate YTLP since RM 1.80. |

|

|

Jan 3 2011, 11:54 PM Jan 3 2011, 11:54 PM

|

Senior Member

588 posts Joined: Jan 2005 |

Deleted

This post has been edited by ost1007: Jan 3 2011, 11:59 PM |

|

|

Jan 7 2011, 11:57 PM Jan 7 2011, 11:57 PM

|

Junior Member

124 posts Joined: Dec 2008 |

Delete

This post has been edited by kchong: Apr 30 2011, 10:32 PM |

|

|

Jan 8 2011, 08:33 AM Jan 8 2011, 08:33 AM

|

All Stars

23,851 posts Joined: Dec 2006 |

QUOTE(darkknight81 @ Jan 3 2011, 12:33 PM) Finally you understand "investment style are differents". We have chosen not to reply your previous post not becos you are right. Just that i think it is wasting my effort. I believe same goes for Skid taikor as well. Finally you have grown up. Brother,I have choosen YTLP just becos it suited me and i have sold off all my YTLP at around RM 2.6+. I started to accumulate YTLP since RM 1.80. Congratulation. I believe you have done the right thing. Invest at your own comfort , according to your own risk level. I believe many financial planners out there would advise you the same. Do not have to follow other people targets as your own targets. You are just you, so long you know and understand what you are doing and setting your plans and goals to achieve. Surely there are many out have done much better than us, but that is not the main issue. We need to learn how to outperform own selves, the enemy within us. Wish you all the best always. This post has been edited by SKY 1809: Jan 8 2011, 08:40 AM |

|

|

Jan 8 2011, 09:23 AM Jan 8 2011, 09:23 AM

|

All Stars

13,681 posts Joined: Mar 2006 |

QUOTE(SKY 1809 @ Jan 8 2011, 08:33 AM) Brother, Congratulation. I believe you have done the right thing. Invest at your own comfort , according to your own risk level. I believe many financial planners out there would advise you the same. Do not have to follow other people targets as your own targets. You are just you, so long you know and understand what you are doing and setting your plans and goals to achieve. Surely there are many out have done much better than us, but that is not the main issue. We need to learn how to outperform own selves, the enemy within us. Wish you all the best always. |

|

|

Jan 8 2011, 11:02 AM Jan 8 2011, 11:02 AM

|

Junior Member

450 posts Joined: Jul 2005 |

QUOTE(kchong @ Jan 7 2011, 11:57 PM) Hope all managed to load up stocks on the sectors mentioned above in my previous post. All banking stocks shoot through the roof. Same with plantation, oil and gas and not forgetting hartalega. Most of them jumped more than 8% in the past 1 week alone. Hartalega breached new height today as the flu epidemic demand is being felt. bro, what do u think bout careplusstill dirt cheap, can bought some into portfolio |

|

|

Jan 8 2011, 11:31 AM Jan 8 2011, 11:31 AM

|

Senior Member

3,944 posts Joined: Jul 2008 |

QUOTE(SKY 1809 @ Jan 8 2011, 09:33 AM) Brother, Thanks Bro, Congratulation. I believe you have done the right thing. Invest at your own comfort , according to your own risk level. I believe many financial planners out there would advise you the same. Do not have to follow other people targets as your own targets. You are just you, so long you know and understand what you are doing and setting your plans and goals to achieve. Surely there are many out have done much better than us, but that is not the main issue. We need to learn how to outperform own selves, the enemy within us. Wish you all the best always. Er... Right or not i am not sure lol. Only time will tell. Yup, i invest at my own comfort. One thing for sure is if i follow your stock pick i cannot sleep well at night. But it does not means that you are wrong. You will not follow my stock pick as well as u will feel damn boring. I hold zero YTLP at the moment. However i still like its diversified utilities business globally. Just that i am not comfortable with their wimax venture. Planning to buy back at a lower price. At the moment holding ARREIT and KPJ REIT only. Alll the best for your investment ya. Some of your stock picks like Mitra has appreciated This post has been edited by darkknight81: Jan 8 2011, 11:35 AM |

| Change to: |  0.0264sec 0.0264sec

1.16 1.16

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 02:20 PM |