Answer to you questions below:

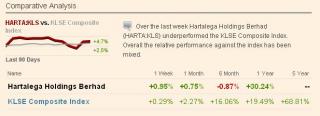

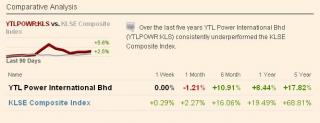

Dividend not factored in. If you want to count beans, one could have gone even further to calculate CAGR with interest reinvested based on actual date the dividends were paid out. Francis is very fond of using this method in his address to shareholder. Even if you do that for YTLP, it still can't beat KLCI (and certainly not Genting and Hartalega even if I forego dividend from both stocks to give you a head start)

QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM)

When YTLPOWR only perform 8.4% on YOY as you said..

Have you added in the 0.15 sen dividend they paid during the year??

as that account for another 7.1% or so making it 15.3%....

Rhethoric questions. No comment. Fact is YTLP did not perform on par against the broader market index

QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM)

Is this a sinking boat? may be not yet...anyway you couldn't run on a sinking boat without getting yourself very wet.

The KLCI is a representation of a basket of companies best representing Malaysian economy. Perhaps you can come up with a better benchmark? The comparison span over 5 years' period. Yet, YTLP never did perform better than KLCI in that 5 years' period. One could have invested in an index-linked fund with much lower cost and risk and yet reaped higher return compared to YTLP. Beats me why there are still people willing to get exposed to YTLP when it started dabbling in wimax and oil shale. ROI is below par and you're exposed to high business risk.

QUOTE(rosdi1 @ Jan 1 2011, 04:06 PM)

KLCI is always a good indicator for a short term but looking at it on yearly term we should look at the content a bit.. they had change the contents over the year.

Added on January 2, 2011, 2:48 amCalm, TAGB does have some very good land banks especially the one at Imbi, Sri Damansara and Australia. Beside equity, I also like to have direct ownership of properties rather than owning property stocks/reits. But that's my personal investment preference. Most of my properties appreciated more than 20% in the last one year alone and it's causing some concern as I don't think this is sustainable

Just be mindful that post 2012 might see some asset bubbles popping like the one that triggered the sub-prime crisis. Cost of raw material is also rising rapidly and might eat up into developer margin if they are not careful. Cheers

QUOTE(calmwater @ Jan 1 2011, 04:38 AM)

Thanks buddy.

It does look like a promising counter and it's last closing price of RM 1.82 is not bad.

As for Tony, he seems to have turned over a new leaf.

Listened to one of his sermon's lately. Quite impressive preacher. Plus their news releases for the counter are very transparent. The hotel's are going to provide solid recurring income which can be used to fuel their property developments. Solid landbank in very exciting areas.

They have won the trust of a large Australian investment firm, Charter Hall.

JV for little Bay, Sydney. Launching soon.

TAGB and especially TAGB-PA are deeply undervalued. My guess is lot's of investors are having wait and see stance.

This horsee is about to take off. I give it not more than one year.

Jan 6 2010, 09:38 AM

Jan 6 2010, 09:38 AM

Quote

Quote

0.2852sec

0.2852sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled