at least now forumers hav some idea on the stock to buy or short, anyone can link us to cramer picks

buy the dip time? but i plan to reduce my riding stock holdings to a minimum within tis 2 months or maybe cut loss

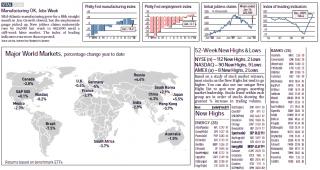

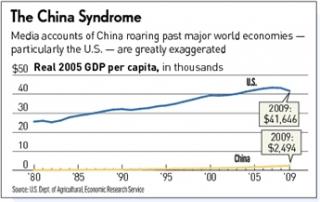

11:15 a.m. Update: The major indexes' losses grew in late-morning trade Wednesday, as a rising dollar weighed on commodities prices. The market also was struggling with spotty bank earnings and concerns over slowing Chinese bank lending.

The S&P 500 slid 1.6%, the Dow 1.4%, the Nasdaq 1.8% and the NYSE composite 2%. Volume swelled across the board. It rose 7% on the NYSE and 23% on the Nasdaq compared with the same period Tuesday.

Jaguar Mining (JAG) skidded 7% in four times its typical turnover. The gold exploration and production company slashed through its 50-day moving average after reporting a fourth-quarter profit that fell short of Wall Street views.

Inergy (NRGY) slid 3% in heavy trade. The propane distributor priced an offering of 5 million shares of common stock at $36.25 a share.

On the upside, Cree (CREE) rocketed 16% in gigantic volume. The maker of power switches, RF devices and other electronics reported fiscal second-quarter earnings of 38 cents a share, blowing past estimates of 30 cents. Cree's stock reached its highest point since September 2000.

10:15 a.m. Update: Stocks opened sharply lower Wednesday, on mixed earnings results from banks and growing concern over China's plans to curb bank lending. The S&P 500 slid 0.9%, the Dow 1.1%, the Nasdaq 1% and the NYSE composite 1.5%.

Volume swelled across the board. It rose 4% on the NYSE and 31% on the Nasdaq compared to the same period Tuesday.

China Automotive Systems (CAAS) fell 3% in heavy volume. The Chinese auto parts maker sits 23% off its Jan. 11 peak. The stock has found support above its 50-day moving average.

Hi-Tech Pharmacal (HITK) tumbled 6% in brisk trade. The drug maker has also staged a sharp pullback to near its 50-day line.

On the upside, Aegean Marine Petroleum (ANW) rose 2% in huge turnover. The supplier of refined marine fuel gapped down at Wednesday's market open after announcing a public offering of 3.9 million shares of common stock. But the stock quickly rebounded into the black

1) Big Banks Deliver Mixed Earnings Results

The financial sector produced mixed results Wednesday as banks continue to struggle with bad credit.

Bank of America (BAC) posted a loss of $5.2 billion, or 60 cents a share, for the fourth quarter. That was worse than the prior year's 48-cent per-share shortfall and below analyst views for a 52-cent loss. Results were hurt by higher credit costs, lower net interest income and the bank's repayment of U.S. government bailout aid.

Elsewhere, Wells Fargo (WFC) swung to a fourth-quarter profit on a pickup in fee income, even as it repaid $25 billion in bailout funds to the U.S. government.

Investment bank Morgan Stanley (MS) earned $617 million, or 29 cents a share, during the last three months of 2009 as its investment banking operations profited from its Smith Barney joint venture. Still, results were below analyst expectations of a profit of 36 cents a share.

BofA, which was one of the hardest hit by the credit crisis and recession, said its results were boosted by strong results from its Merrill Lynch investment banking operations that it acquired a year ago .

Its report fell in line with those of JPMorgan Chase (JPM) and Citigroup ©, both of which had billions in losses from bad loans offset by investment banking income.

The industry's results are a concern for economists and investors, who question whether the economy can have a sustained strong recovery if consumers are still defaulting on loans.

BofA CEO Brian Moynihan echoed those concerns in a statement, saying that "economic conditions remain fragile and we expect high unemployment levels to continue, creating an ongoing drag on consumer spending and growth."

The bank set aside $10.1 billion to cover soured loans, down nearly 14% from the previous quarter. Like Citigroup, Bank of America said it saw some signs of improvement in its loan portfolios. The company said it charged off $8.4 billion in loans during the quarter, down $1.2 billion from the third quarter. Loans are charged off when they are considered uncollectible.

But credit costs remained high, with the bank's credit card unit posting a $1.03 billion loss — well above a $9 million loss a year ago.

On the upside, BofA said its global wealth and investment management unit saw net income rise to $1.3 billion in the quarter, up from $515 million a year earlier. The gain was driven by the addition of Merrill Lynch.

On Tuesday, Citi said it lost $7.58 billion in the fourth quarter as consumers continued to struggle to repay loans and the bank repaid its government bailout. The bank said it set aside $8.18 billion to cover bad loans during the most recent quarter.

Wells Fargo, the fourth-largest U.S. bank by assets, reported a profit of $2.82 billion, or 8 cents a share. Analysts on average expected a loss of 1 cent a share. It lost 79 cents a share the prior year, excluding the impact of its buyout of Wachovia.

While analysts broadly view the San Francisco-based bank as among the stronger survivors of the financial crisis, it is facing mounting losses on Wachovia mortgage portfolios.

Loan losses climbed to $5.9 billion in the fourth quarter from $3 billion a year earlier, driven by residential and commercial mortgage losses.

But the bank set aside only $5.9 billion against loan losses in the quarter, compared with $8.4 billion a year earlier.

Morgan Stanley recorded its second straight profitable quarter following a year of losses. Investment banking, the bulk of its business, has been one of the few healthy segments in the struggling financial industry.

Still, investors have faulted Morgan Stanley for not profiting enough from investment banking and the stock market's big 2009 rally. The company has lagged industry leader Goldman Sachs (GS), which reports its fourth-quarter results on Thursday.

2) New Construction Falls, Inflation Eases

Construction of new homes dipped unexpectedly last month as bad weather hit much of the country. Applications for future projects, however, soared in a sign the industry is ramping up after a debilitating bust.

Meanwhile, inflation pressures at the wholesale level eased in December as a drop in energy prices offset a big jump in food costs.

The Commerce Department on Wednesday said construction of new homes and apartments fell 4% in December to a seasonally adjusted annual rate of 557,000 from an upwardly revised 580,000 in November.

The results were lower than the 572,000 forecast by some economists. The results were led by declines of 19% in the Northeast and Midwest. Construction fell 1% in the West, but rose more than 3% in the South.

Applications for new building permits, a gauge of future activity, rose 11% to an annual rate of 653,000. That was a far stronger showing than economists had predicted and the highest level of activity since October 2008.

The industry has dramatically scaled back construction amid the worst housing bust in decades. Thousands of foreclosed homes have been dumped on the market at bargain prices that make it difficult for the builders to compete.

For all of last year, builders started construction on more than 550,000 homes, down nearly 40 percent from a year earlier and lowest on records dating back to 1959.

The report comes after a survey showed builders' sentiment about the market remains weak. The National Association of Home Builders said Tuesday its index of industry confidence fell in January to the lowest level since last summer.

The drop reflects fears that demand for new homes will be sluggish despite the extension of a federal tax credit.

To give a boost to the still-struggling housing market, Congress decided in November to extend the deadline for a tax credit of up to $8,000 for first-time homebuyers until April and expanded it to include $6,500 for existing homeowners who move.

Elsewhere, the Labor Department said Wednesday that wholesale prices edged up 0.2% last month, much slower than the 1.8% surge in November. Energy prices, which had been up for two months, fell in December.

The price performance at the wholesale level combined with last week's benign reading on consumer prices, supported the view that inflation is not a problem.

That gives the Federal Reserve room to keep interest rates low to boost the country out of a deep recession.

The 0.2% overall increase was slightly higher than the flat reading economists had expected, while the unchanged reading on core prices was lower than the 0.1% advance analysts had forecast.

Energy costs fell by 0.4% in December as the price of gasoline declined by 3.2% — the biggest one-month decline since September. Natural gas prices fell by 1.9%, the biggest decline since last May.

Food costs rose by 1.4%, the third straight month of higher food costs. The December gain was led by a 9.4% rise in pork prices — the biggest increase in a decade — and a 3.7% increase in the cost of dairy products, the largest advance in more than two years.

The rise in food costs accounted for one-fifth of December's overall 0.2% rise in wholesale inflation.

The flat reading for core prices, which excludes food and energy, was helped by a 1.2% dip in the cost of light trucks, a category that includes sport utility vehicles.

For the 12 months ending in December, prices at the wholesale level were up 4.4% compared to a 0.9% drop in wholesale prices in 2008. That big swing reflected a rise in energy costs in 2009.

Core inflation at the wholesale level was much better behaved last year, rising by 0.9% after having surged by 4.5% in 2008.

Last Friday, the government reported that consumer prices edged up a slight 0.1% in December with core prices up the same amount. That finished off a year in which consumer prices rose by 2.7%, reflecting higher energy costs during the year. Excluding food and energy, core consumer prices were up 1.8%, matching the rise in 2008.

Many economists look for inflation pressures to moderate even more in 2010 as the worst recession since the 1930s keeps exerting downward pressure on prices.

The low inflation has allowed Federal Reserve officials to push a key interest rate to its lowest level on record. The Fed's target for banks' overnight lending rate has been at 0 to 0.25% for more than a year.

Many analysts believe the Fed will keep rates low for much of 2010 because of their belief that the economy will not be growing fast enough to keep the unemployment rate from rising.

The jobless rate currently stands at 10%. Many forecasters reckon it will hit 10.5% by the middle of this year before starting to decline.

Jan 21 2010, 12:37 AM

Jan 21 2010, 12:37 AM

Quote

Quote

0.0414sec

0.0414sec

0.68

0.68

7 queries

7 queries

GZIP Disabled

GZIP Disabled