QUOTE(mindstorm @ Jan 30 2010, 05:31 PM)

how do you decide wheather to be "greedy when all fear" or "don't catch a falling knife"?

when there is a strong downtrend, often the downtrend are fed by mini bulls themselves...to be more precised, bulls that are weak holders, thereby turning bears themselves. As prices fall, there will always be contrarians who think, "ah, time to buy... cheap, buy when dip". However after buying, they see that prices continue to head south... after a while, they think, "oh shit, made a wrong decision.." and then they start selling, taking loses because of fear that they will lose more if they continue to hold. Hence they become the bears. Then the next group of bulls will come in thinking, "ah...time to buy now...really low". But then the bears coming in from earlier group will feed the selling pressure caused by overall bad news, and price continue to head south. After a while the same thing happen to the second group(of course it is not so clear-cut) and they also start selling... thereby causing the prices to spiral down.

And when stocks market fall, there is a general mood to spend less causing companies to earn less... and so forth... reflexivity theory kicks in.

We also should not forget there are many big players who have interest in falling prices...

besides this year is world cup year. huh? well, do a google to see the year returns for world cup years. More often than not, it isn't good.

so how sure are you the bottom has been reached for this "mini" reversal?

time to write a granma review

ur analogy sounds ok, however most big funds & forever fans retailers r not nimble nor quick enough to cut loss

big funds cannot create an exit stampede, they need to sell into strength while shouting bull, tat y we see a ding dong & not straight collapse

how many retailers u know wil cut loss? very few do it, most get attach to stocks via dividend, valuation & etc

so once the selling accelerate, at some point of time in future, there wil be no one to sell to, tat y there is a teknik call 'swing trade'

dunno abt the others, but for me, tis is more of a dark art than a simple black & white teori

hmm... world cup years, I learnt not to believe those hype anymore eg. october bear myth, were u in or out of stocks?

My job is not to reassure anyone of anything, kindly do ur own dd & I have no idea has the bottom been reached for this "mini" reversal

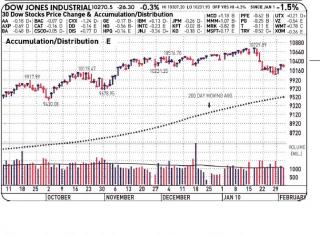

volume is high on down & index seem is gonna hit their 200 dma soon, wil it bounce? I dunno, choose ur side & place ur bet

if sector rotation affect real estate & commodity only, y are all sectors taking a tumble

how do you decide wheather to be "greedy when all fear" or "don't catch a falling knife"?

there is no clear cut answer to ur question, it is more of a dark art & u get better at it + ur odds increase in proportion to how much sifu market teach u a lesson

'Insanity: doing the same thing over and over again and expecting different results - Albert Einstein'

as a guideline "greedy when all fear", anything bullish from klse lyn thread, edge, star biz, analyst report are good signs something not right

initially, stocks wil go up, but there is no news, if u were able analyse & detect it via FA, tat is good for early entry point

now, for 'them' to write positive review, stock could be on uptrend, but since u hav enter earlier via FA, jus ride it

those lazy do r&d on own will just follow recommendation, the trick is to sell it after a certain % up & accept fact, tat u can never sell at the highest

as a guideline "don't catch a falling knife", the indexes are hitting low after low & volume is high, oso support line is being breach

sometimes news is not there or it is conflicting news available for reading, at times volume dun lie, take tat as a clue

& it is alwiz too late to short when the fall occurs, might as well wait for a rebound, but tis no garanti either

since most TA knows the support & resistance price level, try to set below or above price level, as depending on u buying or shorting

"and when stocks market fall, there is a general mood to spend less causing companies to earn less... and so forth... reflexivity theory kicks in"

imo, the next one wil be 8-10 yrs later, ensure u have enuf standby reserves & go SAILANG it! when the next cycle cum

those old timers wil see opportunity & patiently await selling subside, the new virgins wil see blood & fear

look, the investment advisor r starting to be bearish, the followers will follow, jus like how they were slaughter as bull, hav patience

I wanna join in to comment on the debate between the former & latter thoughts on this current pullback

the real & conclusive answer will be clearer & known after 3 months, just like the sub-prime crisis; learn abt cds, swaps & etc at tat time

from an ikan bilis player point of view

former

newsletter - n/a

stock selection:buy & sell price - yup

market direction - yup

worldwide / alien view - yup

prompt feedback for emergency - yup

october myth - yup, we were riding sama2

latter

newsletter - none, not for our view, maybe clients only

stock selection:buy & sell price - none, not for our view, maybe clients only

market direction - none, not for our view, maybe clients only

worldwide / alien view - only china (sure boh?)

prompt feedback for emergency -

october myth - hmm

thus for the moment with a point of 5 to 1, have to side with doomcake

the final winner wil be decided by sifu market itself

» Click to show Spoiler - click again to hide... «

This post has been edited by sulifeisgreat: Jan 31 2010, 03:54 AM

This post has been edited by sulifeisgreat: Jan 31 2010, 03:54 AM

Jan 27 2010, 08:18 AM

Jan 27 2010, 08:18 AM

Quote

Quote

0.0428sec

0.0428sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled