QUOTE(SKY 1809 @ Dec 5 2009, 01:46 PM)

" on ur point of politics, here is an article on the economic crisis & ben, which if u r upset, of coz u won't read icon_rolleyes.gif "

Thanks for showing me the article.

Incidentally I had said something in V45 Post 1465 before I got to read your article. Nothing to be upset about.

AND Many right things could be deemed wrong, and many wrong things could be deemed right , at different time of interpretations. Likewise with investments.

The exception is , if you could come out with a PERFECT ECONOMIC THEORY FOR ALL TIMES.

Reprinted as below :-

" Cashflow really works wonder.

US is all about Cashflow and money printing machines.

So long they keep their printing machines in superb condition, they are still all right.

( worry comes > next election )"

This post has been edited by SKY 1809: Yesterday, 01:00 PM

no prob abt tat, nothing to upset abt Thanks for showing me the article.

Incidentally I had said something in V45 Post 1465 before I got to read your article. Nothing to be upset about.

AND Many right things could be deemed wrong, and many wrong things could be deemed right , at different time of interpretations. Likewise with investments.

The exception is , if you could come out with a PERFECT ECONOMIC THEORY FOR ALL TIMES.

Reprinted as below :-

" Cashflow really works wonder.

US is all about Cashflow and money printing machines.

So long they keep their printing machines in superb condition, they are still all right.

( worry comes > next election )"

This post has been edited by SKY 1809: Yesterday, 01:00 PM

we all here looking for $$$, lookie here, i m number 7

aiyoh, if my words can hurt anyone

then i no idea what anyone will face, since SIFU MARKET take monies away happily & seldom returns it

i shorted ctsh on thursday & got creamed on friday pre market

feels like a kentucky fried ayam

should hav shorted gld, but nothing is perfect...

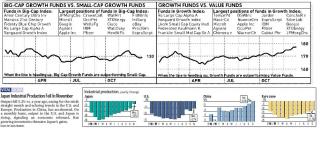

there r trillions of usd sloshing around now, better grab some b4 they turn off the tap

next month, jobless rate will be 9.99% & job loss is lessen by 10,000 - means another bull, dun u love the usa market

as usual, u all know la, i m politically incorrect

» Click to show Spoiler - click again to hide... «

Dec 5 2009, 02:45 PM

Dec 5 2009, 02:45 PM

Quote

Quote

0.0556sec

0.0556sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled