QUOTE(DexterLim93 @ Feb 25 2020, 06:23 PM)

With or without the current political turnoil, BAT stock has risen up significantly and people are going all "hype" out on the stock. However, I believe that would still be the current impact of illicit cigarettes on BAT market. My question is can it really go far as long as illicit cigarettes are not being tackled yet?

Based on actual facts that I know:

- 6 out of 10 cigarettes consumed in Malaysia is illicit as proven from the news as as well.

- The research house has a hold call on BAT, and slashed its price target on the share from RM19.20 to RM11.50 previously

- Illicit market doubled since the surge in excise duty in 2015 (33.5% in 2015 vs 63% in 2019)

A very summarized version on why my skepticism remains even though the growth is showing. Feel free to correct me as I would like to know more feedback from your side as well.

1. Market share of illicit ciggrettes continue to rise. (by how much? it can't be 100%!)

2. Market share of illicit cigarettes stabilize at current levels

3. Market share of illicit cigarettes reduce.

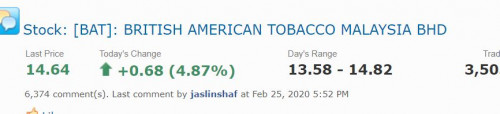

When the stock came into my radar early this year, it was trading slightly above 15 n I thought it was starting to look attractive even under a scenario 2 situation with a scenario 1 being the downside and scenario 3 being the upside. So when price collapsed a further 20+%,, I bought as there was sufficient margin of safety.

Feb 25 2020, 07:01 PM

Feb 25 2020, 07:01 PM

Quote

Quote 0.0153sec

0.0153sec

0.97

0.97

5 queries

5 queries

GZIP Disabled

GZIP Disabled