QUOTE(singkah @ Jan 30 2020, 02:29 AM)

Yes, I'm in.. 😆 BAT, British American Tobacco

BAT, British American Tobacco

|

|

Jan 30 2020, 02:17 PM Jan 30 2020, 02:17 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

4,502 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jan 30 2020, 06:54 PM Jan 30 2020, 06:54 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

4,502 posts Joined: Mar 2014 |

Closed at 12. My average price is 11.05.

Nice..but sadly my Chinese stocks are getting bashed by Corona virus. |

|

|

Feb 16 2020, 03:09 PM Feb 16 2020, 03:09 PM

Return to original view | Post

#3

|

Senior Member

4,502 posts Joined: Mar 2014 |

QUOTE(moosset @ Feb 16 2020, 01:23 AM) ETF.. 0829EA on Bursa. Solid China index. It's still up 15% for 1 year despite trade war, virus etc n just shy of 2% from peak in early Jan. Power of central bank liquidity I guess. Back to BAT, as I mentioned elsewhere, I've exited to make some quick bucks, but it's still on my watch list. See again this week. Final results should be out. |

|

|

Feb 17 2020, 04:05 PM Feb 17 2020, 04:05 PM

Return to original view | Post

#4

|

Senior Member

4,502 posts Joined: Mar 2014 |

QUOTE(Yggdrasil @ Feb 17 2020, 01:01 AM) Off topic but this ETF has pretty high expense fees right? Low liquidity (sell at loss to get out) and high transaction cost (buy and sell) too. Seriously off topic.. This is BAT discussion. Let me try to dig up some Old etf thread n reply u there. This post has been edited by Cubalagi: Feb 17 2020, 04:19 PM |

|

|

Feb 21 2020, 01:51 PM Feb 21 2020, 01:51 PM

Return to original view | Post

#5

|

Senior Member

4,502 posts Joined: Mar 2014 |

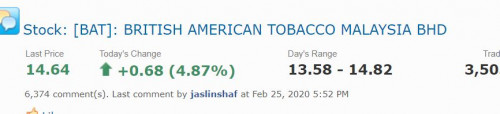

Strong rebound by BAT. 14+ now.

Results came out, horrible 2019, as expected. But last Q was not too bad. The share price was so horribly bashed, that so so results are good enough |

|

|

Feb 25 2020, 07:01 PM Feb 25 2020, 07:01 PM

Return to original view | Post

#6

|

Senior Member

4,502 posts Joined: Mar 2014 |

QUOTE(DexterLim93 @ Feb 25 2020, 06:23 PM)  With or without the current political turnoil, BAT stock has risen up significantly and people are going all "hype" out on the stock. However, I believe that would still be the current impact of illicit cigarettes on BAT market. My question is can it really go far as long as illicit cigarettes are not being tackled yet? Based on actual facts that I know: - 6 out of 10 cigarettes consumed in Malaysia is illicit as proven from the news as as well. - The research house has a hold call on BAT, and slashed its price target on the share from RM19.20 to RM11.50 previously - Illicit market doubled since the surge in excise duty in 2015 (33.5% in 2015 vs 63% in 2019) A very summarized version on why my skepticism remains even though the growth is showing. Feel free to correct me as I would like to know more feedback from your side as well. 1. Market share of illicit ciggrettes continue to rise. (by how much? it can't be 100%!) 2. Market share of illicit cigarettes stabilize at current levels 3. Market share of illicit cigarettes reduce. When the stock came into my radar early this year, it was trading slightly above 15 n I thought it was starting to look attractive even under a scenario 2 situation with a scenario 1 being the downside and scenario 3 being the upside. So when price collapsed a further 20+%,, I bought as there was sufficient margin of safety. |

| Change to: |  0.0220sec 0.0220sec

1.11 1.11

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 05:52 PM |