QUOTE(Kiefer @ Oct 18 2019, 01:28 PM)

my one... huh... hcbc provided restructured statement.. i really donno how they calculate it. So confusing.

I asked the akpk and he said ya very confusing.. he said he will connect to the bank's akpk coordinator, yet coming back telling me that that is the amount.. oh fxxx

somemore ask me what is the problem... I told him again, how can that be.. I ask simple question

1. 10 years is the agreed contract that this is to settle my debt. right??! he said yes

2. why now after 10 years, which i completed and hsbc still have over 5k ?!??! he can't answer and said this is bank calculation.

3. if bank disagree that 10 year can't pay all and not agree with what akpk proposed as per contract, then the bank should answer back to akpk 10 years ago. And yet akpk does not know.. how can that be??

I have no choice to meet other akpk consultant at main branch next week which I booked.

BTW, your case, where you raise your complain to?? BNM?? AKPK?? mind to share

AKPK Consultant just middleman....I asked the akpk and he said ya very confusing.. he said he will connect to the bank's akpk coordinator, yet coming back telling me that that is the amount.. oh fxxx

somemore ask me what is the problem... I told him again, how can that be.. I ask simple question

1. 10 years is the agreed contract that this is to settle my debt. right??! he said yes

2. why now after 10 years, which i completed and hsbc still have over 5k ?!??! he can't answer and said this is bank calculation.

3. if bank disagree that 10 year can't pay all and not agree with what akpk proposed as per contract, then the bank should answer back to akpk 10 years ago. And yet akpk does not know.. how can that be??

I have no choice to meet other akpk consultant at main branch next week which I booked.

BTW, your case, where you raise your complain to?? BNM?? AKPK?? mind to share

Calculation still up to the bank..

i still have 2 debt based on my calculation need more than 10 years.

Reason when i check back.....

Amount by bank as compare to CCRIS report generated at that time differ by 2k.

if follow CCRIS report...should be settle within 10year...

just because amount differ by 2k....need extra months to fully paid.

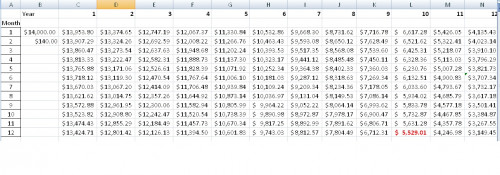

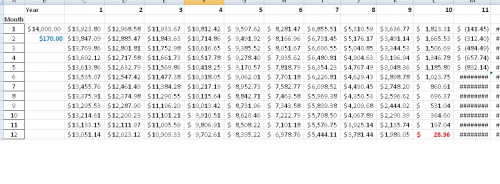

i did the excel and it correctly point out that i need more than 10 years

the other debt is very low monthly payment....10year definitely cannot settle.

i guess at that time AKPK consultant maybe want to help me , so close one eye and force the other bank to take the offer.

Maybe you should do the calculation on excel and show them.

it is very simple formula.

Bank will always say their calculation is correct and AKPK cannot help you at all.

i intend to drag my repayment more that 10 years for that bank...hahaha with the help of AKPK consultant.

Nov 6 2019, 05:16 PM

Nov 6 2019, 05:16 PM

Quote

Quote

0.1444sec

0.1444sec

0.52

0.52

7 queries

7 queries

GZIP Disabled

GZIP Disabled