Over the years AKPK has received numerous reports and feedback from customers of being approached by certain individuals claiming to be representatives or agents of AKPK offering to help them restructure their debts through AKPK’s Debt Management Programme (DMP).

Some of the customers were wise enough to check with AKPK first and avoided being scammed by these agents but many others were not so lucky and have incurred losses.

There are also third parties soliciting money from individuals in debt as payment to restructure or reschedule their debts by referring them to AKPK.

In terms of their modus operandi, usually these agents would make a phone call or send SMS to the customer to offer their services. Individuals who are in some kind of financial mess and in dire need of assistance would be more vulnerable and are more likely to be convinced that the agents can help them. Scammers always prey on people’s feelings and emotions.

The agent will then tell the customer that payment in advance is required first before processing can start. Some may ask for as much as 10% – 20% of the total loan value.

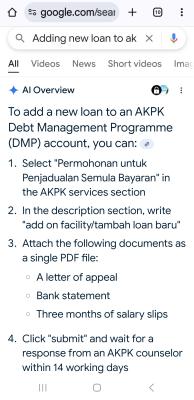

After the payment is made, the agent will then assist the customer to submit a DMP online application to AKPK and book an appointment for counselling. It is usually at the counselling stage that the customer realises he or she has been duped after finding out that AKPK’s services are free and AKPK does not appoint any third party agents.

By then it is too late as they have already parted with their money and in some cases the agent has already disappeared.

They have paid money for a service which they can actually get for free. It’s a double financial blow to someone who is already in a stressful financial situation.

More, ....

AKPK’s Scam Alert: Third Party Agent – Don’t Be Duped – Part One

https://theiskandarian.com/akpks-scam-alert...part-one/?amp=1This post has been edited by MUM: Jul 3 2025, 02:26 PM

Sep 5 2024, 08:24 PM

Sep 5 2024, 08:24 PM

Quote

Quote

0.0348sec

0.0348sec

0.19

0.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled