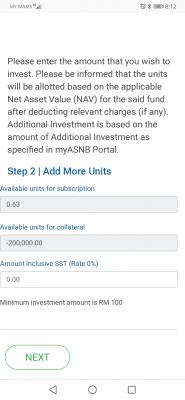

BTW, what's 'units available for collateral' ?

Attached thumbnail(s)

ASB loan, worth to get it???

|

|

Jan 6 2019, 08:20 AM Jan 6 2019, 08:20 AM

Return to original view | IPv6 | Post

#221

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

|

|

|

Jan 6 2019, 04:30 PM Jan 6 2019, 04:30 PM

Return to original view | IPv6 | Post

#222

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

Jan 6 2019, 08:43 PM Jan 6 2019, 08:43 PM

Return to original view | Post

#223

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(wild_card_my @ Jan 6 2019, 06:57 PM) That would be the number of units available to be invested using financing. Ah yes... that makes sense. since PNB only allows 200k loan, that is why mine shows -200k since I'm on 400k loan (200k over the allowed 200k cap). And I'm pretty much at MAX asb investment since I can only add another 63c! hahaDon't you have one of those older accounts with RM400k limit? I have another client with quite high limits too. these people tend to be older or have opened their accounts decades earlier. He doesn't have any loan investments, but has plenty as cash, if I am not mistaken, about 120k So right now my ASB make up is 400k sijil + 240k cash. Can't wait till the cash portion surpasses the sijil loan amount! This post has been edited by buggie: Jan 6 2019, 08:44 PM |

|

|

Jan 13 2019, 01:59 PM Jan 13 2019, 01:59 PM

Return to original view | IPv6 | Post

#224

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

Jan 14 2019, 09:41 PM Jan 14 2019, 09:41 PM

Return to original view | IPv6 | Post

#225

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(voncrane @ Jan 14 2019, 06:12 PM) Yes you still can. At least from MBB.. Adoi..... Biar lah dia if he wants to be thorough and ask... Even if the answer is straight forward and obvious. Any skin off your back meh? Like that also you want to call out ka? Already mentioned he/she'll be 35 this year. Which means currently 34+.. Still ask when was born.. Not simple maths meh? Or no need maths.. Since you've already confirmed that those who are definitely 35 are able to get max 30 years.. Sometimes just a little common sense is required. No need to reach for a larger analysis and response. These comments are totally uncalled for imo. Nak cari pasal buat ape? Live and let live brother... Less bickering and more about making money. |

|

|

Jan 15 2019, 12:20 AM Jan 15 2019, 12:20 AM

Return to original view | Post

#226

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(voncrane @ Jan 14 2019, 11:40 PM) Likewise wild_card_my.. Take your drama out elsewhere. now you are recommending that I be banned or the both of us? Just because I pointed out an issue and disagreed with it? Really taking the high road on there are you.. I'm done on this matter.. I too shall continue to contribute when and where I can..you have your opinions and I have mine. Just because we disagree on certain matters does not mean I have a vendetta against you or anyone on here. That would be a waste. It just means I disagreed.. that's all.. Ciao. dah la tu... mau jugak have the last word... |

|

|

|

|

|

Jan 15 2019, 07:32 PM Jan 15 2019, 07:32 PM

Return to original view | IPv6 | Post

#227

|

Junior Member

449 posts Joined: Jun 2011 |

Basically, you can inject 200k cash into asb. Any dividends earned essentially increases your max cap. So if first put in 100k. And earn dividend 14k making balance 114k. It doesn't mean you can only put in 86k. You can still put in 100k essentially making your cap 214k. If you have 114k, the take out 14k. You can still put back 114k. And not just 100k. So you soft cap has increased with the accumulated dividends. Alert_RaZO liked this post

|

|

|

Jan 16 2019, 02:24 PM Jan 16 2019, 02:24 PM

Return to original view | Post

#228

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(Tucker Crowe @ Jan 16 2019, 12:04 PM) This statement is inaccurate. Yeah Kinda agree with this here. I would take up asbf in a heartbeat given the opportunity. As long as there are no future plans for a bigger commitment within a year. And when I do wanna get that house and free up monthly expenditures to fund that, i'd just cancel/surrender with no penalty. ASBf is very different from buying a house. ASBf, some can be cancelled anytime and some will have a short term lock-in period. This is not true for a home loan, where you need to sell the property to exit. The 'commitment' level for both, as you can see, are not comparable. Or if things get too hot to handle, just terminate. If you do make a loss like cancelling within the first year, i think it's negligible. The potential gains outweighs the risk. |

|

|

Mar 6 2019, 12:30 PM Mar 6 2019, 12:30 PM

Return to original view | Post

#229

|

Junior Member

449 posts Joined: Jun 2011 |

ASB2 dividends coming end of the month!!!

Anyone stoked yet? |

|

|

Mar 6 2019, 01:14 PM Mar 6 2019, 01:14 PM

Return to original view | Post

#230

|

Junior Member

449 posts Joined: Jun 2011 |

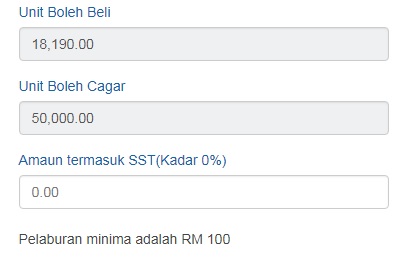

QUOTE(deadgriever @ Mar 6 2019, 10:47 AM) hi guys. U still have 50k allocation for loan (cagar) so it is possible to take another 50k loan, but you might need to take out RM 31,810 since your unit boleh beli is 18,190currently i have 225K cash & 150K loan in ASB1. can i apply another 50K loan? this is my current status of my Unit Boleh Beli & Unit Boleh Cagar  i prefer not to cash out any money from the account when applying a new 50K loan. is that possible? Can bankers confirm this? If betul then take it out and put in ASD(ASB3). Also topup your loan at ASB2... another 10k underutilized there This post has been edited by buggie: Mar 6 2019, 01:18 PM |

|

|

Mar 6 2019, 04:48 PM Mar 6 2019, 04:48 PM

Return to original view | Post

#231

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(deadgriever @ Mar 6 2019, 03:03 PM) thanks for your advice. Go for it! Max that loan. The cash you need to take out put in ASB3 or somewhere else to generate even more returnsASB3 = ASB 3 Didik? same thing? 6.25% dividend performance last year not bad i found out about this issue when i was visiting few different bank branches here in pantai timur. even bankers there cannot confirm whether i can straightaway take a new loan. hope someone here can shed a light. oh ya. about my ASB2 190K, this also done by incompetent bankers here in pantai timur. i asked for 200K loan she gave me 190K loan. right now i will just leave it at 190K coz i heard ASB2 quota is almost finished. im considering to put all that excess money in ASB3 As for ASB2, when you next terminate and reapply, then go for full 200k loan. I know quota maybe full... but keep trying once in awhile. In fact the best time is just after dividend (Early April) as many people cash out then. This post has been edited by buggie: Mar 6 2019, 04:48 PM |

|

|

Mar 7 2019, 04:36 PM Mar 7 2019, 04:36 PM

Return to original view | Post

#232

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

Mar 10 2019, 02:45 AM Mar 10 2019, 02:45 AM

Return to original view | Post

#233

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(MrFay @ Mar 8 2019, 06:13 PM) Hey guys, i would like to ask regarding the cap of asb loan.. lets say that i had 200k (loan) + 14k (dividend) earlier this year.. and i want to terminate the loan.. so PNB will give back the remaining balance of the loan back to the bank and left me with only 14k in my ASB.. no need to take out. just leave it in there and applySo if i'm going to apply for a new asb loan, do i need to withdraw all the 14k to apply for a max 200k loan tenure or just apply for a 190k and withdrew 4k only? Or is it possible to just leave the 14k in asb and apply for a max 200k asb loan giving the total of 214k in my asb? Can someone help me with this? |

|

|

|

|

|

Mar 16 2019, 09:34 PM Mar 16 2019, 09:34 PM

Return to original view | IPv6 | Post

#234

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(matyrze @ Mar 14 2019, 09:40 PM) Wonder if anyone has done the calculation to break even, to determine that it may be too early to terminate current loan.. 3-4 years is the sweet spot for rinse and repeat. From experienceShould get back approx 9k everytime you do that for a nice reward to spend on whatever or, you can reinvest that for more returns. This post has been edited by buggie: Mar 16 2019, 09:35 PM |

|

|

Mar 28 2019, 07:22 AM Mar 28 2019, 07:22 AM

Return to original view | IPv6 | Post

#235

|

Junior Member

449 posts Joined: Jun 2011 |

Anyday now, ASB2 dividend announcement! Get stoked!

|

|

|

Mar 31 2019, 09:11 AM Mar 31 2019, 09:11 AM

Return to original view | IPv6 | Post

#236

|

Junior Member

449 posts Joined: Jun 2011 |

QUOTE(Global_Financing @ Mar 30 2019, 04:21 AM) Hi, 1. You achieve a higher ROI percentage if you terminate and reapply because the ammortization value that you get back is added to your dividend earnings, thus boosting the percentage.I've recently opened ASB account and obtained ASBF 200k from RHB (4.9%) without insurance and paying 1061/mo for 30 years tenure. I will be doing compounding method. there are some questions that I'd like to ask: 1. How do i achieve highest ROI? and what is OPM? 2. I have read in this thread that I should terminate and re apply 200k ASBF every 3 years. but, is 3 years is really the "most optimal" period? im not sure how that is calculated.. how do i even compare to terminating it in 2nd year, or terminating it in 5th year.. to see which is more profitable... 3. I have additional bullets from my salary to pay for monthly commitment on additional 200k ASBF, 30 years tenure. (another RM1k/mo commitment). what's the best option to utilize this bullet? ASBF proxy? wait for ASB2F? everymonth saving into ASB2 acc? <problem with myASNB website> 4. I have tried to Register in myASNB website using my IC, and when the website says it has sent TAC code. Problem is, I dont receive the TAC code on my phone. I've tried everyday for the past 2 weeks. I've went to RHB counter (ASB Agent) to ensure my phone number is correct. anything else i can do here? » Click to show Spoiler - click again to hide... « OPM = is Other People's Money. This term is used a lot here because the concept of this is leveraging OPM. So much so that if I had 200k cash in ASB, I would take it out and apply loan and let OPM do its thing. 2. No right or wrong here. My experience, 3-4 years to boost ROI and take advantage of the usually lower interest rate, or in my case a reward system. I believe as the dividend rates come down, so does the interest rate. To the banks, its still a viable business so in order to milk this cash cow, they have to make it worthwhile for the customers to take up the loan. As soon as its not worthwhile anymore, banks can say bye bye to this profitable portfolio. 3. The best is by ASBf proxy since that's the fund that's giving the best rates. If ASB is the route you wanna take. But not without risk. You gotta really trust your proxy. Gets more complicated if your proxy kicks the bucket. 4. Can't help u there. Check with the portal and/or your telco |

|

|

Apr 1 2019, 05:23 PM Apr 1 2019, 05:23 PM

Return to original view | Post

#237

|

Junior Member

449 posts Joined: Jun 2011 |

The before and after ASB2 dividend payout.... STOKED! Growing EXPONENTIALLY The first of 3 PNB dividends payout for me... next ASB3 in September and then the big one ASB in December. I think I'll have to get a fund that pays out in June so I can get this feeling of 'high' all year long! hopefully can reach 70k all in this year to bring me just under 1.1M. Can't believe that I was just celebrating a milestone in January of surpassing the 1M mark and I'm already talking about reaching 1.1M 3 months later...haha Get started guys... As with compounding 101, the earlier you start the faster the growth! This post has been edited by buggie: Apr 1 2019, 05:53 PM Alert_RaZO liked this post

|

|

|

Apr 3 2019, 06:26 AM Apr 3 2019, 06:26 AM

Return to original view | Post

#238

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

Apr 3 2019, 10:10 AM Apr 3 2019, 10:10 AM

Return to original view | Post

#239

|

Junior Member

449 posts Joined: Jun 2011 |

|

|

|

Apr 3 2019, 01:22 PM Apr 3 2019, 01:22 PM

Return to original view | Post

#240

|

Junior Member

449 posts Joined: Jun 2011 |

ASB loans is not just about 5% vs 6.5%.

Lemme simplify things for the benefit of new readers. On parameters 30 years loan and 6.5% dividend (adopted from last year). 3 years and I terminate and walk away. I paid: 1,100 x 12 month x 3years= 39,600 (actually less – I rounded up) I get: 41,500 (dividend) + 9,000 (amortised) = 50,500 So let’s recap. After 3 years: Money OUT : 39,600 Money IN : 50,500 There’s no hidden things here. After 3 years when all is said and done if I wanna walk away from this investment i would’ve paid 39,600 to the bank and received 50,500. That’s 27.5 % Return And that is in today’s lansdscape. Now there will be some ppl that say dividend rate will drop as they do every year, historically.. yada yada yada.... Even if it drops to 6% you still get the coveted 18% ROI and that’s if the banks don’t revise their rates downward to make it enticing for investors. Now let’s talk about opportunity cost and strategy. Yeah sure times are bad now. But it won’t always stay this way. So what you wanna do now is appreciate your capital. Accumulate and build up that capital which will ultimately earn you more when things look up. If you’ve built up a size of up to 1m already, just imagine IF things started looking up and ASB dividend goes up to 7% or 8% or even dare I dream to the glory days of >10% The person that is savvy has positioned himself to earn dividends on 1M whereas the ill-informed and nay-sayers would just then start out at 200k because it looks good NOW. And by the time they've built a sizable capital, the economy dips again. The irony of it all. If the glory days don’t come back then well.... just be content with your 18-27% returns lah! Tak cukup ah? |

| Change to: |  0.0258sec 0.0258sec

0.71 0.71

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 02:51 PM |