QUOTE(chilskater @ Oct 18 2019, 10:26 AM)

if bank interest is 5% and ASB profit 7%, we untung only 1% la?betul ka?so bank untung banyak?

Firstly... Whats wrong with bank untung banyak? There always that negative perception to "bank earning interest banyak" so therefore this loan is no good. As if bank untung-ing is a big no no. Banks are in the business of making money. People need to understand that. Instead... Concentrate on how much YOU will earn.

Ive copied and paste my post somewhere in mar/apr earlier for the your benefit and the benefit of new readers :-

ASB loans is not just about 5% vs 6.5%.

Lemme simplify things for the benefit of new readers. On parameters 30 years loan and 6.5% dividend (adopted from last year). 3 years and I terminate and walk away.

I paid:

1,100 x 12 month x 3years= 39,600 (actually less – I rounded up)

I get:

41,500 (dividend) + 9,000 (amortised) = 50,500

So let’s recap. After 3 years:

Money OUT : 39,600

Money IN : 50,500

There’s no hidden things here. After 3 years when all is said and done if I wanna walk away from this investment i would’ve paid 39,600 to the bank and received 50,500.

That’s 27.5 % Return

And that is in today’s lansdscape. Now there will be some ppl that say dividend rate will drop as they do every year, historically.. yada yada yada.... Even if it drops to 6% you still get the coveted 18% ROI and that’s if the banks don’t revise their rates downward to make it enticing for investors.

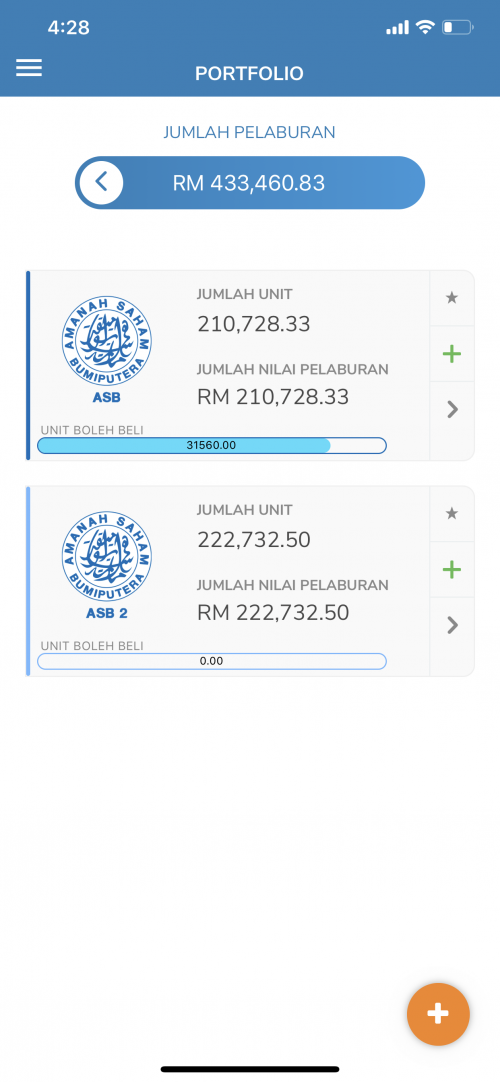

Now let’s talk about opportunity cost and strategy. Yeah sure times are bad now. But it won’t always stay this way. So what you wanna do now is appreciate your capital. Accumulate and build up that capital which will ultimately earn you more when things look up. If you’ve built up a size of up to 1m already, just imagine IF things started looking up and ASB dividend goes up to 7% or 8% or even dare I dream to the glory days of >10%

The person that is savvy has positioned himself to earn dividends on 1M whereas the ill-informed and nay-sayers would just then start out at 200k because it looks good NOW. And by the time they've built a sizable capital, the economy dips again. The irony of it all.

If the glory days don’t come back then well.... just be content with your 18-27% returns

This post has been edited by buggie: Oct 18 2019, 07:12 PM

Apr 5 2019, 08:38 AM

Apr 5 2019, 08:38 AM

Quote

Quote

0.0288sec

0.0288sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled