TTB paid so much as fund manager and also received excellent paid advisory.... I wonder if ICAP bought some glove stocks and if yes, how much? If no, why no?

ICAP, traded price higher than NAV

ICAP, traded price higher than NAV

|

|

Jul 23 2020, 10:18 AM Jul 23 2020, 10:18 AM

Show posts by this member only | IPv6 | Post

#821

|

Senior Member

3,165 posts Joined: Feb 2015 |

TTB paid so much as fund manager and also received excellent paid advisory.... I wonder if ICAP bought some glove stocks and if yes, how much? If no, why no?

|

|

|

|

|

|

Jul 23 2020, 10:26 AM Jul 23 2020, 10:26 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(aspartame @ Jul 23 2020, 10:18 AM) TTB paid so much as fund manager and also received excellent paid advisory.... I wonder if ICAP bought some glove stocks and if yes, how much? If no, why no? If he doesn't do any significant buying, it only shows that he ISN'T willing to take on any risk in buying new stocks.Which makes sense FOR HIM.... why risk it when he's sitting on those pre-2010 gains? all he needs to do is do nothing and collect them yearly fees... good for him .... but is it good for the shareholders of the fund? btw... few of us HAVE BEEN asking the same thing about the high fees for so many years already.... shareholders no complain... so why should he mess with his personal money pot? |

|

|

Jul 23 2020, 10:36 AM Jul 23 2020, 10:36 AM

Show posts by this member only | IPv6 | Post

#823

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 23 2020, 10:26 AM) If he doesn't do any significant buying, it only shows that he ISN'T willing to take on any risk in buying new stocks. If I remember correctly, ICAP was set up right after Asian Financial crisis right? He bought at the lows. Of course, this meant that ICAP will have stellar historical record. After that, he has been waiting for another AFC type crash which never came....every crash is not bad enough if compared to AFC and so he kept waiting lor... and like you say, no need for him to risk his “reputation”..fees still flow in anyway.. who cares?Which makes sense FOR HIM.... why risk it when he's sitting on those pre-2010 gains? all he needs to do is do nothing and collect them yearly fees... good for him .... but is it good for the shareholders of the fund? btw... few of us HAVE BEEN asking the same thing about the high fees for so many years already.... shareholders no complain... so why should he mess with his personal money pot? |

|

|

Jul 23 2020, 10:58 AM Jul 23 2020, 10:58 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(aspartame @ Jul 23 2020, 10:36 AM) If I remember correctly, ICAP was set up right after Asian Financial crisis right? He bought at the lows. Of course, this meant that ICAP will have stellar historical record. After that, he has been waiting for another AFC type crash which never came....every crash is not bad enough if compared to AFC and so he kept waiting lor... and like you say, no need for him to risk his “reputation”..fees still flow in anyway.. who cares? Well, that's his strategy (as far as I can tell) and it's working wonders for him.Shareholders thinks so highly of him... Has anybody dared to challenge his exorbitant yearly fees before? Last 10 years... 58 million in fees charged!!! Where to find? Some more .... it's pretty much legal..... |

|

|

Jul 23 2020, 11:03 AM Jul 23 2020, 11:03 AM

Show posts by this member only | IPv6 | Post

#825

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 10:26 AM) If he doesn't do any significant buying, it only shows that he ISN'T willing to take on any risk in buying new stocks. Pays for his Ferraris and Porches. Which makes sense FOR HIM.... why risk it when he's sitting on those pre-2010 gains? all he needs to do is do nothing and collect them yearly fees... good for him .... but is it good for the shareholders of the fund? btw... few of us HAVE BEEN asking the same thing about the high fees for so many years already.... shareholders no complain... so why should he mess with his personal money pot? |

|

|

Jul 23 2020, 11:08 AM Jul 23 2020, 11:08 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jul 23 2020, 11:17 AM Jul 23 2020, 11:17 AM

Show posts by this member only | IPv6 | Post

#827

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Jul 23 2020, 11:24 AM Jul 23 2020, 11:24 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

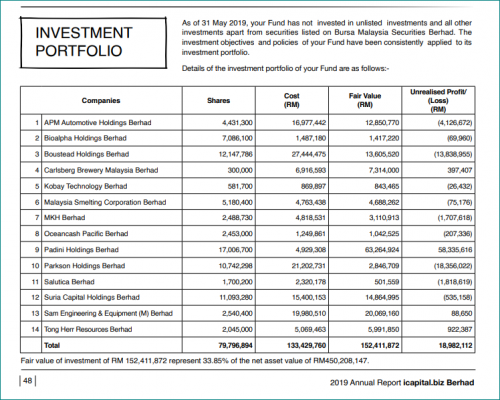

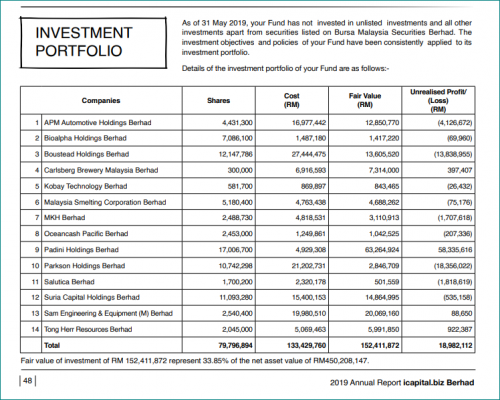

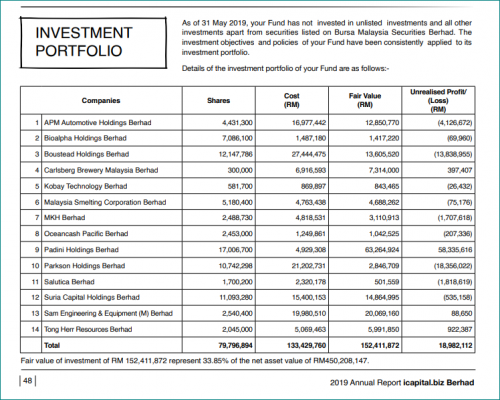

QUOTE(aspartame @ Jul 23 2020, 10:18 AM) TTB paid so much as fund manager and also received excellent paid advisory.... I wonder if ICAP bought some glove stocks and if yes, how much? If no, why no? Oh.....Just saw the most active stock today! iCap got buy!!! Wahhhh..... Ah Teng Boo so genius.... he bought BioAlpha for the fund. No bruff la.... https://mediafiles.icapital.biz/ext-files/i...orts/ar2019.pdf but... the sad thing is.... iCap investment in BioAlpha is only worth 1.4 million.... pg 48  ..... err .... not very good hor .... |

|

|

Jul 23 2020, 11:29 AM Jul 23 2020, 11:29 AM

Show posts by this member only | IPv6 | Post

#829

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 11:24 AM) Oh..... Fatt !Just saw the most active stock today! iCap got buy!!! Wahhhh..... Ah Teng Boo so genius.... he bought BioAlpha for the fund. No bruff la.... https://mediafiles.icapital.biz/ext-files/i...orts/ar2019.pdf but... the sad thing is.... iCap investment in BioAlpha is only worth 1.4 million.... pg 48  ..... err .... not very good hor .... |

|

|

Jul 23 2020, 11:42 AM Jul 23 2020, 11:42 AM

Show posts by this member only | IPv6 | Post

#830

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 23 2020, 11:24 AM) Oh..... Lol... so much research and fees but ended up invested 1.5mil in BioAlpha? Go up 100% also not enough to cover fees.... and funny he considered Boustead and Parkson good enough for long term hold but not Topglove? I mean, it is understandable if layman get stuck in Boustead or Parkson but he is a pro leh..Just saw the most active stock today! iCap got buy!!! Wahhhh..... Ah Teng Boo so genius.... he bought BioAlpha for the fund. No bruff la.... https://mediafiles.icapital.biz/ext-files/i...orts/ar2019.pdf but... the sad thing is.... iCap investment in BioAlpha is only worth 1.4 million.... pg 48  ..... err .... not very good hor .... |

|

|

Jul 23 2020, 11:53 AM Jul 23 2020, 11:53 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

|

|

|

Jul 23 2020, 12:03 PM Jul 23 2020, 12:03 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

ok serious ...

*cough* Imagine .... 10 years later First the big elephant (or perhaps I should say the invisible elephant as posted before... Total fees for 2010 is 4,161,351 Total fees for 2011 is 5,218,328 Total fees for 2012 is 5,899,469 Total fees for 2013 is 6,321,105 Total fees for 2014 is 6,351,797 Total fees for 2015 is 6,552,779 Total fees for 2016 is 6,289,781 *decreased but that year they took an impairment loss of 12.5 million on some of the shares*!! Total fees for 2017 is 6,730,410 Total fees for 2018 is 7,428,302 Total fees for 2019 is 7,439,931 The total fees collected since 2010 was 58 million. If nothing is changed, is it wrong to assume that he will charge at least 7.4 million per year, assuming no more fee increment....*cough*... which means.... icap is gonna pay at least another 74 million in fees for the next 10 years.... now the fund NAV .... in 2010, NAV is 157.58 in 2015, NAV is 211.48 in 2019, NAV is 233.22 The last 10 years, NAV grew only at 4% The last 5 years, NAV grew only at 2%... So estimate NAV to grow how much?? 2%? 3%?? The stock price... exactly 10 years ago, July 2010, iCap was around 1.80.  Today it's only 2.03 ..... *** But the other obvious point to note from that 10 year historical chart is that the stock had generally traded above 2.00. And that 1.80 is a nice cherry picked stock price.... **** So the next 10 years.... estimate stock price? can it retest its past high of 2.80+ ? meanwhile.... what's certain..... is he will pocket that 74 million in fees.... which will bring the total fees collected since 2010 to be...... at least 132 million!!! so who da winner ???? |

|

|

Jul 23 2020, 06:06 PM Jul 23 2020, 06:06 PM

Show posts by this member only | IPv6 | Post

#833

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 23 2020, 12:03 PM) ok serious ... Rm7mil fees... lol.. RM600k per month paid but cannot even notice that Malaysia sort of has a moat in glove making? Research what oh? Instead .. long term hold Boustead? Oh well.. as long as shareholders are happy I guess ...*cough* Imagine .... 10 years later First the big elephant (or perhaps I should say the invisible elephant as posted before... Total fees for 2010 is 4,161,351 Total fees for 2011 is 5,218,328 Total fees for 2012 is 5,899,469 Total fees for 2013 is 6,321,105 Total fees for 2014 is 6,351,797 Total fees for 2015 is 6,552,779 Total fees for 2016 is 6,289,781 *decreased but that year they took an impairment loss of 12.5 million on some of the shares*!! Total fees for 2017 is 6,730,410 Total fees for 2018 is 7,428,302 Total fees for 2019 is 7,439,931 The total fees collected since 2010 was 58 million. If nothing is changed, is it wrong to assume that he will charge at least 7.4 million per year, assuming no more fee increment....*cough*... which means.... icap is gonna pay at least another 74 million in fees for the next 10 years.... now the fund NAV .... in 2010, NAV is 157.58 in 2015, NAV is 211.48 in 2019, NAV is 233.22 The last 10 years, NAV grew only at 4% The last 5 years, NAV grew only at 2%... So estimate NAV to grow how much?? 2%? 3%?? The stock price... exactly 10 years ago, July 2010, iCap was around 1.80.  Today it's only 2.03 ..... *** But the other obvious point to note from that 10 year historical chart is that the stock had generally traded above 2.00. And that 1.80 is a nice cherry picked stock price.... **** So the next 10 years.... estimate stock price? can it retest its past high of 2.80+ ? meanwhile.... what's certain..... is he will pocket that 74 million in fees.... which will bring the total fees collected since 2010 to be...... at least 132 million!!! so who da winner ???? This post has been edited by aspartame: Jul 23 2020, 06:06 PM |

|

|

|

|

|

Jul 23 2020, 07:24 PM Jul 23 2020, 07:24 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(aspartame @ Jul 23 2020, 06:06 PM) Rm7mil fees... lol.. RM600k per month paid but cannot even notice that Malaysia sort of has a moat in glove making? Research what oh? Instead .. long term hold Boustead? Oh well.. as long as shareholders are happy I guess ... .... that's the biggest mystery in all honesty...I am not a shareholder. Never was. Never will be. So why aren't any shareholder complain? Is it because their hair is already wet? But these fees... surely they can approach Teng Boo and say 'look, clearly you have not been performing. You did jack shyte for 10 years. Sepuloh! Well, with the lousy performance, you should not be charging such insane fees. 58 million in total fees for 10 years is insane. It is daylight robbery. If you are gonna argue nothing to buy (ie no value), then you should dissolve the fund! You cannot sit and literally do nothing and collect million in fees!'.... well.. that's what I will say direct to his face... no joke. regarding stock picks... if I have to pick on his stocks, it would be the following.... his insistent on Parkson Holdings is simply beyond me. It fails on so many accounts. It has been losing money for so many years. Why insist hold? Is it because of icap close relationship with Lion group? and Axiata.... is it 12 million or 13 million losses in that stock? All because of his refusal to take part in Axiata's rights issue? |

|

|

Jul 24 2020, 10:38 AM Jul 24 2020, 10:38 AM

Show posts by this member only | IPv6 | Post

#835

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 07:24 PM) .... that's the biggest mystery in all honesty... Some people like to be SUCKered. i guess TTB likes these sort since they are finding his lifestyle.I am not a shareholder. Never was. Never will be. So why aren't any shareholder complain? Is it because their hair is already wet? But these fees... surely they can approach Teng Boo and say 'look, clearly you have not been performing. You did jack shyte for 10 years. Sepuloh! Well, with the lousy performance, you should not be charging such insane fees. 58 million in total fees for 10 years is insane. It is daylight robbery. If you are gonna argue nothing to buy (ie no value), then you should dissolve the fund! You cannot sit and literally do nothing and collect million in fees!'.... well.. that's what I will say direct to his face... no joke. regarding stock picks... if I have to pick on his stocks, it would be the following.... his insistent on Parkson Holdings is simply beyond me. It fails on so many accounts. It has been losing money for so many years. Why insist hold? Is it because of icap close relationship with Lion group? and Axiata.... is it 12 million or 13 million losses in that stock? All because of his refusal to take part in Axiata's rights issue? What a nice scam! |

|

|

Jul 24 2020, 05:56 PM Jul 24 2020, 05:56 PM

Show posts by this member only | IPv6 | Post

#836

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 23 2020, 07:24 PM) .... that's the biggest mystery in all honesty... I am not a shareholder. Never was. Never will be. So why aren't any shareholder complain? Is it because their hair is already wet? But these fees... surely they can approach Teng Boo and say 'look, clearly you have not been performing. You did jack shyte for 10 years. Sepuloh! Well, with the lousy performance, you should not be charging such insane fees. 58 million in total fees for 10 years is insane. It is daylight robbery. If you are gonna argue nothing to buy (ie no value), then you should dissolve the fund! You cannot sit and literally do nothing and collect million in fees!'.... well.. that's what I will say direct to his face... no joke. regarding stock picks... if I have to pick on his stocks, it would be the following.... his insistent on Parkson Holdings is simply beyond me. It fails on so many accounts. It has been losing money for so many years. Why insist hold? Is it because of icap close relationship with Lion group? and Axiata.... is it 12 million or 13 million losses in that stock? All because of his refusal to take part in Axiata's rights issue? QUOTE(prophetjul @ Jul 24 2020, 10:38 AM) Some people like to be SUCKered. i guess TTB likes these sort since they are finding his lifestyle. The best part is it is all set up legally. I don’t know why SC approved such a fund which has to pay both fund management fee and a separate fund advisory fee. Is there any other fund in the world with such arrangement? This type of fund should be set up as open ended fund where disgruntled investors can exit at NAV (the fund has to buy back). Now, everyone is locked in and can only exit by selling in the market at a loss. And, is there any clause under which the fund will be ended? Otherwise, this is perpetual cash generating machine ... for the fund manager ...What a nice scam! This post has been edited by aspartame: Jul 24 2020, 05:57 PM |

|

|

Jul 26 2020, 02:18 PM Jul 26 2020, 02:18 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(aspartame @ Jul 24 2020, 05:56 PM) The best part is it is all set up legally. I don’t know why SC approved such a fund which has to pay both fund management fee and a separate fund advisory fee. Is there any other fund in the world with such arrangement? This type of fund should be set up as open ended fund where disgruntled investors can exit at NAV (the fund has to buy back). Now, everyone is locked in and can only exit by selling in the market at a loss. And, is there any clause under which the fund will be ended? Otherwise, this is perpetual cash generating machine ... for the fund manager ... Hope the shareholders wake up one day! |

|

|

Jul 26 2020, 02:19 PM Jul 26 2020, 02:19 PM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(prophetjul @ Jul 24 2020, 10:38 AM) Some people like to be SUCKered. i guess TTB likes these sort since they are finding his lifestyle. Here is the bigger set of numbersWhat a nice scam! Total fees = fund management fee + investment advisory fee + professional fee (I did not add in the director fees.... Total fees for 2006 is 1,311,317 Total fees for 2007 is 2,833,878 Total fees for 2008 is 4,224,675 Total fees for 2009 is 3,606,446 Total fees for 2010 is 4,161,351 Total fees for 2011 is 5,218,328 Total fees for 2012 is 5,899,469 Total fees for 2013 is 6,321,105 Total fees for 2014 is 6,351,797 Total fees for 2015 is 6,552,779 Total fees for 2016 is 6,289,781 *decreased but that year they took an impairment loss of 12.5 million on some of the shares*!! Total fees for 2017 is 6,730,410 Total fees for 2018 is 7,428,302 Total fees for 2019 is 7,439,931 * please do verify the numbers...cos I could make mistake in typo etc etc... Total fees collected since listing is 68 million. *cough* Now check this stat out... iCapital.Biz consist of 140 million shares On per share basis, the total fees works to be 48.5 sen. (68/140) and as assumed earlier.... if on average 7.4 million is charged per year, then for the next 10 years .. another 74 million will be charged. So for 24 years, Ah Teng Boo would have collected, 74+68 = 142 million in fees!!! or on a per share basis, that's rm1.00 per share!! Ahem! Can you not see everything is snowballed towards Ah Teng Boo's favour? On one of postings in this thread, it was said that the SHAREHOLDERS SLEEP BETTER WITH A PRUDENT FUND MANAGGER .... but .... on the basis on how the fees are charged to the fund... it's dead clear that Ah Teng Boo will be the one sleeping the BEST! |

|

|

Jul 26 2020, 08:05 PM Jul 26 2020, 08:05 PM

Show posts by this member only | IPv6 | Post

#839

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 26 2020, 02:19 PM) Here is the bigger set of numbers As I said, it’s a perpetual cash generating machine. Most closed end funds are exchanged traded INDEX funds, meaning these funds are LOW FEEs and mimic the index movement. ICAP is also a close ended ETF! But it is very high fees! The NAVs are meaningless because the shareholders can’t exit at NAV!Total fees = fund management fee + investment advisory fee + professional fee (I did not add in the director fees.... Total fees for 2006 is 1,311,317 Total fees for 2007 is 2,833,878 Total fees for 2008 is 4,224,675 Total fees for 2009 is 3,606,446 Total fees for 2010 is 4,161,351 Total fees for 2011 is 5,218,328 Total fees for 2012 is 5,899,469 Total fees for 2013 is 6,321,105 Total fees for 2014 is 6,351,797 Total fees for 2015 is 6,552,779 Total fees for 2016 is 6,289,781 *decreased but that year they took an impairment loss of 12.5 million on some of the shares*!! Total fees for 2017 is 6,730,410 Total fees for 2018 is 7,428,302 Total fees for 2019 is 7,439,931 * please do verify the numbers...cos I could make mistake in typo etc etc... Total fees collected since listing is 68 million. *cough* Now check this stat out... iCapital.Biz consist of 140 million shares On per share basis, the total fees works to be 48.5 sen. (68/140) and as assumed earlier.... if on average 7.4 million is charged per year, then for the next 10 years .. another 74 million will be charged. So for 24 years, Ah Teng Boo would have collected, 74+68 = 142 million in fees!!! or on a per share basis, that's rm1.00 per share!! Ahem! Can you not see everything is snowballed towards Ah Teng Boo's favour? On one of postings in this thread, it was said that the SHAREHOLDERS SLEEP BETTER WITH A PRUDENT FUND MANAGGER .... but .... on the basis on how the fees are charged to the fund... it's dead clear that Ah Teng Boo will be the one sleeping the BEST! |

|

|

Jul 26 2020, 08:13 PM Jul 26 2020, 08:13 PM

Show posts by this member only | IPv6 | Post

#840

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Boon3 @ Jul 26 2020, 02:19 PM) Here is the bigger set of numbers The whole setup is like placing a rm140mil FD at 3.8% perpetually for TTB.. like only ah.. he he...Total fees = fund management fee + investment advisory fee + professional fee (I did not add in the director fees.... Total fees for 2006 is 1,311,317 Total fees for 2007 is 2,833,878 Total fees for 2008 is 4,224,675 Total fees for 2009 is 3,606,446 Total fees for 2010 is 4,161,351 Total fees for 2011 is 5,218,328 Total fees for 2012 is 5,899,469 Total fees for 2013 is 6,321,105 Total fees for 2014 is 6,351,797 Total fees for 2015 is 6,552,779 Total fees for 2016 is 6,289,781 *decreased but that year they took an impairment loss of 12.5 million on some of the shares*!! Total fees for 2017 is 6,730,410 Total fees for 2018 is 7,428,302 Total fees for 2019 is 7,439,931 * please do verify the numbers...cos I could make mistake in typo etc etc... Total fees collected since listing is 68 million. *cough* Now check this stat out... iCapital.Biz consist of 140 million shares On per share basis, the total fees works to be 48.5 sen. (68/140) and as assumed earlier.... if on average 7.4 million is charged per year, then for the next 10 years .. another 74 million will be charged. So for 24 years, Ah Teng Boo would have collected, 74+68 = 142 million in fees!!! or on a per share basis, that's rm1.00 per share!! Ahem! Can you not see everything is snowballed towards Ah Teng Boo's favour? On one of postings in this thread, it was said that the SHAREHOLDERS SLEEP BETTER WITH A PRUDENT FUND MANAGGER .... but .... on the basis on how the fees are charged to the fund... it's dead clear that Ah Teng Boo will be the one sleeping the BEST! |

| Change to: |  0.0271sec 0.0271sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 08:33 AM |