QUOTE(Boon3 @ Sep 21 2016, 10:34 AM)

Something interesting:

Teng Boo always boosted his fund annual growth rate.

http://www.thestar.com.my/business/busines...d-to-the-board/Now do you know that if you open up icap first ever anual report, you will find out that the total fees for 2006 is only 1.276 million and as per latest report, the total fees has grown to 6.150 million.

That's a period of just 10 years.

So...

Total fees for 2006 is 1,276,958 million

Total fees for 2016 is 6,150,684 million

Period = 10 years.

Drum roll please.............................

Compound Annual Growth Rate for total fees since 2006 = 17.02%

now there you have it....

clear as hell....

the fund's total fees paid out has been growing at a compounded annual growth rate of 17.02%.

The fund only grew 11 to 12% (I did not check of figure is correct)

So who is clearly better off?

YOU the shareholder or TAN TENG BOO and his CAPITAL DYNAMICS??????

Also...

If Teng Boo thinks that there isn't any better stock investing in the market ( since 2010 !!! ) , then clearly the ONE AND ONLY ONE OPTION is ..... dissolve the fund!!!!

Bungkus.

Mai Tan.

Count.

Return back all money!!!! (what's the point of he saying year year muted KL market la, KLCI stocks expensive la, this la, that la and not put the fund money to use? Did you hire him to do nothing? As it is, the fund has only 7 stocks in the portfolio. Are you willing to pay 6 million plus in fees for him just to manage this 7 stocks and do nothing else?)

This is only fair.

If you don't think is fair, then ........what should you do?

Long time no update...... sorry sorry sorry.....

On the issue of fees again......

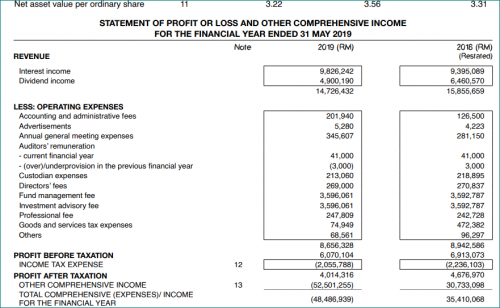

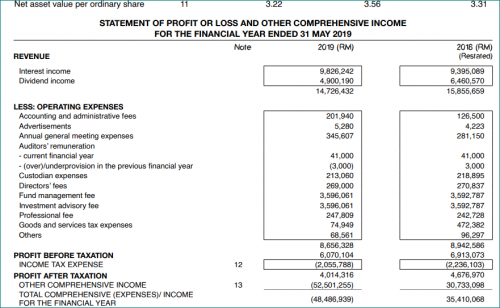

from 2019 AR ...

So .....

Total fees for 2006 is rm1,276,958

Total fees for 2019 is rm7,439,931

total fees increasing since that posting ......... (was I expecting lower fees? )

the fees increased at a CAGR rate of 14.5%

meanwhile iCapital the stock performance ...

would have done justice to the shareholders of the company if the fund was dissolved 5 years ago la....

would have done justice to the shareholders of the company if the fund was dissolved 5 years ago la....Serious la...

You shareholders.... if you are reading this... your AGM is coming soon, yes?

ASK you sifu....

what exactly has done the past 5 years?

what has he done to deserve all the fees he charge the stock?

Seriously....

go count how much fees just the LAST 5 years...

not difficult to count...

go download the AR... and you can see....

and then ask what has the fund done?

who is getting rich at whose expense, huh?

are you paying him for doing nothing?

Jun 13 2019, 09:30 AM

Jun 13 2019, 09:30 AM

Quote

Quote

0.0327sec

0.0327sec

0.91

0.91

6 queries

6 queries

GZIP Disabled

GZIP Disabled