QUOTE(prophetjul @ Nov 19 2014, 03:24 PM)

TTb will be right very soon............. ICAP, traded price higher than NAV

ICAP, traded price higher than NAV

|

|

Dec 1 2014, 02:52 PM Dec 1 2014, 02:52 PM

Return to original view | Post

#81

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

|

|

|

Dec 1 2014, 02:59 PM Dec 1 2014, 02:59 PM

Return to original view | Post

#82

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(SKY 1809 @ Dec 1 2014, 02:57 PM) Only 50% right cos he did not sell the other half...and i am sure he would not hantam his 50% cash.. i scared of futures........ Nato only..talk only but no actions taken...Anyone can be a Guru on Paper trades . I am very Good in Futures by trading big on papers.. Want to follow me ... |

|

|

Dec 1 2014, 03:01 PM Dec 1 2014, 03:01 PM

Return to original view | Post

#83

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Dec 2 2014, 08:59 AM Dec 2 2014, 08:59 AM

Return to original view | Post

#84

|

All Stars

12,279 posts Joined: Oct 2010 |

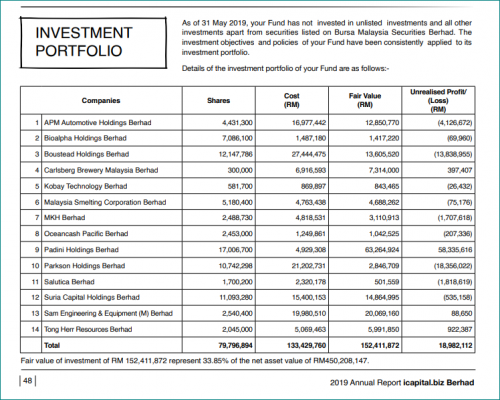

QUOTE(Boon3 @ Dec 2 2014, 08:53 AM) But even if he's right... do you think he would even buy? Also what about his current stocks? Anyone look into his portfolio? This is from the annual report.  Let's have a quick look. Padini - 3 consecutive quarters of declining earnings. Year high 2.13 - now 1.66 Parkson - 9 consecutive quarters of declining earnings. Year high 3.46 - now 2.39 Boustead - 3 consecutive quarters of declining earnings. Year high 5.35 - now 4.79 Suria - 2 consecutive quarters of declining earnings. Year high 2.67 - now 2.45 PIE - 2 consecutive quarters of declining earnings. Year high 6.98 - now 6.81 F&N - 2 consecutive quarters of declining earnings. Year high 18.26 - now 16.70 MSC - 1 quarter of improving earnings. Year high 3.07 - now 2.90 See the BIG picture? The bigger stock holdings in the portfolio are mostly recording declining earnings. Stock prices are declining....... Has this fund manager even evaluate the quality of his own stocks? cc yhtan You study all his counters? Look at Petdag 7,100 shares! What the heck holding only 7,100 shares??? |

|

|

Dec 2 2014, 09:11 AM Dec 2 2014, 09:11 AM

Return to original view | Post

#85

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Dec 2 2014, 09:07 AM) No I don't study his shares at all. It's just part of the topic. We question his investment strategies and with that, we need to ask the question "If the market fall, what about his porfolio"? The stuff I posted - that's 10 mins look see work. Petdag? I believe they used to hold a lot of shares but due to Petdag declining earnings + extreme high valuations, I guess he RIGHTLY took profit. But why hold only 7,000 Petdag shares? |

|

|

Dec 2 2014, 10:14 AM Dec 2 2014, 10:14 AM

Return to original view | Post

#86

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Dec 2 2014, 10:10 AM) Miss your post. Why? 1) As a trophy? ( The fund made big money in this stock) 2) Leave some so can attend Petdag AGM and get some door gift along the way. To boost TTb's ego........a trophy of a successful kill. This post has been edited by prophetjul: Dec 2 2014, 10:14 AM |

|

|

|

|

|

Dec 18 2014, 02:19 PM Dec 18 2014, 02:19 PM

Return to original view | Post

#87

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Dec 18 2014, 12:58 PM) » Click to show Spoiler - click again to hide... « Price of this stock on 24 Jan 2008 is 2.44 !!!!!! Price today? 2.28. » Click to show Spoiler - click again to hide... « |

|

|

Dec 18 2014, 04:30 PM Dec 18 2014, 04:30 PM

Return to original view | Post

#88

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(firee818 @ Dec 18 2014, 03:49 PM) I suggest u need to study over what is close end fund, it has its advantages and disadvantages. You mean TTB regrets making all those millions a year of fees? It would undervalue when the investors sold its shares. Maybe TTB is regretting now to establish close end fund i.e. ICAP, as London fxxking guy investors is taking advantages of this now... Thank for sharing your view. |

|

|

Dec 19 2014, 02:10 PM Dec 19 2014, 02:10 PM

Return to original view | Post

#89

|

All Stars

12,279 posts Joined: Oct 2010 |

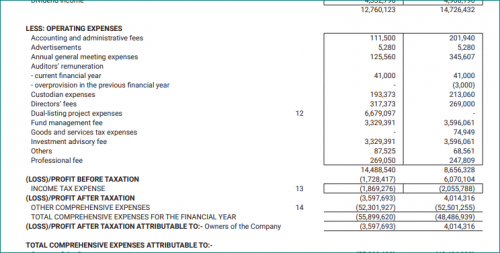

QUOTE(Boon3 @ Dec 19 2014, 09:25 AM) Good day to you. i, a non noted fund manager of sorts put my money into REITs for the last few yaers.I am glad that at least you acknowledge that the fund, has performed poorly the last 5 years. Anyone understand that form is temporary and that class is permanent. But can a last 5 years of under performance be classified as temporary under performance? That's the first thing I would ask, really. Secondly, you mention about the cash pile. Yes, he has 200 million to invest any time. But would he? Now this is an important question, you really need to address for yourself. It's your own money, not mine. If it was me, how would I answer such question? Well, I would refer to the past (I know, the past isn't the future but at least I get a rough idea on what to expect, agree?) First, I would compare last year. Was there any big correction in the market last year? There was the drop on Aug, where the market went from 1807 to 1686...... well... did Teng Boo put the fund money into action? answer...................? Ok what about 2012? There was the 2012 correction in Oct, where the market went from 1675 to 1606.... yeah, not as drastic.... but there was corrections that year too..... but did Teng Boo put the fund money into action? answer..................? So when the market corrects and yet Teng Boo doesn't put the fund money into action, what kind of conclusion can you draw out? Ok.... another exercise. This current correction. Is it worth to buy now? or wait for more price drops? Come next year.... if you read he doesn't put the fund money into action, what does this say? Also, the past 5 years, ask yourself.... is there NOT a single value stock? Why not invest in a company like Dutch Lady when it was trading around 17 ringgit back in 2012? Not a value play for a value investor like Teng Boo? This very last question is most alarming, imo. How could there not be value stocks for Teng Boo to put the fund money into action? Lastly, I am so alarmed by your statement to prophetjul that "As a shareowner of ICAP, I agree to reward for his contribution to the co.". This really shouldn't be. In fact, Teng Boo, aside, this is not how the corporate world should be, Yes, put aside this is Tan Teng Boo. just think of it as a normal corporate....... then ask this.... should any CEO should not rake in millions for not performing. For the record... Total fees for 2009 is 3,495,212 Total fees for 2010 is 4,037,100 Total fees for 2012 is 5,789,726 Total fees for 2013 is 6,179,782 Total fees for 2014 is 6,218,982 Current total of all fees collected since 2009: 25,720,802 Can any human being justify collecting 25 million for basically not doing anything? This is simply just so wrong ... I do hope that one day, you realise this....... good day At least i reaped higher than FD rates! Didnt charge my firends for advising them either! |

|

|

Dec 20 2014, 10:30 AM Dec 20 2014, 10:30 AM

Return to original view | Post

#90

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Dec 20 2014, 10:24 AM) Teaser! TTB is caught in conundrum.To be honest, I think la, this current market should be a good test for Teng Boo and his die-hard supporters.... ie... will he finally put the funds millions and millions of ringgit into use for the fund shareholers. ie... will recent collapse in oil prices, surely there is some value in the market... sooner or later...... if he doesn't buy... clearly his intent his to protect his reputation, sit on the fund money (ie do nothing) and collect big fat fees each year !!!!! He didnt see value at CI 1670, 1600. What can he see at 1700? When will the see value? Is he waiting for 1500, 1400 or 1000? |

|

|

Aug 25 2015, 09:21 AM Aug 25 2015, 09:21 AM

Return to original view | Post

#91

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(yok70 @ Aug 24 2015, 02:02 AM) TTB said (in ICAP's recent report) Warren Buffett also cannot find any stock to buy. He was lying! Who said WB didn't buy? He kept buying IBM and Well Fargo (millions USD) in the past few quarters. And just recently made the highest investment ever on buying Precision Castparts Corp with a price above market value of 21%! Probably busy enjoying his cars the shareholders paid for ! TTB is bluffing us. WB where got wait? WB keeps looking for value investment opportunity. TTB do what? Just wait for market to crash, that's what he did in the past few years. Who cannot do that waiting? Market crash until many people cry and jump off the building that time, just buy cash rich blue chips lah, sure win money. What skill is that? |

|

|

Aug 27 2015, 08:27 AM Aug 27 2015, 08:27 AM

Return to original view | Post

#92

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(aspartame @ Aug 25 2015, 11:42 PM) I think there is something wrong with the arrangement with ICAP. I understand that there are other ETFs traded around the world but these are all low cost some sort of index funds. Their annual management fees are very low and definitely not 2%. Because ICAP is a closed end fund, there is no way to punish the fund manager by redeeming your units as with all open ended funds including unit trusts and also hedge funds. Unit trusts system is very fair, you don't like the fund, you redeem at NAV calculated daily. You get your money back at fair value. Not with ICAP. You tak suka---you keluar! How to keluar? Sell in the open market BUT the market price is way below NAV so you do not transact at fair values when you buy and when you sell. Even if the fund perform like shit, there will be no closure because there is no redemption. Once set up, closed end traded funds like ICAP are perpetual money machine ----- for the fund manager, not you. Only way to buy up all the shares off the market and delist since its under NAV. Which some fund tried to do, but failed.I hope somebody can look into this and see that there is really no need to have a closed end exchange traded fund that is not low cost based. ETFs are OK because they are low cost. They allow people to do indexing at low cost. There is no performance fees. The fund is automatically adjusted to mimic a certain index. These ETFs are to be encouraged, not something like ICAP. It is better to delist it and let people buy/sell at NAV. Is there another fund like ICAP anywhere around the world? |

|

|

Aug 28 2015, 09:04 AM Aug 28 2015, 09:04 AM

Return to original view | Post

#93

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Aug 27 2015, 08:28 AM) This thread active again.... The fund manager is the main key - the main asset and the main liability of the fund itself. Hence, any focus, any discussion has to be on the fund manager itself. The investor of the fund (I think la.. but then... I could be wrong since I am a trader only) needs to gauge and understand what he HAS BEEN doing for fund the past few years. That's the most important gauge. Reputation of the fund manager or his so-called investment ideas/philosophy counts for NOTHING if the fund manager does NOTHING to create value for the fund. As mentioned few very long winded time before... Total fees for 2009 is 3,495,212 Total fees for 2010 is 4,037,100 Total fees for 2012 is 5,789,726 Total fees for 2013 is 6,179,782 Total fees for 2014 is 6,218,982 Total fees for 2015 is 6,318,354 Current total of all fees collected since 2009:32,095,510. Those figures highlights exactly what you mentioned: closed end traded funds like ICAP are perpetual money machine ----- for the fund manager, not you Teng Boo, has collected (not in donations la) 32 million from the fees he charges since 2009!!! And the fees each year INCREASES! And, if anyone analyse these figures and compare to what he has done (FOR the FUND) for the past few years..... yes? And every year, since 2010, he says the same thing... over and over again. Like a broken record.... the market is expensive/over valued/no value blah, blah, blah.. and of course, everyone knows that since 2010, the KLCI went on a fantastic BULL RUN !!! so bull run... this funny manager... just opens his mouth... say market expensive.... and that's it.... meanwhile... he collects his FEES. So how would you even gauge such a funny manager? Would you have RESPECT? Me? I admire him... He so cunning.... Just collects fees only.... and yet he can have so many fansi of his fun ! And for the record... for those who are lazy... this is from the last annual report...  ** looks like Parkson LOSSES for icapital will be MASSIVE! as at 31st May 2015 (29 May to be precise), Parkson last traded at 2.03. Parkson today is trading at 1.12. This looks like another 10 MILLION loss in a single stock for iCapital again. (Axiata was the first!) and this screen shot is from 2014 annual report...  now the question is this..... WHAT SHOULD AN INVESTOR DO IF TENG BOO DOES NOTHING WITH THE 200+++ MILLION CASH IN THE FUND ??? Would you come back the following year, and yet, have the same faith in this fund and its funny manager? ps: this is a broken record for me. evey year... same old same old.... I KNOW YOU WILL BE HERE! |

|

|

|

|

|

Aug 28 2015, 09:42 AM Aug 28 2015, 09:42 AM

Return to original view | Post

#94

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Jun 13 2019, 09:30 AM Jun 13 2019, 09:30 AM

Return to original view | Post

#95

|

All Stars

12,279 posts Joined: Oct 2010 |

NTA @ 31/05/2018 Rm3.56

5108 ICAP ICAPITAL.BIZ BHD NET ASSET VALUE / INDICATIVE OPTIMUM PORTFOLIO VALUE NET ASSET VALUE / INDICATIVE OPTIMUM PORTFOLIO VALUE On behalf of the Board of Directors of icapital.biz Berhad, we wish to announce that the Net Asset Value per share of icapital.biz Berhad as at 4 June 2019 was 3.19. Share price Rm2.36 Meanwhile Tan teng BOO still enjoying his fees........... |

|

|

Jul 23 2020, 11:03 AM Jul 23 2020, 11:03 AM

Return to original view | IPv6 | Post

#96

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 10:26 AM) If he doesn't do any significant buying, it only shows that he ISN'T willing to take on any risk in buying new stocks. Pays for his Ferraris and Porches. Which makes sense FOR HIM.... why risk it when he's sitting on those pre-2010 gains? all he needs to do is do nothing and collect them yearly fees... good for him .... but is it good for the shareholders of the fund? btw... few of us HAVE BEEN asking the same thing about the high fees for so many years already.... shareholders no complain... so why should he mess with his personal money pot? |

|

|

Jul 23 2020, 11:17 AM Jul 23 2020, 11:17 AM

Return to original view | IPv6 | Post

#97

|

All Stars

12,279 posts Joined: Oct 2010 |

|

|

|

Jul 23 2020, 11:29 AM Jul 23 2020, 11:29 AM

Return to original view | IPv6 | Post

#98

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 11:24 AM) Oh..... Fatt !Just saw the most active stock today! iCap got buy!!! Wahhhh..... Ah Teng Boo so genius.... he bought BioAlpha for the fund. No bruff la.... https://mediafiles.icapital.biz/ext-files/i...orts/ar2019.pdf but... the sad thing is.... iCap investment in BioAlpha is only worth 1.4 million.... pg 48  ..... err .... not very good hor .... |

|

|

Jul 24 2020, 10:38 AM Jul 24 2020, 10:38 AM

Return to original view | IPv6 | Post

#99

|

All Stars

12,279 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Jul 23 2020, 07:24 PM) .... that's the biggest mystery in all honesty... Some people like to be SUCKered. i guess TTB likes these sort since they are finding his lifestyle.I am not a shareholder. Never was. Never will be. So why aren't any shareholder complain? Is it because their hair is already wet? But these fees... surely they can approach Teng Boo and say 'look, clearly you have not been performing. You did jack shyte for 10 years. Sepuloh! Well, with the lousy performance, you should not be charging such insane fees. 58 million in total fees for 10 years is insane. It is daylight robbery. If you are gonna argue nothing to buy (ie no value), then you should dissolve the fund! You cannot sit and literally do nothing and collect million in fees!'.... well.. that's what I will say direct to his face... no joke. regarding stock picks... if I have to pick on his stocks, it would be the following.... his insistent on Parkson Holdings is simply beyond me. It fails on so many accounts. It has been losing money for so many years. Why insist hold? Is it because of icap close relationship with Lion group? and Axiata.... is it 12 million or 13 million losses in that stock? All because of his refusal to take part in Axiata's rights issue? What a nice scam! |

|

|

Oct 7 2020, 12:13 PM Oct 7 2020, 12:13 PM

Return to original view | IPv6 | Post

#100

|

All Stars

12,279 posts Joined: Oct 2010 |

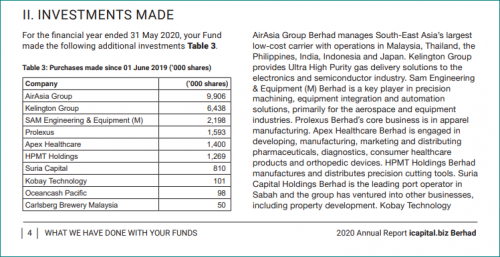

QUOTE(Boon3 @ Oct 7 2020, 12:03 PM) http://mediafiles.capitaldynamics.biz/ext-...ts/ar2020v2.pdf Incredible that the shareholders would pay Ong for doing n0ught! aspartame prophetjul the fees.... did go down...slightly ....  still holding Parkson... and wow... he bought some shares.... lol.... AirAsia. no gloves ....  and the only stock related with could 'benefit' from C19 is Ocncash, which does do masks (iinm) yup.... I see only ONE winner here..... and that's Teng Boo.... |

| Change to: |  0.0476sec 0.0476sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 09:01 PM |