here we go again, roller coaster ride

since cheap dollar is stil hanging around, u know wat to do

http://www.marketwatch.com/story/do-weaker...ling-2009-11-22http://www.marketwatch.com/economy-politic...endars/economic

http://www.marketwatch.com/story/do-weaker...ling-2009-11-22http://www.marketwatch.com/economy-politic...endars/economic

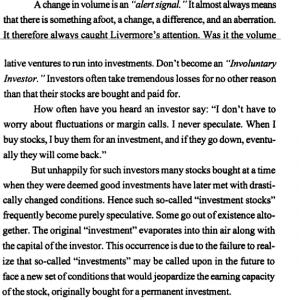

WASHINGTON (MarketWatch) -- After several months of improvement in housing, manufacturing and sales, the U.S. economic recovery appeared to sputter in October, leading investors and analysts to re-evaluate whether their forecasts were too rosy.

The economic data to be released in the holiday-shortened week ahead could provide a few more "what-were-we-thinking?" moments. All in all, though, the data shouldn't kill hopes for modest growth while we wait for the private sector to start hiring again.

Last week, a "reality check" rippled through the markets following weak data on housing starts and industrial production, said Nigel Gault and Brian Bethune, U.S. economists for IHS Global Insight. They expect further "mixed and somewhat ambiguous" reports in the coming week, but, on whole, they say "the evidence is still positive and continues to point to a nascent recovery" that will need "strong policy support" for some time.

Housing

Even four years after the peak, the state of the housing market remains central to the medium-term outlook.

Construction, sales and prices picked up over recent months after hitting generational lows, boosted in part by federal policies and in part by improvement in some of the fundamentals. But the weakening in the October data ahead of the anticipated expiration of the federal home-buying subsidy has put the strength of those fundamentals to the test.

The home-buyer tax credit, of course, has now been extended and even expanded. But buyers and builders didn't know that in October.

Last week, we found out that builders cut back on permits and starts on single-family homes in October, in anticipation that the tax credit would expire on Nov. 30.

This week, we'll get October data on sales of new and existing homes.

Economists surveyed by MarketWatch expect sales of existing homes to rise about 3% to a seasonally adjusted annual rate of 5.74 million. It would be the highest sales rate since June 2007. And it would reflect some sales of buyers rushing to get in ahead of the Nov. 30 deadline. Existing-home sales are recorded at closing.

By contrast, sales of new homes are recorded when the contract is signed, which is at least a month and often much more before the sale closes. To close on a sale before Nov. 30, a buyer would have had to sign contract in September or early October at the latest.

In part because the deadline would have passed for most buyers in October, sales of new homes are projected to have declined about 3% to a seasonally adjusted annual rate of 390,000, the survey says. Sales of new homes have underperformed compared with existing homes, probably because buyers can get a better deal on a foreclosed home or on a home owned by someone who needs to sell, fast.

Federal policies are clearly supporting the market, but there is uncertainty about how strong it would be without the support. Economists for Barclays Capital say that sales of existing homes would have risen 10% without the tax credit, instead of the 24% that has been recorded with it.

Although home prices have fallen and mortgage rates are very low, the housing market faces considerable problems. Foreclosures continue to rise and vacancy rates are at record levels, which mean prices could fall another 5% to 10% by the middle of 2010, according to Jan Hatzius, chief economist for Goldman Sachs.

If prices, sales and construction do sag, banks are likely keep credit extremely tight, which in turn could weigh on the pace of recovery, Hatzius said.

GDP revisions

The other big story for the week could be the revision to third-quarter growth figures. Last month, the Commerce Department said real gross domestic product grew at a 3.5% annualized rate, the first gain in a year. On Tuesday, that figure is likely to be revised to about 2.8%.

The revision comes from more complete data. In the first go-around, the government statisticians must estimate many of the key inputs for September, including foreign trade, inventories and construction spending. Now that those data have been released, it's clear the first estimates were too big.

The largest source of revisions will come from nonresidential construction spending and net exports. Spending on nonresidential structures was weaker than first thought, while imports were stronger than believed, suggesting that more of the gains from increased sales in the third quarter accrued to foreign producers, rather than domestic companies. Inventories will be revised lower.

"Despite the likely downward revision, we still believe that the third quarter will prove to be the first quarter of recovery and that it demonstrates a decisive turn in the economy," wrote economists for Barclays Capital.

Economists see the economy growing at a pace just above its long-term trend. They expect GDP to grow 2.5% in the fourth quarter, 3% in the first quarter of 2010 and 3.5% in the second quarter. That's a far cry from the 6% growth seen in typical V-shaped recoveries, but it's better than a poke in the eye with a sharp stick.

Of course, those are just forecasts. No one really knows for sure how the economy will do over the next 12 to 18 months.

Nov 19 2009, 06:42 PM

Nov 19 2009, 06:42 PM

Quote

Quote

0.0385sec

0.0385sec

1.26

1.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled