remember jus stick to ur own trading plan & refine it via experience & time, ur bank ac wil be an excellent indicator

since we still young , the pros & cons on all tis has been discuss in previous2 post, pls take time to refer the faq

gambling portfolio

doji sighted - gok, pl, aro (swing trade candidates added to watchlist)

still no doji - ebix, trlg (candidates rejected & ignored from watchlist)

to gamble swing trade, need doji & a dose of luck

imo, pls use limit order on day u buy, to be first few in queue for exit

if u refer to the week before doji, u can see it is a long line

now, to exit for profit, imo, use

1/3 of last week line (for those dun wan sakit jantung) eg. inin

2/3 of last week line (medium risk taker) eg. mfe

way above last week line (ultra risk takers, really not recommended) eg. gmcr

1/2 of last week line (medium risk taker, my preference type

) eg. cisg, cern

swing trade case study - all success

if u prefer hold position to nex week & dun wan exit swing trade

i suggest dun be greedy & let others participate in profit too

but if u r forever fans / investors lovers, can keep till kingdom come

...wait, maybe should stick to burlington railroad only

however if insist to enter in, even if road is long & windy for ur type, u never know wat is around the corner

a tree may fall on u, robbers waiting by wayside to kill u, or maybe got mat rempits further up to irritate u, who knows? maybe got pot of gold

but if u wan do pyramiding, then is also a good point to add position

to gamble new high, need balls & bottles of luck, four leaf clover & etc

new high pullback - vprt (for the 4 candidate below, to pyramid position if got pullback)

new high case study success - nflx, iag, amzn & med (kenot add in position, to ride it, if takut, can exit for partial profit)

imo for my preference, jus hang on to it, until signal to sell appears

wun be updating on gold stock, pls monitor urself, if u interested to learn, all i can say is its on uptrend

wait pullback for pyramiding position (since no signal to potong, can hang on to roller coaster ride)

the extremely louyah analyst report, in future wun be posting it, we rely on ozak (unless got catastrophic event eg. 2012, then i inform)

Stocks on Friday grabbed back much of the previous session's losses to finish up for a second straight week.

The Nasdaq popped 0.9%, leading the pack. The NYSE followed with a 0.8% gain. The Dow and the S&P 500 tacked on 0.7% and 0.6%, respectively.

Volume fell across the board.

Friday's rebound in weaker trade continued a recent trend of up days in reduced volume. Including the follow-through day on Nov. 9, the Nasdaq has logged only two gains in greater volume in the past five weeks.

A similar pattern is occurring in the indexes' weekly charts.

That indicates reluctance to buy among institutional investors and isn't the kind of performance that enlivens bulls.

The market did a nice job hand-ling negative news.

In morning trade, the Reuters/University of Michigan consumer sentiment index was released. It was weaker than expected.

The indexes spent about five minutes falling on the news but then turned up.

Among industry groups, airlines, tire makers and gold miners did well Friday. Panamanian airline Copa Holdings (CPA) jumped to a new high in big trade. Gold miner Iamgold (IAG) did the same.

Since the uptrend’s start Nov. 2 (a confirmation always comes later), gold and silver stocks have been strong. The group has had some breakouts from stocks such as Iamgold IAG, Goldcorp GG and Barrick Gold ABX. Others marked new highs: Eldorado Gold EGO, Silver Wheaton SLW and Lihir Gold LIHR. Under these conditions, investors need to watch the price and volume action closely. It also pays to look for breakouts.

One concern now is the Nasdaq’s Accumulation and Distribution Rating of E. It hasn’t budged. This is unusual, judging from what’s happened with the past six follow-throughs that had similar circumstances. Five times, the E rating improved within three sessions of the rally confirmation.

notis, the analyst in lyn like write a lot of stories, dunno its their opinion or others - no offense

but i thought listed co, can pay newspaper editors to write nice write up for them to provide excuses for ikan bilis to jump into their stock

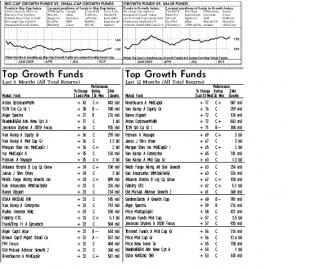

anyway, i like pictures instead, so i put core, since my louyah analyst report no provide for dog jones chart

That's it folks, holiday mood liao, hav fun

Nov 15 2009, 07:01 AM

Nov 15 2009, 07:01 AM

Quote

Quote

0.0663sec

0.0663sec

0.61

0.61

7 queries

7 queries

GZIP Disabled

GZIP Disabled