usa did not down 2.5% haha...

also not compulsory to click the spoiler, its design to agitate the other categories reader & provoke arguments... haha, ain't it fun! to break the monotony of the forum

p/s go & enjoy the holidays + if u r other categories readers, dun la fall into spoiler trap

today is READING DAY, since got free time as holiday.

this is not abt half brain or stupid issue, this r momo in action & they do leave deep impression footprints. the layman investors r stil in a state of shock & they will do nothing but watch... where's my popcorn

Dubai: Many were taken by surprise at the impact the Dubai debt crisis had on world markets. They shouldn't have been. Debt — and its misuse — has been the No. 1 economic issue of our time.

What's the big deal, some wonder? After all, Dubai's total debt of $60 billion or so is but a rounding error on the U.S. deficit of $1.4 trillion in fiscal 2009. Yet world markets plunged sharply when Dubai announced that its debt-fueled building boom had left it unable to pay its bills — despite a tripling in the price of oil.

True, Dubai no longer has much, if any, oil under its sand. But it's one of seven emirates that make up the United Arab Emirates, and the others do still have oil. The fact that the Dubai government refused to step in and guarantee the payments of the Dubai World group — which, by the way, is 100% government-owned — was seen as a bad omen for the world economy.

Maybe this is another recognition of just how leveraged the world economy has become. Many nations today seem to have bet their entire futures on mountains of debt — and the U.S., long a holdout from the trend, seems ready to join their ranks.

As recently as 1989, the countries that make up the Organization of Economic Cooperation and Development, the so-called rich nations' club, had public debt averaging 59% of GDP — which at the time was thought to be excessive.

As of 2008, that had jumped to 79% — and total government indebtedness will possibly soar above 90% this year.

As the OECD itself has said, "These proportions are likely to increase significantly in the coming few years," due largely to stimulus packages put in place to fight the economic recession.

That governments, owing trillions of dollars in debt, might start opting one by one to not pay them is a scary idea to investors. It would cause a global collapse.

And even some countries we don't think of as highly indebted in fact are. Take Japan. Granted, it has a high savings rate. But during the 1990s, it financed a dozen "fiscal stimulus" packages to get its economy moving again.

Today, its debt is a whopping 170% of GDP — the most in the developed world. Those "stimulus" packages did nothing, except stimulate debt. And the U.S. is about to duplicate that mistake.

And what about China, which we always hear is sitting on $1.2 trillion in U.S. debt? Aren't the Chinese pretty much debt-free?

Hardly. As China expert Gordon Chang says, that country's banking system is essentially insolvent. Writing in Forbes, he notes that when Beijing's bank regulator announced two weeks ago that it might force banks to raise long-term capital, the nation's stock markets plunged sharply on record high volume. Why? Investors, though dazzled by China's 1.2 billion consumers, also know that much of China's "miracle" has been funded by bad debt.

All this should be a warning to the U.S. Congress, which continues to fiddle as its fiscal house burns. If not careful, Congress' plans for nationalizing the health care system, its $700 billion TARP bailout program, its $787 billion "stimulus" package, cap-and-trade and a host of other new spending programs will push the U.S. to the same brink as Dubai. Only it will be bigger. Much bigger.

Just a year ago, total U.S. public debt stood at $5.8 trillion. This year, it's $7.6 trillion, on its way to $10 trillion by 2012. Service on the debt is $200 billion now; in 10 years, it'll be at least $700 billion.

A stagnant economy with double-digit employment and massive debt greater than our annual output are no legacy for our children and their children.

At some point, American voters will have to wake up to the reality of what their representatives have created — a Republic of Debt.

WARNING : as usual, below for livermore, speculator & gamble lovers onli, categories other than tat, dun click it & spoil ur day

1) Jesse Livermore did not have a privilege childhood as buffet. He is a rags to riches story & during his era, treatment of depression is not as sophisticated as today. Everyone live life in their own way. Are u really that lucky & have a chance to enjoy the high rolling life? Are u even married with a very supporting & caring wife + children? U may have a silver spoon life & no deprived childhood moments, but what about others? wtf!

2) OK, back to topic, here is louyah analyst report

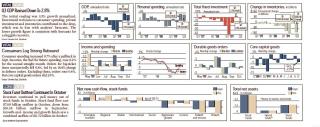

A debt crisis in Dubai rattled Wall Street on Friday, although many stocks trimmed their early losses in an abbreviated session.

The NYSE composite, bearing the weight of tumbling commodity stocks, plunged 2.2%. The Nasdaq and S&P 500 slid 1.7% while the Dow dropped 1.5%.

Indexes gapped down at the open. The Nasdaq and NYSE composite slid below their 50-day moving averages, but rebounded to close above them.

The market bounced soon after the opening-bell plunge.

Volume was light as trading ended three hours early. But at Friday's close, volume was tracking higher compared with the same time Wednesday. That suggested that if the session had gone to its normal length, volume would have ended higher.

In short, the abbreviated session probably spared the market from another distribution day.

The Friday after Thanksgiving is often a placid day in the stock market. But this time, the market was jolted with news from Dubai.

The Middle East city-state said late Wednesday that its main conglomerate, Dubai World, is asking for a six-month moratorium on servicing $59 billion in debt.

A potential default raised fears about the world financial system.

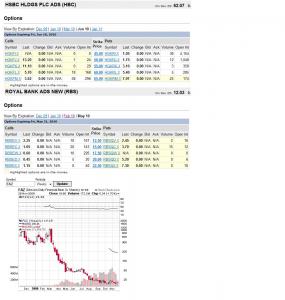

Major banks were among the worst-performing stocks on Friday. The Financial Select Sector SPDR (XLF) tumbled nearly 3%. Analysts watched for banks exposed to Dubai World.

Exchanges overseas came under heavy selling for a second straight day on the Dubai news.

With risk suddenly out of style, the dollar got a respite from its nearly nine-month malaise.

The buck's rebound hit prices of dollar-denominated commodities. Precious metals and energy have been two of the stock market's best areas lately. Still, commodities rebounded alongside the indexes, reducing their losses.

The Dubai news overshadowed the usual post-Thanksgiving story line: Black Friday.

3) no doubt the problem with dubai has been known for quite some time. coz dubai has been reassuring others they can pay obligations on time. thus, it was a real surprise they needed extension. abu dhabi got abt $6oo billion in assets, so why aren't they helping dubai? is there something they know, which we don't?

* DP World excluded from Dubai World debt restructuring

* Dubai debt fears weigh on bank stocks

* Credit default swaps for Dubai soar, rise for neighbours

* Saudi-backed GIB pulls bond sale on Dubai debt move

* Property consultants brace for sale of trophy assets

(Adds details, updates with S&P announcement)

By Tamara Walid and Jeremy Gaunt

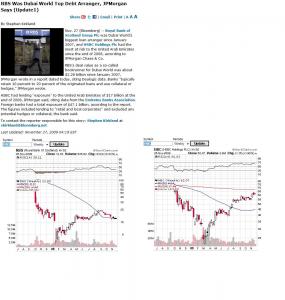

DUBAI/LONDON, Nov 26 (Reuters) - Dubai struggled to ease fears of debt default on Thursday after its move to delay repayments at two flagship firms shook confidence in the Middle East as a centre for investment and a source of capital.

Dubai's debt problems, a hangover from a property boom that produced the world's tallest building, have shaken trust among Western investors who turned to the oil-exporting Gulf region for help during the global financial crisis.

The emirate said on Wednesday it would ask creditors of Dubai World, the conglomerate behind its rapid expansion, and Nakheel, builder of its palm-shaped islands, to agree a standstill on billions of dollars of debt as a first step towards restructuring. [ID:nGEE5AO2L1]

On Thursday, Dubai tried to revive confidence by saying its profitable DP World DPW.DI, which runs 49 ports around the world, would not be involved in the restructuring. DP World, which has $3.25 billion outstanding bonds, is majority owned by Dubai World but has shares listed on NASDAQDubai. [ID:nGEE5AP04P]

"It might be a move to distinguish the solvent from less solvent companies in an attempt to shift the weight away from the less exposed entities," said John Sfakianakis, chief economist at Saudi Fransi bank.

But European bank shares, which had recovered in recent months on hopes that the worst of a global crisis was over, fell to lows not seen since May on Dubai's debt delay.[ID:nGEE5AP0T2]

Shares in companies in which Gulf investors own big stakes, including the London Stock Exchange (LSE.L), UK grocer J Sainsbury (SBRY.L) and German carmakers Porsche (PSHG_p.DE) and Daimler (DAIGn.DE), also fell sharply on concerns the holdings would be cut to meet obligations at home. [MKTS/GLOB]

Exposure to Dubai World could be as high as $12 billion in syndicated and bilateral loans, including existing loans for Nakheel and Istithmar, an investment arm of Dubai's government, banking sources told Thomson Reuters LPC. [ID:nL1595416].

International banks are seeking to clarify their position as they formulate their response to the standstill request and are assessing the implications for lending to Dubai and the Gulf.

"This is very serious and will have implications across the region," a senior banker said. [ID:nGEE5AP10B]

BONDS EXTEND LOSSES

In one of the first signs that Dubai's problems could hurt global fundraising efforts for its neighbours, Saudi-backed Gulf International Bank pulled a bond sale due to priced this week.

Dubai's move will likely lead to a risk reassessment of debt issued by the region's sovereign-linked firms.[ID:nGEE5AP13G]

Ratings agency Standard & Poor's said on Thursday it had placed the ratings of four Dubai-based banks on negative outlook due to their exposure to Dubai World. [ID:nGEE5AP1U3]

S&P's and Moody's Investors Service had already severely downgraded several government-related entities on Wednesday.

Wednesday's announcement also sent the cost of insuring Dubai's debt against default soaring and bond prices tumbling.

Dubai World, whose slogan is "The sun never sets on Dubai World" has $59 billion of liabilities, a large proportion of Dubai's total debt of $80 billion. [ID:nGEE5AO22V]

Dubai's credit default swaps are being quoted as high as 500-550 bps, some traders said, while the cost of insuring Qatari, Abu Dhabi and Bahrain debt also surged.[ID:nGEE5AP0ZI]

Analysts downplayed the fallout for the wider region, however, pointing out that Dubai funded its growth through loans whereas its neighbours are mostly major oil and gas exporters.

"I would not rush into talking about contagion. Anything from Abu Dhabi or Qatar is backed by serious money. Dubai is a lot more leveraged," said Youssef Affany, a relationship manager at Citi who specialises in the region. "There will be some level of solidarity from the emirates and the big neighbour, Saudi."

Analysts expect financial support from Abu Dhabi, a neighbouring member of the United Arab Emirates and home to most of the country's oil, to keep Dubai afloat. But Dubai will probably have to abandon an economic model that focused on heavy real estate investment and inflows of foreign money and labour.

Earlier this year, Dubai headed off investor concerns that it would default on its debt by launching a $20 billion bond programme in which the central bank of the UAE, the world's third largest oil exporter, bought the first $10 billion slice.

Dubai said on Wednesday it had raised a further $5 billion as part of that programme, placing the debt with two Abu Dhabi-controlled banks. But the move raised questions over why Dubai had not raised the entire $10 billion tranche it had planned to sell on the international market.

OPTIONS FOR DUBAI?

If creditors reject proposals to postponed near term debt obligations on ice until May 2010, the Dubai government could be forced to hold a firesale of its international real estate.

International property advisers are bracing for a potential slew of instructions to sell trophy assets owned by Dubai World.

"We do expect the Dubai government to step up efforts to raise capital via real estate sales, and sales of their UK assets in particular," James Lewis, a member of the Gulf capital markets team at property consultant Knight Frank told Reuters.

One fund manager said Dubai could not separate the debts of DP World from the Nakheel bond at the heart of Dubai's problems.

The $3.52 billion bond, which was originally due to mature on Dec. 14, 2009, traded as high as 110 percent of par value on Wednesday before the Dubai government said it would ask creditors for a standstill.

On Thursday the bond traded at 72, and Nakheel's Islamic bond prices extended losses, reaching their lowest level since February, Reuters data showed.

"Trust is the basis of all credit. It can take decades to build up creditworthiness and moments to destroy it. They have the money to pay the Nakheel bond," said the fund manager.

"DP World can't be kept separate. If that's an asset of Dubai World and ownership of that can presumably be attached by Nakheel creditors."

For graphic of a simplified breakdown of the various holdings of Dubai World, Dubai Holding and Investment Corporation of Dubai click

here (Writing by Lin Noueihed, Additional reporting by Ulf Laessing in Saudi Arabia, Sebastian Tong, Steve Slater, Kristen Donovan, Natsuko Waki and Sujata Rao in London, editing by Elizabeth Piper, Erica Billingham and and Andrew Callus) ((Top News Team, EMEA, +44 207 5422171, lin.noueihed.reuters.com@reuters.net))

RESTRUCTURING

Dubai World said in October its restructuring was nearly complete and would help save $800 million in operating costs over the next three years.

The company also said it had reduced its global workforce by 15 percent to around 70,000.

MAJOR HOLDINGS

* Nakheel Properties -- the world's largest privately held real estate company, with developments that span the residential, retail, commercial and leisure sectors. The company has a $3.5 billion sukuk, or Islamic bond, up for maturity on December 14.

In October, Dubai World announced that the management of Nakheel's shopping malls, including the Ibn Batutta Mall and DragonMart in Dubai, were moving to a separate entity, Retailcorp World.

* Istithmar -- a financial investment company with a portfolio of over 50 companies within financial services, consumer, industrial and real estate sectors.

It bought U.S. luxury retailer Barneys New York for $942 million from Jones Apparel Group in 2007. Earlier this month, Istithmaar sold two buildings in London to Great Portland Estates (GPE), according to its financial statements.

The company's equity investment exceeds $2.6 billion across markets ranging from North America to the Far East, according to the website.

* Limitless -- real estate developer with projects in the UAE, Malaysia, Vietnam, Saudi Arabia, Jordan and Russia. In April, the company announced it had cut seven percent of its workforce and delayed a key contract on its proposed $61 billion Arabian Canal project as a result of the global downturn.

* DP World -- listed on Nasdaq Dubai, and one of the largest port operators in the world. In October, DP World said it envisaged a difficult fourth quarter amid falling container volumes.

* Dubai Dry Docks -- involved in ship repair, conversion, new building and other marine-related activities.

* Tejari -- online B2B marketplace and e-commerce hub for businesses in the Gulf region.

* Economic Zones World (Jebel Ali Free Zone) -- provider of industrial and logistics infrastructure solutions including the development and operation of economic zones, technology, logistics and industrial parks.

* Dubai Multi Commodities Center -- created to establish Dubai as a hub for commodities trading, and provide industry-specific market infrastructure for gold & precious metals, diamonds & colored stones, energy and other commodities industries.

4) pelajaran hari ini ialah gila membaca

gila... banyaknya untuk baca

Exit strategy article

Most traders chase the market around, hoping to catch a trend higher or lower. Once positioned, they ignore the warning signs and sit in small losers until they become big losers. They wait to get bailed out when it''s their responsibility to keep accounts lean, mean and profitable.

It''s especially tough for new traders now, because many of them are closet investors. They expect to be rewarded for a buy-and-hold strategy. The only way to defeat this mentality is to manage an aggressive exit strategy on all positions.

Hard Knocks

The rough start to this year presents new traders with the perfect opportunity to master critical survival skills. In fact, this may be the best time for newbies to learn their craft since the bear market. In the real world, tough markets produce tough, successful traders.

Easy markets carry a special hazard: They make us feel a lot smarter than we really are. This delusion eventually forces most new traders to wash out of the markets and find a less stressful hobby.

If you feel the pain when you look at your monthly statement, it probably means your exit strategy isn''t working. It''s a double whammy, because almost any exit strategy is better than no strategy at all. Let me be blunt: You may be a great stock-picker but stink when it comes to booking profits.

It doesn''t matter whether you''re using a trailing-stop system or a percentage gain/loss system, or just selling blindly at a predetermined price. In each case, you''re recognizing the fallibility of your own analysis. The truth is that we''re often right in the short term but wrong over time. So it makes sense to use this built-in defect to your advantage.

One of the biggest challenges in taking a good exit is a psychological one. Dollar signs blind new traders when positions move in their favor. This makes them forget their exit plan and the price chart. It''s a deep-seated flaw, because it exposes their hidden sense of powerlessness.

New traders are so conditioned by a paycheck mentality that they resist creating wealth through their own means. This mind cramp undermines profits, because subconsciously, they don''t really believe they deserve the money. This negative programming can take a lifetime to overcome.

Fortunately, tough markets make it easier to deal with this flaw. Profits become more precious when we see other traders fail. Their deficiencies give us the opportunity to recognize our edge more clearly and understand the strategy that got us there. In most cases, traders will discover that it revolves around an effective exit plan.

For example, I like to take my profits blindly at predetermined price targets. This strategy makes me less emotional and lets me rehearse an exit drill so I can act spontaneously when the time comes.

My exit plan tracks the wisdom of buying in mild times and exiting in wild times. As far as I''m concerned, it makes more sense to be an opportunist and predator than a blind follower of trends. So I plan in advance to sell into a buying spike or buy into a selling spike.

You''ll be rewarded in many ways if you do your exit homework wisely. The most gratifying profits will come from selling into the major top, or covering into the major bottom. And this isn''t as hard as it might sound at first glance, especially to new traders.

Take the time to examine support and resistance, and then guess where the crowd will take action. Over time you''ll become an expert in picking market turning points. Start by asking yourself this common-sense question: Where will other traders get too scared or greedy, and want to jump ship?

It will take a solid exit strategy to stay profitable in 2005. The key to your success lies in recognizing the starting and ending points of major market swings. It''s no different from the methodology used by hedge funds and money managers to earn their living every day.

There will be a time to press your positions, but it sure isn''t now. So put down your technical analysis books and take a good look at current conditions. The wisdom of the masters will do you no good if you don''t align your exit strategy with the reality of the market.

I discussed the need for aggressive exit strategies in trading the current market. Today we''ll examine several ways these tactics are put into action and how they can benefit your bottom line. Although these examples focus on protecting profits, they''re just as valuable when considering stop placement.

These strategies have one thing in common: They require closing out your position without hesitation at a predetermined reward target. This means you''ll exit the trade as soon as price hits the trigger point, regardless of how good or bad it feels at the time.

As you gain experience applying these tactics, you discover that short-term trends appear drawn to specific hotspots before they change direction. This underlying structure lets you visualize your actions well in advance so you can ignore the thrill of the moment and take profits without hesitation when the time comes.

But how do you protect profits if price never reaches the reward target? The best method is to fall back on a profit-protection strategy such as a trailing stop-loss. In other words, keep a fail-safe exit behind advancing price just in case the market turns ahead of schedule.

Then use it to abort the trade and even consider a "stop and reverse," in which you take a fresh position in the opposite direction.

Stocks love to fill old gaps, and they''ll sometimes wait months or years to do so, as the above chart of American Power Conversion (NasdaqNM:APCC - News) shows. Look back on the chart for significant gaps that the current trend is approaching. Then exit the trade immediately when price hits the fill level. Afraid you''ll miss part of the move? Run a trailing stop under the position as soon as it fills the gap. That way you''ll get taken out on the first reversal.

Gaps are especially hard for opposing trends to overcome when they transit a wide-percentage range on heavy volume. Once stocks fill these broad gaps, they''ll often reverse and start substantial movement in the opposite direction. So the fill point is an excellent place to take the money and run.

"1-2" setups such as those shown in the above chart of KLA-Tencor (NasdaqNM:KLAC - News) can really mess with our heads. We enter a long position when it breaks out of the bull flag and then notice the stock will complete a cup-and-handle pattern when it trades to $50. So we fail to catch the considerable profit from the rally off the flag in hopes of catching a larger-scale breakout.

A better strategy is to take profits blindly when the stock reaches large-scale resistance at $50. We can then watch for the breakout from the sidelines, treating the cup-and-handle as a separate trade that requires its own buying signal. The good news is that if the rally falls apart, we''ve already pocketed a big chunk of the move.

The measured move lets you estimate how far the next leg of a rally or selloff should carry. The calculation begins by measuring the last trend before a simple correction, such as ChevronTexaco''s (NYSE:CVX - News) bull flag. In theory, the distance from the flag low to the breakout high should be equal in length to the rally that precedes it. This translates into a simple AB=CD formula.

You''ll be amazed at how often prices move in measured waves. The trick is to watch it unfold and then have the courage to exit when price hits the target. Still not convinced? See if you can find other support or resistance that confirms your target. In this illustration, notice how the measured move corresponds exactly to whole-number resistance at $60.

Most times you can''t predict price-bar expansion in advance, but it''s a great exit signal when it comes. Let''s say you were short Manor Care (NYSE:HCR - News) last Friday when it sold off in a wide-range bar. I''ll bet your first instinct was to pat yourself on the back and think about the next big move down. But if I were short, I''d be using that bar to cover my position and take profits.

Why? Because big bars create short-term overbought and oversold conditions. They''re often followed by days or weeks of contrary movement that retraces the price levels crossed in the bar. I''d rather have that money in my pocket than wait for the next leg of a selloff that may never come.

A little Fibonacci goes a long way in finding profitable exits. The above chart of Anadarko Petroleum (NYSE:APC - News) provides an example. Corrections are often followed by bounces that reach 62% of the last selloff leg. This gives you a magic number to exit a long trade after buying a falling knife. Take the time to confirm your exit by looking for breakdowns from topping patterns and high-volume gaps. These will pinpoint where selling pressure will re-exert its influence.

Exiting trades using price retracements can be difficult psychologically. After all, these are telling you to get out when you''re sitting on a profit in a rising market. But it isn''t so hard to do once you realize that letting your profits run into a major resistance level is rarely a good idea

5) Timing Is Big Part Of Successful Shorting

When a market turns ugly, short selling provides an opportunity for winning ugly.

A short sale involves borrowing shares of a stock through a brokerage and selling the shares. The goal is to buy the stock later at a lower price, profiting from the difference.

The key to success is to combine a sound strategy with proper timing.

"Bull markets don't top out in just one week or one month. A top is a process that requires months to complete. You can easily be premature in short selling. If so, you will be forced to cover and cut your losses."

If you decide to short a stock, here are some guidelines from the book: • Choose the big winners from the preceding rally. They often correct sharply, often from late-stage bases.

• Look for stocks that many mutual funds own. When they head for the exits, their massive holdings will magnify the selling.

• Never short in a bull market.

• One or more recent splits is a good sign. "The reason stock splits are helpful to the short seller, is that if an institution owns 500,000 shares and the stock then splits 3-for-1, now this institution owns 1,500,000 shares, creating more supply should it decide to sell. This effect is multiplied when large numbers of institutions own the stock."

• Avoid thinly traded issues with small floats. Such stocks can advance rapidly during bear-market rallies.

• A key point from the book: "The optimal shorting point will, in the majority of cases, present itself five to seven months after the absolute peak in the stock." Often, stocks will try to rally back above their 50-day moving average a few times, then finally break down decisively.

Finally, be prepared to cover your short quickly if you get it wrong.

Cover the position immediately if you are 7% or 8% in the red.

Don't let a bear rally turn your short into a big loser.

6) Gauging Fund Action Is A Bit Of An Art

Institutional investors can't avoid leaving tracks when they buy a stock.

This is important to the individual investor. Like a surfer, you want to catch and ride the wave of institutional buying in a stock.

Mutual funds, hedge funds, pensions and other institutions can sustain a stock's rise.

For example, when China-based search engine operator Baidu (BIDU) debuted on the Nasdaq in August 2005, there were only a dozen or so U.S. mutual funds that held shares by the end of September.

By the time the stock peaked two years later, there were about seven times as many funds holding more than 50 times as many shares.

Putting the overall picture of fund action together, however, is a bit of an art. It involves several tools:

The Securities and Exchange Commission allows information to be withheld if prompt reporting would interfere with the ability to exit or enter a position. Also, there is a delay of about six weeks or more between the transaction and the reporting of it, even without any SEC exemption.

• The quality of the funds buying or holding a stock is important.

He mentions Will Danoff of Fidelity Contrafund, Jim Stowers of American Century Heritage and Gift Trust, Ken Heebner of CGM Focus and Jeff Vinik of Vinik Asset Management, a hedge fund. writes about buying stocks that have the support of fund managers who have performed well over a number of years.

• Another way to spot institutional support is a six-week win streak.

Research shows six or more consecutive up weeks is a sign of institutional buying, even if some of the weeks are on lower volume than the prior.

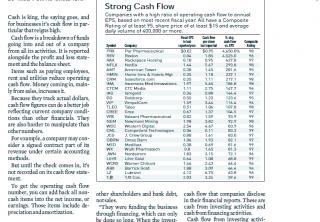

7) Track Volume To Improve Investing Results

Tracking volume for a stock or the broader market is crucial to analyzing what's going on. To ignore the volume component is like driving at night without your headlights on. Every investor wants to buy the stock that's breaking into new high ground. At least as important, we want to know when something we own is losing that strength. Volume is the key. Institutional investors control three-quarters of the market's direction. Thus, when we see spikes in volume -- whether in an individual stock or in the major market indexes -- we know mutual funds, pension funds and other big investors are driving that movement. The ideal situation for the stock or for the market is to garner big gains on heavy volume. That kind of action shows that the big boys are supporting the move. Conversely, big gains in quiet trade should raise a red flag. Such action may suggest that institutions are no longer buying shares with vigor, especially after a long run-up. The other side of the coin is a big loss on heavy turnover. A series of distribution days tells you that a market rally is in trouble. Individual stocks that sell off in a similar manner are likewise at risk. If a stock's going to decline, you'd like to see it occur in light trade. Lower-volume pullbacks after big advances in brisk volume are a bullish sign. When holding any stock, pay close attention to daily and weekly price and volume movement. As this analysis shows, even longtime winners can get into trouble. Pocket profits when sell signs pop up. Don't settle for sloppy or complacent investing.

8) Getting Exit Strategy Turns Failure Into Success

Like a lot of other investors the last three years, John Chuisano has had to learn to invest the hard way.

After nearly a decade of participating in a dividend reinvestment plan, he was seduced into the tech stock boom in the late 1990s.

``I got hurt bad because I didn`t know when to get out,`` he said in his strong New York accent. He rode Cisco, Microsoft and Sun Microsystems a long way down.

He finally threw in the towel on them in April 2001. By then, Cisco was more than 80% off its high. Microsoft had lost two-thirds of its value and Sun about three-fourths.

A couple of months later, He studied charts, the makeup of a sound base and the way stocks move as they advance. He attended workshop.

in which investors look for stock charts that show weeks or months of consolidation and professional accumulation. Then he tried to buy at the exact moment the stock broke to new highs on an increase in volume.

He didn`t still do very well. He`d buy a stock as it broke out and it would almost immediately break down. The problem: The bear market was still raging.

``You have to lose to learn,`` he said.

He smartly sat out 2002. Even in rallies, he couldn`t find stocks with good bases. ``The leaders weren`t leading,`` he said.

But through his study and efforts to re-enter the market he gained something he`d lacked: a discipline with sound buy and sell rules.

He finally started buying again in March of this year just as a real rally was beginning. He says he`s up about 80% year to date.

He`s holding just three now, eBay, Hovnanian Enterprises and d***`s Sporting Goods.

His handling of home builder Hovnanian is a good example of how to invest correctly.

Chuisano bought it May 7 at 40.58 as it broke out of a 26-week base on volume 256% above average. That was about as close to the pivot point of 40.55 as you can get. The Earnings Per Share Rating was 99. The Relative Price Strength Rating was 89. And the Accumulation/Distribution Rating was A. Other housing stocks were also strong, thanks to declining interest rates. Low interest rates make it easier to buy a house.

9) Sound Plan Helps Control Your Emotions

You've heard it so many times: Keep your emotions out of your investing decisions. But the marketplace is full of emotions. And the stay-cool rule is much easier said than done.

But, hard as it is, you must stay cool at all times. Fear and greed will only get you grief.

Too often, investors hold on to losing stocks with the false hope that it will get back to the price they paid for it. Other times, they sell prematurely, forgoing larger profits. But when the market is acting bullish and leading stocks are breaking out, they let fear get the best of them and end up missing opportunities.

Here's how to keep your human elements out of the investment process: Make a plan, and stick to it. Don't make excuses to deviate from the program.

Know what you're going to do before you pull the trigger. Your entry and maximum loss should be clear.

10) Know When To Hold Through Correction

Legendary investor Jesse Livermore once said that the big money in stocks is made by sitting.

The art of holding a stock is perhaps the least understood.

Many people know how to buy quality stocks at the right time. Many know to cut their losses at 7% or 8% when the stock proves to be a mistake. But recognizing the circumstances in which you can hold a stock can be more difficult.

When should you hold a stock?

Rule No. 1: Make sure the environment is right for holding a stock.

The early to middle portion of a bull market is the best situation.

the first two years of a new bull market "typically provide your best and safest period, but they require courage, patience and profitable sitting."

Make sure you have a feel for the market's picture and the backdrop to the picture. For example, you can have tradable uptrends during bear markets. You can have corrections during bull markets.

Holding a stock during a tradable uptrend in a bear market is risky. You're best off taking profits in that situation.

Holding a stock during a correction in a bull market is possible, if you have a decent cushion and you have researched the stock sufficiently.

Rule No. 2: Give your big winners room to run in a strong market.

"In many cases, stocks that advance dramatically by 20% or more in only one to four weeks are the most powerful stocks of all — capable of doubling, tripling, or more,"

"If you own one of these true market leaders, try to hold it through the first couple of times it pulls back in price to, or slightly below, its 10-week moving average price line. Once you have a decent profit, you could also try to hold the stock through its first short-term correction of 10% to 20%."

Some investors do the exact opposite. They are tempted to sell their quick winners to lock in profits and give their duds more time to prove themselves.

In some cases, they might even buy more of the dud stock.

The dud, however, is more likely to turn further south than become the hero of your portfolio.

Over time, a dud strategy could leave you with an all-dud portfolio.

Nov 24 2009, 04:59 PM

Nov 24 2009, 04:59 PM

Quote

Quote

or

or

0.0516sec

0.0516sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled