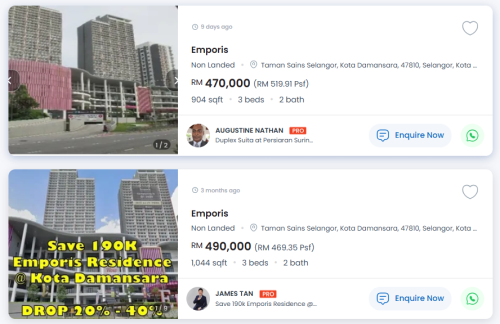

- Oversupply of housing units. First time buyers/younger buyers mostly do not have 10% and money for lawyer cost etc. So they opt for new development which most offer zero entry cost. As a consequence, subsale unit very hard to get buyer (especially unit priced rm400k to RM800k).

- Not easy to get tenant, very competitive market. Maybe oversupply also the factor.

- Cost to own a rental unit is not cheap.

1) Have to installed lighting, fans, aircond, kitchen cabinets, curtains, etc for bare unit. That might cost around RM20k minimum in average.

2) Cost for agent fee, every 2 years or every year.

3) Cost owner have to bear in between period to get a new tenant, maybe minimum can lost 1 month rental, if not lucky can be 2 or 3 months before get new tenant.

4) Cost for monthly Maintenance fees (for condos or landed wioth facilities). This not cheap.

5) Headache to handle bad tenants that give problems or damage the unit. In some cases the deposits cannot cover the repair cost. Owner can consider being lucky if can get good tenant. In general from my experience not easy to get really good tenant. Becos peoples with good financial mostly live in own house, not renting.

6) Cost to pay yearly Cukai pintu/cukai petak.

7) Most cases I notice owner cannot cover bank monthly installment wioth the rental money. Need to top-up.

Considering all these costs, if you carefully calculate, at the end, landlord are are loosing end.

- Condominium can be very less attractive after 10 to 15 years. Looks rundown, old. But not all. So, to sell old condo, not that easy to get buyer. That is one thing, to get the buyer. Another thing is the price might be same or if not lucky, the price is lower that the price owver buy from developer. If higher, not that much. If you calculate all the cost owner have to beat during years of tenancy, after get some untong after sell, is it still worth or just break even? or rugi?

If rugi, all the headache having unit for investment, just for nothing. Only penat and waste of time. Or at least only had the pride of becoming a landlord

Jun 30 2025, 06:26 PM, updated 21h ago

Jun 30 2025, 06:26 PM, updated 21h ago

Quote

Quote

0.0272sec

0.0272sec

0.28

0.28

5 queries

5 queries

GZIP Disabled

GZIP Disabled