Outline ·

[ Standard ] ·

Linear+

Is property investment still worth it?

|

Jingle91

|

Jul 10 2025, 03:02 PM Jul 10 2025, 03:02 PM

|

|

With the current pricing strategy use by developer, buyer leave with almost no meat to eat. Like the donkey work hard to fork out own money and bearing huge loan just to feed developer, bank, and subsidized tenant. Those always selling with good location and facility, sure charge with exorbitant price. So who is winner and who will be loser in this game?

One young relative last weekend just share his story on how he manage to rent out his unit with high rental. He bought a unit with cash back, then use the cash back to do renovation, so his unit is outstanding compare to most others, and able to rent out with good price. But the funniest thing is he still need to cover for almost 500 for maintenance, his mum told me 800 indeed which I don't know who is correct. i saw the photo that he show uncle, well renovated but I am just thinking, now he can't even break even, not to say depreciation incur on his renovation. Next time when want to find new tenant, can be maintain the same price? His good theory is all property prices go up in long run so he can rent out with higher price in next two years. To him he still feel he did wise choice as other unit only can rent 1.9-2k, he can rent 2.8k. But if the tenant buy his own unit and use cash back for same renovation, his monthly installments is abt 3.5k.

So I really don't know how the youth think nowadays, lol. His argument is he paying very little now, for the tenant to cover the rest of instalment, after 35 years, mean when he come to 50, he can have disposable income, and future value sure very good because of "TOD". But his mum told me transacted price drop almost 100k upon vp, maybe due to 80k cash back . So one question come to my mind, in last five years any "TOD" project's sub sale price goes up? Like cheras, macam can't see any condo increase in value, even my friend's unit youcity bought for investment also struggling. Simply because entry price is too high

This post has been edited by Jingle91: Jul 10 2025, 03:02 PM

|

|

|

|

|

|

Jingle91

|

Jul 11 2025, 12:48 PM Jul 11 2025, 12:48 PM

|

|

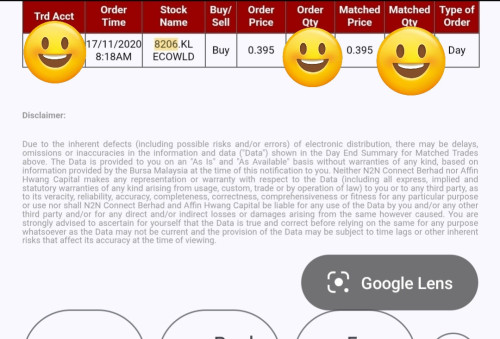

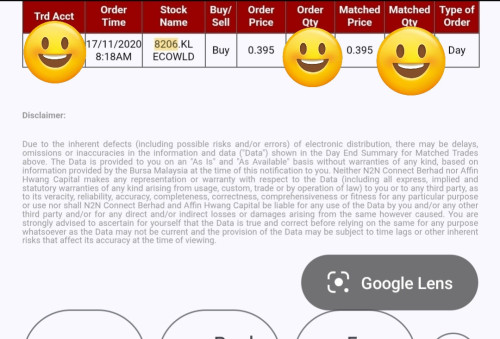

QUOTE(PAChamp @ Jul 11 2025, 11:19 AM) You have accurately described the new property market scenario. Developers take all the meat, bones, skin and hair leaving you with nothing but have to top up to cover. Please consider adding more to EPF instead if you have extra cash. "Guaranteed " returns of +-5% in this day and age is excellent. Only thing is cannot take out until 55yrs. Uncle still believe more in stock. This is one of my old good memory during MCO. Anyway, recently uncle just learn how to buy fix fund offer by PNB through tng, very convenient, expect for 4% div enough for uncle already, always play safe  |

|

|

|

|

|

Jingle91

|

Jul 11 2025, 01:35 PM Jul 11 2025, 01:35 PM

|

|

QUOTE(PAChamp @ Jul 11 2025, 01:05 PM) My experience with unit trust also dissapointing. Took out money from EPF to buy unit trust but covid came wipe out all profit and fund was in the red few years. Only after covid got some <10% gain. If money left in EPF, got few years dividend >20%. Regret. My savings in other unit trusts also loss. PNB very safe ah? 4% is good enough in this day and age. Don't lose money cukup. Can't comment much on UT, because some ppl win some ppl lose. I got one senior manager who retired with huge balance in UT. She earned alot as she bought those equity fund mark to KLCI mainly, start invest constantly when that time KLCI was 700points ++ when she retired was 1200++, she constantly invest all these years and beat the epf. But uncle won't do that now due to no confidence at all to current gov, if najib still in house I will be aggressive, lol. PNB if not mistaken also conservative for their fix fund, they kumpul money to buy gov bond which is very safe, then pay out the div. Those equity with price fluctuation, uncle won't touch Good point, as long don't lose money will be deemed as good investment. Uncle just don't understand why youth nowadays so keen to "invest" in condo then call themselves as "investor", and must buy one expensive cup of ice coffee and hold in hand when sharing their story, lol, maybe like that only can show he is successful . But what uncle see is holding negative asset and stay afloat with own blood😅. |

|

|

|

|

Jul 10 2025, 03:02 PM

Jul 10 2025, 03:02 PM

Quote

Quote

0.0132sec

0.0132sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled