Outline ·

[ Standard ] ·

Linear+

News EPF Account 3 to go live on May 11

|

TSxpole

|

Apr 25 2024, 12:18 PM, updated 2y ago Apr 25 2024, 12:18 PM, updated 2y ago

|

|

EPF Account 3 to go live on May 11PETALING JAYA: The Employees Provident Fund (EPF) has launched Account 3 with members given a one-time opt-in option to transfer funds from their Account 2 to the newly launched "Akaun Fleksibel". EPF members would have between May 11 and Aug 31 to decide.

All EPF members under 55 would now have three accounts from that date: the Akaun Persaraan (Retirement Account), Akaun Sejahtera and Akaun Fleksibel.

Following the restructuring of the accounts, contributions would be split three ways with 75% going into Account 1, 15% into Account 2 and 10% into Account 3.

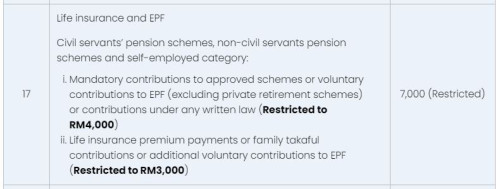

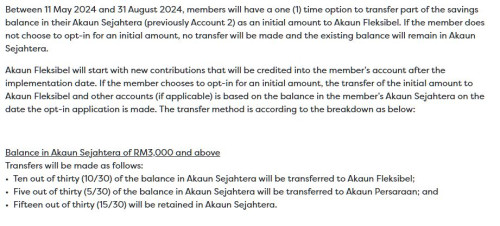

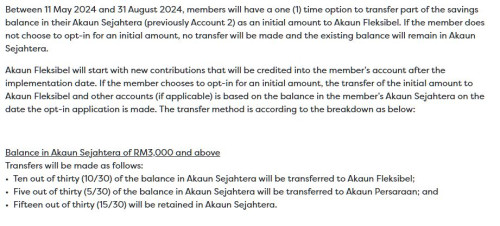

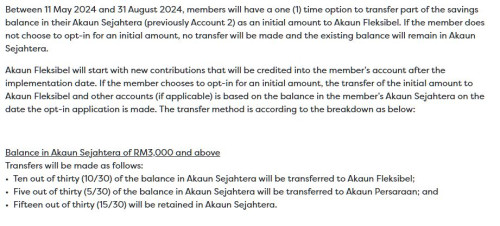

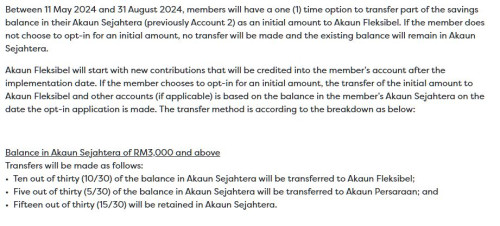

While the savings in Account 1 and Account 2 would remain, Account 3 would start with a zero balance if a member chooses not to opt in for an initial amount."Between May 11 and Aug 31, members will have a one-time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel," the retirement fund said on Thursday (April 25). Members could only choose to opt for the transfer of the initial amount to Akaun Fleksibel one time starting from the effective date until Aug 31, after which the opt-in cannot be cancelled. If a member chooses to opt in, the funds will be transferred into their Account 3 within 24 hours. They would then have to key in their bank details and phone number in order to cash out.

"If the member does not choose to opt in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera. "Akaun Fleksibel would start with new contributions that would be credited into the member’s account after the implementation date," it added. However, if a member chooses not to opt in for an initial amount, no funds would be transferred from their existing balance in their Akaun Sejahtera. In this case, the Akaun Flexible would start with the new contributions that would be credited into the member’s account after the implementation date. "If the member chooses to opt-in for an initial amount,the transfer of the initial amount to Akaun Fleksibel and other accounts (if applicable) is based on the balance in the member’s Akaun Sejahtera on the date the opt-in application is made," it said.

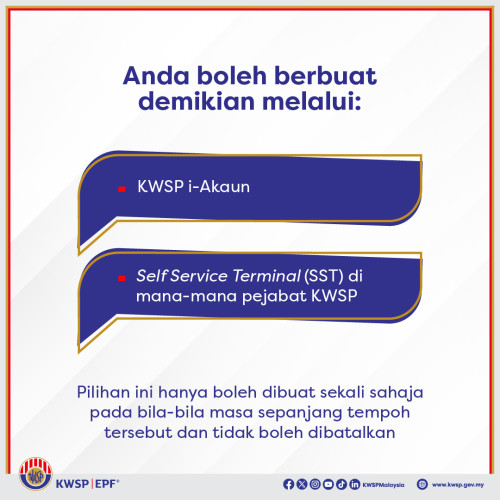

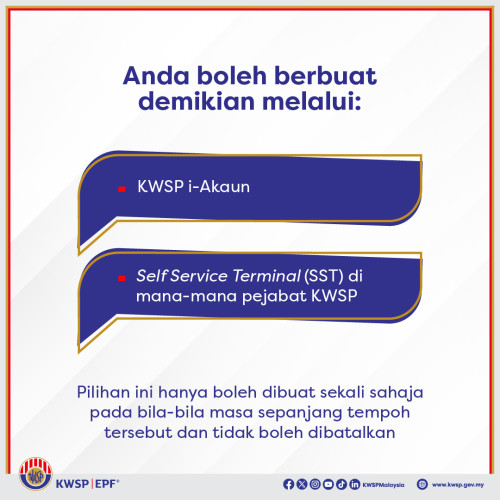

"Application for withdrawal from Akaun Fleksibel can be made through KWSP i-Akaun or at any EPF branches nationwide," it said.

"Members could fully access the system on May 12," it added.

Members who wished to take advantage of this opt-in could submit their application through the KWSP i-Akaun application or the Self-Service Terminals at any EPF branches nationwide.

For those with more than RM3,000 in their Akaun Sejahtera (Account 2), a third of their balance savings would be transferred to the Akaun Fleksibel while one-sixth would be transferred to Akaun Persaraan (Account 1).

The remaining balance would be retained in the Akaun Sejahtera.

For those with a balance of RM1,000 and below, the full amount would be transferred to Akaun Fleksibel. For those with a balance of more than RM1,000 and less than RM3,000, the amount transferred to Akaun Fleksibel would be RM1,000, with the remainder retained in Akaun Sejahtera."No distribution will be made to Akaun Persaraan for a savings balance below RM3,000," it said.   https://www.thestar.com.my/news/nation/2024...-live-on-may-11This post has been edited by xpole: Apr 25 2024, 01:19 PM https://www.thestar.com.my/news/nation/2024...-live-on-may-11This post has been edited by xpole: Apr 25 2024, 01:19 PM

|

|

|

|

|

|

Rusty Nail

|

Apr 25 2024, 12:20 PM Apr 25 2024, 12:20 PM

|

|

"No distribution will be made to Akaun Persaraan for a savings balance below RM3,000," it said.

kek kesian biforti

|

|

|

|

|

|

kcal

|

Apr 25 2024, 12:21 PM Apr 25 2024, 12:21 PM

|

Getting Started

|

so the tered before this false alarm ya?

|

|

|

|

|

|

gundamsp01

|

Apr 25 2024, 12:22 PM Apr 25 2024, 12:22 PM

|

|

why the f there is no guide on totally opt out from acc 3??

|

|

|

|

|

|

kcal

|

Apr 25 2024, 12:23 PM Apr 25 2024, 12:23 PM

|

Getting Started

|

QUOTE(gundamsp01 @ Apr 25 2024, 12:22 PM) why the f there is no guide on totally opt out from acc 3?? opt out utk apa? EPF try to make ur life easier. before this ppl want to WD money from acc 2 need to follow leceh procedure. now they give u liberty to withdraw anytime u sukak, good mah This post has been edited by kcal: Apr 25 2024, 12:25 PM |

|

|

|

|

|

doremon

|

Apr 25 2024, 12:23 PM Apr 25 2024, 12:23 PM

|

|

QUOTE(gundamsp01 @ Apr 25 2024, 12:22 PM) why the f there is no guide on totally opt out from acc 3?? Cannot. Account 1,2,3 will be default. |

|

|

|

|

|

a13solut3

|

Apr 25 2024, 12:24 PM Apr 25 2024, 12:24 PM

|

|

macam no opt out for Acct3, then they better make sure the dividend is the same as Acct 1 & 2, then i no complain.

|

|

|

|

|

|

itv

|

Apr 25 2024, 12:24 PM Apr 25 2024, 12:24 PM

|

New Member

|

Will this account 3 received the same dividen distribution as acc 1 and 2? If lower then better put back into Acc 1 or 2.

|

|

|

|

|

|

pandah

|

Apr 25 2024, 12:26 PM Apr 25 2024, 12:26 PM

|

|

Whether opt in initial amount or not, new contribution will always be split to acc 3?

This post has been edited by pandah: Apr 25 2024, 12:27 PM

|

|

|

|

|

|

poooky

|

Apr 25 2024, 12:28 PM Apr 25 2024, 12:28 PM

|

|

Nice can withdraw 1/3 of ACC 2.

|

|

|

|

|

|

TSxpole

|

Apr 25 2024, 12:29 PM Apr 25 2024, 12:29 PM

|

|

QUOTE(pandah @ Apr 25 2024, 12:26 PM) Whether opt in initial amount or not, new contribution will always be split to acc 3? Yes correct |

|

|

|

|

|

Le Don

|

Apr 25 2024, 12:30 PM Apr 25 2024, 12:30 PM

|

|

QUOTE(a13solut3 @ Apr 25 2024, 12:24 PM) macam no opt out for Acct3, then they better make sure the dividend is the same as Acct 1 & 2, then i no complain. divi will be less for act3 |

|

|

|

|

|

Xploit Machine

|

Apr 25 2024, 12:31 PM Apr 25 2024, 12:31 PM

|

|

Akaun Boleh Keluar Bila-Bila KWSP Mula Bulan Depan

25.04.2024 - Penstrukturan semula akaun Kumpulan Wang Simpanan Pekerja (KWSP), yang antaranya memperkenalkan akaun fleksibel bagi membolehkan wang dikeluarkan pada bila-bila masa, akan bermula pada 11 Mei depan. Menurut struktur baru, akaun 1 akan dikenali sebagai akan persaraan, akaun 2 dikenali sebagai akaun sejahtera dan akaun baru akan dikenali sebagai akaun fleksibel. Menurut KWSP, akaun sejahtera bertujuan "menangani keperluan kitaran hatatr yang menymbang kepada sekejahreraan semasa persaraan" manakala akaun fleksibel pula untuk keperluan jangka pendek. Caruman pula akan dipecahkan seperti berikut:

Akaun persaraan 75%

Akaun sejahtera 15%

Akaun fleksibel 10%

Dalam sistem sekarang, sebanyak 70 peratus caruman akan dimasukkan kepada akaun 1 dan 30 peratus lagi dalam akaun 2. Akaun sejahtera akan bermula dengan sifar tetapi pencarum diberi pilihan untuk memindahkan wang daripada akaun sejahtera sekali saja antara 11 Mei (hari pertama penstrukturan) hingga 31 Ogos. Pecahan wang yang dipindahkan berbeza mengikut keadaan, seperti di bawah;

Baki RM3,000 dan ke atas

10/30 baki dipindahkan ke akaun fleksibel

5/30 baki dipindahkan ke akaun persaraan

15/30 kekal dalam akaun sejahtera.

Baki RM1,000 dan ke bawah

Semua amaun dipindahkan ke akaun fleksibel.

Baki lebih RM1,000 tetapi tidak lebih RM3,000

RM1,000 dipindahkan ke akaun fleksibel

Selebihnya kekal dalam akaun sejahtera

|

|

|

|

|

|

doremon

|

Apr 25 2024, 12:32 PM Apr 25 2024, 12:32 PM

|

|

QUOTE(a13solut3 @ Apr 25 2024, 12:24 PM) macam no opt out for Acct3, then they better make sure the dividend is the same as Acct 1 & 2, then i no complain. Kalau takut, keluarkan duit from acc 3 cepat2 self contribute dalam kwsp balik. Pusing2 sampai acc 3 RM0 This post has been edited by doremon: Apr 25 2024, 12:32 PM |

|

|

|

|

|

LemonHoneyIce

|

Apr 25 2024, 12:34 PM Apr 25 2024, 12:34 PM

|

New Member

|

How to withdraw? Need go EPF or they distribute special ATM card

|

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:34 PM Apr 25 2024, 12:34 PM

|

|

At the end of the day, after reading through everything, I think this is a fair implementation.

1. There is no change to the dividend for Account 3.

2. Opt-in mechanism for existing EPF balances. Those who don’t need the money in Account 3, do not need to opt-in.

3. Apportionment into EPF is from May 2024 onwards is revised from 70:30 to 75:15:10. With this change, there is more money locked-in (75% vs 70% before), but greater flexibility to do withdrawals at any point in time should the need arise.

4. For long-term holders, no underlying change at all. Only difference is, we can now withdraw 10% of our future contributions at any time without penalty.

5. The fact that we can withdraw 10% of future contributions at any time might pose an issue to some people with impulse control issues. This is my only gripe with this change.

6. This might enable EPF to offer slightly more “optimized” returns, at least for Conventional fund as there will be less “lazy capital”.

7. For Shariah fund, not sure how EPF will deal with this issue as the B40 and M40 most prone to withdrawal are likely to come from here. As the Shariah fund is smaller, it might be adversely impacted by liquidity constraints. Hopefully, liquidity will not be generated at the expense of Conventional fund.

|

|

|

|

|

|

contestchris

|

Apr 25 2024, 12:34 PM Apr 25 2024, 12:34 PM

|

|

QUOTE(itv @ Apr 25 2024, 12:24 PM) Will this account 3 received the same dividen distribution as acc 1 and 2? If lower then better put back into Acc 1 or 2. Use your logic, what will cause them to declare less dividend? The Account 3 cannot be gamed. We can’t just pump in money for short term, and then withdraw. Cause, the apportionment is fixed at 75:15:10. Given that, I find it hard to understand why people expect lower dividend for Account 3. If anything, if EPF loses 5% of annual dividend declared each year (half of the 10% from Account 3), it would be a lower base and hence higher dividend the following year for those who did not withdraw. This is as long as the withdrawals do not cause liquidity issues, which I don’t think they will given EPF’s asset allocation to cash/money market which is sufficient to absorb this. Also don't forget, Account 1 allocation has increased from 70% to 75%. This money remains locked till retirement. |

|

|

|

|

|

Chanwsan

|

Apr 25 2024, 12:35 PM Apr 25 2024, 12:35 PM

|

|

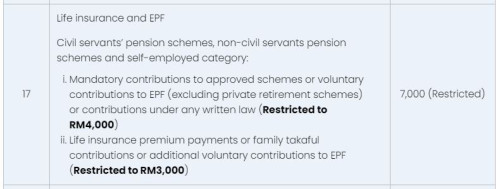

Bodo hamkaling cannot opt out of this acc3 shit.

Imma withdraw and recontribute back as voluntary contribution and claim tax o0o

|

|

|

|

|

|

TSxpole

|

Apr 25 2024, 12:37 PM Apr 25 2024, 12:37 PM

|

|

QUOTE(LemonHoneyIce @ Apr 25 2024, 12:34 PM) How to withdraw? Need go EPF or they distribute special ATM card

"Members could fully access the system on May 12," it added. |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 12:37 PM Apr 25 2024, 12:37 PM

|

|

How to completely opt out for account 3 from May 2024 distribution onwards?

Is there an opt out option?

This post has been edited by jojolicia: Apr 25 2024, 01:28 PM

|

|

|

|

|

|

Human Nature

|

Apr 25 2024, 12:38 PM Apr 25 2024, 12:38 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 distribution all together? By becoming 55 years old  |

|

|

|

|

|

atook

|

Apr 25 2024, 12:38 PM Apr 25 2024, 12:38 PM

|

New Member

|

QUOTE(LemonHoneyIce @ Apr 25 2024, 12:34 PM) How to withdraw? Need go EPF or they distribute special ATM card transfer masuk bank acc la |

|

|

|

|

|

pisces88

|

Apr 25 2024, 12:39 PM Apr 25 2024, 12:39 PM

|

|

QUOTE(gundamsp01 @ Apr 25 2024, 12:22 PM) why the f there is no guide on totally opt out from acc 3?? bcos u totally dont need do anything. so how to give guide? |

|

|

|

|

|

alexleow81

|

Apr 25 2024, 12:39 PM Apr 25 2024, 12:39 PM

|

|

Niama. Macam takde bantu aje 1/3. Lebih baik jangan bagi keluarkan.

This post has been edited by alexleow81: Apr 25 2024, 12:39 PM

|

|

|

|

|

|

Le Don

|

Apr 25 2024, 12:40 PM Apr 25 2024, 12:40 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 from May 2024 distribution onwards all together? Is there a opt out option? No opt out it seems |

|

|

|

|

|

hongchai888

|

Apr 25 2024, 12:40 PM Apr 25 2024, 12:40 PM

|

|

How is the calculation ? Says account 2 got RM 10k

|

|

|

|

|

|

nicole_4ever

|

Apr 25 2024, 12:41 PM Apr 25 2024, 12:41 PM

|

|

So can apply after May 12?

|

|

|

|

|

|

Jasonist

|

Apr 25 2024, 12:41 PM Apr 25 2024, 12:41 PM

|

|

so can get money onot.. niamah so many mcm2

|

|

|

|

|

|

kcal

|

Apr 25 2024, 12:42 PM Apr 25 2024, 12:42 PM

|

Getting Started

|

QUOTE(hongchai888 @ Apr 25 2024, 12:40 PM) How is the calculation ? Says account 2 got RM 10k 1/3 is rm3333.33 |

|

|

|

|

|

SUSEX Unseen Forces

|

Apr 25 2024, 12:42 PM Apr 25 2024, 12:42 PM

|

Getting Started

|

The problem is how many dividend for account 3?

|

|

|

|

|

|

Le Don

|

Apr 25 2024, 12:44 PM Apr 25 2024, 12:44 PM

|

|

QUOTE(nicole_4ever @ Apr 25 2024, 12:41 PM) So can apply after May 12? u want transfer 1/3 account no2 to account no3? |

|

|

|

|

|

nicole_4ever

|

Apr 25 2024, 12:44 PM Apr 25 2024, 12:44 PM

|

|

QUOTE(Le Don @ Apr 25 2024, 12:44 PM) u want transfer 1/3 account no2 to account no3? Yeap. |

|

|

|

|

|

annoymous1234

|

Apr 25 2024, 12:47 PM Apr 25 2024, 12:47 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 from May 2024 distribution onwards all together? Is there an opt out option? No way to opt out. It is what it is. |

|

|

|

|

|

hihihehe

|

Apr 25 2024, 12:47 PM Apr 25 2024, 12:47 PM

|

|

Retirement funds become retirement atm

|

|

|

|

|

|

-PuPu^ZaPruD3r-

|

Apr 25 2024, 12:48 PM Apr 25 2024, 12:48 PM

|

|

Just in time for the KKB by-election.. LOL

|

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 12:50 PM Apr 25 2024, 12:50 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 from May 2024 distribution onwards all together? Is there an opt out option? Why opt out? It didn't mention different dividend rate. |

|

|

|

|

|

seather

|

Apr 25 2024, 12:52 PM Apr 25 2024, 12:52 PM

|

|

no mention on the Acc 3 withdrawal process..

if it is like a savings acc and dividend is same across, this means savers r fucuk again.. because some of the fund have to be kept liquid and not possible for long term investment..

oh well.. i will make sure my children don have to contribute to EPF in the future..

This post has been edited by seather: Apr 25 2024, 12:52 PM

|

|

|

|

|

|

jojolicia

|

Apr 25 2024, 12:53 PM Apr 25 2024, 12:53 PM

|

|

QUOTE(EX Unseen Forces @ Apr 25 2024, 12:42 PM) The problem is how many dividend for account 3? My wifu kbkb complaining very low compared to acc 1&2. She asking for option to opt-out from creating acc 3 |

|

|

|

|

|

TSxpole

|

Apr 25 2024, 12:54 PM Apr 25 2024, 12:54 PM

|

|

QUOTE(nicole_4ever @ Apr 25 2024, 12:41 PM) So can apply after May 12? Starting may 12 |

|

|

|

|

|

nelson969

|

Apr 25 2024, 12:54 PM Apr 25 2024, 12:54 PM

|

|

so silent on dividend , die lo election .

|

|

|

|

|

|

jojolicia

|

Apr 25 2024, 12:55 PM Apr 25 2024, 12:55 PM

|

|

QUOTE(poweredbydiscuz @ Apr 25 2024, 12:50 PM) Why opt out? It didn't mention different dividend rate. Yes, it was mentioned Acc 3 will not be paid same dividend as Acc 1 & 2. A very low dividen for acc 3 This post has been edited by jojolicia: Apr 25 2024, 12:56 PM |

|

|

|

|

|

TSxpole

|

Apr 25 2024, 12:55 PM Apr 25 2024, 12:55 PM

|

|

QUOTE(Jasonist @ Apr 25 2024, 12:41 PM) so can get money onot.. niamah so many mcm2 Yes u can. Starting 12 may can apply to move 10/30 of your Akaun 2 to akaun 3 |

|

|

|

|

|

yhtan

|

Apr 25 2024, 12:56 PM Apr 25 2024, 12:56 PM

|

|

if dividend is same across for all 3 accounts then i'm ok with it. But for those withdrawing account 2 for housing purpose better think twice, they shrink from 30% withdrawable amount to 25% of it.

|

|

|

|

|

|

trevorgoh

|

Apr 25 2024, 12:57 PM Apr 25 2024, 12:57 PM

|

New Member

|

What about voluntary contribution? Will it be automatically allocated following the 75-15-10 proportion also? Can the voluntary contribution be put 100% into account 3?

|

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 12:58 PM Apr 25 2024, 12:58 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:55 PM) Yes, it was mentioned Acc 3 will not be paid same dividend as Acc 1 & 2. A very low dividen for acc 3 Please share official sos. |

|

|

|

|

|

vez

|

Apr 25 2024, 12:59 PM Apr 25 2024, 12:59 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:55 PM) Yes, it was mentioned Acc 3 will not be paid same dividend as Acc 1 & 2. A very low dividen for acc 3 sos please |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 12:59 PM Apr 25 2024, 12:59 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 12:56 PM) if dividend is same across for all 3 accounts then i'm ok with it. But for those withdrawing account 2 for housing purpose better think twice, they shrink from 30% withdrawable amount to 25% of it. It was announced dividen will not be the same across the 3 accounts. Acc 1&2 same but surely not acc 3. |

|

|

|

|

|

ye0073

|

Apr 25 2024, 12:59 PM Apr 25 2024, 12:59 PM

|

|

So if got 100,000 at account 2

• 100,000 x 10/30 = 33,333 to account 3

• 100,000 x 5/30 = 16,667 to account 1

• 100,000 x 15/30 = 50,000 remain in account 2

|

|

|

|

|

|

jojolicia

|

Apr 25 2024, 01:00 PM Apr 25 2024, 01:00 PM

|

|

QUOTE(vez @ Apr 25 2024, 12:59 PM) Wait, I find the old article again |

|

|

|

|

|

nelson969

|

Apr 25 2024, 01:01 PM Apr 25 2024, 01:01 PM

|

|

here the sos, smh boomer / gen z / alpha kekw |

|

|

|

|

|

Capt. Marble

|

Apr 25 2024, 01:01 PM Apr 25 2024, 01:01 PM

|

Getting Started

|

So ifon sales naik again ar after this?

|

|

|

|

|

|

Lembu Goreng

|

Apr 25 2024, 01:02 PM Apr 25 2024, 01:02 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:59 PM) It was announced dividen will not be the same across the 3 accounts. Acc 1&2 same but surely not acc 3. It was never announced, but it was speculated though |

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 01:03 PM Apr 25 2024, 01:03 PM

|

|

QUOTE(nelson969 @ Apr 25 2024, 01:01 PM)  here the sos, smh boomer / gen z / alpha kekw No wonder so many bodo kena scammed. They believe everything posted online is true. Kekwa. |

|

|

|

|

|

SUSSihambodoh

|

Apr 25 2024, 01:03 PM Apr 25 2024, 01:03 PM

|

|

Inflation will go up in Q4 2024 this year. Businesses will be doing great until the money is fully used, then there will be calls to allow more withdrawals.

Stupid gomen.

|

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:04 PM Apr 25 2024, 01:04 PM

|

|

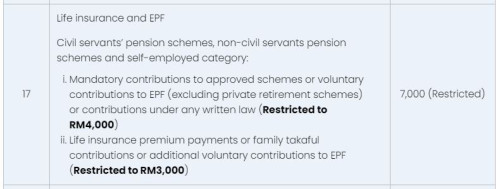

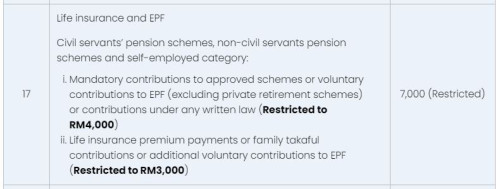

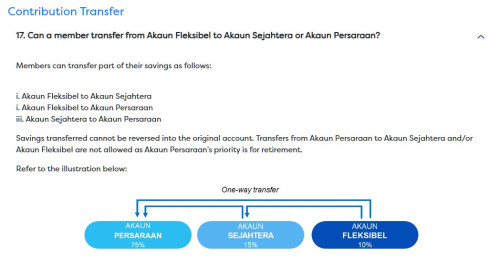

For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  |

|

|

|

|

|

rickyro

|

Apr 25 2024, 01:05 PM Apr 25 2024, 01:05 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  Dang.. then that thins out the 100k limit per year |

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 01:07 PM Apr 25 2024, 01:07 PM

|

|

QUOTE(rickyro @ Apr 25 2024, 01:05 PM) Dang.. then that thins out the 100k limit per year Worth it la. Immediately gain 20%+ of relief wo. This post has been edited by poweredbydiscuz: Apr 25 2024, 01:08 PM |

|

|

|

|

|

coyouth

|

Apr 25 2024, 01:07 PM Apr 25 2024, 01:07 PM

|

|

QUOTE(rickyro @ Apr 25 2024, 01:05 PM) Dang.. then that thins out the 100k limit per year Self contribution, they divide between 3 accounts again. No difference. |

|

|

|

|

|

yhtan

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:59 PM) It was announced dividen will not be the same across the 3 accounts. Acc 1&2 same but surely not acc 3. any official source for this? QUOTE(nelson969 @ Apr 25 2024, 01:01 PM)  here the sos, smh boomer / gen z / alpha kekw kekwa, ini speculation |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

|

|

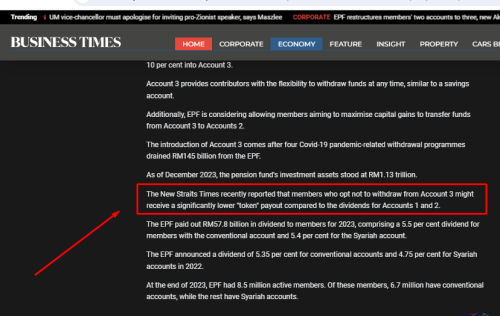

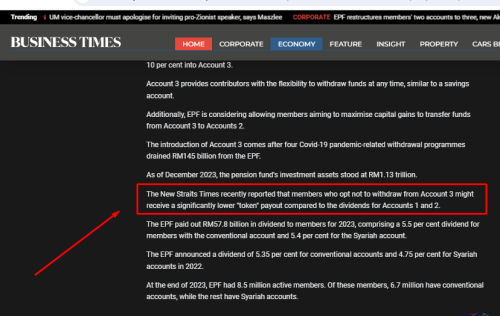

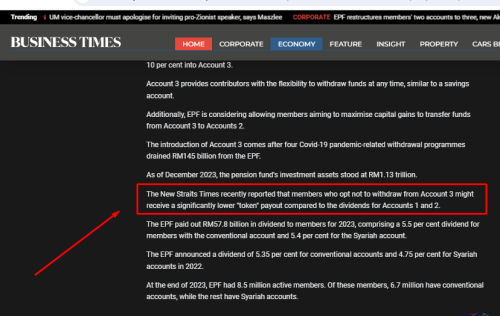

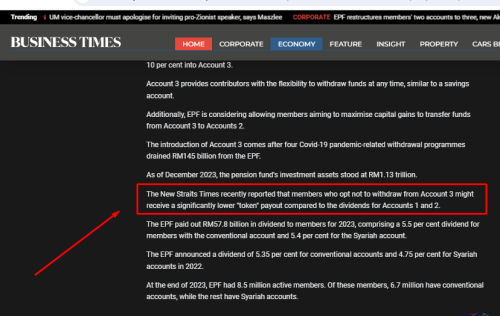

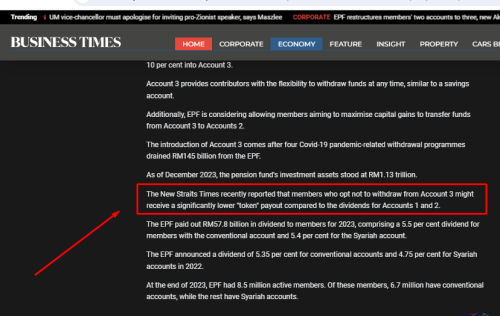

QUOTE(vez @ Apr 25 2024, 12:59 PM) https://www.nst.com.my/business/economy/202...opt-out-optionsRead 4th last para "The New Straits Times recently reported that members who opt not to withdraw from Account 3 might receive a significantly lower "token" payout compared to the dividends for Accounts 1 and 2" Surely you don't get same dividen for an account akin a normal saving account. This post has been edited by jojolicia: Apr 25 2024, 01:10 PM |

|

|

|

|

|

SUSjoe_star

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

|

|

Bottom line: they need to be upfront what account 3 dividen going to be.

|

|

|

|

|

|

vez

|

Apr 25 2024, 01:09 PM Apr 25 2024, 01:09 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  don think they so dumb they might implement just like SSPN, nett in, if you withdraw x amount, you put in y, your nett in is y-x |

|

|

|

|

|

vez

|

Apr 25 2024, 01:10 PM Apr 25 2024, 01:10 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 01:09 PM) speculate only, adui ini orang |

|

|

|

|

|

ShadowR1

|

Apr 25 2024, 01:11 PM Apr 25 2024, 01:11 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 12:59 PM) So if got 100,000 at account 2 • 100,000 x 10/30 = 33,333 to account 3 • 100,000 x 5/30 = 16,667 to account 1 • 100,000 x 15/30 = 50,000 remain in account 2 Errr, the way I understand is Acc 3 will start from 0. From now onwards u can choose what will go into Acc 3. 10/30 or 5/30 or 15/30. And not taking whats already in Acc 2 and divided it by 10/30 or 5/30 or 15/30 and put into Acc 3. Do correct me if my understanding is wrong. |

|

|

|

|

|

vez

|

Apr 25 2024, 01:12 PM Apr 25 2024, 01:12 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 12:59 PM) So if got 100,000 at account 2 • 100,000 x 10/30 = 33,333 to account 3 • 100,000 x 5/30 = 16,667 to account 1 • 100,000 x 15/30 = 50,000 remain in account 2 more easier is account 1 70k account 2 30k end up account 1 75k (account 2 5/30 into here) account 2 15k (account 2 15/30 remain) account 3 10k (account 2 10/30 into here) |

|

|

|

|

|

Lembu Goreng

|

Apr 25 2024, 01:12 PM Apr 25 2024, 01:12 PM

|

|

why dont they allow those with above RM1mil to opt out from Acct 3 completely?

Completely useless this Acct 3 for us

This post has been edited by Lembu Goreng: Apr 25 2024, 01:13 PM

|

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:13 PM Apr 25 2024, 01:13 PM

|

|

QUOTE(ShadowR1 @ Apr 25 2024, 01:11 PM) Errr, the way I understand is Acc 3 will start from 0. From now onwards u can choose what will go into Acc 3. 10/30 or 5/30 or 15/30. And not taking whats already in Acc 2 and divided it by 10/30 or 5/30 or 15/30 and put into Acc 3. Do correct me if my understanding is wrong. Can transfer for 1 time option. QUOTE Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera.  |

|

|

|

|

|

Koranshita

|

Apr 25 2024, 01:16 PM Apr 25 2024, 01:16 PM

|

|

If by default not doing anything mean 0% allocation to acc3 Correct?

Can only change once a year? Or once a lifetime?

Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera.

Only will touch this if I have no way out.

This post has been edited by Koranshita: Apr 25 2024, 01:17 PM

|

|

|

|

|

|

a13solut3

|

Apr 25 2024, 01:16 PM Apr 25 2024, 01:16 PM

|

|

QUOTE(doremon @ Apr 25 2024, 12:32 PM) Kalau takut, keluarkan duit from acc 3 cepat2 self contribute dalam kwsp balik. Pusing2 sampai acc 3 RM0 Good idea lol. Let's see how it goes after this. |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 01:17 PM Apr 25 2024, 01:17 PM

|

New Member

|

QUOTE(Lembu Goreng @ Apr 25 2024, 01:02 PM) It was never announced, but it was speculated though QUOTE(poweredbydiscuz @ Apr 25 2024, 01:03 PM) No wonder so many bodo kena scammed. They believe everything posted online is true. Kekwa. QUOTE(yhtan @ Apr 25 2024, 01:09 PM) any official source for this? kekwa, ini speculation QUOTE(vez @ Apr 25 2024, 01:10 PM) speculate only, adui ini orang IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then? Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) This post has been edited by askingquestion: Apr 25 2024, 01:20 PM |

|

|

|

|

|

nelson969

|

Apr 25 2024, 01:18 PM Apr 25 2024, 01:18 PM

|

|

TLDR so far i read >account 3 start with 0 > during May 11 2024 and August 31 2024, member can transfer money from account 2 to account 3 , if they decide no transfer ,at 1 Sep 2024, your account 3 is starting with 0 >75:15:10 contribution, do your calculation >No impact on the EPF’s portfolio, dividend for Account 3 could differ in future>Withdrawal amount of RM50 from account 3 >>only age 55 below, after 55 age above, account 3 and account 2 will go into account 1 my opinion neh, make sure at 60 years old u get 800k 900k 1m in KWSP and leech of the dividend, it is susceptible all of us will live thru pass 60 until 100 or 90 not a good move, this is probably respond to ppl who withdraw money during covid-19 they doing this just to make sure ppl work until 100, no retirement like sg, hk , japan , korea , china , American i am expecting them to push the retirement age from 60 to 70 or 63 source : https://www.malaymail.com/news/malaysia/202...rst-year/130739This post has been edited by nelson969: Apr 25 2024, 01:20 PM |

|

|

|

|

|

Boy96

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

|

|

Ok time to withdraw and but in AHB or Tabung Haji.. higher dividen without need for zakat deduction

|

|

|

|

|

|

Koranshita

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

|

|

QUOTE(doremon @ Apr 25 2024, 12:32 PM) Kalau takut, keluarkan duit from acc 3 cepat2 self contribute dalam kwsp balik. Pusing2 sampai acc 3 RM0 How to self contribute.. I check I macam not entitled |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 01:19 PM Apr 25 2024, 01:19 PM

|

|

QUOTE(joe_star @ Apr 25 2024, 01:09 PM) Bottom line: they need to be upfront what account 3 dividen going to be. Correct. Yes or No, that Acc 3 (if unwithdrawn/ untouched) dividen will the same as announced for Acc 1 & 2. This post has been edited by jojolicia: Apr 25 2024, 01:20 PM |

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:20 PM Apr 25 2024, 01:20 PM

|

|

QUOTE(Koranshita @ Apr 25 2024, 01:16 PM) If by default not doing anything mean 0% allocation to acc3 Correct? Can only change once a year? Or once a lifetime? Between 11 May 2024 and 31 August 2024, members will have a one (1) time option to transfer part of the savings balance in their Akaun Sejahtera (previously Account 2) as an initial amount to Akaun Fleksibel. If the member does not choose to opt-in for an initial amount, no transfer will be made and the existing balance will remain in Akaun Sejahtera. Only will touch this if I have no way out. You do or not account 3 is fixed. 10% of the contribution will goes to account 3. The account 2 transfer to account 3 is once a lifetime between 11 May 2024 and 31 August 2024. |

|

|

|

|

|

ZeroSOFInfinity

|

Apr 25 2024, 01:22 PM Apr 25 2024, 01:22 PM

|

|

QUOTE(contestchris @ Apr 25 2024, 12:34 PM) Use your logic, what will cause them to declare less dividend? The Account 3 cannot be gamed. We can’t just pump in money for short term, and then withdraw. Cause, the apportionment is fixed at 75:15:10. Given that, I find it hard to understand why people expect lower dividend for Account 3. If anything, if EPF loses 5% of annual dividend declared each year (half of the 10% from Account 3), it would be a lower base and hence higher dividend the following year for those who did not withdraw. This is as long as the withdrawals do not cause liquidity issues, which I don’t think they will given EPF’s asset allocation to cash/money market which is sufficient to absorb this. Also don't forget, Account 1 allocation has increased from 70% to 75%. This money remains locked till retirement. Basically, giving you the carrot.... but also holding the stick. |

|

|

|

|

|

etan26

|

Apr 25 2024, 01:23 PM Apr 25 2024, 01:23 PM

|

|

QUOTE(itv @ Apr 25 2024, 12:24 PM) Will this account 3 received the same dividen distribution as acc 1 and 2? If lower then better put back into Acc 1 or 2. Lucky me, already passed 55 so no Acc 3. |

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 01:23 PM Apr 25 2024, 01:23 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:17 PM) IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then? Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) By your logic, what's the point of account 2 if it has same dividend as account 1? Just make it 30% of account 1 allowed to be withdraw for certain conditions. |

|

|

|

|

|

ZeroSOFInfinity

|

Apr 25 2024, 01:25 PM Apr 25 2024, 01:25 PM

|

|

QUOTE(jojolicia @ Apr 25 2024, 12:37 PM) How to opt out for account 3 from May 2024 distribution onwards all together? Is there an opt out option? I think not. Basically all contributors below 55 are "assigned" 3 accounts from May onwards. Only difference is that you can withdraw 10%, but as a "penalty" a 5% .... "retainer fee" goes to Akaun 1 - which you can only withdraw after 55. |

|

|

|

|

|

StupidGuyPlayComp

|

Apr 25 2024, 01:27 PM Apr 25 2024, 01:27 PM

|

|

the dividend across 3 accounts same or not? of acc3 will lesser?

|

|

|

|

|

|

ShadowR1

|

Apr 25 2024, 01:27 PM Apr 25 2024, 01:27 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:13 PM) Can transfer for 1 time option.  I see. Thank for the clarification. |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 01:27 PM Apr 25 2024, 01:27 PM

|

New Member

|

QUOTE(poweredbydiscuz @ Apr 25 2024, 01:23 PM) By your logic, what's the point of account 2 if it has same dividend as account 1? Just make it 30% of account 1 allowed to be withdraw for certain conditions. Different functionality Because account 1 money cannot be withdraw unless very specific circumstances (death, retirement, etc) Account 2 was made so we could withdraw the money for certain purpose. Since account 2 was for the purpose of withdrawing money, let people withdraw from account 2 lor. Why need account 3? |

|

|

|

|

|

Avangelice

|

Apr 25 2024, 01:29 PM Apr 25 2024, 01:29 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  Abang tax relief and life insurance long ago separate dah. For those contribution more that 4k max relief have no reason to self contribute |

|

|

|

|

|

GambitFire

|

Apr 25 2024, 01:29 PM Apr 25 2024, 01:29 PM

|

Getting Started

|

For those who opt to transfer certain portion from acc 2 to acc3, what is the cutoff period they referring to? Is it based on May balance? Since we have time until Aug to decide can I do it on Aug and will they use Aug balance instead since will be higher?

|

|

|

|

|

|

ZeroSOFInfinity

|

Apr 25 2024, 01:30 PM Apr 25 2024, 01:30 PM

|

|

QUOTE(nelson969 @ Apr 25 2024, 01:01 PM)  here the sos, smh boomer / gen z / alpha kekw Keyword - "might". No official word on this, right? |

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 01:30 PM Apr 25 2024, 01:30 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:27 PM) Different functionalityBecause account 1 money cannot be withdraw unless very specific circumstances (death, retirement, etc) Account 2 was made so we could withdraw the money for certain purpose. Since account 2 was for the purpose of withdrawing money, let people withdraw from account 2 lor. Why need account 3? You already answered yourself. Topkek. They already renamed them to Account Retirement, Account Sejahtera, Account Flexible. Which is quite clear. Wait, you know that Acc 3 can be withdraw for whatever reason. Right? This post has been edited by poweredbydiscuz: Apr 25 2024, 01:31 PM |

|

|

|

|

|

nelson969

|

Apr 25 2024, 01:31 PM Apr 25 2024, 01:31 PM

|

|

QUOTE(ZeroSOFInfinity @ Apr 25 2024, 01:30 PM) Keyword - "might". No official word on this, right? thesundaily quoted >No impact on the EPF’s portfolio, dividend for Account 3 could differ in future |

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:33 PM Apr 25 2024, 01:33 PM

|

|

QUOTE(GambitFire @ Apr 25 2024, 01:29 PM) For those who opt to transfer certain portion from acc 2 to acc3, what is the cutoff period they referring to? Is it based on May balance? Since we have time until Aug to decide can I do it on Aug and will they use Aug balance instead since will be higher? Do it on Aug for higher balance. |

|

|

|

|

|

Oltromen Ripot

|

Apr 25 2024, 01:35 PM Apr 25 2024, 01:35 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:27 PM) Different functionality Because account 1 money cannot be withdraw unless very specific circumstances (death, retirement, etc) Account 2 was made so we could withdraw the money for certain purpose. Since account 2 was for the purpose of withdrawing money, let people withdraw from account 2 lor. Why need account 3? A1 - withdraw due to explicit circumstances. A2 - withdraw due to specific need, requires approval. A3 - withdraw minimum RM50 anytime. no need someone to approve. |

|

|

|

|

|

SUSSihambodoh

|

Apr 25 2024, 01:40 PM Apr 25 2024, 01:40 PM

|

|

Gomen said no to withdrawals earlier but actually allowing more to be withdrawn. Past ones max 60k iinm.

Now if you have 300k in your account 2,.you can withdraw 100k to spend on anything you like.

Kekwa. Then 2025 can claim economic growth under mafani, funded by people's retirement money.

|

|

|

|

|

|

jojolicia

|

Apr 25 2024, 01:43 PM Apr 25 2024, 01:43 PM

|

|

QUOTE(GambitFire @ Apr 25 2024, 01:29 PM) For those who opt to transfer certain portion from acc 2 to acc3, what is the cutoff period they referring to? Is it based on May balance? Since we have time until Aug to decide can I do it on Aug and will they use Aug balance instead since will be higher? For you (in bold) If the member chooses to opt-in for an initial amount,the transfer of the initial amount to Akaun Fleksibel and other accounts (if applicable) is based on the balance in the member’s Akaun Sejahtera on the date the opt-in application is made," it said. This post has been edited by jojolicia: Apr 25 2024, 01:43 PM |

|

|

|

|

|

ZeroSOFInfinity

|

Apr 25 2024, 01:43 PM Apr 25 2024, 01:43 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:27 PM) Different functionality Because account 1 money cannot be withdraw unless very specific circumstances (death, retirement, etc) Account 2 was made so we could withdraw the money for certain purpose. Since account 2 was for the purpose of withdrawing money, let people withdraw from account 2 lor. Why need account 3? If you look more closely, account 3 IS necessary. Think of this way... if you can withdraw anytime.... people will start withdrawing like crazy and then account 2 would be empty in no time. You can try to put a condition that you must have a minimum amount inside, but what IS the minimum? RM 10? 100? 1000? By creating account 3, basically you can withdraw all without any conditions. This post has been edited by ZeroSOFInfinity: Apr 25 2024, 01:45 PM |

|

|

|

|

|

guailow83

|

Apr 25 2024, 01:44 PM Apr 25 2024, 01:44 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:13 PM) Can transfer for 1 time option.  +1 |

|

|

|

|

|

Lembu Goreng

|

Apr 25 2024, 01:44 PM Apr 25 2024, 01:44 PM

|

|

Iphone sales gonna go up up up

|

|

|

|

|

|

Koranshita

|

Apr 25 2024, 01:49 PM Apr 25 2024, 01:49 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:20 PM) You do or not account 3 is fixed. 10% of the contribution will goes to account 3. The account 2 transfer to account 3 is once a lifetime between 11 May 2024 and 31 August 2024. 10% is auto and cannot be ammend? I mean if I dowan to or I want only 5% . Something like that. |

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:51 PM Apr 25 2024, 01:51 PM

|

|

QUOTE(Koranshita @ Apr 25 2024, 01:49 PM) 10% is auto and cannot be ammend? I mean if I dowan to or I want only 5% . Something like that. Too bad at this moment it does not provide this option. The only way to do is withdraw money from account 3 and transfer back as self-contribution. |

|

|

|

|

|

SUSfuzzy

|

Apr 25 2024, 01:52 PM Apr 25 2024, 01:52 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  If your salary is 3k, you would already max out the 4k EPF relief, no need to withdraw anymore. |

|

|

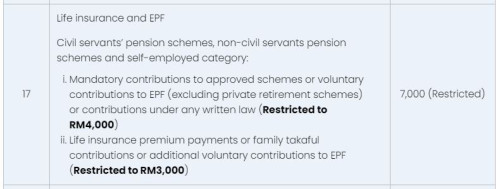

|

|

|

Atrocious

|

Apr 25 2024, 01:54 PM Apr 25 2024, 01:54 PM

|

Getting Started

|

QUOTE(Lembu Goreng @ Apr 25 2024, 01:44 PM) Iphone sales gonna go up up up Yes, cow. So are genuine leather products.. |

|

|

|

|

|

hafiziza

|

Apr 25 2024, 01:58 PM Apr 25 2024, 01:58 PM

|

Getting Started

|

10/30 baki dipindahkan ke akaun fleksibel

5/30 baki dipindahkan ke akaun persaraan

15/30 kekal dalam akaun sejahtera.

I wonder whether this is fixed or the maximum. For example, can I transfer 9/30 to akaun fleksibel, 4/30 to akaun persaraan dan retain the rest in akaun sejahtera?

|

|

|

|

|

|

ye0073

|

Apr 25 2024, 01:59 PM Apr 25 2024, 01:59 PM

|

|

QUOTE(hafiziza @ Apr 25 2024, 01:58 PM) 10/30 baki dipindahkan ke akaun fleksibel 5/30 baki dipindahkan ke akaun persaraan 15/30 kekal dalam akaun sejahtera. I wonder whether this is fixed or the maximum. For example, can I transfer 9/30 to akaun fleksibel, 4/30 to akaun persaraan dan retain the rest in akaun sejahtera? This is fixed. |

|

|

|

|

|

zhou.xingxing

|

Apr 25 2024, 02:03 PM Apr 25 2024, 02:03 PM

|

|

this is what the best finance minister can do?

|

|

|

|

|

|

Lembu Goreng

|

Apr 25 2024, 02:05 PM Apr 25 2024, 02:05 PM

|

|

QUOTE(Atrocious @ Apr 25 2024, 01:54 PM) Yes, cow. So are genuine leather products.. not to mention people will eat more wagyu steak  |

|

|

|

|

|

Duckies

|

Apr 25 2024, 02:06 PM Apr 25 2024, 02:06 PM

|

|

My concern is dividend how? All 3 accounts same?

|

|

|

|

|

|

creep

|

Apr 25 2024, 02:06 PM Apr 25 2024, 02:06 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 01:09 PM) any official source for this? kekwa, ini speculation I saw in fb someone attended the briefing with EPF, got ppl asking the rate she said all 3 acc same rate |

|

|

|

|

|

rcracer

|

Apr 25 2024, 02:07 PM Apr 25 2024, 02:07 PM

|

|

Dividend most important, no fuxking way mandatory contribution with zero dividend, every time withdraw and put into what ?

|

|

|

|

|

|

poweredbydiscuz

|

Apr 25 2024, 02:07 PM Apr 25 2024, 02:07 PM

|

|

QUOTE(Duckies @ Apr 25 2024, 02:06 PM) My concern is dividend how? All 3 accounts same? Same same but different. |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 02:07 PM Apr 25 2024, 02:07 PM

|

New Member

|

QUOTE(poweredbydiscuz @ Apr 25 2024, 01:30 PM) You already answered yourself. Topkek. They already renamed them to Account Retirement, Account Sejahtera, Account Flexible. Which is quite clear. Wait, you know that Acc 3 can be withdraw for whatever reason. Right? QUOTE(Oltromen Ripot @ Apr 25 2024, 01:35 PM) A1 - withdraw due to explicit circumstances. A2 - withdraw due to specific need, requires approval. A3 - withdraw minimum RM50 anytime. no need someone to approve. QUOTE(ZeroSOFInfinity @ Apr 25 2024, 01:43 PM) If you look more closely, account 3 IS necessary. Think of this way... if you can withdraw anytime.... people will start withdrawing like crazy and then account 2 would be empty in no time. You can try to put a condition that you must have a minimum amount inside, but what IS the minimum? RM 10? 100? 1000? By creating account 3, basically you can withdraw all without any conditions. Just change account 2 to have a maximum % you can withdraw. Just the fact that there is account 3, and that account 3 is mandatory (why, in fact EPF should love it if more people opt out of account 3 and put in account 1/2 if same dividend), tell me account 3 dividend is going to be less. I like to be proven wrong, but I don't think I am going to be. This post has been edited by askingquestion: Apr 25 2024, 02:09 PM |

|

|

|

|

|

spursfan

|

Apr 25 2024, 02:08 PM Apr 25 2024, 02:08 PM

|

Getting Started

|

QUOTE(askingquestion @ Apr 25 2024, 01:27 PM) Different functionality Because account 1 money cannot be withdraw unless very specific circumstances (death, retirement, etc) Account 2 was made so we could withdraw the money for certain purpose. Since account 2 was for the purpose of withdrawing money, let people withdraw from account 2 lor. Why need account 3? sebab ekonomi tak jalan. my takeaway from this is be prepared for another round of inflation. what do the government expect if they put more money into the people's pockets? |

|

|

|

|

|

rcracer

|

Apr 25 2024, 02:11 PM Apr 25 2024, 02:11 PM

|

|

Should be incentivised if account 3 > certain amount or within certain percentage of total of account 1 and 2, recover full dividend rate

|

|

|

|

|

|

TSxpole

|

Apr 25 2024, 02:17 PM Apr 25 2024, 02:17 PM

|

|

For self contribution, it would be better if EPF let people choose which acct they can choose to self contrubute

Example if I want to save money in EPF but choose Acct 3 to save

If EPF let people do this, I will dump all my KDI saving, Touch N Go money to EPF

No need to put in other platforms

|

|

|

|

|

|

kkkw80

|

Apr 25 2024, 02:21 PM Apr 25 2024, 02:21 PM

|

|

QUOTE(Capt. Marble @ Apr 25 2024, 01:01 PM) So ifon sales naik again ar after this? Woohoo I can buy at least 7 IPhone |

|

|

|

|

|

ye0073

|

Apr 25 2024, 02:30 PM Apr 25 2024, 02:30 PM

|

|

QUOTE(creep @ Apr 25 2024, 02:06 PM) I saw in fb someone attended the briefing with EPF, got ppl asking the rate she said all 3 acc same rate Yes. News also report current it is same. But future might change. The art of word.  |

|

|

|

|

|

nono111

|

Apr 25 2024, 02:32 PM Apr 25 2024, 02:32 PM

|

New Member

|

answer from live chat |

|

|

|

|

|

yhtan

|

Apr 25 2024, 02:36 PM Apr 25 2024, 02:36 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:17 PM) IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then? Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) To cater for emergency withdrawal, the floodgate has been open since MCO time, by doing this government increase account 1 to 75% in return. For me if there is any emergency scenario, i can withdraw this money without go and loan from bank. QUOTE(Boy96 @ Apr 25 2024, 01:19 PM) Ok time to withdraw and but in AHB or Tabung Haji.. higher dividen without need for zakat deduction ASB and Tabung Haji return how many %? Why not switch to EPF syariah account? QUOTE(creep @ Apr 25 2024, 02:06 PM) I saw in fb someone attended the briefing with EPF, got ppl asking the rate she said all 3 acc same rate  |

|

|

|

|

|

Boy96

|

Apr 25 2024, 02:46 PM Apr 25 2024, 02:46 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 02:36 PM) ASB and Tabung Haji return how many %? Why not switch to EPF syariah account? :thumbsup: AHB not ASB.. AHB is 2.5% every 6 Month.. so 5% a year. Tabung Haji is 3.1% annually. EPF syariah havent potong 2.5% zakat yet off whatever dividens you are getting |

|

|

|

|

|

yhtan

|

Apr 25 2024, 02:48 PM Apr 25 2024, 02:48 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 02:46 PM) AHB not ASB.. AHB is 2.5% every 6 Month.. so 5% a year. Tabung Haji is 3.1% annually. EPF syariah havent potong 2.5% zakat yet off whatever dividens you are getting oh amanah hartanah bumiputra let say EPF dividend is 6%, after zakat should be effectively 5.85%? This post has been edited by yhtan: Apr 25 2024, 02:49 PM |

|

|

|

|

|

Boy96

|

Apr 25 2024, 02:52 PM Apr 25 2024, 02:52 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 02:48 PM) oh amanah hartanah bumiputra let say EPF dividend is 6%, after zakat should be effectively 5.85%? If u have 100000 in your account, then dividen 6%.. become 106000 106000 - 2.5% = 103,350 So effective 3.35% saja... It deduct 2.5% of the whole balance every year This post has been edited by Boy96: Apr 25 2024, 02:53 PM |

|

|

|

|

|

tifosi

|

Apr 25 2024, 02:54 PM Apr 25 2024, 02:54 PM

|

|

QUOTE(doremon @ Apr 25 2024, 12:32 PM) Kalau takut, keluarkan duit from acc 3 cepat2 self contribute dalam kwsp balik. Pusing2 sampai acc 3 RM0 Your interest will be affected. |

|

|

|

|

|

30624770

|

Apr 25 2024, 02:58 PM Apr 25 2024, 02:58 PM

|

Getting Started

|

QUOTE(xpole @ Apr 25 2024, 03:17 PM) For self contribution, it would be better if EPF let people choose which acct they can choose to self contrubute Example if I want to save money in EPF but choose Acct 3 to save If EPF let people do this, I will dump all my KDI saving, Touch N Go money to EPF No need to put in other platforms You want it to be like bank savings account lah but remember how much is bank savings account interest? |

|

|

|

|

|

Dr Jan Itor

|

Apr 25 2024, 03:03 PM Apr 25 2024, 03:03 PM

|

Getting Started

|

Time to buy IPhone 17 plus pro max 1tb

|

|

|

|

|

|

yhtan

|

Apr 25 2024, 03:14 PM Apr 25 2024, 03:14 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 02:52 PM) If u have 100000 in your account, then dividen 6%.. become 106000 106000 - 2.5% = 103,350 So effective 3.35% saja... It deduct 2.5% of the whole balance every year Zakat 2.5% is not based on 6k return? How come your principal kena zakat as well? |

|

|

|

|

|

ye0073

|

Apr 25 2024, 03:14 PM Apr 25 2024, 03:14 PM

|

|

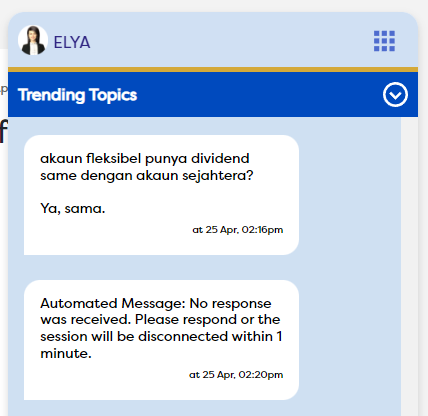

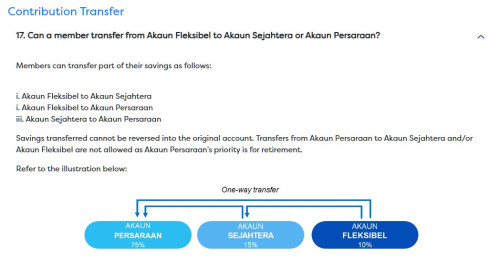

More info here at Q&A page. https://www.kwsp.gov.my/account-restructuringCan transfer back to account 1 or account 2 from account 3. QUOTE Members can submit a contribution transfer application at any EPF counter by completing the “Borang Pindahan Simpanan Ke Akaun Persaraan/ Akaun Sejahtera”.  |

|

|

|

|

|

jaycee1

|

Apr 25 2024, 03:19 PM Apr 25 2024, 03:19 PM

|

|

QUOTE(Sihambodoh @ Apr 25 2024, 01:40 PM) Gomen said no to withdrawals earlier but actually allowing more to be withdrawn. Past ones max 60k iinm. Now if you have 300k in your account 2,.you can withdraw 100k to spend on anything you like. Kekwa. Then 2025 can claim economic growth under mafani, funded by people's retirement money. I think if you have 300k or more in ACC2, you probably don't need the 100k in ACC3. You either already did pretty good for yourself to have additional savings and liquidity somewhere else or are already close to retirement. To me ACC3 is pretty much useless unless maybe a quick way to get funds lets say for a medical emergency. But we all know what people will spend ACC3 monies on. This post has been edited by jaycee1: Apr 25 2024, 03:20 PM |

|

|

|

|

|

Boy96

|

Apr 25 2024, 03:21 PM Apr 25 2024, 03:21 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 03:14 PM) Zakat 2.5% is not based on 6k return? How come your principal kena zakat as well? Zakat has always been based on principal, not on the returns. But for epf theres an exemption where u only start paying zakat every year once you reach 55 age This post has been edited by Boy96: Apr 25 2024, 03:23 PM |

|

|

|

|

|

adamhzm90

|

Apr 25 2024, 03:23 PM Apr 25 2024, 03:23 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 02:52 PM) If u have 100000 in your account, then dividen 6%.. become 106000 106000 - 2.5% = 103,350 So effective 3.35% saja... It deduct 2.5% of the whole balance every year Not whole year la..once the money is yours eg 50 and 55 yo then can calculate based on the amount you get |

|

|

|

|

|

annoymous1234

|

Apr 25 2024, 03:23 PM Apr 25 2024, 03:23 PM

|

|

just in time can use acc 2 to buy macbook

|

|

|

|

|

|

Boy96

|

Apr 25 2024, 03:24 PM Apr 25 2024, 03:24 PM

|

|

QUOTE(adamhzm90 @ Apr 25 2024, 03:23 PM) Not whole year la..once the money is yours eg 50 and 55 yo then can calculate based on the amount you get Ya. Patut ramai once hit umur tu, withdraw all masuk tabung haji |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:26 PM Apr 25 2024, 03:26 PM

|

|

I will put some money into Acc3.....in-case something CB happen.

BTW, money from Acc3 can transfer to Acc 1 / 2 as contribution.

I just put 10k in Acc3.

This post has been edited by RegentCid: Apr 25 2024, 03:27 PM

|

|

|

|

|

|

ferricide

|

Apr 25 2024, 03:28 PM Apr 25 2024, 03:28 PM

|

|

By introducing AC3, the govt now secures even more money into AC1 if those choose to opt in.

Nice move.

|

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:30 PM Apr 25 2024, 03:30 PM

|

New Member

|

QUOTE(RegentCid @ Apr 25 2024, 03:26 PM) I will put some money into Acc3.....in-case something CB happen. BTW, money from Acc3 can transfer to Acc 1 / 2 as contribution. I just put 10k in Acc3.Sure or not? I thought all personal contribution is also splited up by account 1 and 2 (before account 3 is announced). Can pick which account to contribute? |

|

|

|

|

|

KarchKiraly

|

Apr 25 2024, 03:30 PM Apr 25 2024, 03:30 PM

|

Getting Started

|

Better withdraw account 3 and put into physical gold.

This post has been edited by KarchKiraly: Apr 25 2024, 03:30 PM

|

|

|

|

|

|

N9484640

|

Apr 25 2024, 03:33 PM Apr 25 2024, 03:33 PM

|

|

Withdrawal - online can do

To transfer from acct 3 to acct 1 or 2 - must goto kwsp fill form 🤦🏻♂️

This post has been edited by N9484640: Apr 25 2024, 03:33 PM

|

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:34 PM Apr 25 2024, 03:34 PM

|

New Member

|

QUOTE(N9484640 @ Apr 25 2024, 03:33 PM) Withdrawal - online can do To transfer from acct 3 to acct 1 or 2 - must goto kwsp fill form 🤦🏻♂️ There should be an auto opt in/opt out option. |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:36 PM Apr 25 2024, 03:36 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 02:30 PM) Sure or not? I thought all personal contribution is also splited up by account 1 and 2 (before account 3 is announced). Can pick which account to contribute? It will split 1/3 from your account 2 into account 3. My Account 3 after split from account 2 amount approx. Rm17k Extra 7k will contibution back into Account 2 |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:38 PM Apr 25 2024, 03:38 PM

|

New Member

|

QUOTE(RegentCid @ Apr 25 2024, 03:36 PM) It will split 1/3 from your account 2 into account 3. My Account 3 after split from account 2 amount approx. Rm17k Extra 7k will contibution back into Account 2 The split is not automatic one, I thought need to apply? |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:42 PM Apr 25 2024, 03:42 PM

|

|

QUOTE(askingquestion @ Apr 25 2024, 02:38 PM) The split is not automatic one, I thought need to apply? Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. This post has been edited by RegentCid: Apr 25 2024, 03:47 PM |

|

|

|

|

|

SUSSihambodoh

|

Apr 25 2024, 03:45 PM Apr 25 2024, 03:45 PM

|

|

QUOTE(jaycee1 @ Apr 25 2024, 03:19 PM) I think if you have 300k or more in ACC2, you probably don't need the 100k in ACC3. You either already did pretty good for yourself to have additional savings and liquidity somewhere else or are already close to retirement. To me ACC3 is pretty much useless unless maybe a quick way to get funds lets say for a medical emergency. But we all know what people will spend ACC3 monies on. People with 1m will still withdraw. Let's say if you have 1010k in EPF. You can only withdrawax 10k. Unless you want to buy house or other reasons, you can't touch your 303k in account 2. Now with this account 3, I can withdraw 101k from my account 2 and put as down-payment to buy a BMW. I get to piap more girls, BMW salesmen happy, gomen happy. |

|

|

|

|

|

spacelion

|

Apr 25 2024, 03:46 PM Apr 25 2024, 03:46 PM

|

|

There should be a one button press to change distribution to 85%-15%-0%

But I guess they want us to withdraw deposit as it will increase their kpi

|

|

|

|

|

|

jmas

|

Apr 25 2024, 03:47 PM Apr 25 2024, 03:47 PM

|

|

QUOTE(Avangelice @ Apr 25 2024, 01:29 PM) Abang tax relief and life insurance long ago separate dah. For those contribution more that 4k max relief have no reason to self contribute QUOTE(fuzzy @ Apr 25 2024, 01:52 PM) If your salary is 3k, you would already max out the 4k EPF relief, no need to withdraw anymore. maxed the 4k compulsory, still got 3k voluntary right? (unless life insurance already maxed as well)  |

|

|

|

|

|

stevenryl86

|

Apr 25 2024, 03:49 PM Apr 25 2024, 03:49 PM

|

|

QUOTE(RegentCid @ Apr 25 2024, 03:42 PM) Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. Opt in for initial transfer from acct2 to acct3. If you don’t opt in, your acct3 will start with zero and upcoming contribution will split to 3 account Everyone will have account 3! This post has been edited by stevenryl86: Apr 25 2024, 03:50 PM |

|

|

|

|

|

RegentCid

|

Apr 25 2024, 03:49 PM Apr 25 2024, 03:49 PM

|

|

QUOTE(spacelion @ Apr 25 2024, 02:46 PM) There should be a one button press to change distribution to 85%-15%-0% But I guess they want us to withdraw deposit as it will increase their kpi Edited This post has been edited by RegentCid: Apr 25 2024, 04:02 PM |

|

|

|

|

|

askingquestion

|

Apr 25 2024, 03:52 PM Apr 25 2024, 03:52 PM

|

New Member

|

QUOTE(RegentCid @ Apr 25 2024, 03:49 PM) May 12 - August 31....This period you didnt do anything.....by Sept 1 Your Account 3 will remain zero forever.....EPF will remain old split at 70% account 1, 30% account 2. Spacelion is probably talking about future contribution. He doesn't want to contribute to account 3. |

|

|

|

|

|

SUSfuzzy

|

Apr 25 2024, 03:53 PM Apr 25 2024, 03:53 PM

|

|

QUOTE(RegentCid @ Apr 25 2024, 03:42 PM) Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. This is wrong info. |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 03:54 PM Apr 25 2024, 03:54 PM

|

|

QUOTE(N9484640 @ Apr 25 2024, 03:33 PM) Withdrawal - online can do To transfer from acct 3 to acct 1 or 2 - must goto kwsp fill form 🤦🏻♂️ 🤦🤦Tak pasal pasal buat menyusahkan je. |

|

|

|

|

|

N9484640

|

Apr 25 2024, 03:54 PM Apr 25 2024, 03:54 PM

|

|

QUOTE(RegentCid @ Apr 25 2024, 03:49 PM) May 12 - August 31....This period you didnt do anything.....by Sept 1 Your Account 3 will remain zero forever.....EPF will remain old split at 70% account 1, 30% account 2. No la, if you don’t opt in for the initial transfer from acct 2 to acct 3, then acct 3 will just start from zero. 10% of contribution will still end up in acct 3 |

|

|

|

|

|

nonexno

|

Apr 25 2024, 03:56 PM Apr 25 2024, 03:56 PM

|

|

QUOTE(jaycee1 @ Apr 25 2024, 03:19 PM) I think if you have 300k or more in ACC2, you probably don't need the 100k in ACC3. You either already did pretty good for yourself to have additional savings and liquidity somewhere else or are already close to retirement. To me ACC3 is pretty much useless unless maybe a quick way to get funds lets say for a medical emergency. But we all know what people will spend ACC3 monies on. Not really true also. Things are so crazy expensive now. |

|

|

|

|

|

jojolicia

|

Apr 25 2024, 03:58 PM Apr 25 2024, 03:58 PM

|

|

QUOTE(RegentCid @ Apr 25 2024, 03:42 PM) Starting May 12 - August 31. You can choose OPT in or no OPT in. NO OPT IN, means remain same......Account 1 & 2 ...Account 3 will remain zero forever. EPF money will remain 70% account 1 , 30% account 2. If you choose OPT In....account 3 automatic take 1/3 amount of your money from Account 2. Starting May 12 - August 31 >> This opt in is only for the transfer of one time initial fund from current acc2. If you opt out (do nothing) means your Acc 3 start from 0, only building up fr May24 distributions onwards The new distribution of 75/15/10 from May-24 onwards is auto for all across. This post has been edited by jojolicia: Apr 25 2024, 04:02 PM |

|

|

|

|

|

spursfan

|

Apr 25 2024, 04:15 PM Apr 25 2024, 04:15 PM

|

Getting Started

|

QUOTE(nelson969 @ Apr 25 2024, 01:18 PM)  TLDR so far i read >account 3 start with 0 > during May 11 2024 and August 31 2024, member can transfer money from account 2 to account 3 , if they decide no transfer ,at 1 Sep 2024, your account 3 is starting with 0 >75:15:10 contribution, do your calculation >No impact on the EPF’s portfolio, dividend for Account 3 could differ in future>Withdrawal amount of RM50 from account 3 >>only age 55 below, after 55 age above, account 3 and account 2 will go into account 1 my opinion neh, make sure at 60 years old u get 800k 900k 1m in KWSP and leech of the dividend, it is susceptible all of us will live thru pass 60 until 100 or 90 not a good move, this is probably respond to ppl who withdraw money during covid-19 they doing this just to make sure ppl work until 100, no retirement like sg, hk , japan , korea , china , American i am expecting them to push the retirement age from 60 to 70 or 63 source : https://www.malaymail.com/news/malaysia/202...rst-year/130739we're the cheese leleh generation. not gonna reach 90 or 100. 60 may be hard for some. |

|

|

|

|

|

SUSSihambodoh

|

Apr 25 2024, 04:20 PM Apr 25 2024, 04:20 PM

|

|

QUOTE(Sihambodoh @ Apr 25 2024, 03:45 PM) People with 1m will still withdraw. Let's say if you have 1010k in EPF. You can only withdrawax 10k. Unless you want to buy house or other reasons, you can't touch your 303k in account 2. Now with this account 3, I can withdraw 101k from my account 2 and put as down-payment to buy a BMW. I get to piap more girls, BMW salesmen happy, gomen happy. QUOTE(sexysarah1992 @ Apr 25 2024, 03:38 PM) 33% to acc3 17% to acc1 I will withdraw 80k for my alphard downpayment Told ya, although I am not sure if he has 1m |

|

|

|

|

|

TSxpole

|

Apr 25 2024, 04:30 PM Apr 25 2024, 04:30 PM

|

|

|

|

|

|

|

|

Avangelice

|

Apr 25 2024, 04:47 PM Apr 25 2024, 04:47 PM

|

|

QUOTE(jmas @ Apr 25 2024, 03:47 PM) maxed the 4k compulsory, still got 3k voluntary right? (unless life insurance already maxed as well)  People like me maxed that shit every year. No way waste money self contribute |

|

|

|

|

|

sexysarah1992

|

Apr 25 2024, 04:57 PM Apr 25 2024, 04:57 PM

|

|

QUOTE(Sihambodoh @ Apr 25 2024, 04:20 PM) Told ya, although I am not sure if he has 1m Not yet reach 1m but achievable by end of next year |

|

|

|

|

|

yhtan

|

Apr 25 2024, 05:07 PM Apr 25 2024, 05:07 PM

|

|

QUOTE(Boy96 @ Apr 25 2024, 03:21 PM) Zakat has always been based on principal, not on the returns. But for epf theres an exemption where u only start paying zakat every year once you reach 55 age Then your zakat based on gross salary and net salary? if net salary then your calculation is correct |

|

|

|

|

|

jmas

|

Apr 25 2024, 05:13 PM Apr 25 2024, 05:13 PM

|

|

QUOTE(Avangelice @ Apr 25 2024, 04:47 PM) People like me maxed that shit every year. No way waste money self contribute I dont hv life insurance yet, so still can voluntary |

|

|

|

|

|

Boy96

|

Apr 25 2024, 05:22 PM Apr 25 2024, 05:22 PM

|

|

QUOTE(yhtan @ Apr 25 2024, 05:07 PM) Then your zakat based on gross salary and net salary? if net salary then your calculation is correct Its not based on your salary but rather your total wealth at the end of each year minus 2.5%. if all your investments and bank accounts accumulate to have over rm21k (minus AHB and tabung haji) you have to start paying already This post has been edited by Boy96: Apr 25 2024, 05:23 PM |

|

|

|

|

|

vez

|

Apr 26 2024, 08:37 AM Apr 26 2024, 08:37 AM

|

|

QUOTE(askingquestion @ Apr 25 2024, 01:17 PM) IMO, if account 3 same dividend as account 1 and 2, what is the point of account 3 then? Just make it easier to withdraw from account 2 then (like you can withdraw x% from account 2 once a year etc) x% they make and name it account 3  if they make it x% from account 2, people confuse  and not easy to maintain, how long the x% in account 2 reset for next withdrawal etc for example if 50% from account 2 is withdrawable, once got ppl withdraw 50%, what next? coming month salary in, what is the amount of 50% can withdraw? the logic and algorithm not to say cannot achieve, and eventually system can calculate, ppl will be confuse just like WHY account 1 and 2 if 30% can use for house  why why why... separating to account 3 is best for manage and easily straightforward how much one can withdraw |

|

|

|

|

|

eugenecctan

|

Apr 26 2024, 08:57 AM Apr 26 2024, 08:57 AM

|

|

So many ppl opt out because making assumption Acc 3 will be less interest? 😅

|

|

|

|

|

|

TSxpole

|

Apr 26 2024, 09:19 AM Apr 26 2024, 09:19 AM

|

|

QUOTE(eugenecctan @ Apr 26 2024, 08:57 AM) So many ppl opt out because making assumption Acc 3 will be less interest? 😅 What do u mean by opt out? Acct 3 will be compulsory to all epf holders The only thing that u can do is by transferring the fund from Acc 3 to Acc 1/2 manually at epf counter |

|

|

|

|

|

budaken

|

Apr 26 2024, 09:29 AM Apr 26 2024, 09:29 AM

|

Getting Started

|

someone really need to explain this to me.  so means let's say i have 10k in 2nd account, how much really can i draw to my upcoming 3rd account? |

|

|

|

|

|

poweredbydiscuz

|

Apr 26 2024, 09:32 AM Apr 26 2024, 09:32 AM

|

|

QUOTE(budaken @ Apr 26 2024, 09:29 AM) someone really need to explain this to me.  so means let's say i have 10k in 2nd account, how much really can i draw to my upcoming 3rd account? Account 2 = Akaun Sejahtera Account 3 = Akaun Fleksibel So 10k x 10/30 = 3.33k you can withdraw. This post has been edited by poweredbydiscuz: Apr 26 2024, 09:33 AM |

|

|

|

|

|

Kr0ll3R

|

Apr 26 2024, 04:04 PM Apr 26 2024, 04:04 PM

|

|

Is it safe to say that at the end of the year, I transfer all my account 3 balance to account 1/2, this consider as voluntary contribution for the tax relief, right?

This post has been edited by Kr0ll3R: Apr 26 2024, 04:04 PM

|

|

|

|

|

|

LaiN87

|

Apr 26 2024, 04:24 PM Apr 26 2024, 04:24 PM

|

|

QUOTE(budaken @ Apr 26 2024, 09:29 AM) so means let's say i have 10k in 2nd account, how much really can i draw to my upcoming 3rd account? As someone said before, max amount is 3.3k if your acc 2 have 10k now. Explanation: Any amount more than 3k: 1/3 goes Acc3, 1/6 goes Acc1, 1/2 remain acc2. So if you have 10k in Acc2, you can opt in for 10k. But only 3.3k will go into Acc3. 1.67k will go into Acc1. 5k remain in Acc2. Above is max amount. You can opt in lower than 10k. 5k eg is acceptable. Then divide all the amount above by half. QUOTE(Kr0ll3R @ Apr 26 2024, 04:04 PM) Is it safe to say that at the end of the year, I transfer all my account 3 balance to account 1/2, this consider as voluntary contribution for the tax relief, right? Doesn’t work that way. You need to physically take that amount out of Acc3 to ur bank acc. Use I-Akaun to deposit 3k back into EPF self contribution. And your acc3 will have rm300 more after that  |

|

|

|

|

|

alexkos

|

Apr 26 2024, 04:27 PM Apr 26 2024, 04:27 PM

|

|

finally got extra cash to fund ayam Axia 1.0L E Cash RM22,000

IDUP MADANI

|

|

|

|

|

|

budaken

|

Apr 29 2024, 02:44 PM Apr 29 2024, 02:44 PM

|

Getting Started

|

QUOTE(poweredbydiscuz @ Apr 26 2024, 09:32 AM) Account 2 = Akaun Sejahtera Account 3 = Akaun Fleksibel So 10k x 10/30 = 3.33k you can withdraw. QUOTE(LaiN87 @ Apr 26 2024, 04:24 PM) As someone said before, max amount is 3.3k if your acc 2 have 10k now. Explanation: Any amount more than 3k: 1/3 goes Acc3, 1/6 goes Acc1, 1/2 remain acc2. So if you have 10k in Acc2, you can opt in for 10k. But only 3.3k will go into Acc3. 1.67k will go into Acc1. 5k remain in Acc2. Above is max amount. You can opt in lower than 10k. 5k eg is acceptable. Then divide all the amount above by half. Doesn’t work that way. You need to physically take that amount out of Acc3 to ur bank acc. Use I-Akaun to deposit 3k back into EPF self contribution. And your acc3 will have rm300 more after that  thanks for the clarfication |

|

|

|

|

|

Pain4UrsinZ

|

Apr 29 2024, 02:48 PM Apr 29 2024, 02:48 PM

|

|

QUOTE(ye0073 @ Apr 25 2024, 01:04 PM) For those who wants to opt out, can withdraw the money from account 3, and put it back thru self-contribution and enjoy tax relief of 7K.  u think epf sozai mie,like SSPN also calculating deposite + minus any withdrawal |

|

|

|

|

|

Pain4UrsinZ

|

Apr 29 2024, 02:51 PM Apr 29 2024, 02:51 PM

|

|

this is a scam, after restructuring my Account 1 from 72% of total become 75% of total, they just want to lock more money in Account 1 for many years

This post has been edited by Pain4UrsinZ: Apr 29 2024, 02:51 PM

|

|

|

|

|

Apr 25 2024, 12:18 PM, updated 2y ago

Apr 25 2024, 12:18 PM, updated 2y ago

Quote

Quote

0.0549sec

0.0549sec

0.92

0.92

5 queries

5 queries

GZIP Disabled

GZIP Disabled