The financial stretch continues to keep Malaysians living in major cities from realising their dreams of home ownership.

Among the younger generation, their major concerns are the property prices that are now multiple times more than the annual household income. It is not easy for those with no fixed income or low salaries to secure a home loan.

While money issues are already weighing heavily on people’s minds, the younger generation’s inability to afford a home is exacerbated with the fact that they are buckling under the skyrocketing cost of living.

Until today, housing affordability remains a conundrum in Malaysia despite the various initiatives taken by the government, among others, through the National Affordable Housing Policy. The initiative aims to enable the housing affordability issue in the country to be tackled in a holistic way.

In fact, millennials, aged between 25-40 and those of up to 45, are delaying the purchase of their first home. What’s keeping them from buying homes at the rate of previous generations?

According to a lecturer at the Urban and Regional Planning, Security and Community Development Department of Social and Development Sciences, Faculty of Human Ecology, Universiti Putra Malaysia (UPM), Dr Mohammad Mujaheed Hassan, a study has shown that other factors also contributed to the issue.

Citing a study entitled ‘The Variations In Preferences of The Young Generation In Klang Valley Towards Housing Property Demand’ conducted by UPM in mid-2022, Mohammad Mujaheed, who is also involved in the research said, today’s younger generation has high financial commitments.

A total of 2,523 respondents aged 25 to 45 in Kuala Lumpur, Selangor and Putrajaya with individual monthly income of RM4,360 to RM9,620 were interviewed in the study aimed at identifying this group’s financial level, in terms of their ability to save, invest as well as their financial liabilities.

He said that out of the total, 1,697 respondents or 67.3 per cent were committed to monthly car instalments of between RM800 and RM1,200.

“For them, owning a car is a benchmark of their success in life. Ironically, some of them take the public transport to work and leave their car at home,” he told Bernama recently.

Besides that, Mohammad Mujaheed said the study also shows that 1,833 respondents or 72.7 per cent have credit card commitments with at least two banks.

“Having a credit card is a ‘responsibility’ for the younger generation as an alternative for them to have regular access to credit and as cash advance.

“The study also reveals that 843 (33.4 per cent) of respondents were renting with monthly rental of RM500 to RM1,200,” he said, adding that 73.9 per cent of the respondents had no disposal income for savings or investment.

Elaborating on the issue, Mohammad Mujaheed said based on the study, the younger generation prefers to rent due to several factors, although they can afford to buy their own home based on the monthly rentals they paid for.

“They argue that the location of the house that they can pay for is far from their workplace, on top of other payments such as tax assessments, maintenance fees, etc that will further add to their financial burden.

“By renting, they only have to fork out for their rent and utility bills. They said that their rented house is only for them to rest and sleep at night. Much of the time is spent outside their house and at work,” he added.

At the same time, some of these millennials are tied to personal loans, among others for their wedding, while others are caught in the credit card debt trap.

This situation is not surprising as the Credit Counselling and Debt Management Agency has earlier highlighted that the majority of youth who were declared bankrupt in the country was due to credit card debts.

According to Mohammad Mujaheed, the tendency for the younger people to give other priorities rather than home ownership has caused many to be saddled with longstanding debts, hence preventing them from buying a house despite getting older.

“The situation is rather serious and has largely contributed to cases of being blacklisted by financial agencies, living in debt, bankrupt and perhaps problems such as stress, borrowing from ‘along’, etc,” he said.

He said while it is not wrong for the younger generation to own a car or apply for personal loan, they should give priority to home ownership as it is an asset compared to a vehicle which is a liability as it depreciates in value each year.

“A house is an asset with its value appreciating every year. While it is not wrong to rent, but on hindsight, through monthly rentals, it seems that we are ‘helping’ the owner to settle his housing loan repayment,” he argued.

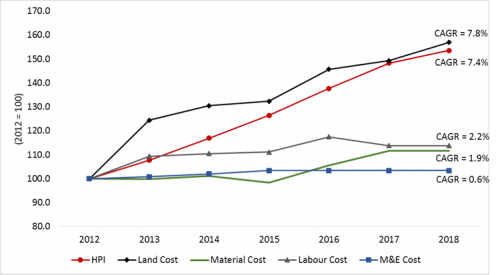

He said if the problem persists, this group will continue to delay the purchase of their home to meet other needs, noting that it is feared that they will not be able to own their own house in the future given the consistent upward trajectory in residential property prices.

“The younger generation should no longer adopt a wait-and-see approach. The longer they wait, the higher the prices of houses given that the growth of household income is not at par with the growth in property or house prices,” he said, adding that what’s worrying, this group will end up as ‘homeless’ when they reach their golden age.

Without ruling out the possibility that this group would ‘share’ a home with their parents or other family members, Mohammad Mujaheed said that this could only be realised if their parents have their own house.

“Otherwise, a family will be faced with the possibility of being homeless or continue to rent permanently (from one generation to another) as they do not own any property,” he stressed.

https://www.malaymail.com/news/malaysia/202...of-reach/113296

Malaysian millennials give up on home ownership

Jan 19 2024, 10:05 AM, updated 2y ago

Jan 19 2024, 10:05 AM, updated 2y ago

Quote

Quote

0.0943sec

0.0943sec

0.49

0.49

5 queries

5 queries

GZIP Disabled

GZIP Disabled