QUOTE(hksgmy @ Jun 7 2024, 07:01 PM)

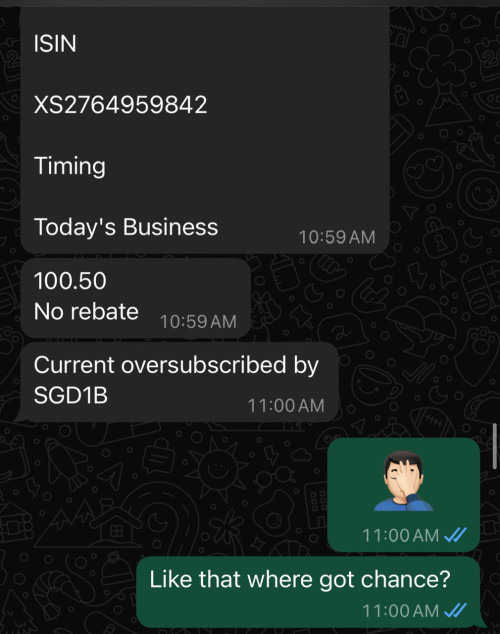

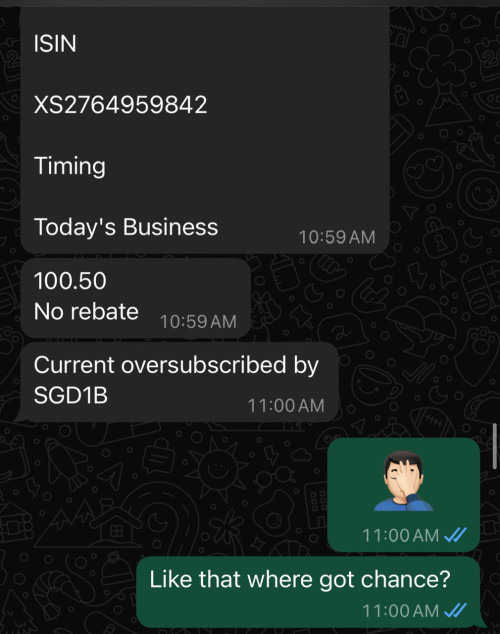

Yes. If the banks are the book runners, I usually get rebates from Maybank but hardly ever from DBS or UOB. This time, Maybank not the book runners. And 1B oversubscribed… super not likely

Edited to add Maybank’s RM msg and my response:

you guys are lucky there

here book runner or not

bankers dont give a hoot (PAR price) what more rebate...

unless bonds yang tak laku maybe

QUOTE(hksgmy @ Jun 7 2024, 07:02 PM)

Perp bonds will find it hard to get a higher rating. It’s always like that. And, I bank with HSBC and the bulk of my AUD wealth is held with them. I figured

if I don’t trust the bank and its fundamentals, why would I want to hold money with HSBC?It’s sorta the

same kind of kindergarten logic that I apply when buying stocks of DBS, UOB, OBCB and Maybank… I bank with these guys in Singapore, so if I don’t trust them, why would I continue to keep my money with them? Hahah.

whoa that is really kindergarten logic bro..

you mean if this subordinated BBB bond koyak, HSBC must be bankrupt close shop?

and your other wealths with HSBC would all be burnt?

No bro that is a fallacy.

It is far from that.

This bond can default or even be written off by HSBC

and yet HSBC still open for business

that is how risky perpetual bond can be

i know you can afford to burn a lot or 2 of your bonds..but that is another matter.

How senior each of your wealth in HSBC matters

Not semua pun sama.

FD tops the rank

then senior secured bond ,,,, down to junior subordinated..

QUOTE(hksgmy @ Jun 7 2024, 07:13 PM)

And yeah, I saw what you posted about the premium re Malaysian bonds. Crazy money grab. It’s like an extra one or two ringgit per unit… that’s almost like secondary market level of profit for the bankers…

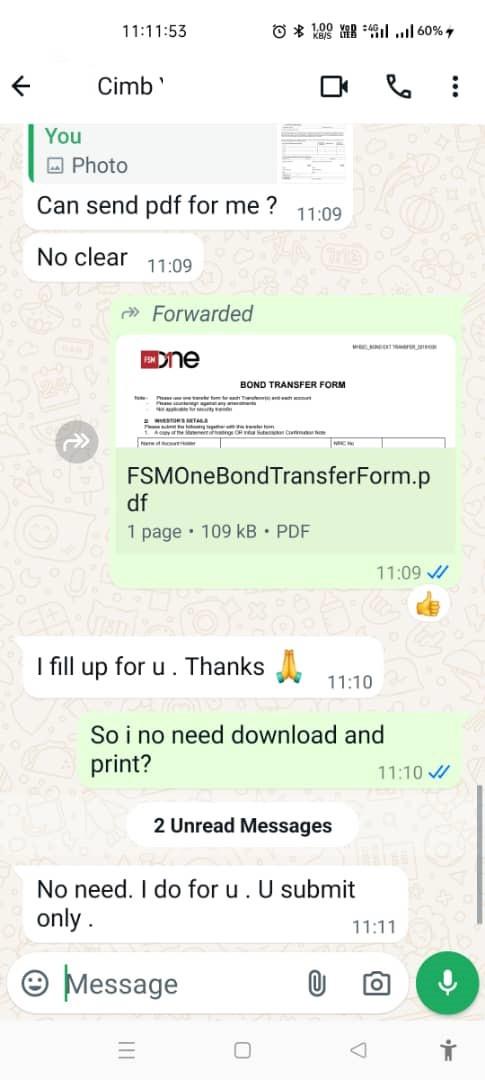

Yeah i paid RM102 for Hicom bond at CIMB, at MBB it was RM101.50 and FSM only 100.50

but that doesnt mean at secondary market the bankers make more profits

Jun 7 2024, 07:13 PM

Jun 7 2024, 07:13 PM

Quote

Quote

0.0238sec

0.0238sec

1.19

1.19

6 queries

6 queries

GZIP Disabled

GZIP Disabled