» Click to show Spoiler - click again to hide... «

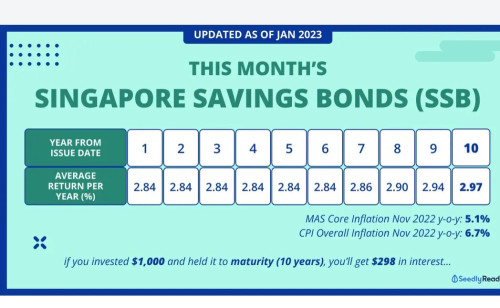

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

|

Mar 3 2023, 10:48 AM Mar 3 2023, 10:48 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

SSB application details from BT 020323.

» Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Mar 4 2023, 02:27 PM Mar 4 2023, 02:27 PM

|

Junior Member

692 posts Joined: Nov 2021 |

|

|

|

Mar 4 2023, 04:53 PM Mar 4 2023, 04:53 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Unkerpanjang @ Jan 15 2023, 07:34 PM) Bro TOS, pls shout out if you find rates increasing, add 1 buy...I no syiok, Jan 2023 yield low, man. But just hold lah, better than 0%. Kamsiah. Happy New Year. Rates increasing as you wished.  https://www.ilovessb.com/ |

|

|

Mar 7 2023, 03:19 PM Mar 7 2023, 03:19 PM

|

|||||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This week's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-10 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-10 Both 1-month and 3-month MAS bill COY below 4%. Response is cooler compared to last week yet COYs are lower. -------------------------- My first 6M T-bill bought last year matures today. Principal will be credited after 5pm supposedly. This post has been edited by TOS: Mar 7 2023, 03:20 PM nexona88 liked this post

|

|||||||||||||||

|

|

Mar 9 2023, 07:51 PM Mar 9 2023, 07:51 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

ilovessb.com may soon include T-bills and SGS securities stuffs, which will be helpful for newcomers to SG's risk-free space. https://forums.hardwarezone.com.sg/threads/...#post-146612514 TaiGoh liked this post

|

|

|

Mar 10 2023, 05:36 PM Mar 10 2023, 05:36 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

OCBC, UOB customers can tap CPF funds to buy T-bills online from Mar 31 and Apr 22 respectively

https://www.businesstimes.com.sg/companies-...s-online-mar-31 There's a paywall, but no worries, I will post the whole article in 2 days time when the physical newspaper is available at my uni's library. This post has been edited by TOS: Mar 10 2023, 05:37 PM |

|

|

|

|

|

Mar 10 2023, 07:31 PM Mar 10 2023, 07:31 PM

Show posts by this member only | IPv6 | Post

#287

|

Junior Member

302 posts Joined: Mar 2010 |

https://www.fsmone.com.my/funds/research/ar...bonds-on-fsmone

fsmone can trade US and SG government bond online now |

|

|

Mar 10 2023, 07:36 PM Mar 10 2023, 07:36 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(zebras @ Mar 10 2023, 07:31 PM) https://www.fsmone.com.my/funds/research/ar...bonds-on-fsmone Be mindful it's twice (min. commissions/fees) as expensive as IBKR. (10 USD vs 5 USD)fsmone can trade US and SG government bond online now |

|

|

Mar 10 2023, 07:56 PM Mar 10 2023, 07:56 PM

Show posts by this member only | IPv6 | Post

#289

|

Junior Member

302 posts Joined: Mar 2010 |

|

|

|

Mar 10 2023, 07:57 PM Mar 10 2023, 07:57 PM

Show posts by this member only | IPv6 | Post

#290

|

Junior Member

302 posts Joined: Mar 2010 |

QUOTE(TOS @ Mar 10 2023, 05:36 PM) OCBC, UOB customers can tap CPF funds to buy T-bills online from Mar 31 and Apr 22 respectively What are the fees for UOB?https://www.businesstimes.com.sg/companies-...s-online-mar-31 There's a paywall, but no worries, I will post the whole article in 2 days time when the physical newspaper is available at my uni's library. |

|

|

Mar 10 2023, 08:13 PM Mar 10 2023, 08:13 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(zebras @ Mar 10 2023, 07:56 PM) 10k USD is not a small amount. And another thing important for you to know. I could be wrong, but insider sources mentioned to me that FSM bonds are "not even held on a custodian basis", so everything is in FSM's name (i.e., on FSM/iFAST's balance sheet). Buying bonds on FSM platform implies a "private agreement" between you and FSM. If FSM/iFAST went bankrupt, you have to "go to court to show that you have a private arrangement with FSM", as the source asserts. This is different from IBKR, whose holdings are segregated in a custodian account separated from the broker's holding company. *Retail investors often forget about counterparty risk.* QUOTE(zebras @ Mar 10 2023, 07:57 PM) Are you referring to cash purchase of SG T-bills or purchase via CPF?Cash purchase is free on primary market provided you have CDP account. You can of course purchase the bills in secondary market via SG brokers or FSM. For CPF-OA investments, you need to open a CPFIS account at one of the 3 local banks (DBS, UOB, OCBC) before you can purchase T-bills from primary market. https://investmentmoats.com/saving-and-inve...ills-sgs-bonds/ All 3 local SG banks have quarterly custodian fees of about 2 SGD. See links below. DBS: https://www.dbs.com.sg/iwov-resources/media...ule_charges.pdf OCBC: https://www.ocbc.com/personal-banking/inves...estment-account UOB: https://www.uob.com.sg/personal/invest/fina...nt-account.page You are welcome to join your SG friends over at HWZ if you would like to know more: https://forums.hardwarezone.com.sg/threads/...769601/page-629 This post has been edited by TOS: Mar 12 2023, 06:03 PM zebras liked this post

|

|

|

Mar 12 2023, 02:00 PM Mar 12 2023, 02:00 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(TOS @ Mar 10 2023, 05:36 PM) OCBC, UOB customers can tap CPF funds to buy T-bills online from Mar 31 and Apr 22 respectively As promised, the full article shown below:https://www.businesstimes.com.sg/companies-...s-online-mar-31 There's a paywall, but no worries, I will post the whole article in 2 days time when the physical newspaper is available at my uni's library. » Click to show Spoiler - click again to hide... « |

|

|

Mar 13 2023, 01:18 PM Mar 13 2023, 01:18 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(TOS @ Mar 9 2023, 07:51 PM) ilovessb.com may soon include T-bills and SGS securities stuffs, which will be helpful for newcomers to SG's risk-free space. The site is ready: https://www.ilovessb.com/sgshttps://forums.hardwarezone.com.sg/threads/...#post-146612514 Source: https://forums.hardwarezone.com.sg/threads/...#post-146663759 TaiGoh liked this post

|

|

|

|

|

|

Mar 13 2023, 05:13 PM Mar 13 2023, 05:13 PM

|

Senior Member

2,114 posts Joined: Jul 2013 |

|

|

|

Mar 13 2023, 05:31 PM Mar 13 2023, 05:31 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(leo_kiatez @ Mar 13 2023, 05:13 PM) Buy from primary market, i.e. directly from DBS/UOB/OCBC via their online portal. Free of charge for T-bills, 2 SGD charge per purchase/redemption for SSB. But again, this is limited to those with CDP account only. |

|

|

Mar 14 2023, 03:00 PM Mar 14 2023, 03:00 PM

|

|||||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

This week's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-17 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-03-17 Both 1 month and 3 month are surprisingly cooler than last week, 1 month BTC almost dropping below 2. |

|||||||||||||||

|

|

Mar 15 2023, 05:48 PM Mar 15 2023, 05:48 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

FXFA screenshots for tomorrow's 6M T-bill auction (bid ends tonight at 9 pm).

Offshore EuroSing » Click to show Spoiler - click again to hide... « Onshore » Click to show Spoiler - click again to hide... « The rates are pretty low at 3.2-3.5% p.a. Not sure if the FXFA settings have been changed... But this round of auction may throw some downside surprises. One should be mentally prepared. I double-check with Bloomberg's quote for the latest price for 6M T-bill issued 2 weeks ago. The rates are about 3.8-3.9% p.a. » Click to show Spoiler - click again to hide... « MAS published 3.91% as the closing yield for the T-bill issued 2 weeks ago, for reference. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspx This round I bid 3.85% p.a. This post has been edited by TOS: Mar 15 2023, 06:20 PM |

|

|

Mar 15 2023, 10:49 PM Mar 15 2023, 10:49 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

I think tomorrow's number auction number will be messed up...

US 6 month yield just collapsed 4%... a 20-basis-point jump down... https://www.investing.com/rates-bonds/u.s.-...onth-bond-yield |

|

|

Mar 15 2023, 11:58 PM Mar 15 2023, 11:58 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Expected Fed fund rates are collapsing rapidly. Reinvestment risk is rising.

https://www.wsj.com/livecoverage/stock-mark...YQbBAHlXQibfCvI » Click to show Spoiler - click again to hide... « This post has been edited by TOS: Mar 15 2023, 11:58 PM |

|

|

Mar 16 2023, 01:45 PM Mar 16 2023, 01:45 PM

Show posts by this member only | IPv6 | Post

#300

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Mar 15 2023, 05:48 PM) FXFA screenshots for tomorrow's 6M T-bill auction (bid ends tonight at 9 pm). Cut off yield 3.65%. Offshore EuroSing » Click to show Spoiler - click again to hide... « Onshore » Click to show Spoiler - click again to hide... « The rates are pretty low at 3.2-3.5% p.a. Not sure if the FXFA settings have been changed... But this round of auction may throw some downside surprises. One should be mentally prepared. I double-check with Bloomberg's quote for the latest price for 6M T-bill issued 2 weeks ago. The rates are about 3.8-3.9% p.a. » Click to show Spoiler - click again to hide... « MAS published 3.91% as the closing yield for the T-bill issued 2 weeks ago, for reference. https://eservices.mas.gov.sg/statistics/fda...ssuePrices.aspx This round I bid 3.85% p.a. I did not apply this time round. TOS liked this post

|

| Change to: |  0.0614sec 0.0614sec

0.57 0.57

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 06:12 AM |