Outline ·

[ Standard ] ·

Linear+

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

SUSTOS

|

Feb 9 2023, 09:31 AM Feb 9 2023, 09:31 AM

|

|

OCBC's 3.88% p.a. 8-month CPF FD should help divert some money flows in the upcoming auctions. https://www.ocbc.com/personal-banking/depos...t#section-cpftdBBCWatcher made a good analysis here: https://forums.hardwarezone.com.sg/threads/...#post-146178926QUOTE OCBC is making a fairly attractive offer, but bear in mind the most recent T-bill had an EIR of 4.04%. That's the rate you should be comparing to fixed deposits, not the T-bill's cut-off yield (COY). Then you adjust the T-bill for the shorter tenor, CPF Investment Scheme (OA) fees (if any different from the fixed deposit; maybe not), placement delay (OCBC's fixed deposit can start on any banking day), and EIR uncertainty.

On the other hand it's now possible (at least at DBS) to place a T-bill order online, from the comfort of your sofa, using CPF Ordinary Account dollars. OCBC is still requiring a trip to a branch to open their fixed deposit using CPF Ordinary Account funds. Some people may prefer the sofa-based offer.

OCBC is requiring a minimum placement of $20,000, meaning you have to have at least $40,000 in your OA to start (since you cannot invest the first $20,000). The T-bill minimum is much lower: slightly less than the $1,000 face value. Also, if you're age 55+ (or soon will be) then a T-bill can be effectively used to withdraw funds from OA via a transfer of the T-bill to your CDP account and CPF Investment Account closure. I don't think the same option is available via OCBC's fixed deposit with OA dollars.

And of course these are both short-term vehicles, not long-term ones. If your OA dollars are not going to be used relatively soon (for housing in particular) then they really should be going into one or a couple long-term vehicles. The easiest long-term vehicle is simply to transfer OA dollars to your SA. The next easiest is to transfer your OA dollars to a family member's SA or RA. (Limits apply.) But the CPF Investment Scheme (OA) offers lots of other long-term vehicles, too. This post has been edited by TOS: Feb 9 2023, 09:31 AM |

|

|

|

|

|

SUSTOS

|

Feb 13 2023, 12:51 PM Feb 13 2023, 12:51 PM

|

|

For people who are using CPF for upcoming T-bill via DBS online, the closing date is tomorrow before 12 noon. Issue Code BS23103T Issue Date 21 Feb 2023 Tenor 182 Days Open On 09 Feb 2023 06:00 PM Singapore Close On 15 Feb 2023 09:00 PM Singapore For payment by CPF, cut-off time is one working day earlier at 12 noon.Source: https://forums.hardwarezone.com.sg/threads/...#post-146252189 |

|

|

|

|

|

harmonics3

|

Feb 13 2023, 01:48 PM Feb 13 2023, 01:48 PM

|

|

Anyone knows whether one can uplift/withdraw DBS (SG) eFD on the maturity date itself (like local Malaysian eFD)?

I have my first DBS eFD maturing today and the interests credited to my saving account today but the principal is still intact in the FD account (showing same maturity date).

Unfortunately I don't remember which of the following maturity instructions I opted for when I placed the eFD:

1) Credit interests and principal to saving account

2) Credit interests to saving account and renew the principal at the same tenor

3) Renew the interests+principal at the same tenor.

Do I have to wait until tomorrow, i.e. maturity+1 day to see the update?

This post has been edited by harmonics3: Feb 13 2023, 01:49 PM

|

|

|

|

|

|

TSikanbilis

|

Feb 13 2023, 05:43 PM Feb 13 2023, 05:43 PM

|

|

QUOTE(harmonics3 @ Feb 13 2023, 01:48 PM) Anyone knows whether one can uplift/withdraw DBS (SG) eFD on the maturity date itself (like local Malaysian eFD)? I have my first DBS eFD maturing today and the interests credited to my saving account today but the principal is still intact in the FD account (showing same maturity date). Unfortunately I don't remember which of the following maturity instructions I opted for when I placed the eFD: 1) Credit interests and principal to saving account 2) Credit interests to saving account and renew the principal at the same tenor 3) Renew the interests+principal at the same tenor. Do I have to wait until tomorrow, i.e. maturity+1 day to see the update? Your fd and interests should reflect in your savings account if you choose option 1. Else you might have chosen option 2 when u placed the fd. Last time i got penalised after selecting option 2 and rate renew at board rate. Have to pay penalty fee for early withdrawal since the board rate is bad. |

|

|

|

|

|

TSikanbilis

|

Feb 13 2023, 05:45 PM Feb 13 2023, 05:45 PM

|

|

DBS FD promotion 4.88% 3 months tenure. Code SR1B.

Min 20k to 1M

|

|

|

|

|

|

ntchong

|

Feb 13 2023, 06:08 PM Feb 13 2023, 06:08 PM

|

Getting Started

|

QUOTE(ikanbilis @ Feb 13 2023, 05:45 PM) DBS FD promotion 4.88% 3 months tenure. Code SR1B. Min 20k to 1M contemplating this or MBB 12 months at 3.9% any guesses on what interest rate will be like by May/June 2023? |

|

|

|

|

|

TSikanbilis

|

Feb 13 2023, 06:13 PM Feb 13 2023, 06:13 PM

|

|

QUOTE(ntchong @ Feb 13 2023, 06:08 PM) contemplating this or MBB 12 months at 3.9% any guesses on what interest rate will be like by May/June 2023? No idea what future rates would be. I just put whatever is highest currently. 4.88% looks very good to me although it’s only 3 months tenure. Or you can take the middle road and put 50% of your fund to each FD. |

|

|

|

|

|

ntchong

|

Feb 13 2023, 06:15 PM Feb 13 2023, 06:15 PM

|

Getting Started

|

QUOTE(ikanbilis @ Feb 13 2023, 06:13 PM) No idea what future rates would be. I just put whatever is highest currently. 4.88% looks very good to me although it’s only 3 months tenure. Or you can take the middle road and put 50% of your fund to each FD. ok.. that makes sense. would like to open RHB account but alas not possible online? |

|

|

|

|

|

ntchong

|

Feb 13 2023, 08:19 PM Feb 13 2023, 08:19 PM

|

Getting Started

|

QUOTE(ikanbilis @ Feb 13 2023, 05:45 PM) DBS FD promotion 4.88% 3 months tenure. Code SR1B. Min 20k to 1M HWZ says 4.88% a bug, might revised rate |

|

|

|

|

|

SUSTOS

|

Feb 13 2023, 08:37 PM Feb 13 2023, 08:37 PM

|

|

QUOTE(ntchong @ Feb 13 2023, 08:19 PM) HWZ says 4.88% a bug, might revised rate Not a bug, it's someone leaking "sensitive" info. https://www.facebook.com/photo.php?fbid=101...24219374&type=3The 4.88% rate is supposedly for customers who bought UT products. Now need to see if DBS will honor those of you who "fast hand fast leg" deposit your money. In the worst case you will get board rate only lol |

|

|

|

|

|

TSikanbilis

|

Feb 13 2023, 08:45 PM Feb 13 2023, 08:45 PM

|

|

QUOTE(TOS @ Feb 13 2023, 08:37 PM) Not a bug, it's someone leaking "sensitive" info. https://www.facebook.com/photo.php?fbid=101...24219374&type=3The 4.88% rate is supposedly for customers who bought UT products. Now need to see if DBS will honor those of you who "fast hand fast leg" deposit your money. In the worst case you will get board rate only lol WTF! If DBS dont honor the rate then it's a real shitty bank! |

|

|

|

|

|

harmonics3

|

Feb 13 2023, 08:46 PM Feb 13 2023, 08:46 PM

|

|

QUOTE(ikanbilis @ Feb 13 2023, 05:43 PM) Your fd and interests should reflect in your savings account if you choose option 1. Else you might have chosen option 2 when u placed the fd. Last time i got penalised after selecting option 2 and rate renew at board rate. Have to pay penalty fee for early withdrawal since the board rate is bad. Just checked again after 8:30pm and I can see the principal was also credited to my saving account as well  Looks like DBS credit the interests and principal at different time within same day. Ya, I tried out the steps for premature withdrawal for my other 5-month eFD and saw there's a penalty fees of SG$10.17. However, the higher interest (3.8%pa for 5 months) due for this premature withdrawal seems to make it worthwhile even with this penalty compared to my matured 3.5%pa 3-month FD. |

|

|

|

|

|

SUSTOS

|

Feb 13 2023, 08:50 PM Feb 13 2023, 08:50 PM

|

|

QUOTE(ikanbilis @ Feb 13 2023, 08:45 PM) WTF! If DBS dont honor the rate then it's a real shitty bank! lol "chinaman" style hard to say.  QUOTE(harmonics3 @ Feb 13 2023, 08:46 PM) Just checked again after 8:30pm and I can see the principal was also credited to my saving account as well  Looks like DBS credit the interests and principal at different time within same day. Ya, I tried out the steps for premature withdrawal for my other 5-month eFD and saw there's a penalty fees of SG$10.17. However, the higher interest (3.8%pa for 5 months) due for this premature withdrawal seems to make it worthwhile even with this penalty compared to my matured 3.5%pa 3-month FD. That's funny. My USD FD at DBS has both principal and interests paid out early morning the same day. As for the penalty fee, is the 10.17 SGD fixed regardless of amount and maturity date? Or is it principal/maturity-dependent? This post has been edited by TOS: Feb 14 2023, 10:32 AM |

|

|

|

|

|

harmonics3

|

Feb 13 2023, 09:07 PM Feb 13 2023, 09:07 PM

|

|

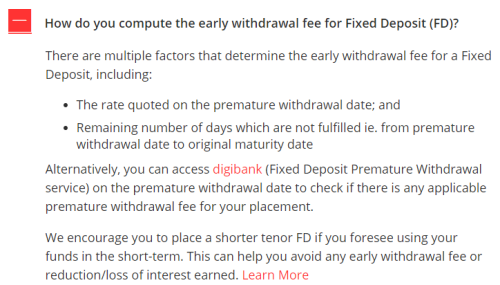

QUOTE(ikanbilis @ Feb 13 2023, 05:45 PM) DBS FD promotion 4.88% 3 months tenure. Code SR1B. Min 20k to 1M Expired already  QUOTE(TOS @ Feb 13 2023, 08:50 PM) lol "chinabank" style hard to say.  That's funny. My USD FD at DBS has both principal and interests paid out early morning the same day. As for the penalty fee, is the 10.17 SGD fixed regardless of amount and maturity date? Or is it principal/maturity-dependent? Not too sure about the 10.17 SGD penalty fee, based on DBS website below: https://www.dbs.com.sg/personal/deposits/fi...s/fixed-depositIt seems like it's determined case by case basis:  |

|

|

|

|

|

SUSTOS

|

Feb 14 2023, 01:01 PM Feb 14 2023, 01:01 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.91% | 3.98% | | Median yield | 3.8% | 3.9% | | Average yield | 3.35% | 3.17% | | BTC ratio | 2.36 | 2.71 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-1712-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-17Both 1-month and 3-month MAS bill drop below 4%. Tomorrow have to bid 3.8 liao... ---------------------------- QUOTE T-bills tide to turn in May, says DBS's Piyush Gupta https://www.theedgesingapore.com/news/banki...ss-piyush-gupta |

|

|

|

|

|

SUSTOS

|

Feb 15 2023, 06:11 PM Feb 15 2023, 06:11 PM

|

|

I bid 3.84%, just slightly below the EuroSing bid yield. Bloomberg FXFA screenshots: Offshore yields 3.86-3.91%: » Click to show Spoiler - click again to hide... « Onshore yields 4.05%: » Click to show Spoiler - click again to hide... « ikanbilis go non-comp is it?  Must double-check... |

|

|

|

|

|

TSikanbilis

|

Feb 16 2023, 01:02 PM Feb 16 2023, 01:02 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Feb 16 2023, 01:02 PM Feb 16 2023, 01:02 PM

|

|

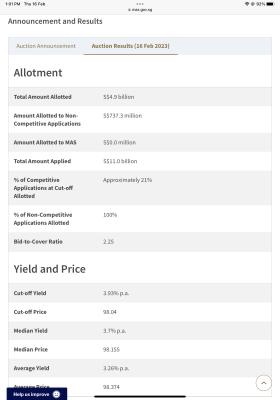

Result released pretty early today... 3.93%  Finally after dozens of failed bids.... my bid is successful again. | % of Competitive Applications at Cut-off Allotted | Approximately 21% | | % of Non-Competitive Applications Allotted | 100% | | Bid-to-Cover Ratio | 2.25 | | Cut-off Yield (Price) | 3.93% p.a. (98.04) | | Median Yield (Price) | 3.7% p.a. (98.155) | | Average Yield (Price) | 3.26% p.a. (98.374) |

Source: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-21 |

|

|

|

|

|

SUSTOS

|

Feb 18 2023, 12:37 PM Feb 18 2023, 12:37 PM

|

|

BT 170223 reports on the latest 3.93% COY 6M T-bill: » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

SUSTOS

|

Feb 21 2023, 03:04 PM Feb 21 2023, 03:04 PM

|

|

This week's MAS Bill auction results: | Tenure | 4-week | 12-week | | Cut-off yield | 3.95% | 3.99% | | Median yield | 3.78% | 3.92% | | Average yield | 3.38% | 3.59% | | BTC ratio | 2.42 | 2.46 |

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-2412-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2023-02-24Both 1-month and 3-month MAS bill still below 4%. |

|

|

|

|

Feb 9 2023, 09:31 AM

Feb 9 2023, 09:31 AM

Quote

Quote

0.0254sec

0.0254sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled