» Click to show Spoiler - click again to hide... «

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

SG Savings Bond (SSB) & Treasury Bills (T-bills), Guaranteed by Singapore Government

|

|

Nov 13 2022, 11:56 AM Nov 13 2022, 11:56 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

From BT 111122:

» Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Nov 16 2022, 02:45 PM Nov 16 2022, 02:45 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

2023 Auctions and Issuance Calendar is out

https://www.mas.gov.sg/bonds-and-bills/auct...suance-calendar |

|

|

Nov 16 2022, 04:32 PM Nov 16 2022, 04:32 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

MAS bill auction results yesterday for reference:

1M cut-off 3.89% median 3.7% average 3.1% 3M cut-off 4.42% median 4.25% average 3.76% Source: 4-week/1M: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-18 12-week/3M: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-18 This post has been edited by TOS: Nov 16 2022, 04:33 PM |

|

|

Nov 17 2022, 12:12 PM Nov 17 2022, 12:12 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Hansel @ Nov 12 2022, 02:22 PM) Emm, bro TOS,... how is the penalty calculated ? Or is it a flat rate the moment we withdraw before the due date ? Found something for you:https://forums.hardwarezone.com.sg/threads/...#post-144814517 » Click to show Spoiler - click again to hide... « This post has been edited by TOS: Nov 17 2022, 12:12 PM Hansel liked this post

|

|

|

Nov 17 2022, 05:35 PM Nov 17 2022, 05:35 PM

Show posts by this member only | IPv6 | Post

#105

|

Senior Member

2,543 posts Joined: Jan 2003 |

T bill auction 24 Nov 2022 is now open for application.

https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-29 |

|

|

Nov 17 2022, 05:43 PM Nov 17 2022, 05:43 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ikanbilis @ Nov 17 2022, 05:35 PM) T bill auction 24 Nov 2022 is now open for application. MAS only increased amount from 4.5 to 4.8 billion SGD... 6.7% increment...https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-29 |

|

|

|

|

|

Nov 17 2022, 06:04 PM Nov 17 2022, 06:04 PM

Show posts by this member only | IPv6 | Post

#107

|

Senior Member

2,543 posts Joined: Jan 2003 |

|

|

|

Nov 17 2022, 06:40 PM Nov 17 2022, 06:40 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ikanbilis @ Nov 17 2022, 06:04 PM) With all the kiasu kiasi sinkie bidding low with their cpf, the yield may be around 4% again. No... please no... I may have to bid at 4% also. Ok lah you wanna help Sporeans force hand at cheng hu to lend monies to GIC at higher rates. This is a noble effort... (beware though, PAP may not like you But I will most likely bid at 4.5%. See how next week's 3M rate goes. |

|

|

Nov 18 2022, 11:30 AM Nov 18 2022, 11:30 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Some banks offering higher rates for CPF account holders. May help to divert the fund flow to T-bills.

» Click to show Spoiler - click again to hide... « |

|

|

Nov 19 2022, 10:06 AM Nov 19 2022, 10:06 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

https://www.straitstimes.com/opinion/forum/...using-cpf-funds

QUOTE Forum: Allow online applications for SGS products for those using CPF funds PUBLISHED 5 HOURS AGO At the latest auction of Treasury Bills, I submitted a bid through my bank, since I was using funds from my Central Provident Fund (CPF) Ordinary Account. After the bills’ issue date, I found that no deduction had been made from my CPF account. My relationship manager checked, and told me that the bank had sent the signed form to the Monetary Authority of Singapore (MAS). But when I checked with MAS, it said that it had not received any bid made under my name. I have kept a copy of the application form with the bank and time stamp as proof of my bid. I think it is time that the CPF Board allowed members to apply for Singapore Government Securities (SGS) products online, instead of requiring members to apply in person at a bank branch. Goh Geok Huat |

|

|

Nov 19 2022, 06:00 PM Nov 19 2022, 06:00 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(TOS @ Nov 19 2022, 10:06 AM) Ppl who want to use cpf need to do own calculation due to the way cpf calculate interest based on the lowest balance of the month. So the month you take X out that X have no cpf interest. Hence the T-bill must be higher to cover that loss. Same concept applies when T-bill mature that month and you put back will not enjoy any cpf interest tooOnline application using CPF for T-bill is a hotly sought after feature which the banks have not implemented yet all so manual now TOS liked this post

|

|

|

Nov 20 2022, 08:22 PM Nov 20 2022, 08:22 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

» Click to show Spoiler - click again to hide... « Source: https://forums.hardwarezone.com.sg/threads/...769601/page-405 |

|

|

Nov 22 2022, 01:07 PM Nov 22 2022, 01:07 PM

|

||||||||||||

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Today's MAS Bill auction results:

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 So, tomorrow gonna bid 4.5% p.a. for the 6-month T-bill. |

||||||||||||

|

|

|

|

|

Nov 22 2022, 02:42 PM Nov 22 2022, 02:42 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Fate Collide @ Nov 22 2022, 02:34 PM) Ya, that's correct. 2% spread for selling them to the 3 primary dealers DBS, UOB and OCBC. So, time your cash flow "accurately". Onshore SGD FDs are comparable alternatives. Otherwise, you can use SSB if the interest far exceeds the (2+2 = 4) SGD transaction costs, or if you can swallow FX risk, USD FDs/US T-Bills/ US T-bill ETFs are close substitutes. This post has been edited by TOS: Nov 22 2022, 02:42 PM |

|

|

Nov 23 2022, 09:45 AM Nov 23 2022, 09:45 AM

Show posts by this member only | IPv6 | Post

#115

|

||||||||||||

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Nov 22 2022, 01:07 PM) Today's MAS Bill auction results: I bid 4% this time round. If still cannot get then i will go for DBS eFD again but i read the DBS promotion has ended. Have to wait for new promo then.

Source: 4-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 12-week: https://www.mas.gov.sg/bonds-and-bills/auct...date=2022-11-25 So, tomorrow gonna bid 4.5% p.a. for the 6-month T-bill. TOS liked this post

|

||||||||||||

|

|

Nov 23 2022, 10:14 AM Nov 23 2022, 10:14 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Nov 23 2022, 10:58 AM Nov 23 2022, 10:58 AM

Show posts by this member only | IPv6 | Post

#117

|

Senior Member

2,543 posts Joined: Jan 2003 |

QUOTE(TOS @ Nov 23 2022, 10:14 AM) Have another account SCB but i just closed the account last week when i went to SG. Too troublesome to maintain 2 accounts and their bonus saver account requires maintain sgd3k else sgd5 being charged every month. So i closed it. TOS liked this post

|

|

|

Nov 23 2022, 04:47 PM Nov 23 2022, 04:47 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(ikanbilis @ Nov 23 2022, 09:45 AM) I bid 4% this time round. If still cannot get then i will go for DBS eFD again but i read the DBS promotion has ended. Have to wait for new promo then. I received DBS FD promo today. New promo code, so I guess it's another campaign: https://forum.lowyat.net/index.php?showtopi...ost&p=105950711Anyway, I bid 4.35% p.a., pity those Sporeans... |

|

|

Nov 24 2022, 03:47 PM Nov 24 2022, 03:47 PM

Show posts by this member only | IPv6 | Post

#119

|

Senior Member

2,543 posts Joined: Jan 2003 |

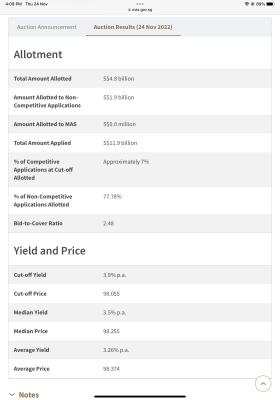

Cut off yield for T bill BS22123S 3.9%

This post has been edited by ikanbilis: Nov 24 2022, 04:10 PM TOS liked this post

|

|

|

Nov 24 2022, 04:35 PM Nov 24 2022, 04:35 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

| Change to: |  0.0460sec 0.0460sec

0.52 0.52

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 14th December 2025 - 02:42 AM |