QUOTE(DragonReine @ Apr 4 2022, 05:58 PM)

Welcome to the VWRA and chill club If can get 3 person confirmed maybe can start a list of people who hold 80% VWRA or above

Bogleheads Local Chapter [Malaysia Edisi]

|

|

Apr 4 2022, 06:00 PM Apr 4 2022, 06:00 PM

Return to original view | Post

#61

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(DragonReine @ Apr 4 2022, 05:58 PM) Welcome to the VWRA and chill club If can get 3 person confirmed maybe can start a list of people who hold 80% VWRA or above DragonReine liked this post

|

|

|

|

|

|

Apr 4 2022, 09:07 PM Apr 4 2022, 09:07 PM

Return to original view | Post

#62

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(melondance @ Apr 4 2022, 08:14 PM) It's still good, VT even carry more stocks, but of course, there's the the withholding tax issues. My friend buys VT now too because the transaction cost is way cheaper for him to DCA, and his portfolio size isn't large enough to worry about WHT tax drag yet. Once VT yearly dividend tax drag is bigger than maximum possible transaction cost of VWRA, then it's better to switch over.Welcome to the club! This post has been edited by Hoshiyuu: Apr 4 2022, 09:07 PM CoastFireSoon liked this post

|

|

|

Apr 4 2022, 09:10 PM Apr 4 2022, 09:10 PM

Return to original view | Post

#63

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(TOS @ Apr 4 2022, 08:45 PM) You missed some important points. They look the same. The largest holdings look similar. Yeap, hence the eternal SP500 vs VT vs VXUS+VTI vs SWRD/IWDA+EIMI/WSML vs VWRA portfolio discussions and disagreements. But they follow different indices. VWRA follows FTSE All World Index, VT follows FTSE Global All-Cap Index. Global All Cap has twice the no. of constituents compared to All World. Global All cap includes small cap (All world excludes small caps), hence the larger no. of constituents. ---------------------------------------------------- On top of that, VWRA follows Irish tax laws and Ireland's law, VT follows US law. They are different. Ireland is a tax haven. There is an added layer of country and regulatory risk not seen in VWRA superficially (the lower WHT comes with a hidden price). Just something to note. In the end, passive investing still depends on which indices you follow. Too many variants of indices on the streets and you will turn passive into active since people will start to compare indices (this index outperform that one... etc.) At this level of diversification and generally low costs, the choices among these start to become a way smaller concern, and the biggest impact is going to be the ability to ignore everything, deposit regularly, diligently until retirement. Thanks for the value added replies! This post has been edited by Hoshiyuu: Apr 4 2022, 09:11 PM |

|

|

Apr 4 2022, 09:22 PM Apr 4 2022, 09:22 PM

Return to original view | Post

#64

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(AthrunIJ @ Apr 4 2022, 09:12 PM) Cant wait This post has been edited by Hoshiyuu: Apr 4 2022, 09:23 PM AthrunIJ liked this post

|

|

|

Apr 6 2022, 09:28 PM Apr 6 2022, 09:28 PM

Return to original view | Post

#65

|

Senior Member

1,210 posts Joined: Nov 2011 |

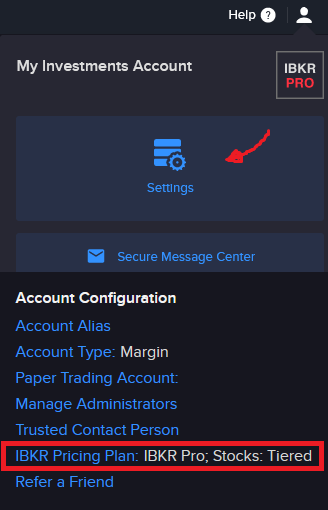

QUOTE(Ancient-XinG- @ Apr 6 2022, 09:10 PM) hi any IBKR user can answr me? Are you on Fixed Pricing? You need to swap over to Tiered Pricing to access USD 1.70 commission for Ireland/UK stocks & ETF traded in USD.i bought 1 share of VWRA, but the commission there stated 4.00 my order match 112.50, but cost is 116.00 anyone can enlighten me?  This post has been edited by Hoshiyuu: Apr 6 2022, 09:43 PM |

|

|

Apr 6 2022, 10:45 PM Apr 6 2022, 10:45 PM

Return to original view | Post

#66

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Ancient-XinG- @ Apr 6 2022, 10:33 PM) Can be changed anytime at account settings, try going to setting > bottom left, its just a click. This post has been edited by Hoshiyuu: Apr 6 2022, 11:46 PM cucumber liked this post

|

|

|

|

|

|

Apr 7 2022, 04:07 PM Apr 7 2022, 04:07 PM

Return to original view | Post

#67

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Toku @ Apr 7 2022, 03:54 PM) That is too much diversification I am afraid. And the China sector is too low. Not good for long term. No one manage your money better than yourself. Out of curiosity, what would be your ideal portfolio? How many stocks is too concentrated, how many stocks is considered diversified? How much China sector do you allocate in your portfolio? I assume you fully manage your portfolio, where do you buy and hold your holdings? This post has been edited by Hoshiyuu: Apr 7 2022, 04:07 PM |

|

|

Apr 7 2022, 05:05 PM Apr 7 2022, 05:05 PM

Return to original view | Post

#68

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Davidtcf @ Apr 7 2022, 04:33 PM) Yeap, that's what I thought too. So I am curious what his portfolio would look like. For individual stock investors, their satisfied level of diversification can be anywhere between 5 to 50 or more, so I am curious of his definition and platform of investment. |

|

|

Apr 7 2022, 09:57 PM Apr 7 2022, 09:57 PM

Return to original view | Post

#69

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(TOS @ Apr 7 2022, 08:11 PM) I refer to Bogleheads as having faith in index providers' analysis and judgements, not the ETFs/index funds themselves (maybe the fund managers have, but still they are bound by the fund's prospectus and other legal documents which govern the funds' operations). Great discussion points like yours are always appreciated and welcomed. Part of the problem with Bogleheads community is that there really isn't much to talk about, doubly so when we don't even need to discuss tax-advantage/exempt/disadvantage accounts.So, the manager of the index funds just follow the index, and "Bogleheads" would buy the index. If you trace the money, it's Bogleheads who buy the index (and maybe some others who want a piece of the index in their portfolio). Why would someone buy a product if they don't have faith in it, right? The complicated analysis and judgements are done by the the index providers, like S&P, FTSE, MSCI etc. They have "methodologies" to follow in choosing the index constituents. E.g. this is MSCI's "methodologies": https://www.msci.com/index-methodology Ya, nothing fancy. It's just a philosophy, there are different ways of investing out there. But since this thread is about Bogleheads in Malaysia, I presume we just stick to Bogleheads stuff here. I am not sure if active vs passive/Bogleheads discussions/debates are allowed in this "local chapter". And yes, we are definitely here to make money. The only thing that differs is how to make money, i.e. the approach (whether the process involves too much costs etc.) Plus, any constructive discussion of non-Bogleheads is also healthy, either it'll point out faults of Bogleheads or reaffirms other Bogleheads to stay the course. Always welcomed to have more activity here. TOS liked this post

|

|

|

Apr 9 2022, 02:38 PM Apr 9 2022, 02:38 PM

Return to original view | Post

#70

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(chiacp @ Apr 9 2022, 11:42 AM) As a boglehead, there are a couple of investment philosophy i believe in. That's the spirit. Buy and hold the entire haystack, earn average return, don't take uncompensated risks, be productive in life instead. Check account upon retirement 1. Long term buy and hold is the best policy. 2. Costs is BAD. Therefore frequent trading just increases cost. 3. Diversification ie. Buying the whole market to hedge against all scenarios (as much as possible) I dont pretend to be better than the anyone else in stock picking; over long term, the "best" active managers has NOT done better than a passively held whole market low cost ETF. I dont know whats the next top stocks or what the interest rate going to be. Nor do I care to crack my head trying to research them. Investing is ensure more free time to do what is important to me and have a good night's sleep without looking at what the stock markets are doing on a regular basis. |

|

|

Apr 10 2022, 06:03 AM Apr 10 2022, 06:03 AM

Return to original view | Post

#71

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(jutamind @ Apr 9 2022, 03:29 PM) Just an open question, for those opting to buying stocks/ETF via foreign trading platform, what's your plan for estate planning just in case we KO unexpectedly/prematurely? Does your family members/spouse have the capability to manage your portfolio/repatriate your money back to Malaysia by themselves? Hmm, I am a little on the younger side, so I'm not sure how valid my opinion is, or perhaps people would think less of me for being on the paranoid side, but I'll share it anyway.This is the only factor that prevent me from investing big amount in foreign trading platform and opt for local robo/local based US trading platform First of all, I invest primarily in VWRA, an Irish-domiciled ETF. I will never have an holding of more than 60k in US stocks/ETF/cash in my IBKR account so I shouldn't be liable for any US estate tax concerns. I've told my close family that I have foreign investment, and that in the event of my demise, they are free to help themselves to it, at least I would have paid for my own funeral. As a backup plan, I've also prepared a document detailing my access info, screenshots of how to liquidate my portfolio, my withdrawal routes, as well as instructions on how to contact IBKR for assistance should they are unable to or unwilling to pretend to be me and access my funds. Of course, there's always an option to proceed with my will and death certificate to access it legally - if it does come to this, and they find it worth the trouble. The document is then stored in an encrypted volume requiring PASSWORD_A, attached to my gmail on scheduled send in 6 months, and also stored in a physical thumbdrive, mentions that password will be emailed in 1 month. Then in another gmail account, PASSWORD_A is also on scheduled send in 7 months. Then, I set an reminder to myself to renew the send date every 5 or so months to keep it from sending out until I die, acting like a dead man's switch. This should keep my access detail safe even if I made a mistake now and then (e.g. forget to renew encrypted volume send date), stolen, or my relationship with my family deteriorates in the future. If it sounds mega paranoid, it is. I am a selfish person and my benefits should always comes first above all else. I wouldn't trust a second soul to access any of my finances as long I am still alive. I've seen enough bad story regarding family and money as it is. TL;DR: Family is aware of where I am invested, will have access to my investment as soon as my death certificate is issued, or in 7 months as a backup. This post has been edited by Hoshiyuu: Apr 10 2022, 06:08 AM walau2020 liked this post

|

|

|

Apr 10 2022, 12:19 PM Apr 10 2022, 12:19 PM

Return to original view | Post

#72

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(AthrunIJ @ Apr 10 2022, 10:48 AM) It's just a one time setup, I believe it took me a day to get everything in order - maintenance is about 5min every 5 or so months. It's alright I guess? I tried to minimize the effort needed to maintain it so I would maintain it, haha.QUOTE(yklooi @ Apr 10 2022, 11:20 AM) Just another just in case scenario,... What if you did not die but just incapacitated,... Unable to communicates.... Does Yr family members has access to Yr password so as the liquidate some investment money for you to use? Well, if I am incapacitated enough that I couldn't reset my dead man's switch, they would get access to my account in 6 months. If I am incapacitated to that point I would be at their mercy regardless, which I do hope I will have a good enough relationship to be in their care without being taken advantage of.QUOTE(Davidtcf @ Apr 10 2022, 11:41 AM) From what he wrote it seems he will not share his passwords as long he’s still alive. Meaning using lawyer letter or death cert to claim those investment. If so it will incur 40% estate tax if investments are in IBKR. My will is only applicable at my death, and I believe estate tax will not be applicable to my fund in any scenario. Unless you have something in mind that I may have missed? I would very much appreciate the advice.If you trust your loved ones enough then you can share the logins. Even if they were to access and sell all your shares they can’t withdraw to their own account.. need to withdraw to account with same name. But sometimes is not about the greed part.. is how some family members might make noise, lecture you, keep probe and criticise etc type. If so I understand why some would not want to share their logins also. This post has been edited by Hoshiyuu: Apr 10 2022, 12:19 PM |

|

|

Apr 12 2022, 01:38 AM Apr 12 2022, 01:38 AM

Return to original view | Post

#73

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(sgh @ Apr 11 2022, 06:45 PM) Now is year 2022 new era ppl are not so fixated on marriage they pursue solo freedom and happiness which mean can really be single all the way till death. It is a choice now compared to olden times. I will respect their choice. As to how they explain to their parents I guess they need find a way somehow. QUOTE(DragonReine @ Apr 11 2022, 07:25 PM) Even married people these days keep finances separate, and it's not like it's THAT complicated if they decide to change nomination/will arrangements. Pretty much, yeah. I'll be looking for a great roommate more than a classic wife, so to say. We will appreciate financial independence, we will be okay that we have both shared and personal finances, we will not have kids.The above makes sense from a single person perspective who don't trust family taking advantage of their wealth, might be complicated but that's their choice. I've talking to my parents, and my dad's pretty modern and have 0 Chinese "the family-line have to go on" mentality, my mom slowly warmed up over the years as she saw more and more marriage and family fail around us. Didn't take much to convince them nor there were much objections, thankfully. Plus, it only sounds complicated when you type it out like that QUOTE(Davidtcf @ Apr 11 2022, 11:27 PM) Ic. If you trust enough then ok to go ahead, since that person holding your bank access but didn’t abuse it. Completely opposite of me, my parents have full trust and confidence in each other. I am pretty sure my dad just tosses everything he makes to my mom let her manage everything finance related, hahaha. This does mean he does occasionally need to ask for money (that he made) for cigarettes at times.Me and my wife has separate bank accounts and we don’t share access.. heck won’t know exactly what each have inside also haha. If I die one day before her she can ask lawyer help to access my bank accounts, even without will as long we remained married.. so I don’t feel need to grant her access while I’m still alive. I know some people might even have one account where both husband and wife share it.. we are not at that level 😅 if wanna invest that time sure headache also will this setup.. in the end still need account under own name. |

|

|

|

|

|

Apr 12 2022, 02:07 AM Apr 12 2022, 02:07 AM

Return to original view | Post

#74

|

Senior Member

1,210 posts Joined: Nov 2011 |

For those who are concerned:

QUOTE(IBKR) IB does not determine the Estate procedure and handling of your account. Rather, the laws in your part of Malaysia do. For any tax questions, it's best to discuss those matters with a qualified tax advisor in your country. IB does not withhold any Estate taxes. This post has been edited by Hoshiyuu: Apr 12 2022, 02:08 AMIf IB receives Letters Testamentary, will will pay out to your Estate. If IB receives a Certificate of Inheritance, we'll pay out to the listed heirs. Thank you, Patrick R IB Estate Services |

|

|

Apr 19 2022, 11:43 AM Apr 19 2022, 11:43 AM

Return to original view | Post

#75

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(rEvivEd- @ Apr 19 2022, 10:20 AM) Hi guys newbie to trading here. Just to balance out the discussion, my two cents as a staunch supporter of the Bogleheads philosophy will always be VWRA and chill, spend the time maximizing your income and enjoy life.My plan to start @ 10K into ETF ( looking at CSPX or VWRA) or is there another ETF or combinations I should look at? Onwards I’ll prolly DCA into the etf that I am putting into. Which is the best path / route should I take. TIA With my full respects and as Ramjade may have mentioned that it's not for everyone - while selling options is a solid income sources, do not mistake it as effortless free lunch. Going in without proper homework and an already large enough capital may not be the best of ideas. Plus, there is also a small chance that the premiums you've earned might be lower than just simply holding it when market is in bull season. I have my eyes set on that income sources too, but personally, I wouldn't treat the underlying securities as the backbone of my portfolio, and I would only do it when I can easily afford multiple contracts with just 20% of my portfolio, probably in my latter years when I have retired from my day job. Criticism, corrections and discussion very much welcomed! I am happy to learn more and even happier to be corrected. |

|

|

Apr 22 2022, 07:06 AM Apr 22 2022, 07:06 AM

Return to original view | Post

#76

|

Senior Member

1,210 posts Joined: Nov 2011 |

|

|

|

Apr 22 2022, 08:16 PM Apr 22 2022, 08:16 PM

Return to original view | Post

#77

|

Senior Member

1,210 posts Joined: Nov 2011 |

The Boglehead's take: It's all just noise, barely a blip in 10 years much less 30, stay the course.

|

|

|

Apr 24 2022, 03:41 PM Apr 24 2022, 03:41 PM

Return to original view | Post

#78

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(walau2020 @ Apr 24 2022, 03:03 PM) Aha~ boglehead thread in lowyat forum. 15% of my portfolio is small cap value-tilt (about twice the size of normal small cap allocation) implemented via factor filtered small cap ETFs provided by Avantis in a 60% US 40% ex-US ratio. (AVUV 9%, AVDV 6%) Btw, does anyone here implement factor investing in their portfolio? Personally I don't believe it's a move a true purist Boglehead's would do, so I wouldn't recommend that actively to anyone here. But my reasoning for this allocation is that: 1. VWRA do not contain any small caps. 2. Large-medium caps and small-caps rotates in performance much like International and US performance rotates. 3. Unfiltered small caps Unfiltered small caps often have too much bad stocks dragging it's performance down. So I'm only taking slightly more compensated risk to complement my portfolio and every so slightly increased the long term (~20y) expected rewards (~0.5% or so). However my strong recommendation is still to avoid complexity as much as possible, and go with a life-long 2-fund portfolio of VWRA+(VAGU/AGGU). This post has been edited by Hoshiyuu: Apr 24 2022, 03:48 PM |

|

|

Apr 24 2022, 10:42 PM Apr 24 2022, 10:42 PM

Return to original view | Post

#79

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(encikbuta @ Apr 24 2022, 10:21 PM) oh cool, you're implementing the Rational Reminder Model Portfolio! I was looking into this but was a bit hesitant when i found out that AVDV does not invest in emerging markets (no China & South East Asia Ah, I'm only implementing it on the small caps part of my portfolio (VWRA+AVUV+AVDV), while a proper RR factor tilted portfolio would apply it to large and medium caps too.Emerging markets are generally one hell of a mixed bag leaning towards mostly negative anyway, so I am only interested in the large caps of EMs which are already included in VWRA - and I don't need factor tilting for that. And yeah, I don't really see a reason to buy generic small cap or small cap blends - even among factor filtered ones, Avantis (basically Dimensional really) seems to be the only ones implementing the Fama French asset pricing model properly. Still, kinda happy to meet folks who knows about Rational Reminder on this forum too. This post has been edited by Hoshiyuu: Apr 24 2022, 10:58 PM encikbuta liked this post

|

|

|

Apr 27 2022, 10:15 AM Apr 27 2022, 10:15 AM

Return to original view | Post

#80

|

Senior Member

1,210 posts Joined: Nov 2011 |

With major indices going on a discount recently, I'd imagine there are a few investors thinking whether to act on the price changes or not, so here's my 2 cents:

It doesn't matter if you are a Boglehead. Stay the course. Invest early, invest often, stay invested, time in the market beats timing the market. That is to say, set up an amount you are comfortable to DCA in fixed interval, amend that amount when your financials changes. If you receive a windfall/a sudden sum of extra money that can be invested, invest all of them as early as you can. If you insist on "buying on a discount"... Best case scenario, you save a few bucks per share buying at the absolute dip, but the chances that you buying at the "right time" every time for the rest of your portfolio's life span is basically 0 so it's all gonna even out. Worst case scenario... you miss the best days of the market that almost single handedly defines your total returns. miss the best days of the market.  What if you just bought in at the worst possible time? The world's worst market timer Should I hold onto my cash and wait for it to drop more? Buy the dip! (For lower returns?) This post has been edited by Hoshiyuu: Apr 27 2022, 10:16 AM |

| Change to: |  0.0399sec 0.0399sec

0.21 0.21

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 09:34 PM |