QUOTE(AthrunIJ @ Apr 4 2022, 09:02 AM)

So how do bogleheads choose their ETF of choice?

I have limited fund and around 3 or 4 ETFs to invest in.

VUAA, VWRA, SWRD.

My plan is to just invest straight into one of them probably hit the goal then rotate to the other ETFs.

Or can get some advice from sifus here. 👀😬

Some info regarding my portfolio.

SA - RM60k (include simple)

Local burse - RM85k

Soon International ETFs - RM10k

The goal is to buy the entire haystack, not look for a needle in it that's outperforming.

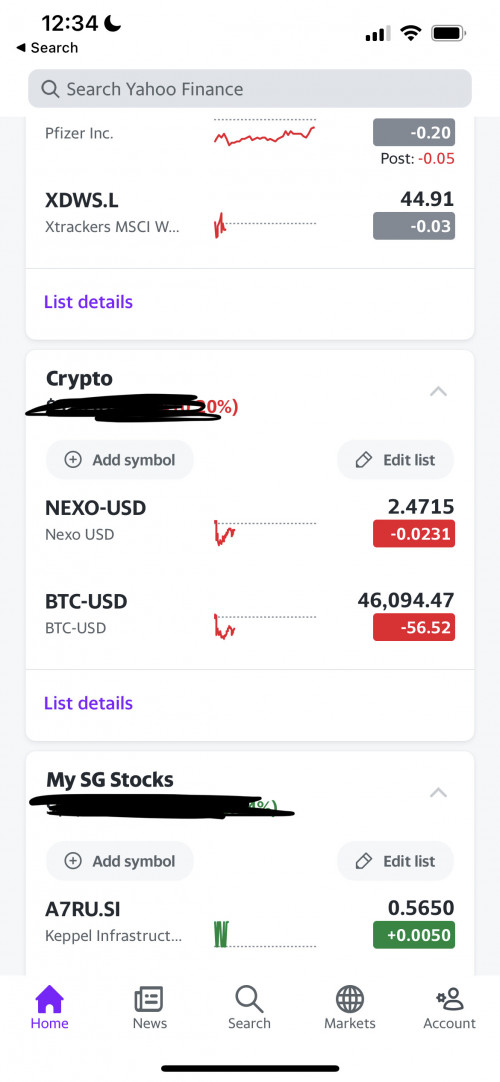

For classic American Bogleheads, it's simple, the equities part of the portfolio is either VT (~9300 stocks globally, Large,Mid,Small caps by market weight) which auto balances to roughly 60US:40ex-US, or VTI (US total market)+VXUS (ex-US total market) at their preferred ratio.

For us Malaysians, due to withholding tax concerns and that there is no direct VT and VTI+VXUS equivalent, we often buy their Irish-domiciled equivalent ETFs to mimic the portfolio. From there, we decide what kind of coverage we want.

VWRA/VWRD (Recommended):=Less stock due to missing small caps, but still holds 85% of the invest-able market cap.

+Single ticker portfolio possible

+Overall higher return overtime compared to VT due to 15% withholding tax

VWRD+WSML(Developed countries small caps):

+Covers Global large and mid caps and developed countries small caps

-Lacks emerging market small caps

VWRD+WSML+EIMI(Emerging market all caps):

+Almost fully replicates VT

-Terrible for rebalancing

For me personally, I strongly recommend VWRA and chill - one ticker, 0 rebalance troubles, save transaction cost.

However, I should put out a disclaimer that my actual portfolio is VWRA (80%), AVUV(9%), AVDV(6%), Others (5%) and I do strongly recommend against this portfolio.

AVUV and AVDV are my choices due to Avantis's factor filtered small caps have empirical evidence that it out performs general market-weighted small cap ETFs. They are however US-domiciled, but the re-balancing cost is low and dividends is not much of a concern for small caps stocks.

So that is how I've come to the conclusion to what I hold.

--------

Why I dont hold X:

Stashaway:Actively managed funds with high fees (0.7% a year for my level), severely underperforms everything, could not commit to their portfolio and high turnover for what is touted as passive investing.

After I've started my DIY portfolio, Stashaway has zero value to me at all angles and I've fully dropped it.

Local bursa:The notable companies in Bursa is also already included in VWRA.

Furthermore, Bursa has spent the last 20 years trading sideways with 0 improvement, gains come from swings but not overall market growth, political and currency risk threatens it everyday, and a strong, consistent foreign fund outflow meant it's hopeless eventually. Not to mention the trading costs are ironically higher than foreign stocks. Strong pass, I will not waste my time and money here.

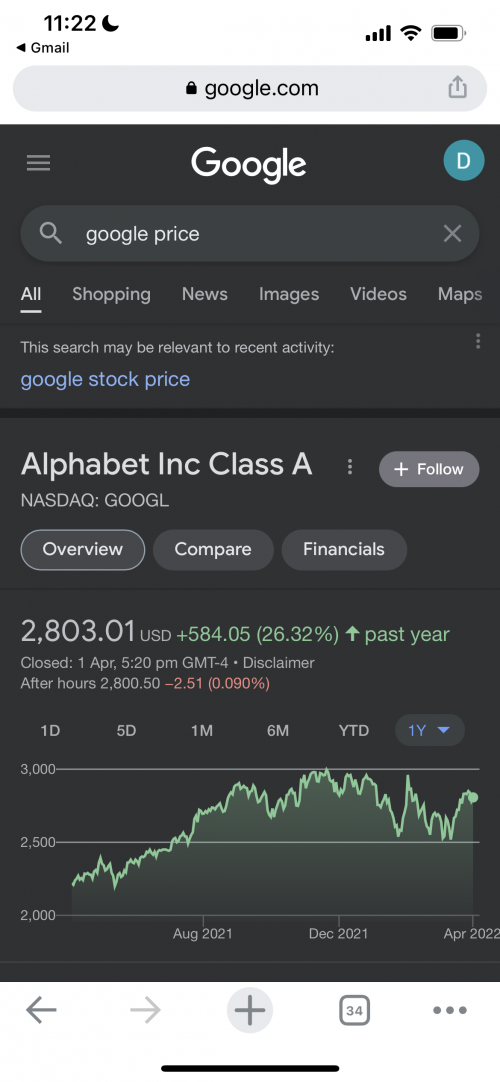

VUAA/CSPX/SP500:Insanely overvalued, too concentrated. Winners rotate and historically speaking, US and ex-US market take turns winning. I'll play on both sides instead of betting US will win forever and maintain my average returns. If I am buying the haystack anyway, why limit myself to only parts of the haystack? And for those who love tech stocks, no AMD, no TSMC, no TencentBaba here.

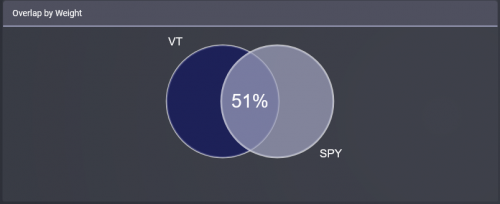

SWRD:obsolete in my portfolio due to superior VWRA holdings, and if I buy both, they overlap quite much and will overweight a lot of stocks in my portfolio (VWRA tracks FTSE, SWRD tracks MSCI, it's generally not good to track multiple overlapping indexes).

--------

Finally

, fees, fees, fees.It's very important, so I'll repeat it 3 times.

Every ringgit that doesn't end up in your portfolio is potentially 10 ringgit that has gone into the shitter. This is why everyone should be extremely vary of the percentage based on going cost.

If the market is down bad and returns barely 2% a year, 0.7% (Stashaway) fees will erode your portfolio return to well below 3 month FD rates. And ironically enough, higher cost portfolio almost never give higher returns contrary to popular beliefs.

If you invest RM1000 a month, buying 4 different tickers that cost 2USD per transaction, on top of forex...before you know it, your real invested ringgit amount is only ~RM950 ish. Then when rebalancing is needed, double that cost. You will not be a happy man when you see your IBKR report and commission and cost ate a solid percent out of your yearly returns.

Criticism and discussion welcomed!This post has been edited by Hoshiyuu: Apr 4 2022, 09:55 AM

Mar 29 2022, 12:34 PM

Mar 29 2022, 12:34 PM

Quote

Quote

0.0419sec

0.0419sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled