QUOTE(Takudan @ May 2 2023, 10:32 PM)

Ah, you mean open without pass. Ok ok. Without pass, choice is indeed limited, only aware of CIMB SG and Maybank SG, same situation as opening a bank account in SG.

Anyone know about foreign FD?

|

|

May 2 2023, 10:37 PM May 2 2023, 10:37 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Takudan @ May 2 2023, 10:32 PM) Ah, you mean open without pass. Ok ok. Without pass, choice is indeed limited, only aware of CIMB SG and Maybank SG, same situation as opening a bank account in SG. Takudan liked this post

|

|

|

|

|

|

May 3 2023, 04:28 AM May 3 2023, 04:28 AM

Show posts by this member only | IPv6 | Post

#722

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(Takudan @ May 2 2023, 10:32 PM) ELIGIBILITY SC requirements as below:Nationality: Singapore citizen / Singapore permanent resident / foreigner Age requirement: Minimum 18 years old Eligibility Singaporeans or Singapore Permanent Residents 18 years and above Foreigners with Employment Pass or Work Permit Holders Ah, I browsed through 3 of the links you shared. - Standard Chartered looks A-OK as long as we have the required documents listed for foreigners. - RHB one doesn't allow it - Bank of China one I couldn't find anything about eligibility so I'm not sure... I only have CIMB SG to test it myself, that's why I could only confirm for this If you are a foreigner, please prepare: Passport (front & back) - at least 6 months validity Plus, any of the following as residential proof: Latest utility or telecommunications bill Latest bank or credit card statement Tenancy agreement Letter from employer Government-issued documents stating address (e.g. IRAS, CPF, ICA) At the end of the day easier to use SingPass or MyInfo 🤦♀️ |

|

|

May 4 2023, 11:45 PM May 4 2023, 11:45 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

OCBC "restarted" offering CPF OA FD for a few weeks, then stopped again... quietly stopped some more...

https://forums.hardwarezone.com.sg/threads/...#post-147413868 Really chinaman bank style... |

|

|

May 5 2023, 01:18 PM May 5 2023, 01:18 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

» Click to show Spoiler - click again to hide... « Source: pclow59/HWZ, 联合早报 This post has been edited by TOS: May 5 2023, 01:22 PM |

|

|

May 12 2023, 05:57 PM May 12 2023, 05:57 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

HK overnight HIBOR spiked to 4.81% p.a. yesterday, a 16-year high. HKD liquidity tightening. Small-medium banks all upped their short-term FD rates. Even virtual banks followed suit. PAOB 3-month FD rate raised to 3.7%, upped 50 basis points. Welab's rate upped 110 basis points to 3.6% p.a. https://finance.mingpao.com/fin/daily/20230...%a9%ba%e9%96%93 on2920 liked this post

|

|

|

May 16 2023, 01:25 PM May 16 2023, 01:25 PM

|

Senior Member

9,353 posts Joined: Aug 2010 |

QUOTE(TOS @ May 12 2023, 05:57 PM) HK overnight HIBOR spiked to 4.81% p.a. yesterday, a 16-year high. HKD liquidity tightening. Good for FD enthusiasts.Small-medium banks all upped their short-term FD rates. Even virtual banks followed suit. PAOB 3-month FD rate raised to 3.7%, upped 50 basis points. Welab's rate upped 110 basis points to 3.6% p.a. https://finance.mingpao.com/fin/daily/20230...%a9%ba%e9%96%93 Bad for MNACT & Mapletree Logistics Trust. The borrowing cost is really a huge thing to a REIT. I looked closely at the Cromwell Euro REIT presentation slides for 1QFY23 just now.... |

|

|

|

|

|

May 16 2023, 01:26 PM May 16 2023, 01:26 PM

|

Senior Member

9,353 posts Joined: Aug 2010 |

QUOTE(TOS @ May 4 2023, 11:45 PM) OCBC "restarted" offering CPF OA FD for a few weeks, then stopped again... quietly stopped some more... I'm with OCBC, bro,... DBS too.https://forums.hardwarezone.com.sg/threads/...#post-147413868 Really chinaman bank style... |

|

|

May 22 2023, 09:09 AM May 22 2023, 09:09 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

UOB 6-month and 12-month deposit rates drop to 3.1% p.a. Min fresh fund 10k SGD.

Sourced from lzydata/HWZ. |

|

|

May 22 2023, 10:49 AM May 22 2023, 10:49 AM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

HKD and USD promo FDs for HK banks:

» Click to show Spoiler - click again to hide... « Sourced from 香港明报 Money Monday 220523. |

|

|

May 22 2023, 11:58 AM May 22 2023, 11:58 AM

Show posts by this member only | IPv6 | Post

#730

|

Senior Member

1,056 posts Joined: Jun 2011 From: Kuala Lumpur, Malaysia |

|

|

|

May 22 2023, 12:32 PM May 22 2023, 12:32 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Takudan @ May 22 2023, 11:58 AM) lol those promo FDs are meant for new users/fresh funds only. The starting amount isn't small either. 10k-30k USD in some cases.You will need a HK address and HK identity card to open an account at most HK banks. For banks which require online account opening, their apps may not be available at other jurisdictions like Malaysia (i.e., you need to connect to HK VPN of fly to HK and connect to Internet there for the app to be shown on your phone's app store). » Click to show Spoiler - click again to hide... « |

|

|

May 26 2023, 06:52 PM May 26 2023, 06:52 PM

|

Senior Member

924 posts Joined: Aug 2013 |

For those who are thinking of investing in foreign currency FD and don't mind doing so in the domestic banks, I think RHB MCA account is really a good option.

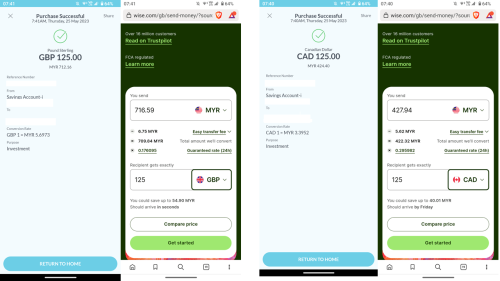

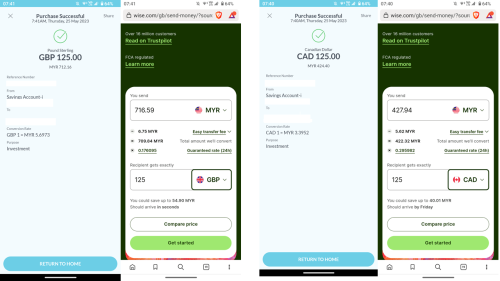

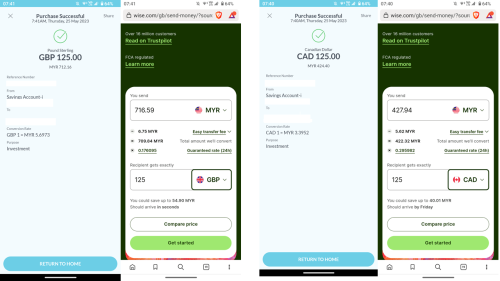

Pros 1. Possibly the best rate in the market, it's even better than Wise for sure. 2. All balances receive very competitive interest, calculated daily, credited monthly. (no lock-up period, but rate is lower than FD). 3. Insured by PIDM up to RM250k. Cons 1. Only useful for keeping foreign currencies in your own RHB account 2. Outward TT will incur fees, inward TT is free though. So conversion from different currencies between different bank accounts across countries, Wise would be better. 3. Limited to 24 currencies, Wise have more currencies. 4. Each conversion must involve Ringgit. IE say to convert between USD and EUR, U need to convert USD to MYR first, then MYR to EUR, so you lose on the double spread. Wise is better for direct conversion between any pair of currencies not involving ringgit. Every month, on salary date, I just put some money into the high yielding currencies of AUD, CAD, GBP, NZD, SGD and USD. Call rate as of today: AUD (3.25%), CAD (4%), GBP (4.1%), NZD (4.5%), SGD (3.4%), USD (4.95%). Comparison of rates between RHB and Wise as at 25 May 2023 morning, of conversion from Ringgit into the respective currencies. Rate from Wise website is taken at the same time I did conversion from Ringgit. USD125: RHB (RM576.13), Wise (RM580) AUD125: RHB (RM377.66), Wise (RM380.21) GBP125: RHB (RM712.16), Wise (RM716.59) CAD125: RHB (RM424.40), Wise (RM427.94) NZD125: RHB (RM352.58), Wise (RM355.36) SGD125: RHB (RM427.59), Wise (RM431.47) I don't put into FD in RHB MCA account as it required 2000unit foreign currency for initial deposit, and interest will only be credited after tenure is completed. Plus, there's only small difference in interest rate between call account and FD account for most currencies. https://www.rhbgroup.com/personal/deposits/...view/index.html    This post has been edited by Mr Gray: May 26 2023, 07:13 PM |

|

|

May 26 2023, 07:39 PM May 26 2023, 07:39 PM

Show posts by this member only | IPv6 | Post

#733

|

Senior Member

4,652 posts Joined: Jan 2003 |

QUOTE(Mr Gray @ May 26 2023, 06:52 PM) For those who are thinking of investing in foreign currency FD and don't mind doing so in the domestic banks, I think RHB MCA account is really a good option. You can use weekly Term Deposit rather letting the money to sit idle 🤦♀️ as certain currencies have weekly term for itPros 1. Possibly the best rate in the market, it's even better than Wise for sure. 2. All balances receive very competitive interest, calculated daily, credited monthly. (no lock-up period, but rate is lower than FD). 3. Insured by PIDM up to RM250k. Cons 1. Only useful for keeping foreign currencies in your own RHB account 2. Outward TT will incur fees, inward TT is free though. So conversion from different currencies between different bank accounts across countries, Wise would be better. 3. Limited to 24 currencies, Wise have more currencies. 4. Each conversion must involve Ringgit. IE say to convert between USD and EUR, U need to convert USD to MYR first, then MYR to EUR, so you lose on the double spread. Wise is better for direct conversion between any pair of currencies not involving ringgit. Every month, on salary date, I just put some money into the high yielding currencies of AUD, CAD, GBP, NZD, SGD and USD. Call rate as of today: AUD (3.25%), CAD (4%), GBP (4.1%), NZD (4.5%), SGD (3.4%), USD (4.95%). Comparison of rates between RHB and Wise as at 25 May 2023 morning, of conversion from Ringgit into the respective currencies. Rate from Wise website is taken at the same time I did conversion from Ringgit. USD125: RHB (RM576.13), Wise (RM580) AUD125: RHB (RM377.66), Wise (RM380.21) GBP125: RHB (RM712.16), Wise (RM716.59) CAD125: RHB (RM424.40), Wise (RM427.94) NZD125: RHB (RM352.58), Wise (RM355.36) SGD125: RHB (RM427.59), Wise (RM431.47) I don't put into FD in RHB MCA account as it required 2000unit foreign currency for initial deposit, and interest will only be credited after tenure is completed. Plus, there's only small difference in interest rate between call account and FD account for most currencies. https://www.rhbgroup.com/personal/deposits/...view/index.html    Hansel liked this post

|

|

|

|

|

|

May 26 2023, 07:42 PM May 26 2023, 07:42 PM

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(xander2k8 @ May 26 2023, 07:39 PM) You can use weekly Term Deposit rather letting the money to sit idle 🤦♀️ as certain currencies have weekly term for it term deposit requires a minimum of 2000 units of foreign currency for initial deposit. My monthly deposit and total deposit is way smaller than that. Any balances still generates interest, the money is not sitting idle. If you have more than 2000 units of FC, feel free to put it into term deposit and get higher interest rate. Your choice.This post has been edited by Mr Gray: May 26 2023, 07:44 PM Hansel and CommodoreAmiga liked this post

|

|

|

May 28 2023, 01:01 PM May 28 2023, 01:01 PM

|

Senior Member

9,353 posts Joined: Aug 2010 |

Good discussions above, bros,....

|

|

|

May 31 2023, 02:58 PM May 31 2023, 02:58 PM

|

Junior Member

525 posts Joined: Jan 2003 From: 25.18.122.57 |

QUOTE(Mr Gray @ May 26 2023, 06:52 PM) For those who are thinking of investing in foreign currency FD and don't mind doing so in the domestic banks, I think RHB MCA account is really a good option. Inward TT is free of charge?Pros 1. Possibly the best rate in the market, it's even better than Wise for sure. 2. All balances receive very competitive interest, calculated daily, credited monthly. (no lock-up period, but rate is lower than FD). 3. Insured by PIDM up to RM250k. Cons 1. Only useful for keeping foreign currencies in your own RHB account 2. Outward TT will incur fees, inward TT is free though. So conversion from different currencies between different bank accounts across countries, Wise would be better. 3. Limited to 24 currencies, Wise have more currencies. 4. Each conversion must involve Ringgit. IE say to convert between USD and EUR, U need to convert USD to MYR first, then MYR to EUR, so you lose on the double spread. Wise is better for direct conversion between any pair of currencies not involving ringgit. Every month, on salary date, I just put some money into the high yielding currencies of AUD, CAD, GBP, NZD, SGD and USD. Call rate as of today: AUD (3.25%), CAD (4%), GBP (4.1%), NZD (4.5%), SGD (3.4%), USD (4.95%). Comparison of rates between RHB and Wise as at 25 May 2023 morning, of conversion from Ringgit into the respective currencies. Rate from Wise website is taken at the same time I did conversion from Ringgit. USD125: RHB (RM576.13), Wise (RM580) AUD125: RHB (RM377.66), Wise (RM380.21) GBP125: RHB (RM712.16), Wise (RM716.59) CAD125: RHB (RM424.40), Wise (RM427.94) NZD125: RHB (RM352.58), Wise (RM355.36) SGD125: RHB (RM427.59), Wise (RM431.47) I don't put into FD in RHB MCA account as it required 2000unit foreign currency for initial deposit, and interest will only be credited after tenure is completed. Plus, there's only small difference in interest rate between call account and FD account for most currencies. https://www.rhbgroup.com/personal/deposits/...view/index.html    Meaning, if I transfer US$1000 from an oversea bank into this account, I would receive US$1000? Of course we don't take into account the fee charge by the overseas bank. |

|

|

May 31 2023, 06:49 PM May 31 2023, 06:49 PM

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(Ethan @ May 31 2023, 02:58 PM) Inward TT is free of charge? Correction. There's only RM5 fee.Meaning, if I transfer US$1000 from an oversea bank into this account, I would receive US$1000? Of course we don't take into account the fee charge by the overseas bank. https://www.rhbgroup.com/others/highlights/...0908/index.html So yup, u should get US1000, minus RM5 |

|

|

May 31 2023, 08:06 PM May 31 2023, 08:06 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Ethan @ May 31 2023, 02:58 PM) Inward TT is free of charge? Meaning, if I transfer US$1000 from an oversea bank into this account, I would receive US$1000? Of course we don't take into account the fee charge by the overseas bank. QUOTE(Mr Gray @ May 31 2023, 06:49 PM) Correction. There's only RM5 fee. rhb mca has no inward fee... u get full 1khttps://www.rhbgroup.com/others/highlights/...0908/index.html So yup, u should get US1000, minus RM5 |

|

|

May 31 2023, 08:27 PM May 31 2023, 08:27 PM

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(dwRK @ May 31 2023, 08:06 PM) Yes you're right https://www.rhbgroup.com/files/personal/mul...account-faq.pdf  dwRK liked this post

|

|

|

May 31 2023, 08:35 PM May 31 2023, 08:35 PM

|

Senior Member

6,230 posts Joined: Jun 2006 |

usd 5.25% liao for 3 months...

|

| Change to: |  0.0242sec 0.0242sec

0.20 0.20

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 01:49 AM |