How does a high deductible standalone medical insurance work?

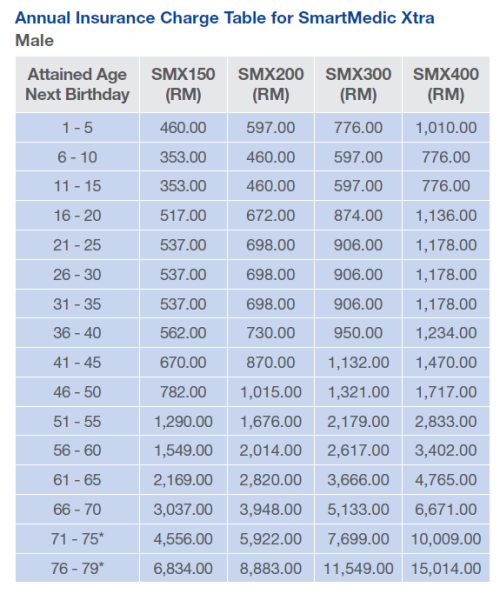

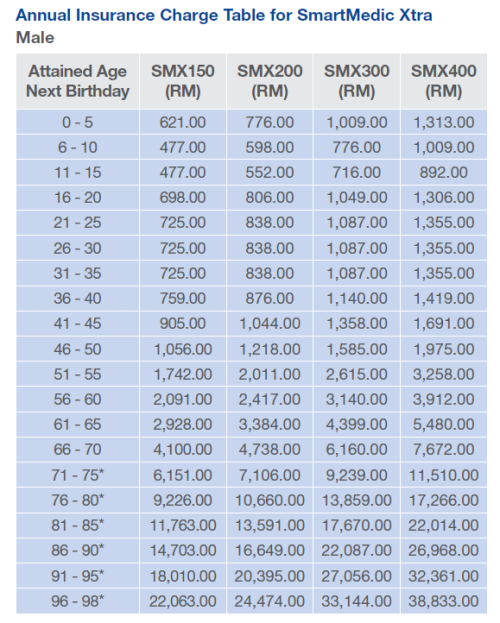

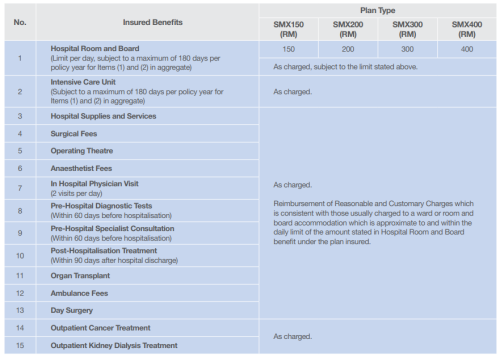

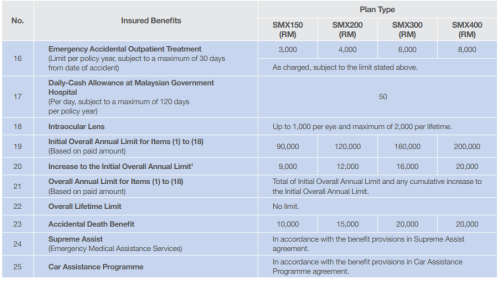

Let’s say I have a Group medical policy at work that covers me until RM30k. I’m hopeful of being gainfully employed for most of the next say, 20 to 30 years. To supplement my Group medical policy, I decide to purchase a standalone medical policy with a deductible of RM30k.

The idea is that the first RM30k will be covered by my Group medical policy paid for by my employer, while anything beyond that is covered by my personal medical card. My annual premium rates will be reduced by around 70% doing this.

In this scenario, assume life is perfect. Assume no changes in the Group policy. Assume that the policy renewal date matches 100%. And assume that the Group policy is under AIA while the individual medical policy is under Great Eastern. Both have cashless facilities. No exclusions or pre-existing.

How workable is this?

Insurance Talk V7!, Your one stop Insurance Discussion

Oct 14 2024, 04:23 PM

Oct 14 2024, 04:23 PM

Quote

Quote

0.0536sec

0.0536sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled