QUOTE(super911 @ Aug 15 2021, 12:31 AM)

Recently there is a viral covid hospitalization charges over RM300K. Is there any medical card willing to cover this amount?

bro...these are case to case basis....

let me share you a real life example....

Scenario 1 - real case of my friend in negeri sembilan

A close friend of mine get covid positive , he also have insurance plan with prudential.

when he admitted to hospital , doctor say he is just mild case nothing to worry about...just quarantine at home.

However, he is worried & insists want to be admitted, with self paying bills.

He is panic , worried it will escalate to stage 3/4 suddenly.

Well, of course doctor welcomed him, since he mentioned self pay.

THIS SCENARIO CANNOT CLAIM INSURANCE MEDICAL CARD.

He stays around 1 week and total bill around 60k.

Will the bill amount same when claim using medical card ?

Well, case to case basis, always bear in mind that certain portion of itemised item cannot be claim by medical card & medical card is used for necessary treatment basis only.

Scenario 2Someone kena covid and private hospital say he need immediate treatment.

Then this is different case. Later on if the bill charged 200k , it can be claims by any insurer that covers covid.

Claim limit , claim terms , cashless or reimbursement is depend on respective insurer T&C.

Better to standby cash in case of emergency.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

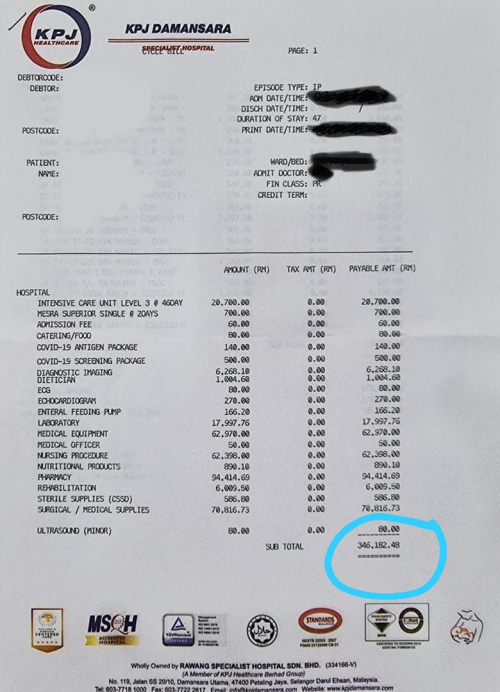

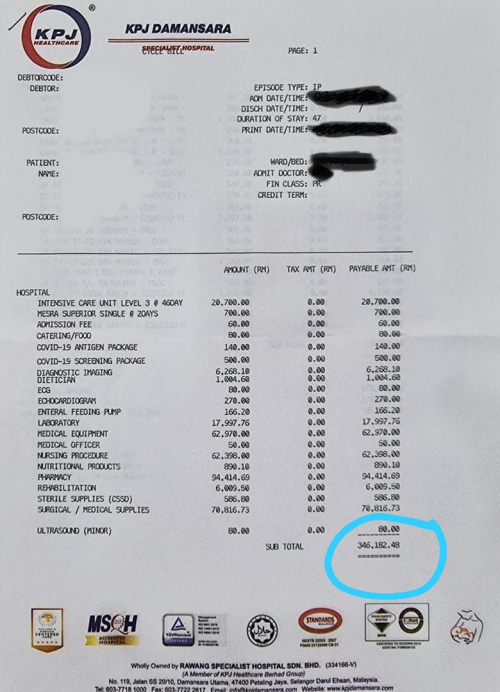

Regarding the screenshot of the 300k bill that everyone shared on social media is very brief , we cant just judge the book by its cover.

It can be the customer pay himself or claim from medical card.

When it comes to medical card usage, it is subject to necessary treatment ONLY.

So back to your question : Is there any medical card willing to cover this amount?

For prudential , yes , subjected that is it necessary covid treatment & the covid promotion still ongoing.

*subjected to cashless or reimbursement basis

For other insurance company , you may check with respective LYN members other insurance brand. [ Not 100% portion of the bill can be claimed. ]

» Click to show Spoiler - click again to hide... «

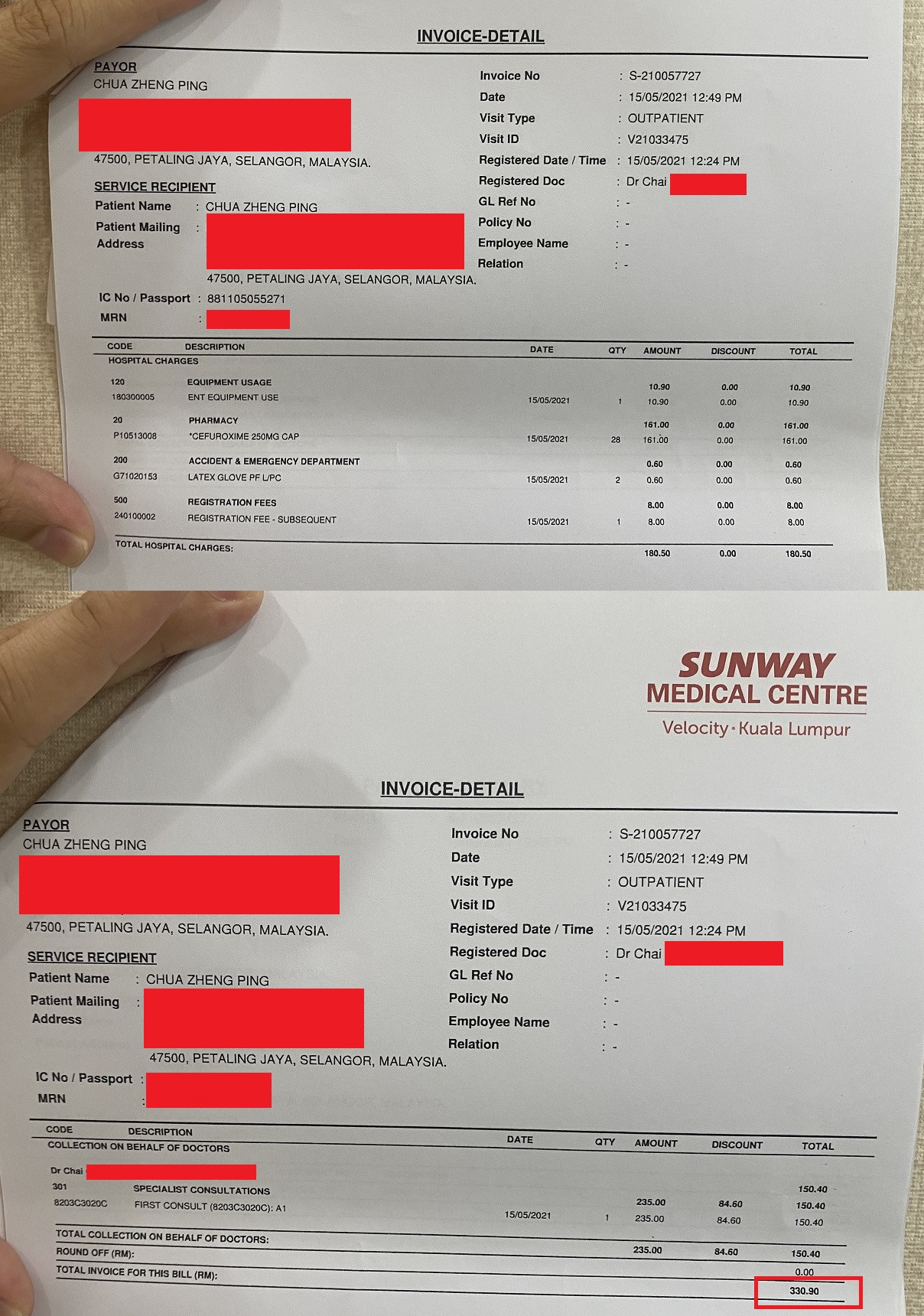

*Disclaimer ,screenshot above is not my client , and its shared viral from social media which answered to super911 post*

*Disclaimer ,screenshot above is not my client , and its shared viral from social media which answered to super911 post*

Aug 7 2021, 09:35 AM

Aug 7 2021, 09:35 AM

Quote

Quote

0.0380sec

0.0380sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled