Outline ·

[ Standard ] ·

Linear+

Let's Talk Properties. The Q&As, What would you like to know?

|

OldSchoolJoke

|

Nov 17 2021, 12:49 PM Nov 17 2021, 12:49 PM

|

Getting Started

|

QUOTE(DragonReine @ Nov 17 2021, 12:44 PM) If you want to avoid MOT altogether then your best bet would be to look for any property with ongoing HOC, or look for property under 500k under residential title if you're first time home buyer to be eligible for exemption. Other T&Cs associated with first home buyer exemption: MOT will only collect when property is fully constructed so it depends if you're able to save up that much during the construction period. oh. this is new. thanks but the <RM500k limit  |

|

|

|

|

|

DragonReine

|

Nov 17 2021, 01:08 PM Nov 17 2021, 01:08 PM

|

|

QUOTE(OldSchoolJoke @ Nov 17 2021, 12:49 PM) oh. this is new. thanks but the <RM500k limit  yeah 😅 limited to smaller high rise or non-klang valley property. |

|

|

|

|

|

flyingturtle77

|

Nov 17 2021, 02:09 PM Nov 17 2021, 02:09 PM

|

Getting Started

|

QUOTE(YeohKW @ Nov 16 2021, 06:21 PM) Actually the Valuer appointed are bank panel Valuer also. For insurance side, I am too sure too as we don’t deal with it. For valuation report, most bank even before they get the report, they have already offer you a loan based in indicative valuation. The Valuer are assigned to confirm on the value based on the report they submitted. The Valuer will make arrangement to visit the property, take photos, do some measurements and go back to prepare the report then submit to the bank. sadly i dont have friends working in bank mortgage area, otherwise i can ask more to understand how bank really release payment to Seller. thanks and appreaciate your input, i gained alot from ur input |

|

|

|

|

|

TSYeohKW

|

Nov 17 2021, 11:17 PM Nov 17 2021, 11:17 PM

|

Getting Started

|

QUOTE(flyingturtle77 @ Nov 17 2021, 02:09 PM) sadly i dont have friends working in bank mortgage area, otherwise i can ask more to understand how bank really release payment to Seller. thanks and appreaciate your input, i gained alot from ur input Glad to help even if it’s a bit |

|

|

|

|

|

katmai81

|

Nov 18 2021, 07:33 AM Nov 18 2021, 07:33 AM

|

Getting Started

|

Can I clarify the following are the miscellaneous fees for buying a new or subsale property

1) stamp duty for MOT (which is also stamp duty for SPA)

2) legal fees for SPA

3) legal fees for loan

4) stamp duty for loan

5) loan processing fees

6) disbursement fees

Anything else I m missing out?

And how much each of these cost usually when taking consideration of the property price (is it 5% of the selling price)

Tq

|

|

|

|

|

|

mini orchard

|

Nov 18 2021, 08:14 AM Nov 18 2021, 08:14 AM

|

|

QUOTE(katmai81 @ Nov 18 2021, 07:33 AM) Can I clarify the following are the miscellaneous fees for buying a new or subsale property 1) stamp duty for MOT (which is also stamp duty for SPA) 2) legal fees for SPA 3) legal fees for loan 4) stamp duty for loan 5) loan processing fees 6) disbursement fees Anything else I m missing out? And how much each of these cost usually when taking consideration of the property price (is it 5% of the selling price) Tq Valuation fee MRTA |

|

|

|

|

|

DragonReine

|

Nov 18 2021, 11:10 AM Nov 18 2021, 11:10 AM

|

|

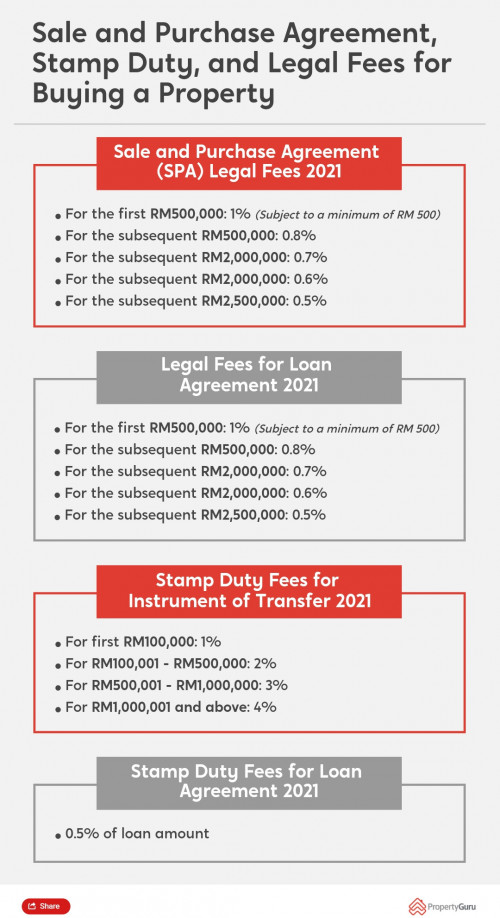

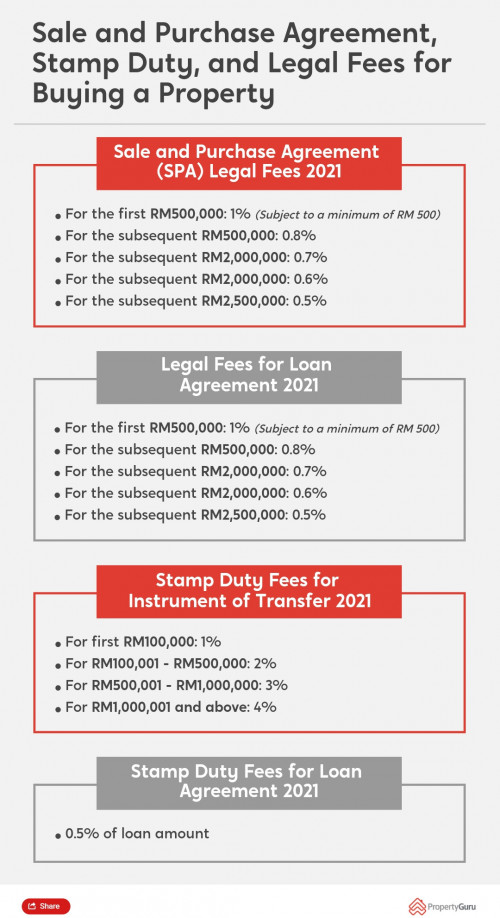

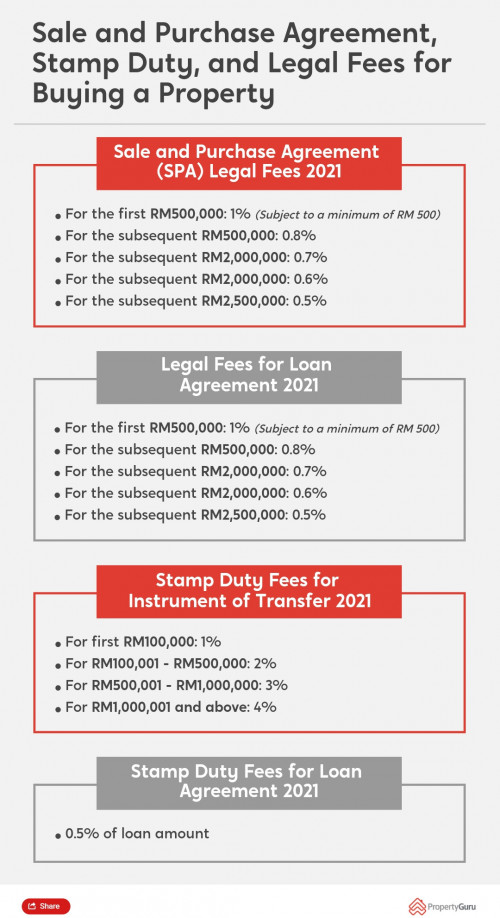

QUOTE(katmai81 @ Nov 18 2021, 07:33 AM) Can I clarify the following are the miscellaneous fees for buying a new or subsale property 1) stamp duty for MOT (which is also stamp duty for SPA) 2) legal fees for SPA 3) legal fees for loan 4) stamp duty for loan 5) loan processing fees 6) disbursement fees Anything else I m missing out? And how much each of these cost usually when taking consideration of the property price (is it 5% of the selling price) Tq Can calculate the standard fees for stamp duty and legal fees from the following graphic:  |

|

|

|

|

|

keelim

|

Nov 20 2021, 10:05 PM Nov 20 2021, 10:05 PM

|

|

Dear all,

I have a question on MRTA. If loan is 100k, MRTA is 3k, tenor 10 years - and the loan is refi in year 3 immediately after lock-in period with another bank, would the borrower stil need to settle the balance unpaid MRTA?

Thanks

|

|

|

|

|

|

keelim

|

Nov 20 2021, 10:07 PM Nov 20 2021, 10:07 PM

|

|

QUOTE(DragonReine @ Nov 18 2021, 11:10 AM) Can calculate the standard fees for stamp duty and legal fees from the following graphic:  Under 3rd party loan, if the borrower’s name is not in the SPA, does the Borrower enjoy stamp duty waiver on loan agreement under HOC? |

|

|

|

|

|

DragonReine

|

Nov 20 2021, 10:27 PM Nov 20 2021, 10:27 PM

|

|

QUOTE(keelim @ Nov 20 2021, 10:07 PM) Under 3rd party loan, if the borrower’s name is not in the SPA, does the Borrower enjoy stamp duty waiver on loan agreement under HOC? Not sure, need to ask lawyer about it. |

|

|

|

|

|

TSYeohKW

|

Nov 21 2021, 12:42 AM Nov 21 2021, 12:42 AM

|

Getting Started

|

QUOTE(keelim @ Nov 20 2021, 10:07 PM) Under 3rd party loan, if the borrower’s name is not in the SPA, does the Borrower enjoy stamp duty waiver on loan agreement under HOC? Most bank will required borrower name to be listed in SPA nowadays. |

|

|

|

|

|

keelim

|

Nov 21 2021, 12:03 PM Nov 21 2021, 12:03 PM

|

|

QUOTE(keelim @ Nov 20 2021, 10:05 PM) Dear all, I have a question on MRTA. If loan is 100k, MRTA is 3k, tenor 10 years - and the loan is refi in year 3 immediately after lock-in period with another bank, would the borrower stil need to settle the balance unpaid MRTA? Thanks Hi - could anyone shade some light? |

|

|

|

|

|

gooroojee

|

Nov 21 2021, 12:06 PM Nov 21 2021, 12:06 PM

|

|

I have a question. Developer submitted progressive billing to me and bank, but my panel loan lawyer (with developer since it's free) hasn't received a disclaimer letter from the developer and my loan processing tersangkut for 6 months now.

The progressive billing is overdue. I want to ask:

1. Will I be responsible for the late payment? I signed the loan documents in May 2021.

2. Will I be eligible for the free stamp duty? If the loan processing takes longer than this year?

Thanks!

|

|

|

|

|

|

mini orchard

|

Nov 21 2021, 12:48 PM Nov 21 2021, 12:48 PM

|

|

QUOTE(gooroojee @ Nov 21 2021, 12:06 PM) I have a question. Developer submitted progressive billing to me and bank, but my panel loan lawyer (with developer since it's free) hasn't received a disclaimer letter from the developer and my loan processing tersangkut for 6 months now. The progressive billing is overdue. I want to ask: 1. Will I be responsible for the late payment? I signed the loan documents in May 2021. 2. Will I be eligible for the free stamp duty? If the loan processing takes longer than this year? Thanks! 1. Check with developer why disclaimer letter not issued. If is their fault, then the developer should not charge for late payment. 2. No. All claims under hoc must be completed on or b4 31.12.21. |

|

|

|

|

|

TSYeohKW

|

Nov 21 2021, 10:46 PM Nov 21 2021, 10:46 PM

|

Getting Started

|

QUOTE(keelim @ Nov 21 2021, 12:03 PM) Hi - could anyone shade some light? For MRTA, if u refinance, there’s a chance the bank u refinancing with will require you to get another insurance to cover the loan |

|

|

|

|

|

hanhanhan

|

Nov 22 2021, 04:55 PM Nov 22 2021, 04:55 PM

|

|

» Click to show Spoiler - click again to hide... « QUOTE(keelim @ Nov 20 2021, 10:07 PM) Under 3rd party loan, if the borrower’s name is not in the SPA, does the Borrower enjoy stamp duty waiver on loan agreement under HOC? from what i understand in the PUA, borrower name must be in SPA. "Stamp duty shall be exempted in respect of any loan agreement to finance the purchase of residential property under the Home Ownership Campaign 2021, the value of which is more than three hundred thousand ringgit but not more than two million five hundred thousand ringgit, executed between an individual named in

a sale and purchase agreement and..." This post has been edited by hanhanhan: Nov 22 2021, 04:55 PM |

|

|

|

|

|

Argiope

|

Dec 17 2021, 12:21 PM Dec 17 2021, 12:21 PM

|

|

I sold my property recently. The property has outstanding loan with HL and the new financier (CIMB) had transferred the balance for full redemption in mid Nov. However, HL still proceed to deduct my loan servicing account for the installment in Dec. I contacted the HL staff who handled my redemption to understand why and learnt that they were not aware of the funds being transferred to them... Shortly after me telling them, they updated my loan account with a negative balance now (cos they have deducted in excess).

I asked for the refund of my Dec installment + the balance of the pro-rated Nov installment but was told that she only looks after redemption process and that my lawyer should liaise with another dept within HL. I asked for the contact number but she refused to provide 😑 and claimed that my lawyer should know? Technically my lawyer is the buyer's lawyer but I also paid for her service to help me run the docs required.

HL is super messy, ultra slow and very cincai. I don't know why they issued a redemption statement to me when I'm the seller and charged an admin fee for it. The redemption statement should be addressed to CIMB to inform them how much my loan balance is. When asked why, they issued a fresh redemption statement to CIMB and charged me another admin fee 🙄

My questions are: what is the correct process? Should my lawyer know which dept in HL she should go to or I should be the one chasing? I have not signed the Deed of Reassignment.

|

|

|

|

|

|

mini orchard

|

Dec 17 2021, 12:55 PM Dec 17 2021, 12:55 PM

|

|

QUOTE(Argiope @ Dec 17 2021, 12:21 PM) I sold my property recently. The property has outstanding loan with HL and the new financier (CIMB) had transferred the balance for full redemption in mid Nov. However, HL still proceed to deduct my loan servicing account for the installment in Dec. I contacted the HL staff who handled my redemption to understand why and learnt that they were not aware of the funds being transferred to them... Shortly after me telling them, they updated my loan account with a negative balance now (cos they have deducted in excess). I asked for the refund of my Dec installment + the balance of the pro-rated Nov installment but was told that she only looks after redemption process and that my lawyer should liaise with another dept within HL. I asked for the contact number but she refused to provide 😑 and claimed that my lawyer should know? Technically my lawyer is the buyer's lawyer but I also paid for her service to help me run the docs required. HL is super messy, ultra slow and very cincai. I don't know why they issued a redemption statement to me when I'm the seller and charged an admin fee for it. The redemption statement should be addressed to CIMB to inform them how much my loan balance is. When asked why, they issued a fresh redemption statement to CIMB and charged me another admin fee 🙄 My questions are: what is the correct process? Should my lawyer know which dept in HL she should go to or I should be the one chasing? I have not signed the Deed of Reassignment. The 1st rule for any payment .....NEVER use auto debit. You should never allow a third party to control your money. As the borrower, you have to request for a refund. |

|

|

|

|

|

chriskk

|

Dec 28 2021, 12:23 PM Dec 28 2021, 12:23 PM

|

New Member

|

Hi sifu, can ask about the stamp duty exemption (property <500k) for first home buyer - I've never purchase property before but my parents recently transfer their house ownership to me. Will I be eligible for the stamp duty exemption if I transfer the ownership of the inherited home to my sibling and then after that buy my first property?

This post has been edited by chriskk: Dec 28 2021, 12:24 PM

|

|

|

|

|

|

mini orchard

|

Dec 28 2021, 08:59 PM Dec 28 2021, 08:59 PM

|

|

QUOTE(chriskk @ Dec 28 2021, 12:23 PM) Hi sifu, can ask about the stamp duty exemption (property <500k) for first home buyer - I've never purchase property before but my parents recently transfer their house ownership to me. Will I be eligible for the stamp duty exemption if I transfer the ownership of the inherited home to my sibling and then after that buy my first property? No |

|

|

|

|

Nov 17 2021, 12:49 PM

Nov 17 2021, 12:49 PM

Quote

Quote

0.0250sec

0.0250sec

0.69

0.69

6 queries

6 queries

GZIP Disabled

GZIP Disabled