new properties that listen with 0% downpayment, no legal fees, etc

is it real? like i only need to pay for booking fee to purchase a house?

no hidden charges

Let's Talk Properties. The Q&As, What would you like to know?

Let's Talk Properties. The Q&As, What would you like to know?

|

|

Nov 17 2021, 11:16 AM Nov 17 2021, 11:16 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

285 posts Joined: Mar 2010 |

new properties that listen with 0% downpayment, no legal fees, etc

is it real? like i only need to pay for booking fee to purchase a house? no hidden charges |

|

|

|

|

|

Nov 17 2021, 12:36 PM Nov 17 2021, 12:36 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

285 posts Joined: Mar 2010 |

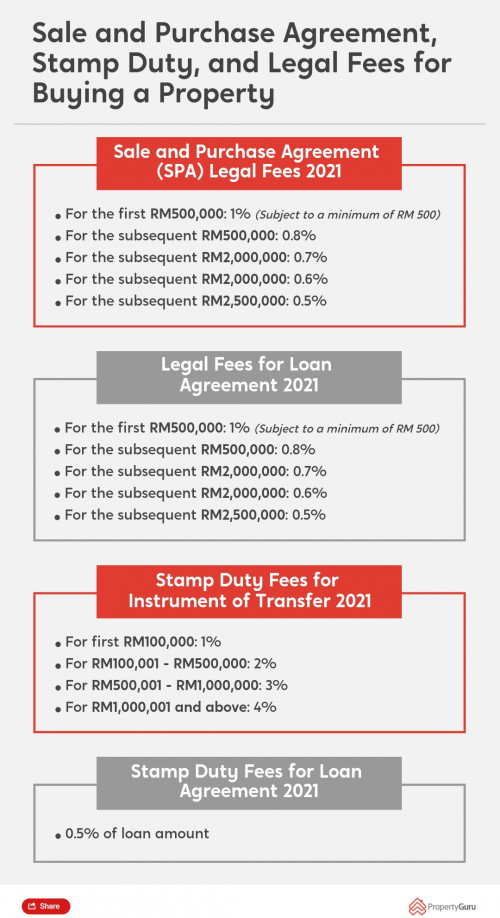

QUOTE(DragonReine @ Nov 17 2021, 11:51 AM) A lot of newly launched properties have such promos, but please read the fine print carefully. thanks alot for the insightMost only cover legal fees if you sign with their panel lawyers. You usually still need to pay for stamp duty on memorandum/instrument of transfer aka MOT (chargeable when received vacent possession) and for loan agreement. However if you're first home owner there's full stamp duty exemption given to both MOT and loan agreement for the purchase of a first home worth not more than RM500,000. This exemption will be for the Sale and Purchase Agreement completed between January 2021 to 31 December 2025. In addition there's current Home Ownership Campaign where you can apply to waive the stamp duty for MOT, subject to application of unit with REDHA (not all projects/units within project are under MOT). Beware that sometimes during application of HOC developer often marks up property price to report to REDHA and this may cause you to need to pay extra charges (sometimes few hundred, sometimes few thousand) because there's a difference between initial agreed price and the REDHA price. Note that properties with 0% downpayment are often sold at "future price" and are over current market value, so if you're doing this for investment/short term stay, be aware that there's high chance you're overpaying for the property, so do your due diligence.  im afraid of the MOT charges, i don't have much cash in hard for this. this is what i worry about. |

|

|

Nov 17 2021, 12:49 PM Nov 17 2021, 12:49 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

285 posts Joined: Mar 2010 |

QUOTE(DragonReine @ Nov 17 2021, 12:44 PM) If you want to avoid MOT altogether then your best bet would be to look for any property with ongoing HOC, or look for property under 500k under residential title if you're first time home buyer to be eligible for exemption. oh.Other T&Cs associated with first home buyer exemption: MOT will only collect when property is fully constructed so it depends if you're able to save up that much during the construction period. this is new. thanks but the <RM500k limit |

|

|

Mar 25 2022, 10:31 PM Mar 25 2022, 10:31 PM

Return to original view | Post

#4

|

Junior Member

285 posts Joined: Mar 2010 |

seeing many leasehold properties now

is there anyway for government to take back before the contract end? |

|

|

Mar 25 2022, 11:25 PM Mar 25 2022, 11:25 PM

Return to original view | Post

#5

|

Junior Member

285 posts Joined: Mar 2010 |

QUOTE(YeohKW @ Mar 25 2022, 10:53 PM) Normally govt won’t simply take it back unless there’s a need to upgrade the infrastructure in the area and there’s no other option available. Else the tenure of the title can be extended. do government pay back when taking back?And FYI, even if it’s freehold, govt can still take it back if they need to build infrastructure on the land. if yes, is it by percentage or? |

|

|

Mar 29 2022, 09:50 PM Mar 29 2022, 09:50 PM

Return to original view | Post

#6

|

Junior Member

285 posts Joined: Mar 2010 |

for subsale, meaning downpayment and fees are bare by buyer?

no free MOT, legal fees, stamp duty, etc provided? |

| Change to: |  0.0274sec 0.0274sec

0.54 0.54

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 11:15 AM |