QUOTE(kelvinlym @ Dec 31 2020, 08:34 PM)

Tq Kelvin,...

I'll reply to comments 4) and 5).

To 4), everytime a new acct-holder or a member opens a new acct OR a house-owner opens a new acct as a host, ABNB becomes stronger and the barrier-to-entry for competitors become higher. The members of ABNB are very active. ABNB is a key pioneer in the renting-out of individual homes as holiday accommodations. This, in itself, provides first-mover advantage,.. and this first-mover advantage usually creates a barrier-of-entry for the first-mover.

I agree the capex of ABNB is low, and there is almost negligible hard assets for a business the size of ABNB. Wouldn't this be a good mix ?

To 5), Looking at a business from the opposite end, a dividend-paying business would also signal business performance has been good. Hence, one way I would judge the performance of a business is from the perspective of whether it is paying out a sustainable dividend or not.

Think I'll reply to 3) too, I would reply to part of your statements. Sometimes,.. it is no more necessary today to look at metrics and company performance figures. IPOs and share price performance are heavily moved by sentiments, and by write-ups of analysts and bloggers out there. Anyway,... having said the last two sentences, ABNB has turned profitable this year.

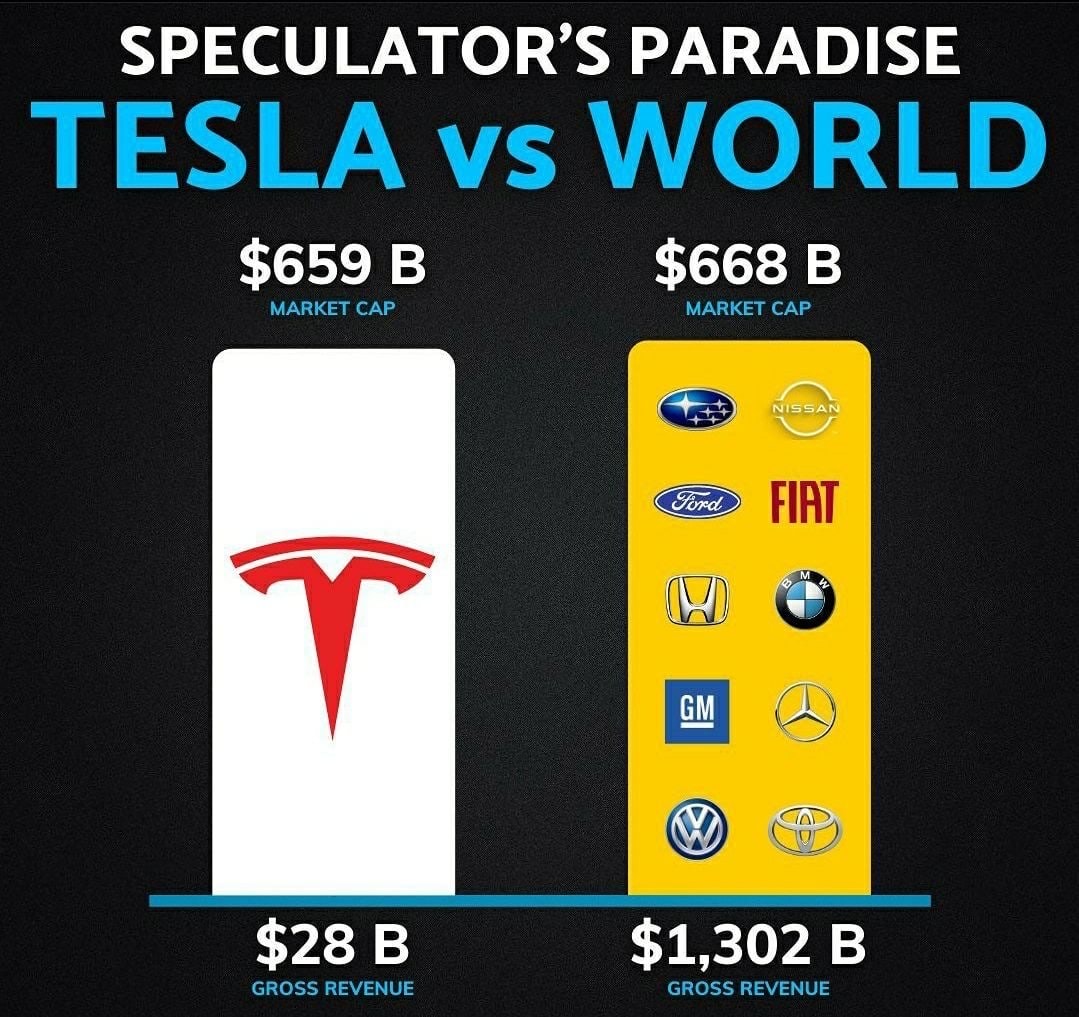

And TSLA has turned slightly profitable without using carbon credit earnings. The production facilities in Shenzhen are ramping-up. I think there is good progress too with the plant in Germany and the plant in Texas.

Hi Kelvin,.. I edited to add another input here after reading your inputs again : To your 4), to your 2nd and 3rd sentences, if you are relating yearly capex size to barriers-of-entry, I'm afraid though having a big capex size may prevent many companies from being able to oarticipate in an industry, this is no more a strong determining criteria in the new-age digital economy, take for example, in ecommerce.

A small company or even an inidividual can behave as a retailer without a shopfront, hence, entering the retail industry, competing with the likes of big retailers. A website is all the small company or the individual needs.

This post has been edited by Hansel: Jan 2 2021, 03:46 PM

Nov 30 2020, 11:05 AM

Nov 30 2020, 11:05 AM

Quote

Quote

0.1159sec

0.1159sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled