QUOTE(Mr.Docter @ Jun 12 2020, 06:47 AM)

Hi,

Received this offer from one of the bank. Details as below.

- A fixed deposit (similar amount) per annum whereby one-off for the 1st year and multiple deposits for the subsequent year.

- Counted by the date of 1st deposit as a year for the dividend.

- The principle is compulsory to be deposit annually for six years before being able to withdraw.

- After the 6th year, if you haven't withdrawn the accumulated principle - you can enjoy continuous dividends for a maximum of 20 years.

- Dividends for frontliner - 30% p.a (!!!) - limited time & quota for selected group of individual.

- Minimum of RM10k/year. Don't overcommit as you need to deposit a similar amount every year for six years.

- If you haven't withdrawn the dividends, it will be compound for the next year with an average of 5-8%. However, you are free to withdraw the dividends as you like.

- Possible to open more than one policy.

- Policy approval is based on overall financial status.

- Limited quota.

- Insured by PIDM.

The guaranteed of 30% p.a for maximum of 20 years was in black & white on my form from the bank, not agent's lips.

Most likely going to open for both of my kids if all okay.

Thanks in advance for all the input and insight!

if i am not mistaken,...many months/years back...almost similar product from HLA...

can check from previous LYN threads for some valuable threads and posts....

https://www.google.com/search?q=hla+wealth+...iw=1366&bih=657where they gives 20% pa.....

from only after 1st year after deposit

sort of like...

July 2020 you deposit RM10000

July 2021 you deposit RM10000, you get RM2000, thus 20% of your current deposit money, but your total deposit is RM20000, (2k of 18k is 11.1%)

July 2022 you deposit RM10000, you get RM2000, thus 20% of your current deposit money, but your total deposit is RM30000, (2k of 26k is 7.69%)

July 2023 you deposit RM10000, you get RM2000, thus 20% of your current deposit money, but your total deposit is RM40000, (2k of 34k is 5.88%)

July 2024 you deposit RM10000, you get RM2000, thus 20% of your current deposit money, but your total deposit is RM50000, (2k of 42k is 4.76%)

July 2025 you deposit RM10000, you get RM2000, thus 20% of your current deposit money, but your total deposit is RM60000, (2k of 50k is 4%)

and so on....

do take note....if you take that $$ out...your total cash value will be much affected later on

like in post 9 mentioned...."cash back came from your own capital."

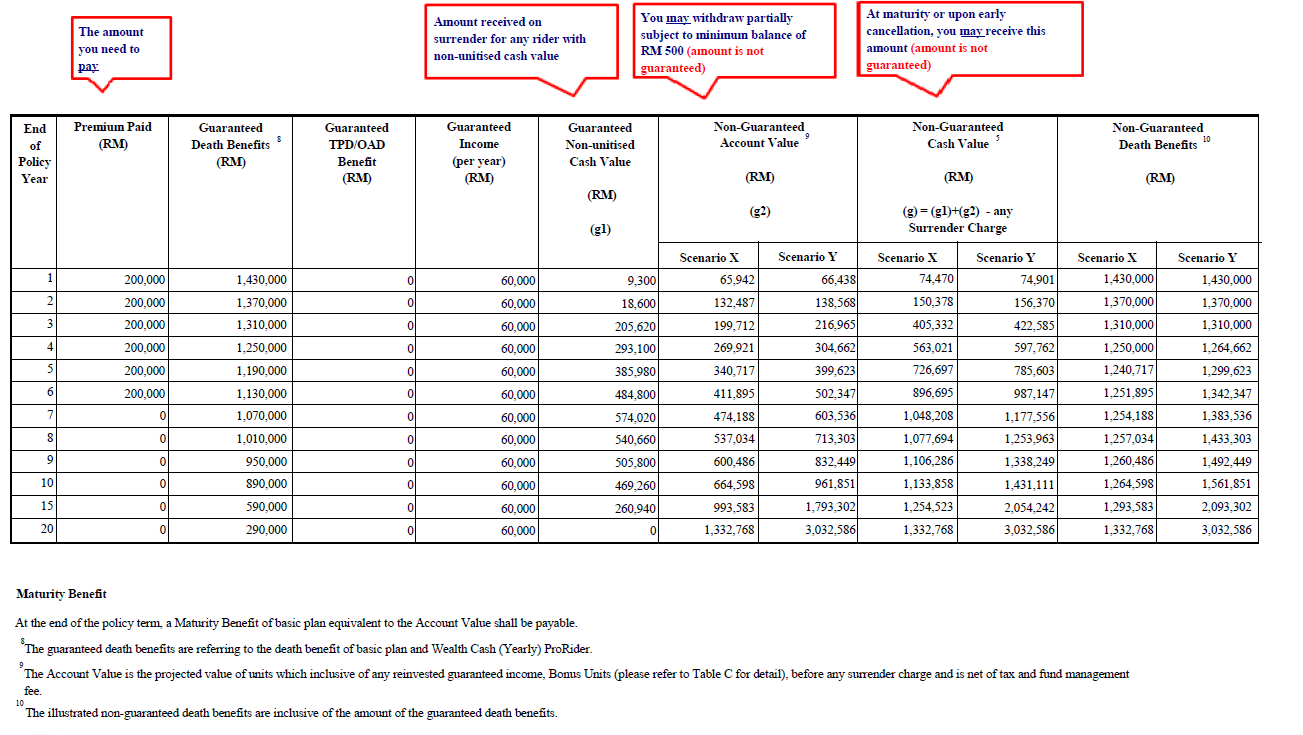

or see the % of reduction of the "Guaranteed Death Benefits" as in the same image in post 17

this "REDUCTION" was not highlighted to the unobservant.....they are just too focused on what is the ROI...

they can gives you abit more % of ROI BUT reduce on other benefits

This post has been edited by yklooi: Jun 15 2020, 09:40 AM

Jun 12 2020, 06:47 AM, updated 6y ago

Jun 12 2020, 06:47 AM, updated 6y ago

Quote

Quote

0.4188sec

0.4188sec

0.30

0.30

5 queries

5 queries

GZIP Disabled

GZIP Disabled