Hi,

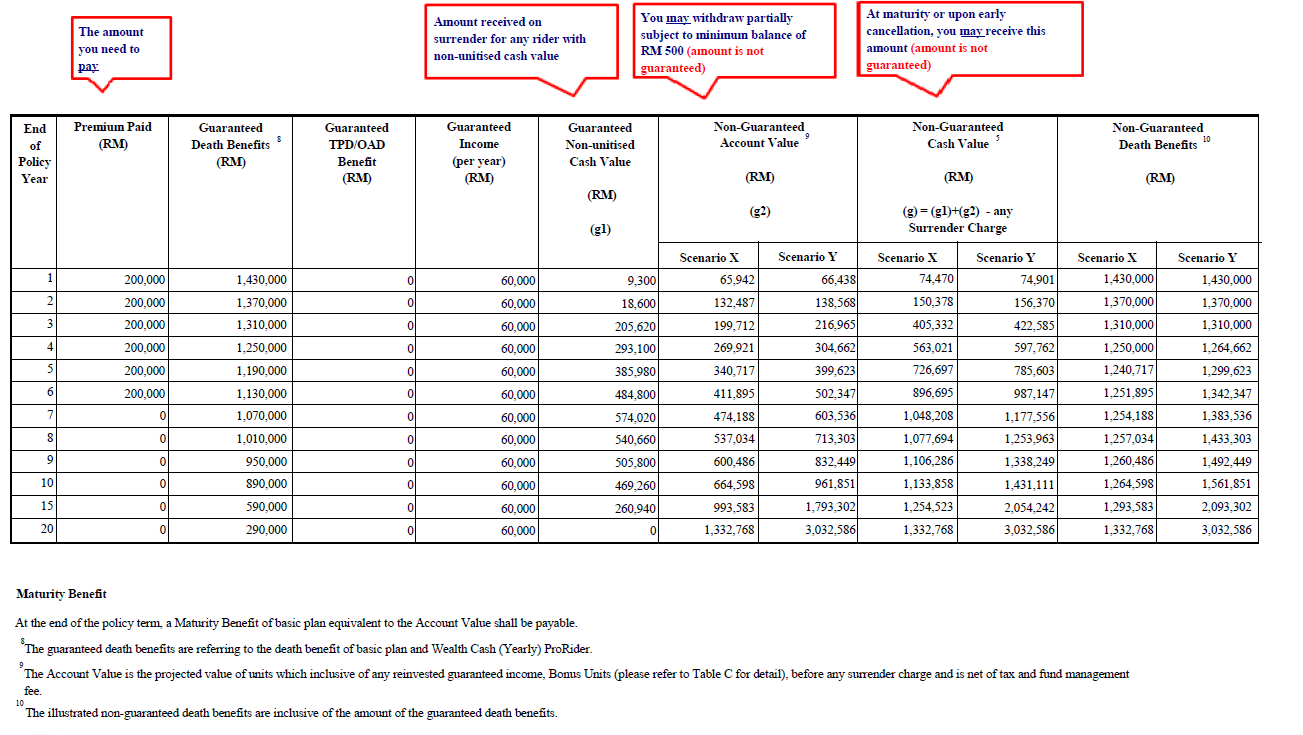

Received this offer from one of the bank. Details as below.

- A fixed deposit (similar amount) per annum whereby one-off for the 1st year and multiple deposits for the subsequent year.

- Counted by the date of 1st deposit as a year for the dividend.

- The principle is compulsory to be deposit annually for six years before being able to withdraw.

- After the 6th year, if you haven't withdrawn the accumulated principle - you can enjoy continuous dividends for a maximum of 20 years.

- Dividends for frontliner - 30% p.a (!!!) - limited time & quota for selected group of individual.

- Minimum of RM10k/year. Don't overcommit as you need to deposit a similar amount every year for six years.

- If you haven't withdrawn the dividends, it will be compound for the next year with an average of 5-8%. However, you are free to withdraw the dividends as you like.

- Possible to open more than one policy.

- Policy approval is based on overall financial status.

- Limited quota.

- Insured by PIDM.

The guaranteed of 30% p.a for maximum of 20 years was in black & white on my form from the bank, not agent's lips.

Most likely going to open for both of my kids if all okay.

Thanks in advance for all the input and insight!

Wealth Booster Plan, Investment Scheme

Jun 12 2020, 06:47 AM, updated 6y ago

Jun 12 2020, 06:47 AM, updated 6y ago

Quote

Quote

0.0222sec

0.0222sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled