QUOTE(ironman16 @ Jun 30 2020, 10:29 PM)

This Robo only can funding using maybank acc?

Can use maybank MAE to funding?

Feel lazy go to Maybank to open the savings acc just bcoz wanna test this Robo.

cannot cause need tie debit card

-----------additional comment--------------

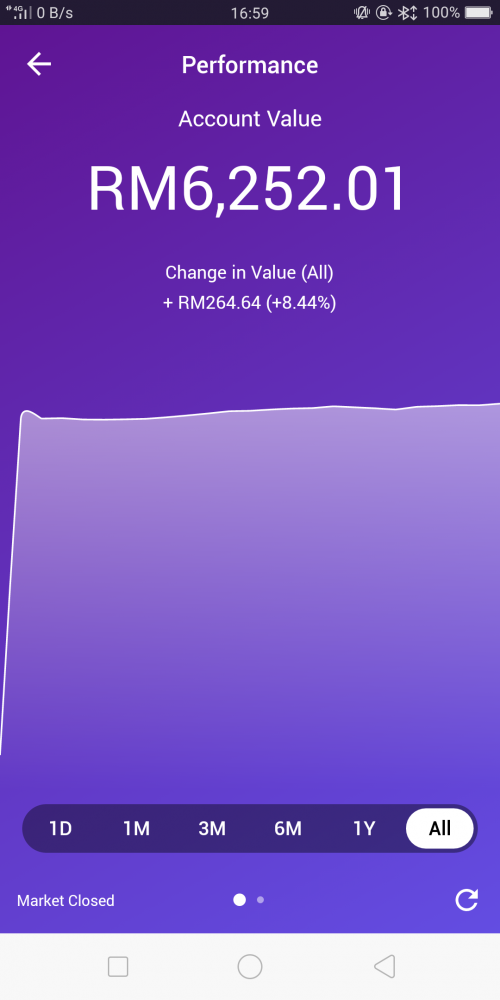

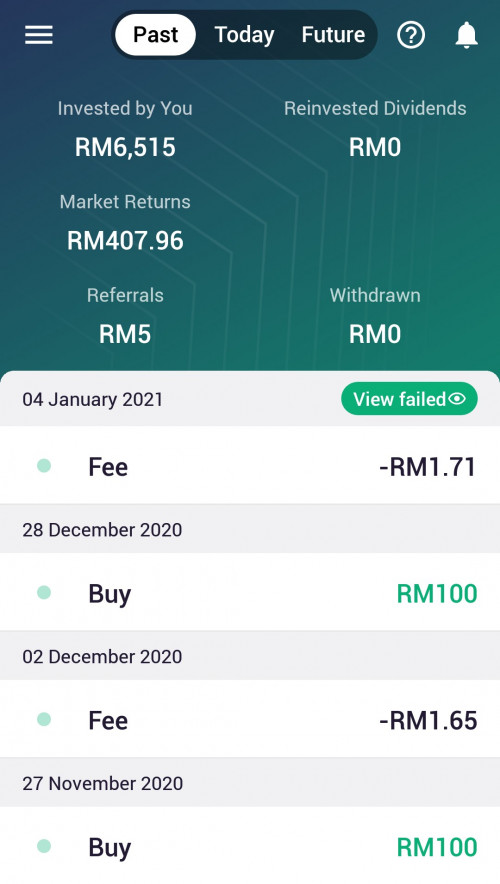

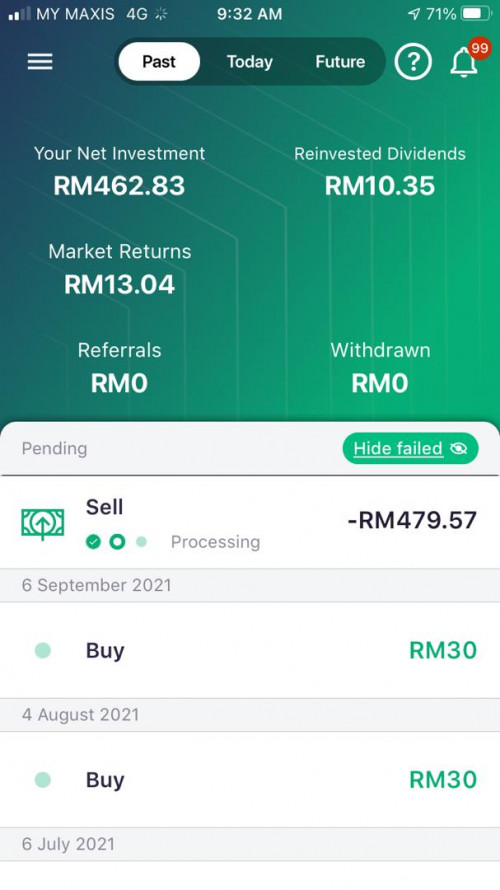

so far i have throw money inside, withdraw money out and i would say slow la

UT always slow la

deposit money is like immediate they will potong your account

but till the money actually get invested is like up to 3 to 4 days le.. sometimes 5 days - really dont know why since i am still new

i also go try switch portfolio and that itself take 7 to 8 days

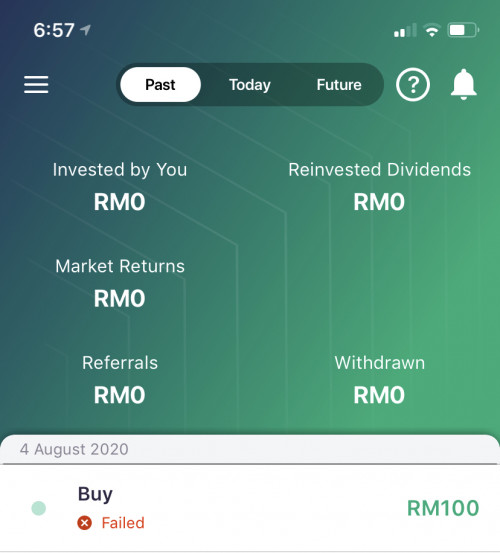

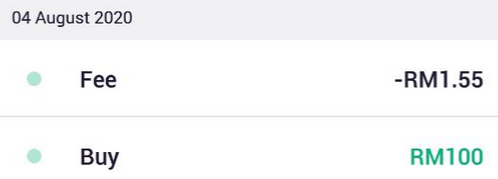

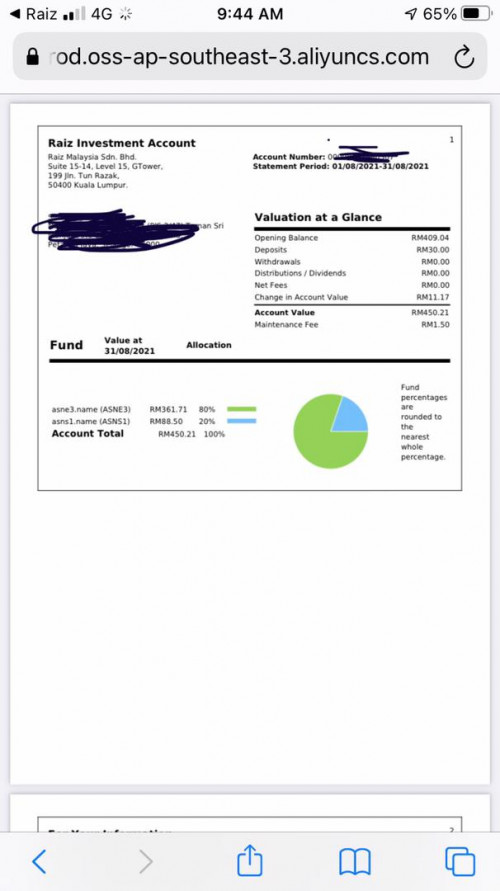

the only thing i yet to see now is their charges of RM1.50 or their statement

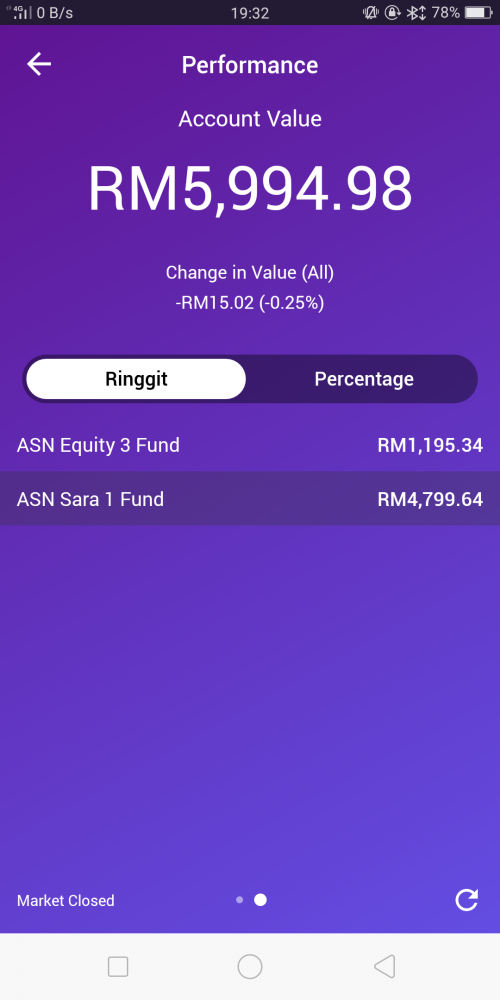

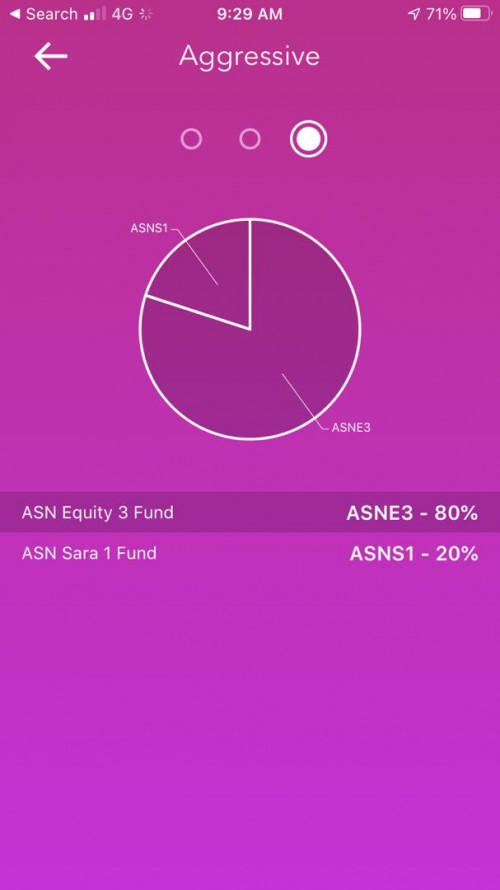

the part on cannot see the number of unit own is not true, we can see it

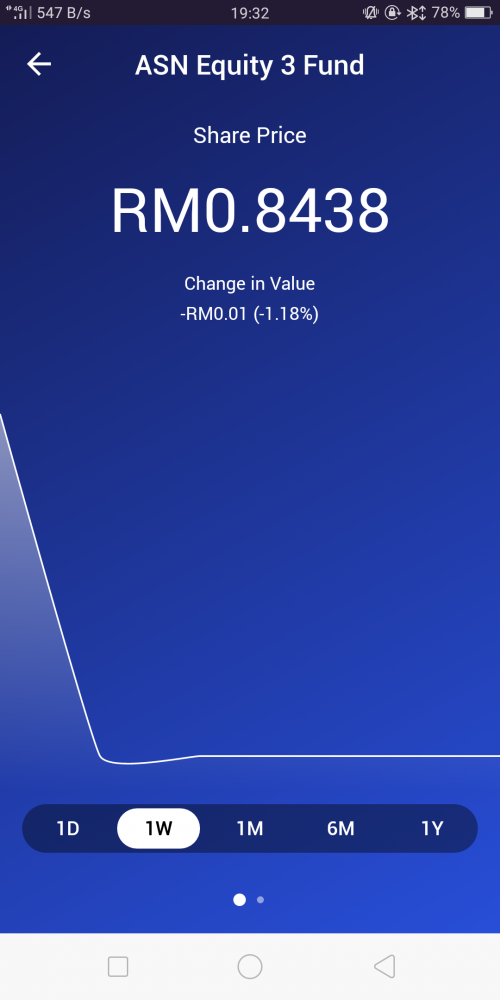

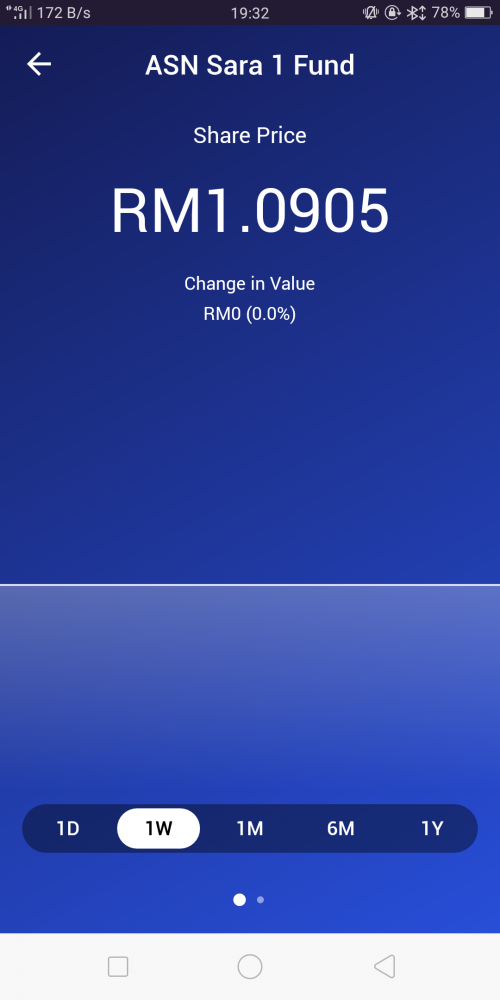

Go to "today", performance details, go to the bottom can see 2 "dots", scroll to right, then hit the fund name, then again go to the bottom can see 2 dots then scroll to right

you will see shares own, holding value, todays price

i think is very transparent

-------question------------

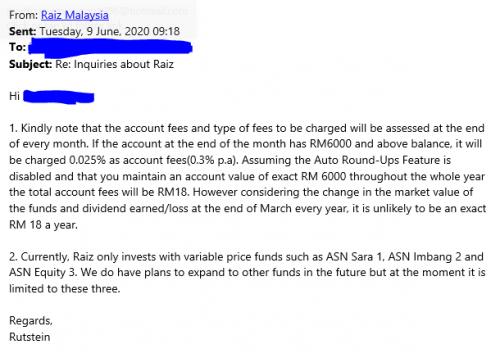

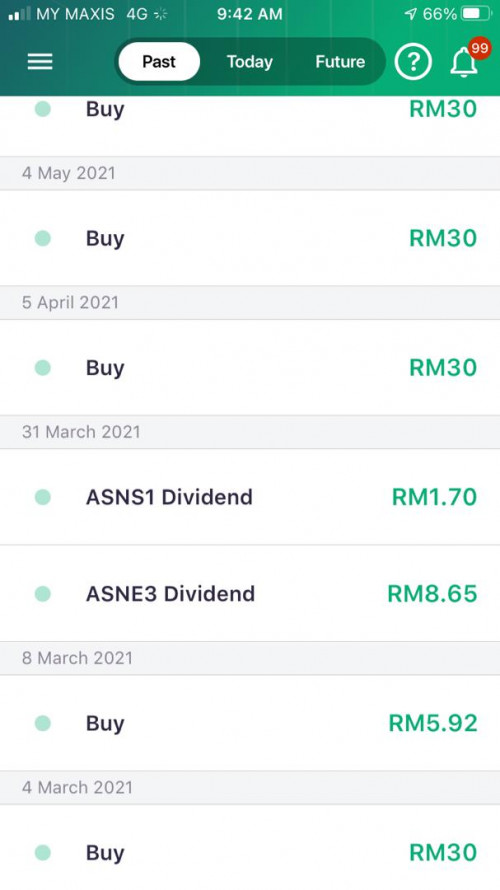

here in Raiz regardless of amount, number of times you put money in take money out, they charge a flat 0.3% / RM1.50 which ever higher

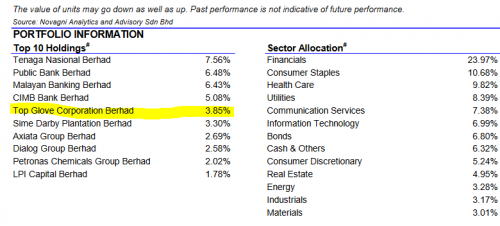

if we buy this UT from myASNB app, what is their charges?

i dont have ASNB at all

May 31 2020, 04:57 PM, updated 6y ago

May 31 2020, 04:57 PM, updated 6y ago

Quote

Quote

0.2434sec

0.2434sec

0.57

0.57

6 queries

6 queries

GZIP Disabled

GZIP Disabled