Outline ·

[ Standard ] ·

Linear+

Investment Raiz Malaysia, https://raiz.com.my/

|

abcn1n

|

Jun 6 2020, 01:28 AM Jun 6 2020, 01:28 AM

|

|

QUOTE(extinct_83 @ Jun 5 2020, 06:00 PM) Buying directly with ASNB only - there's a sales charge of 2%. There's also annual management fees of 1% p.a. In terms of fees, I think Raiz is cheaper QUOTE(Eurobeater @ Jun 5 2020, 11:59 PM) Its actually looks like its cheaper to buy ASNB funds via Raiz, esp if you have more than 6k. I have the ASNB app, but the fees are still very significant. For example, if you want to invest in the more conservative ASNB Sara funds, there is a sales charge of 1.5% for each transaction and an annual management fee of 1%. If you invested 6k as a lump sum at the start of the year, you'll give away a total of 2.5% of that 6k by the end of the year. Raiz appears to only have an annual management fee of just 0.3% and no sales charges. So it looks like a steal! No switching fees also. Ehh, Raiz no need to pay the sales charge meh? If Raiz is paying and not charging us, then not easy for Raiz to earn |

|

|

|

|

|

abcn1n

|

Jun 8 2020, 12:10 AM Jun 8 2020, 12:10 AM

|

|

QUOTE(Eurobeater @ Jun 6 2020, 11:16 AM) I dont see the sales charges in the website so i assumed don't have to pay. After all, the app is a JV with PNB as well. Hopefully someone who has used the app can enlighten us. QUOTE(Barricade @ Jun 6 2020, 11:27 AM) No service charge. No withdrawal fee. Straight to the point RM1.50 fee per month below 6k and 0.3% per annum above 6k Also withdrawal takes few days so there could be difference in the final withdrawal amount compared to the value you see in the app on the day you withdraw QUOTE(MNet @ Jun 7 2020, 11:37 AM) Seems like no sales charge etc. Thanks for all the answers |

|

|

|

|

|

abcn1n

|

Jun 10 2020, 12:33 AM Jun 10 2020, 12:33 AM

|

|

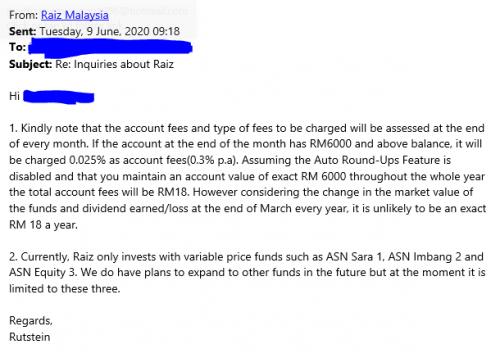

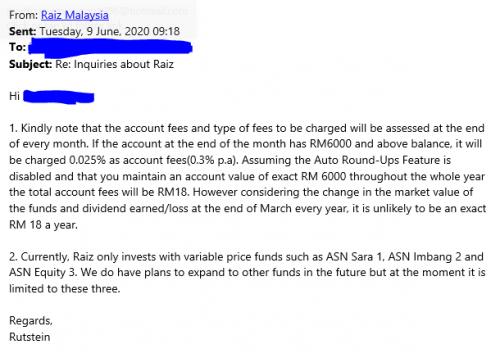

QUOTE(frostbyte13 @ Jun 9 2020, 12:16 PM) Can confirm too; this response from Raiz after I keep prodding them for an answer. Rest assured that the only fees our users will be charge are the account fees at the end of the month, there is no deposit, sales, or withdrawal charge whatsoever. This is what makes Raiz beginner-friendly, we will handle most of the formalities and cost making it easy to invest for our users.Account got verified this morning, made a request for deposit of RM100 & they already accepted it. Now to see turnaround in investing it. Looks good, 6K dump ahoy. I had an extremely unpleasant & embarrassing experience going to the bank to buy ASNB before. The bank clerk who attended to me did not even put in any effort to enlighten carefully the steps required to get started with ASNB; she was just contented to making me frustrated so that she doesn't wanna file the paperwork.  Thanks. Wow, the clerk so lazy. She should be trying to sell to you the funds. Sorry for your bad experience. QUOTE(Eurobeater @ Jun 9 2020, 02:05 PM) I emailed them to confirm their fees and what ASNB funds they invest in. Here's their response  Seems like a steal to me. I'm going to redeem my current ASNB VP holdings sometime this week and put them in here instead. Good to have black and white from them This post has been edited by abcn1n: Jun 10 2020, 12:53 AM |

|

|

|

|

|

abcn1n

|

Jun 12 2020, 11:47 PM Jun 12 2020, 11:47 PM

|

|

QUOTE(frostbyte13 @ Jun 11 2020, 03:53 PM) I gather because my 1st attempt was trying to buy the limited quantity ASM funds. I'm a self-taught noob, don't know cannot open account without buying units. So I said okay lo, how about buying equity funds? Can you recommend how to get started? She's like eh adik pergi baca sendiri la. Ini nak beli ke tak, bukan untuk Q&A. I got fed-up & left LOL. The wealth management industry in Malaysia is super-ripe for disruption to take this unpleasant experiences out of the way. BTW, i dumped RM6k in already. Let's see returns after 1 month. Bad mentality by the clerk. Its her duty to help customers especially when customer wants to buy. Glad you left |

|

|

|

|

Jun 6 2020, 01:28 AM

Jun 6 2020, 01:28 AM

Quote

Quote

0.0270sec

0.0270sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled