deleted

This post has been edited by extinct_83: Mar 15 2021, 12:19 AM

Investment Raiz Malaysia, https://raiz.com.my/

Investment Raiz Malaysia, https://raiz.com.my/

|

|

Mar 15 2021, 12:16 AM Mar 15 2021, 12:16 AM

|

Junior Member

475 posts Joined: Apr 2010 |

deleted

This post has been edited by extinct_83: Mar 15 2021, 12:19 AM |

|

|

|

|

|

Mar 17 2021, 10:03 AM Mar 17 2021, 10:03 AM

Show posts by this member only | IPv6 | Post

#442

|

Senior Member

923 posts Joined: Sep 2010 From: Alor Setar, Kuala Lumpur |

QUOTE(extinct_83 @ Mar 13 2021, 11:30 AM) The profit/lost is base on the unit price ups/downs. So if the unit up 1%, your profit should be up by 1%. Raiz has a combination of 2 unit trusts for conventional and high risk profile - so calculation of profit will be slightly complicated than the balanced profile - it has to take account of both unit trust price of the day. To check the price, I usually got to ASNB website: [url=https://www.asnb.com.my/asnbv2_0index_EN.php[/url] - Click the orange box to see Today's price. Can someone elaborate on this image here?The balance always changes on day to day basis This post has been edited by ahchat: Mar 17 2021, 10:04 AM Attached thumbnail(s)

|

|

|

Mar 17 2021, 10:35 AM Mar 17 2021, 10:35 AM

Show posts by this member only | IPv6 | Post

#443

|

Senior Member

1,620 posts Joined: Mar 2020 |

|

|

|

Mar 17 2021, 05:41 PM Mar 17 2021, 05:41 PM

|

Junior Member

475 posts Joined: Apr 2010 |

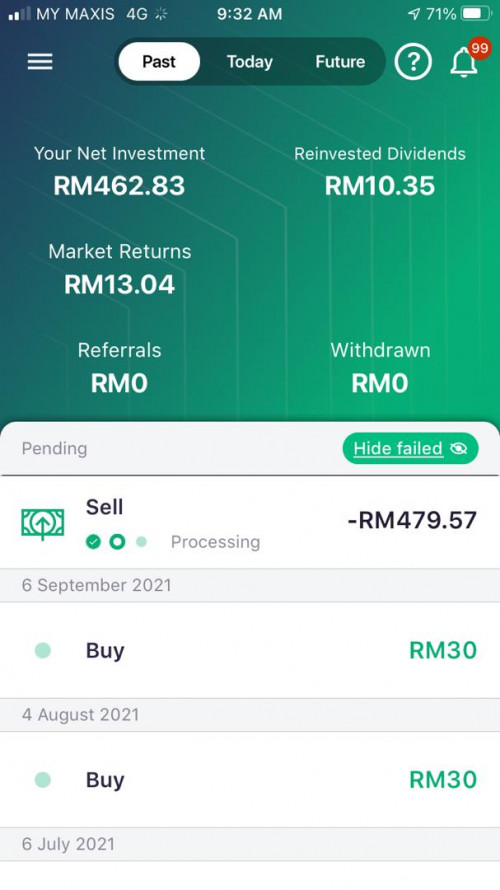

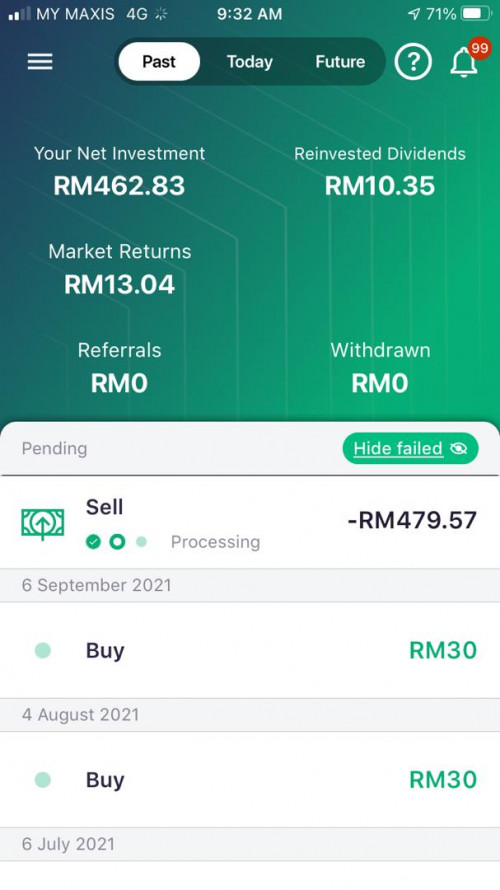

QUOTE(ahchat @ Mar 17 2021, 11:03 AM) This number behind the purple background is the unrealized profits/lost + your contribution. If you click the 'Past' tap at the top (next to 'Today') you'll see more detail of how much you have contributed at 'Invested by you' and how much profit/losses at "Market returns". If you get dividends, it will be posted at "Reinvested dividends". |

|

|

Mar 17 2021, 10:18 PM Mar 17 2021, 10:18 PM

Show posts by this member only | IPv6 | Post

#445

|

All Stars

17,517 posts Joined: Feb 2006 From: KL |

moving out once i breakeven. should have known asnb variable fund are only so so

|

|

|

Mar 18 2021, 01:48 PM Mar 18 2021, 01:48 PM

Show posts by this member only | IPv6 | Post

#446

|

Senior Member

678 posts Joined: Dec 2007 From: Shah Alam |

|

|

|

|

|

|

Mar 18 2021, 02:21 PM Mar 18 2021, 02:21 PM

|

All Stars

17,517 posts Joined: Feb 2006 From: KL |

QUOTE(matyrze @ Mar 18 2021, 01:48 PM) yup, bad timing i guess. within days only drop already. lol. matyrze liked this post

|

|

|

Mar 23 2021, 03:52 PM Mar 23 2021, 03:52 PM

|

Senior Member

3,389 posts Joined: Sep 2019 |

How much returns your guys gained from this ?

|

|

|

Apr 7 2021, 10:23 AM Apr 7 2021, 10:23 AM

Show posts by this member only | IPv6 | Post

#449

|

Junior Member

52 posts Joined: Jul 2010 |

This thread still alive ah? Or everyone close account already lol

Did anyone notice that dividend is not included into the account value? My understanding is your account value should be Invested by You + Market Return + Dividend Now is just Invested by You + Market Return, means you cant withdraw your dividend Or did I misunderstood something here? |

|

|

Apr 7 2021, 10:28 AM Apr 7 2021, 10:28 AM

Show posts by this member only | IPv6 | Post

#450

|

All Stars

14,965 posts Joined: Mar 2015 |

QUOTE(yayai @ Apr 7 2021, 10:23 AM) This thread still alive ah? Or everyone close account already lol for that, i googled and found thisDid anyone notice that dividend is not included into the account value? My understanding is your account value should be Invested by You + Market Return + Dividend Now is just Invested by You + Market Return, means you cant withdraw your dividend Or did I misunderstood something here? Won’t I earn distributions from my portfolio? Yes, you will! Your distributions will be automatically reinvested in your portfolio. You can view your distribution history through the Raiz app. https://www.raiz.com.my/support/ |

|

|

Apr 7 2021, 10:35 AM Apr 7 2021, 10:35 AM

Show posts by this member only | IPv6 | Post

#451

|

All Stars

17,517 posts Joined: Feb 2006 From: KL |

QUOTE(yayai @ Apr 7 2021, 10:23 AM) This thread still alive ah? Or everyone close account already lol instant regret. waiting to breakeven before moving all out.Did anyone notice that dividend is not included into the account value? My understanding is your account value should be Invested by You + Market Return + Dividend Now is just Invested by You + Market Return, means you cant withdraw your dividend Or did I misunderstood something here? |

|

|

Apr 7 2021, 10:57 AM Apr 7 2021, 10:57 AM

Show posts by this member only | IPv6 | Post

#452

|

Junior Member

52 posts Joined: Jul 2010 |

QUOTE(MUM @ Apr 7 2021, 10:28 AM) for that, i googled and found this I'm not talking about distributions la, I'm talking about withdrawing what is suppose to be the total value of my account.Won’t I earn distributions from my portfolio? Yes, you will! Your distributions will be automatically reinvested in your portfolio. You can view your distribution history through the Raiz app. https://www.raiz.com.my/support/ QUOTE(!@#$%^ @ Apr 7 2021, 10:35 AM) Updated: Support finally replied, turns out the dividend is already included in the account value, just the app doesn't list out the detail transaction, which is another thing I don't quite like a bout RaizRequested for account closure already so bye Raiz! This post has been edited by yayai: Apr 9 2021, 09:46 AM |

|

|

Jun 10 2021, 09:18 AM Jun 10 2021, 09:18 AM

|

All Stars

17,517 posts Joined: Feb 2006 From: KL |

QUOTE(yayai @ Apr 7 2021, 10:23 AM) This thread still alive ah? Or everyone close account already lol just closed the account last week with 0.33% profit in 6 months. im surprised there is even profit.Did anyone notice that dividend is not included into the account value? My understanding is your account value should be Invested by You + Market Return + Dividend Now is just Invested by You + Market Return, means you cant withdraw your dividend Or did I misunderstood something here? |

|

|

|

|

|

Sep 21 2021, 10:09 AM Sep 21 2021, 10:09 AM

|

Junior Member

199 posts Joined: Feb 2020 |

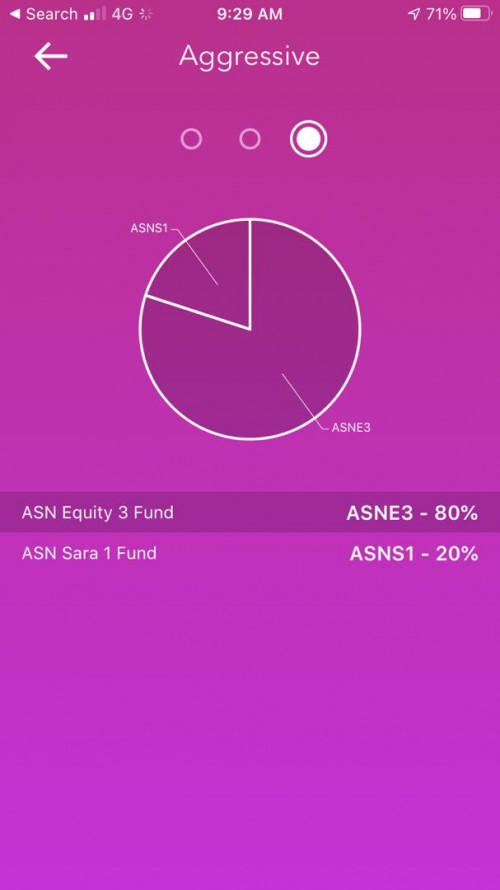

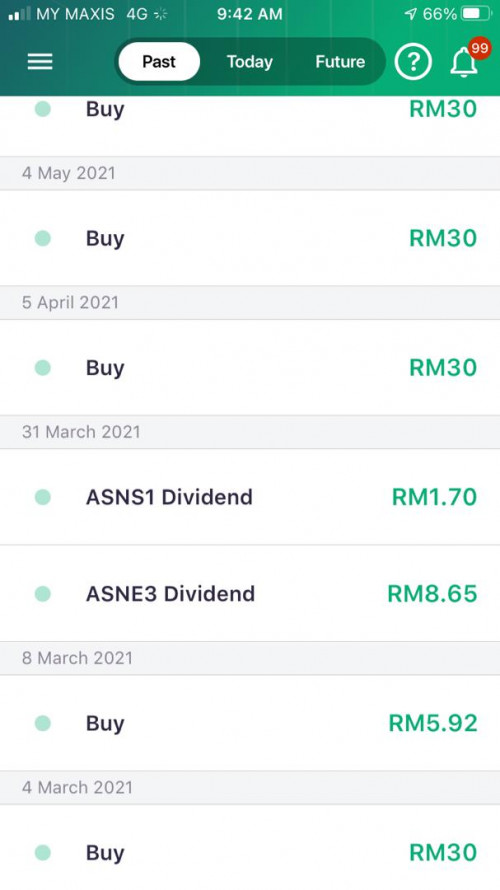

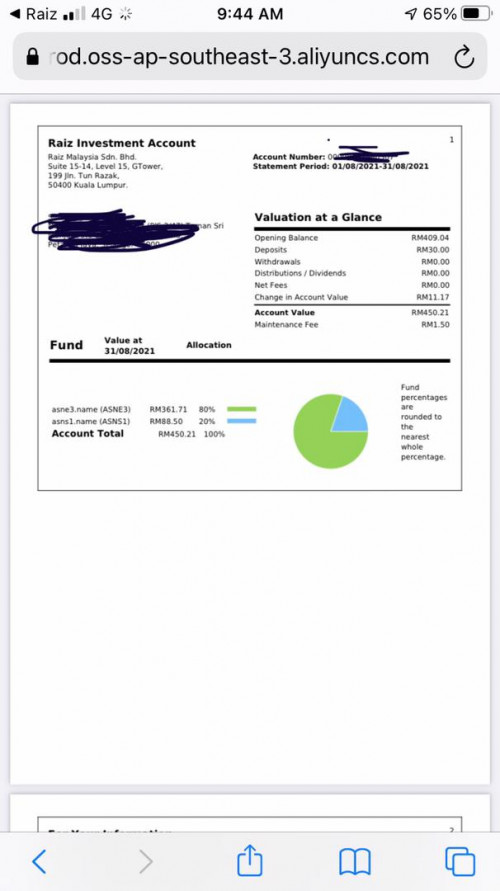

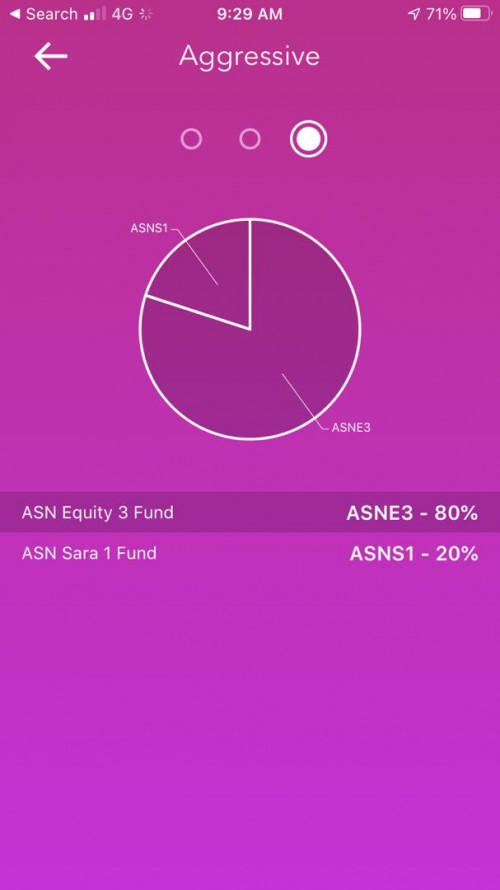

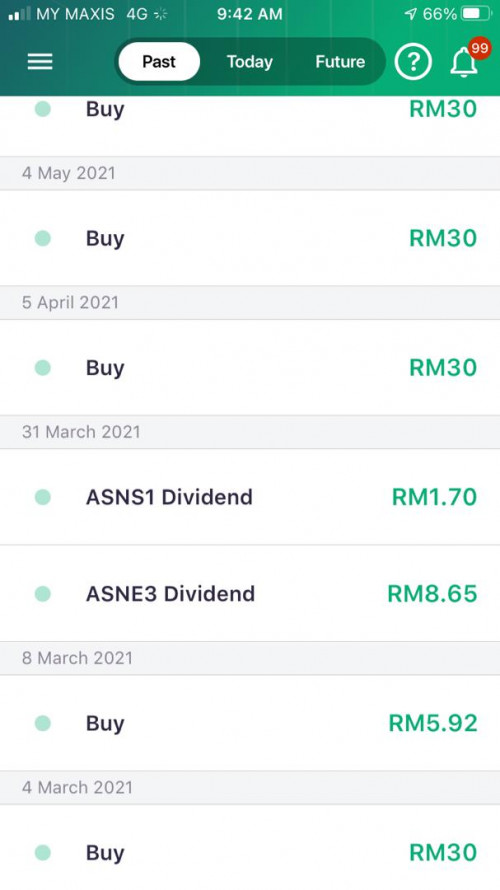

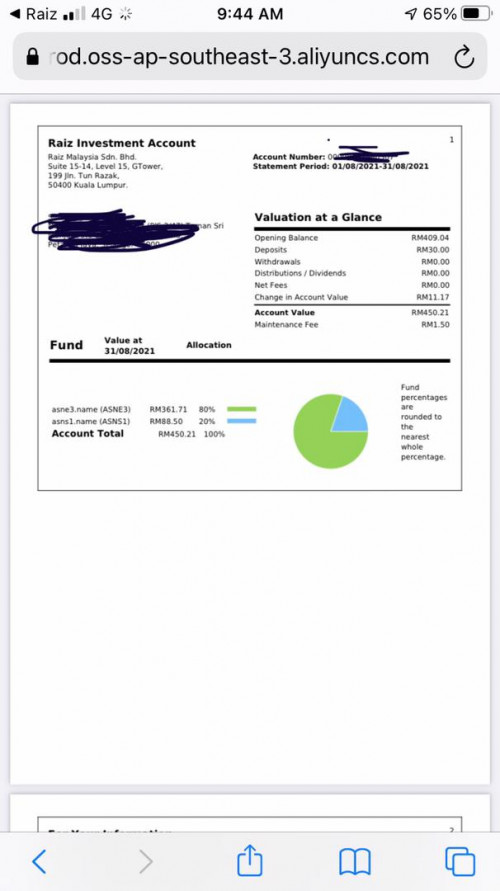

I just withdraw the money from Raiz.

I started invested from last October with monthly RM 30 contribution and some auto round-up. Aggressive profolio which were ASE3 (80%) and ASNS1 (20 %) FInally i got RM 13.04 return..... The key reason i found their monthly maintenance fee was higher than expectation. Example: If i invested RM 480, even no withdraw, they will still charge RM 1.5 as maintenance fee. So the total maintenance fee is RM 1.5 x 12 = RM 18 RM18/RM 480 = 3.75 % per annum. For easier calculation, Take note that if there are no variation of the fund value, you still need to pay RM 1.5 each month, unless you reach RM 6000 value and the fee change to 0.3 %. so it is reoccurance of 3.75 % or RM 18 per year If you buy through online ASNB portal, it just 2 % one-short and you didn't need to bother any maintenance fee https://www.asnb.com.my/asnbv2_2funds_EN.php#asn-e3 So in summary, my review is neutral for Raiz, this is actually for those to let the app directly Auto deduct the value and maintain investment discipline... But if for those investor whom can directly invest, then you can save some fees in long run.     This post has been edited by Shining star: Sep 21 2021, 10:11 AM |

|

|

Sep 21 2021, 01:48 PM Sep 21 2021, 01:48 PM

Show posts by this member only | IPv6 | Post

#455

|

Senior Member

1,620 posts Joined: Mar 2020 |

QUOTE(Shining star @ Sep 21 2021, 10:09 AM) I just withdraw the money from Raiz. Well done on reviewing and realizing it.I started invested from last October with monthly RM 30 contribution and some auto round-up. Aggressive profolio which were ASE3 (80%) and ASNS1 (20 %) FInally i got RM 13.04 return..... The key reason i found their monthly maintenance fee was higher than expectation. Example: If i invested RM 480, even no withdraw, they will still charge RM 1.5 as maintenance fee. So the total maintenance fee is RM 1.5 x 12 = RM 18 RM18/RM 480 = 3.75 % per annum. For easier calculation, Take note that if there are no variation of the fund value, you still need to pay RM 1.5 each month, unless you reach RM 6000 value and the fee change to 0.3 %. so it is reoccurance of 3.75 % or RM 18 per year If you buy through online ASNB portal, it just 2 % one-short and you didn't need to bother any maintenance fee https://www.asnb.com.my/asnbv2_2funds_EN.php#asn-e3 So in summary, my review is neutral for Raiz, this is actually for those to let the app directly Auto deduct the value and maintain investment discipline... But if for those investor whom can directly invest, then you can save some fees in long run.     But just saying, you could have avoided it if you read the first page. |

|

|

Sep 21 2021, 02:04 PM Sep 21 2021, 02:04 PM

|

Junior Member

199 posts Joined: Feb 2020 |

QUOTE(thecurious @ Sep 21 2021, 01:48 PM) Well done on reviewing and realizing it. yes, but i think you may be misunderstood.But just saying, you could have avoided it if you read the first page. It should be giving a try for any new investment scheme... Ofcourse, as careful invester, i read all the pages and trace the investment. The market didn't perform well to supercede the return. Furthermore, i compare the return from Raiz vs if i directly invest it. I found it better to do directly to save the cost, at least from maintenance fee point of view. Anyway, thanks for sharing the idea. At least we learn a lesson what to do.... jonoave liked this post

|

|

|

Sep 21 2021, 02:10 PM Sep 21 2021, 02:10 PM

Show posts by this member only | IPv6 | Post

#457

|

Senior Member

1,620 posts Joined: Mar 2020 |

QUOTE(Shining star @ Sep 21 2021, 02:04 PM) yes, but i think you may be misunderstood. Nope, no misunderstanding unless you mis represented your points.It should be giving a try for any new investment scheme... Ofcourse, as careful invester, i read all the pages and trace the investment. The market didn't perform well to supercede the return. Furthermore, i compare the return from Raiz vs if i directly invest it. I found it better to do directly to save the cost, at least from maintenance fee point of view. Anyway, thanks for sharing the idea. At least we learn a lesson what to do.... Your summary about direct investing and maintenance fees are all discussed in the first few pages already. But anyway you already found out after experiencing it yourself. Just saying you could have avoided it. |

|

|

Sep 21 2021, 04:54 PM Sep 21 2021, 04:54 PM

|

Junior Member

199 posts Joined: Feb 2020 |

QUOTE(thecurious @ Sep 21 2021, 02:10 PM) Nope, no misunderstanding unless you mis represented your points. Let wait for other to check whether my points are correct...Your summary about direct investing and maintenance fees are all discussed in the first few pages already. But anyway you already found out after experiencing it yourself. Just saying you could have avoided it. I think Raiz is same like Stashaway and Wahed? Have you read those condition? if yes, just share with us... |

|

|

Sep 21 2021, 05:32 PM Sep 21 2021, 05:32 PM

Show posts by this member only | IPv6 | Post

#459

|

Senior Member

1,620 posts Joined: Mar 2020 |

QUOTE(Shining star @ Sep 21 2021, 04:54 PM) Let wait for other to check whether my points are correct... Think you are the one misunderstanding here. I never said your points are wrong.I think Raiz is same like Stashaway and Wahed? Have you read those condition? if yes, just share with us... I said they are already discussed in the first few pages. |

|

|

Jul 28 2022, 05:15 PM Jul 28 2022, 05:15 PM

|

Junior Member

271 posts Joined: Oct 2006 |

anyone still using raiz? just curious need to hold for how long ... or once get satisfied return then sell off all the units ...

|

|

Topic ClosedOptions

|

| Change to: |  0.0233sec 0.0233sec

0.61 0.61

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 04:19 PM |