QUOTE(farizmalek @ Apr 8 2021, 10:50 PM)

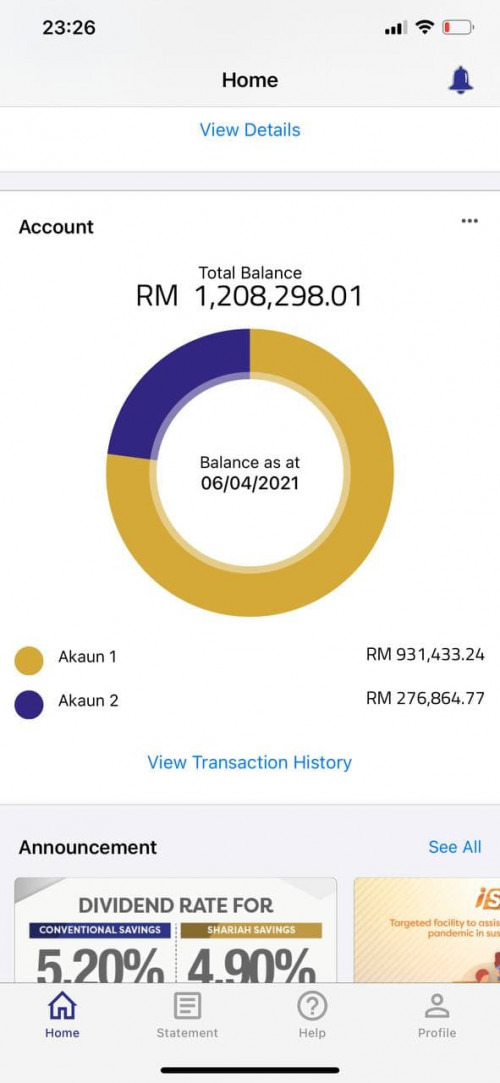

No need to be at 50s to be a millionaires. With careful plan and disciplines at 41 also can. Makan gaji also can. Just work smart and pray.

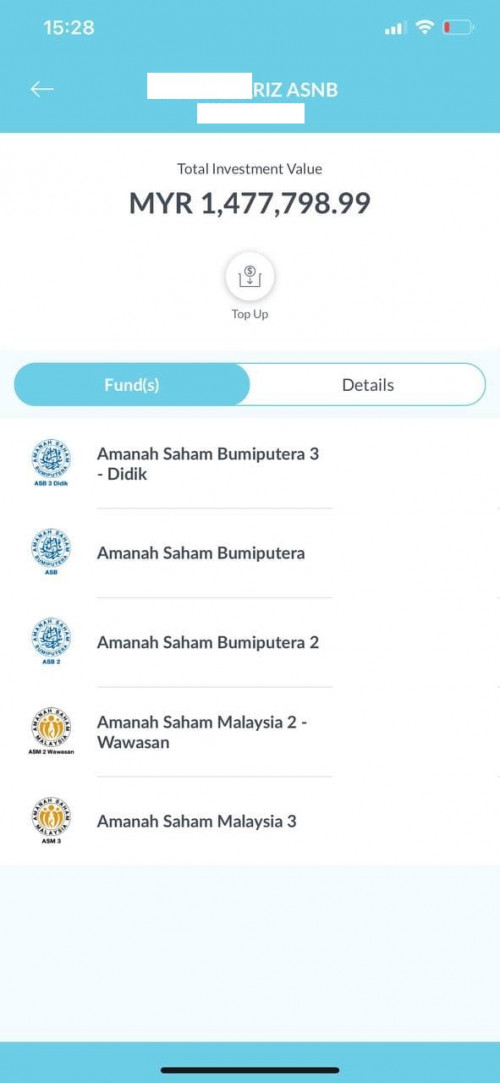

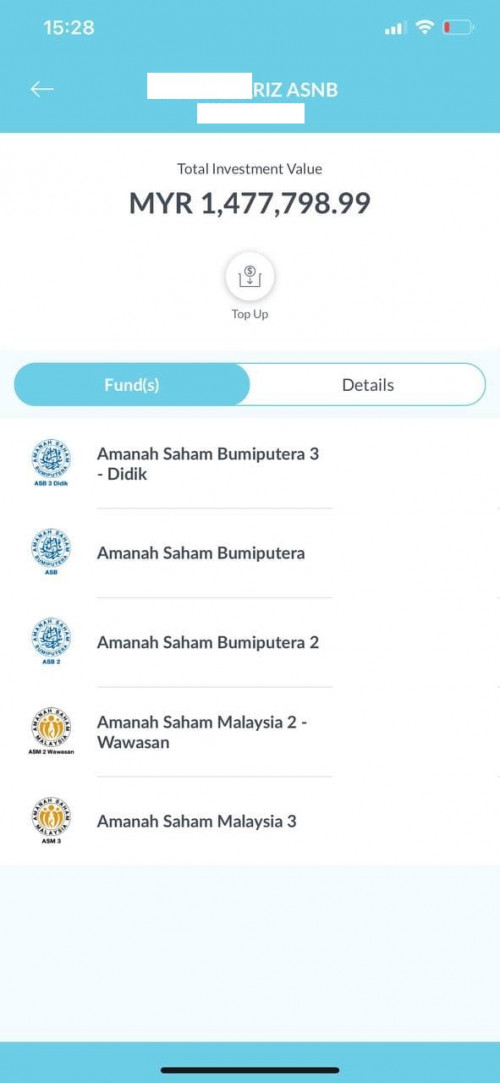

Yeap there's the asb screenshot

Well I also makan gaji and was already a millionaire at 32, of course I keep reminding myself what I was taught before I started working which is = 'if you think that you are smart, a lot of people are smarter than you. If you think that you are rich, a lot of people are richer than you'. I will leave the showing off to you, a pro. Kinda ironic when you mention about praying, just remember dengan sikap takabur,ujub dan riak, anytime Tuhan boleh tarik balik nikmat tu.

QUOTE(DragonReine @ Apr 9 2021, 12:10 PM)

A lot harder for non-bumi, won't have assess to ASB funds and other economical incentives like house price discounts, easier access to public universities etc.

Not to say that bumi don't have own cchallenges like discrimination, but when it comes to things where gahmen got incentives like ASNB, education, bumi has substantial advantage on starting point for savings.

As a bumi, I too agree.

QUOTE(backspace66 @ Apr 9 2021, 03:05 PM)

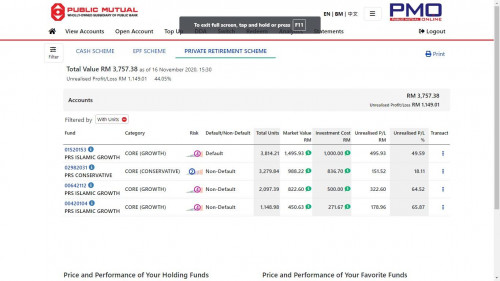

Funny popeye the sailorman. I didnt know you need a million in epf to be a millionaire. This is new knowledge. Glad i learn new thing from popeye.

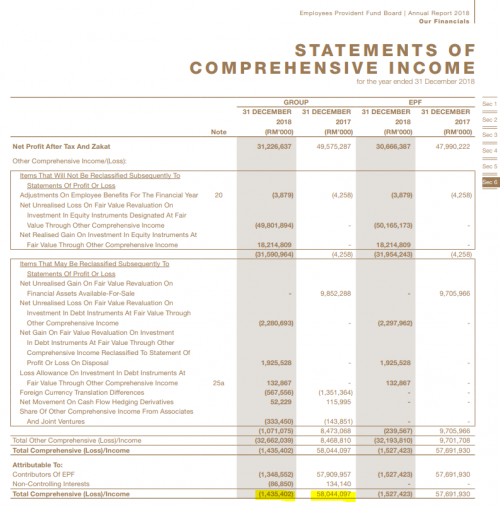

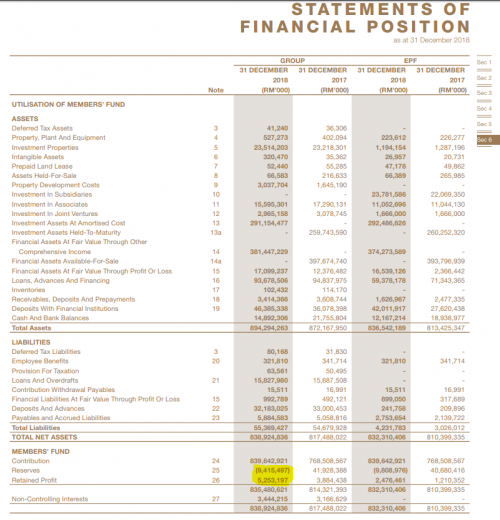

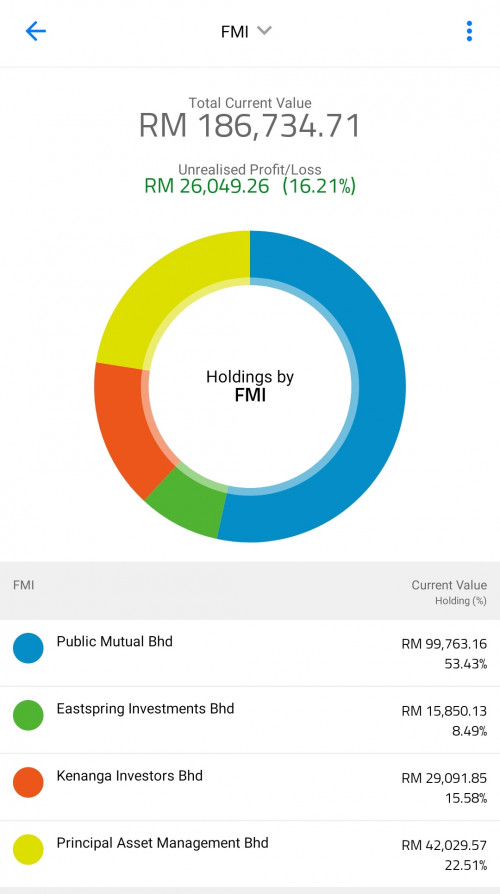

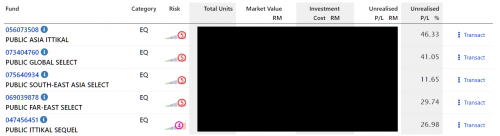

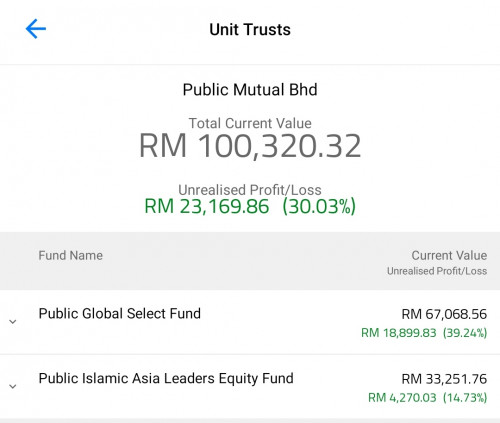

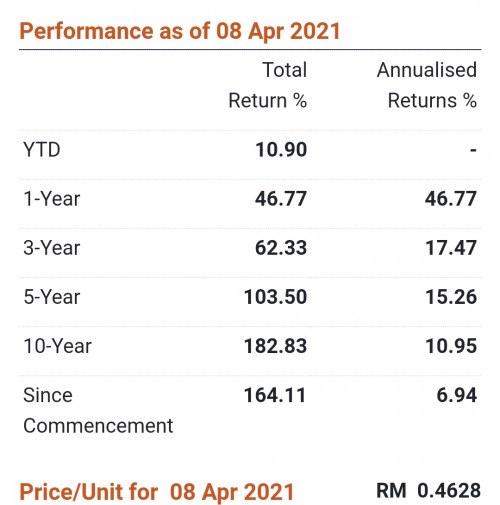

Net asset at least for me is a few multiple the one in epf, targeting at least 3 or 4 times by the time i retire. Not anyone can be popeye and enjoy not paying tax.

LOL. You know what they say about guys with big cars right? Trying to compensate for something else lol

Okay now back to the topic.

May 15 2020, 12:50 PM, updated 6y ago

May 15 2020, 12:50 PM, updated 6y ago

Quote

Quote

0.1443sec

0.1443sec

0.72

0.72

6 queries

6 queries

GZIP Disabled

GZIP Disabled