QUOTE(klangboy83 @ Dec 2 2020, 05:19 PM)

I initially invested some elf money into mutual fund through investment agent. This year, I asked whether got any difference if I invest directly through I-invest, he said cannot, EPF withdrawal can only be done through thumb print using agent's help... is he BS me? do I need to do thumb print withdrawal with I-invest website?

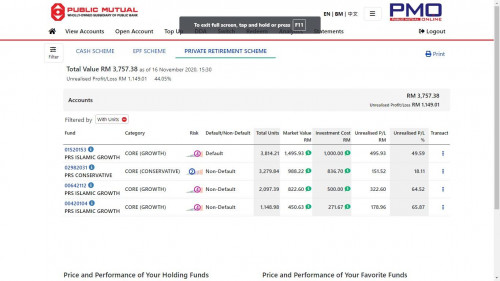

That is pure BS, he just want to earn partly from the sales charge. If you buy yourself from epf-mis portal, you can get 0 % sales charge and he will not earn anything from you. Just as a reminder, 0% sales charge is temporary until next year april IIRC. As for FSM , the sales charge for epf-mis is 0% even after the next april 2021 but other fund house such as public mutual will start to charge 0.5% afterwards.

Register for FSM and public mutual online and proceed to invest through epf-mis.

This post has been edited by backspace66: Dec 2 2020, 06:06 PM

Dec 2 2020, 06:01 PM

Dec 2 2020, 06:01 PM

Quote

Quote

0.1141sec

0.1141sec

0.85

0.85

6 queries

6 queries

GZIP Disabled

GZIP Disabled